DSCimage/iStock via Getty Images

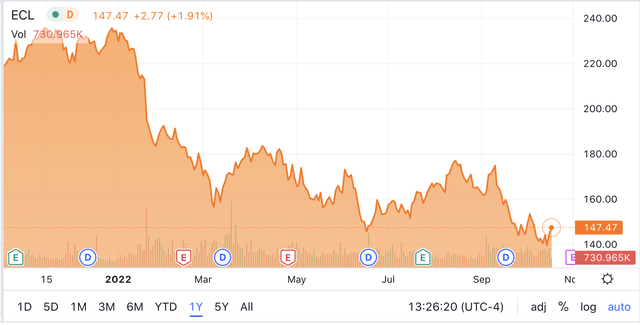

Shares of Ecolab (NYSE:ECL) have been a poor performer this year, falling nearly 40% from their highs as elevated inflation has compressed margins and greatly reduced earnings power. While management has said that the company has passed the worst of the inflation problems, shares remain expensive, and I would continue to avoid the stock.

Ecolab provides chemical products alongside digital solutions to increase the efficacy and cleanliness of operations with a focus on reducing water, energy, and carbon intensity. It primarily serves customers in the food services, food and beverage processing, health and life sciences, and industrial water industries, as well as companies like refineries and paper processors, which use significant water.

Ecolab’s main sources of revenue include water treatment products to help manufacturing plants use less water, manage corrosion, optimize boilers, and use the correct treatment chemicals to cleanse wastewater. These tools are used in food manufacturing, paper processing, oil refining, and heavy industry. It provides the sanitation tools to make food safe for human consumption via sanitization chemicals and antimicrobial products. It providers cleansers and sanitizers for washing dishes at hotels and restaurants, running laundries, making hotels a major customer. Ecolab’s cleansing and sanitation products are also used in the health and life science industries for testing, surgeries, and equipment.

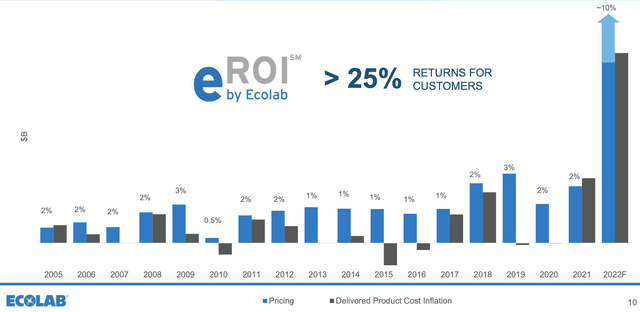

These are high growth product lines, particularly as global “ESG” and climate concerns have pushed operators across industries to minimize their waste. Reducing water usage, minimizing energy costs, and ensuring food is safe are good end-markets to be in around the world. Plus, by reducing waste, Ecolab’s products save customers’ money, and it tries to price its products and services so that customers achieve a 25% return on their investment via lower costs. From 2010-2019, this model worked well, generating 10% annual EPS growth. Unfortunately, 2022 has been a very challenging year.

In the company’s second quarter, revenue rose by 13% to $3.6 billion despite a 4% currency headwind. Margin pressures though led to an 8% decline in adjusted operating income to $431 million, and adjusted EPS fell 10% to $1.10. Currency reduced the topline by 4%, and it also reduced earnings per share by about $0.06. The company actually reported strong volume growth of 8% with the one area of disappointment being healthcare, which has lagged as pricing contracts tend to be fixed for a longer period of time and in the US, higher-margin elective surgeries have recovered more slowly than anticipated. Demand has also been slower in Europe.

Ecolab’s problems primarily come from the cost side. The company has faced over $1 billion in inflationary pressures the past eighteen months. This year it has seen 30% raw material cost inflation, which is double the expectations at the start of the year. This excess inflation has forced guidance reductions. At the start of the year, management expected “low teens” earnings growth. Now, management expects to have modest year on year growth, which assumes a low-single-digit decline in Q3 followed by earnings growth of about 20% in Q4.

This is an optimistic outlook to close the year, particularly as the macroeconomic environment has degraded, and it is rooted in its pricing actions. During Q2, pricing rose by 9%, and June was the first month where price gains exceeded inflation, helping gross margins to stabilize. On April 1, the company announced a new energy surcharge, based on oil and natural gas prices in local markets. This surcharge is particularly important in Europe, which has seen its natural gas prices rise far more dramatically as the shut-off of Russian exports has caused a significant supply squeeze.

There has been a bit of a delay between what energy prices are today and when customers pay the surcharge. This timing lag was a $0.17 cent headwind to Q2 EPS, which management expects to recapture over the balance of the year. It is this energy surcharge that has given management confidence its H2 pricing will exceed inflation, helping to dramatically ease margin pressure and cause a material acceleration in earnings by Q4. Overall, about 2/3 of its pricing actions are “structural,” meaning they should stick in 2023 while the remaining 1/3 is tracking energy prices. As you can see below, management has a strong history of delivering better pricing outcomes than its input inflation, and if its H2 pricing plan holds, that will be the case for the full year after a very challenging first half.

While inflation headwinds have hopefully peaked, currency does continue to be a headwind. 56% of Ecolab’s sales come from North America, about 20% from Europe, 9% from Asia ex-China, 5% China, and 10% from other emerging markets. For the full year, FX will reduce earnings by about $0.30. Its relatively low Chinese exposure has minimized fallout from its COVID-zero policies. That said, its large European exposure is a concern. While it is passing on natural gas costs, elevated costs are likely to put the economy into a recession in my view, which may reduce activity at industrial plants and travel and may lead to a cyclical downturn in demand for Ecolab’s products.

Given the company is banking on a strong Q4 to lift full year EPS to at least $4.50 and propel a reacceleration in growth in 2023, these economic headwinds may serve to dent some of the benefits ECL is now receiving on pricing. When the company reports third quarter earnings on November 1, risks are skewed to management having to temper expectations somewhat, especially if a weakening economy leads to some reticence on the part of customers to accepting price hikes.

Even at $4.50 EPS this year and assuming 10-12% EPS growth next year, shares have a 30x forward multiple. This is still an expensive stock. Now, it is highly cash flow generative. In H1, it generated $182 million in free cash flow with a $420 million working capital drag for a normalized run-rate of $1.2 billion. That leaves the stock with just a 3% free cash flow yield.

With this cash flow, it has rewarded shareholders having bought back $400 million in stock year to date. Over the past 10 years, it has returned $8.5 billion to shareholders, half via buyback and half via dividends. The company has increased its dividend twenty-eight straight years, and over the past five years, it has increased it by 6.6% per year, with a current yield of 1.4%. I would expect annual dividend increases to continue.

As noted at the outset, this is a business operating in attractive end-markets that are increasingly relevant in a waste-conscious world. This is why it has set a long-term aim of 6-8% sales growth and 15% EPS growth. Management sees a $152 billion market opportunity, of which is has about 8% market share, which is larger than any peer. Its existing customers account for $69 billion of that market, providing $56 billion of sales opportunity, plus $83 billion in potential from new potential customers. It retains over 90% of its customers, and its top 10 customers are less than 10% of sales.

This strong long-term picture is being dented by near-term challenges, and while management is credible when they say they have passed the worst of the inflation problem, there could be broader economic headwinds on the horizon. Moreover, at 30x earnings, shares are really looking through these challenges. I would rather own a company like Air Products (APD), which has similar ESG tailwinds, energy pass-through pricing mechanisms, but trades at low 20s earnings multiple. At $125, or about 25x forward earnings, Ecolab would become a more interesting investment given its long-term tailwinds. But for now, I would sell shares, especially with downside risk around Q3 earnings and guidance.

Be the first to comment