gorodenkoff

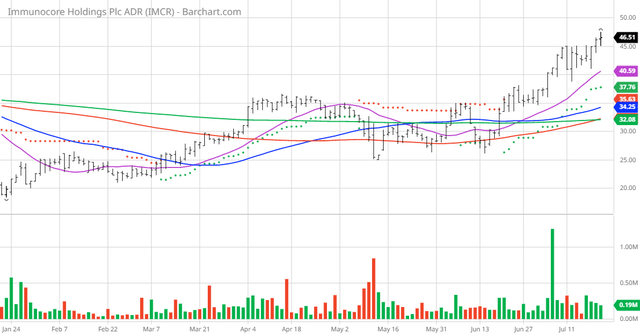

The Chart of the Day belongs to the healthcare biotech company Immunocore (IMCR). I found the stock by sorting Barchart’s Top Stocks to Own list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 6/22 the stock gained 26.25%.

Immunocore Holdings plc, a commercial-stage biotechnology company, engages in the development of immunotherapies for the treatment of cancer, infectious, and autoimmune diseases. The company offers KIMMTRAK for the treatment of patients with unresectable or metastatic uveal melanoma. Its other programs for oncology comprise IMC-C103C that is in Phase I/II dose escalation trial in patients with solid tumor cancers, including non-small-cell lung (NSCLC), gastric, head and neck, ovarian, and synovial sarcoma cancers; IMC-F106C, which is in a Phase I/II dose escalation trial in patients with multiple solid tumor cancers comprising NSCLC, small-cell lung, endometrial, ovarian, cutaneous melanoma, and breast cancers. In addition, the company’s programs for infectious diseases include IMC-I109V, which is in a Phase I/II clinical trial in patients with chronic hepatitis B virus; and IMC-M113V that is in pre-clinical development stage for patients with human immunosuppression virus. Further, it develops product candidates to provide precision targeted immunosuppression for the treatment of autoimmune diseases. Immunocore Holdings plc was founded in 1999 and is headquartered in Abingdon, the United Kingdom.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals but increasing

- 58.00+ Weighted Alpha

- 28.48% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 38.33% in the last month

- Relative Strength Index 67.80%

- Technical support level at 44.45

- Recently traded at $46.95 with 50-day moving average of $34.24

Fundamental factors:

- Market Cap $1.90 billion

- Revenue expected to grow 180.00% this year and another 11.70%

- Earnings estimated increase 17.20% this year

Analysts and Investor Sentiment – I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts have 2 strong buy. 2 buy and 1 hold opinions on the stock

- Analysts give an average price targets at 53.27 with some analysts predicting as high as 78.45

- The individual investors following the stock on Motley Fool have not found this one yet

- 752 investors are monitoring the stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector

Industry

Ranked Overall

Ranked in Sector

Ranked in Industry

Be the first to comment