francescoch/iStock via Getty Images

There is an answer to inflation.

Remember, inflation is always and everywhere a monetary phenomenon.

This is from the economist Milton Friedman.

And, what is the relationship, right now, between money and inflation?

Well, look at the following chart.

Inflation Follows Money (Bureau of Labor Statistics, Federal Reserve)

The red line represents the rate of increase in core inflation.

The blue line is the year-over-year rate of growth of the M2 measure of the money stock.

As the presenter, Donald Luskin, chief investment officer of TrendMacro, writes in the Wall Street Journal,

“the relationship between money-supply growth, as measured by M2 (currency in circulation plus liquid bank and money-market funds balance) and subsequent inflation HAS BEEN STATISTICALLY NEAR-PERFECT IN THE PANDEMIC ERA, with a 13-month lag.” (Caps added by me).

“Year-over-year M2 growth began to accelerate during the pandemic recession in April 2020, and core inflation started to accelerate 13 months later, in May 2021.”

“M2 growth peaked at a history-making, off-the-charts 27 percent in February 2021, and core CPI peaked 13 months later, in March 2022.”

“Both M2 growth and core CPI have been falling every month since their respective peaks.”

Wow!

Monetarism is back!

Note What Is Happening?

According to this hypothesis, prices are coming down.

First, note that inflation peaked in March of 2022. The peak rate was 6.5 percent.

Now, the full consumer price index is not the one being used in this presentation. The inflation measure used here is the “core” inflation measure that removes some highly variable components of the full consumer price index.

This, supposedly, gives us a better picture of what the underlying structure of inflation really looks like and excludes those components that are highly variable and whose movements are misleading as far as the general trend of inflation is concerned.

There is a second factor that took place beginning in April 2020 that Mr. Luskin also calls our attention to.

In Mr. Luskin’s view, the Federal Reserve was not really responsible for the monetary blast that occurred in 2020 and 2021.

Mr. Luskin writes:

“The Fed didn’t cause the underlying growth of money.”

Okay, tell us about this.

“We have to blame Congress for that, ” Mr. Luskin writes.

“Since the onset of the pandemic, lawmakers have spent about $6 trillion on various income-support programs for households and businesses, including three rounds of stimulus payments, extended and enhanced unemployment benefits, refundable child credits through the tax code, and forgivable Paycheck Protection Program loans.”

“That all dropped straight into the bank accounts that are part of M2, which also grew about $6 trillion over precisely the same period.”

“The Fed had nothing to do with that.”

But, from April 2021 through March 2022, the Federal Reserve was regularly purchasing $120.0 billion in securities held outright to add to its portfolio and to increase bank reserves to absorb the Treasury money flowing into the Treasury’s deposits.

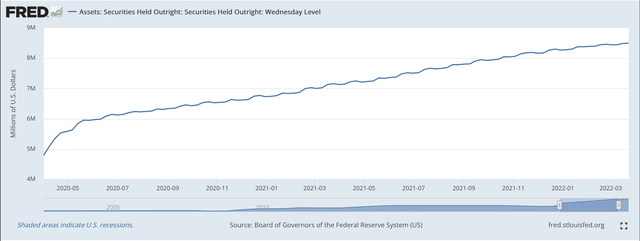

Securities held outright by the Federal Reserve rose from $4,800 billion in the banking week ending April 1, 2020, to $8,500 billion in the banking week ending March 23 20022.

Here is the chart.

Securities Held Outright (Federal Reserve)

Although the Fed did not create the programs applied by the U.S. Treasury Department, the Federal Reserve certainly played a major role in making sure that commercial banks had sufficient reserves on hand to support the Treasury monies as they were being disbursed to the public.

The Fed could have stayed out of the picture and let the U.S. Treasury Department just allocate the funds to the rest of the economy. But, Federal Reserve chairman Jerome Powell was working hand-in-hand with the U.S. Treasury Department to make sure that the funds were available to the recipients of the government largess and to make sure that all the programs worked smoothly so that there would not be any more disruptions to the economy.

The U.S. Treasury Department could not have done all this job alone.

The fact that everything worked so well I believe signals that the U.S. Treasury Department and the Federal Reserve worked closely together and provided thee massive amount of liquidity to the economy efficiently and effectively.

I believe Mr. Luskin is wrong to relieve the Federal Reserve of any responsibility for the massive influx of money into the financial system and into the economy.

Going Forward

Going forward from here, one can see that the movement of the money stock that has already taken place will, if Mr. Luskin is correct, result in the rate of inflation dropping to 2.3 percent in the spring of 2023.

That is, the Federal Reserve has already done all the work it needs to do to bring the U.S. inflation rate back down close to the Fed’s target range for inflation.

One market point of confirmation of this point is to look at the inflationary expectations that investors have built into the yield on U.S. Treasury securities.

As I have been discussing elsewhere, the expected rate of inflation built into the yields of the 5-year U.S. Treasury note has been around 2.5 percent to 2.6 percent recently.

Many analysts have wondered and worried about why these price expectations are so low.

Well, here is a reason why these inflationary expectations are so low.

Market participants are aware that monetary growth has collapsed from the peak levels they reached in late 2021 and early 2022.

As Mr. Luskin writes,

“That’s what happens when money-supply growth collapses.”

“Always and everywhere.”

“And, that leads straight to a policy prescription (monetarists) would applaud: on Wednesday (at the next meeting of the Federal Open Market Committee) the FED SHOULD DO NOTHING (my caps).”

According to this analysis, inflation is coming under control. What the Fed, therefore, needs to concentrate on is the future growth of the M2 stock of money.

A New Narrative On The Scene

So we have analysts on the scene that are presenting us with a new narrative for the future of monetary policy.

These analysts seem to go so far as to argue that “the cow is already in the barn,” now all we need to do is shut the door behind it to have the Federal Reserve where it wants to be with inflation running around 2.0 percent.

We certainly need to pay attention to this narrative, but we need to give it a lot more scrutiny before we totally give monetary policy over to the emerging monetarists.

It would certainly be a nice conclusion to the current range of events that got us to where we now are. But, I don’t think we can just give in to this new information.

Federal Reserve officials are ready to move its policy rate of interest by 75 basis points this week.

This is what is expected. This is what should be done.

But, we really need to take a close look at the new data that Mr. Luskin has presented to us.

Be the first to comment