putilich/iStock via Getty Images

Investment Thesis

Marqeta (NASDAQ:MQ), the card issuing processor, is down +70% since its IPO, even though the company continues to rapidly grow and operate with a clean balance sheet.

The problem for Marqeta is twofold. Marqeta’s growth rates are rapidly decelerating. And its path to GAAP profitability is a long way away.

How much of those concerns are already priced in? After all, let’s be honest, down +70% in 12 months is a lot.

On the one hand, bulls highlight its rapidly growing TAM and that Marqeta’s opportunities are immense.

While bears, like myself, continue to have an issue with its valuation.

Bear Market Rallies

Bear market rallies are so challenging. They erode investors’ capital. They erode investors’ enthusiasm.

With interest rates so rapidly moving up, there’s a huge amount of unpredictability. What’s the actual damage being made to the economy? And what’s an appropriate multiple for tech stocks?

There are just so many more questions than there are answers right now or at least accurate answers.

Marqeta’s Prospects Discussed

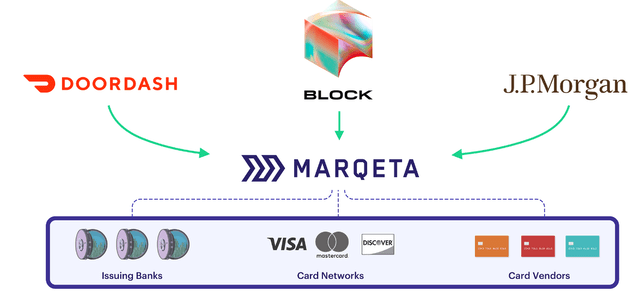

Marqeta is a modern card issuing platform. Marqeta’s business model aims to open up fintech, by creating customized payment cards.

For example, Marqeta’s biggest customer Block, which makes up nearly 70% of its total business, uses Cash App to get more depositors on board.

So what Marqeta provides to Block, and other partners such as DoorDash (DASH) is flexibility. It removes friction from the payment system, by having money move to the payment card instantly. The platform delivers rapid scalability to its customers.

Here’s an example; let’s say that you order something from DoorDash. You pay on DoorDash’s app, and that cash gets distributed to the driver, which then pays at the takeaway shop. Hence, Marqeta solves a key problem for DoorDash.

As you can imagine, card issuers’ demand for just-in-time funding solutions will continue to increase, as payment complexity evolves.

For their part, Marqeta declares that it’s seeking out many different verticals beyond food ordering, Buy Now Pay Later, and expense management.

Marqeta describes how its business today is only scratching 1% of its total addressable market and how Marqeta’s opportunity will continue to expand over time.

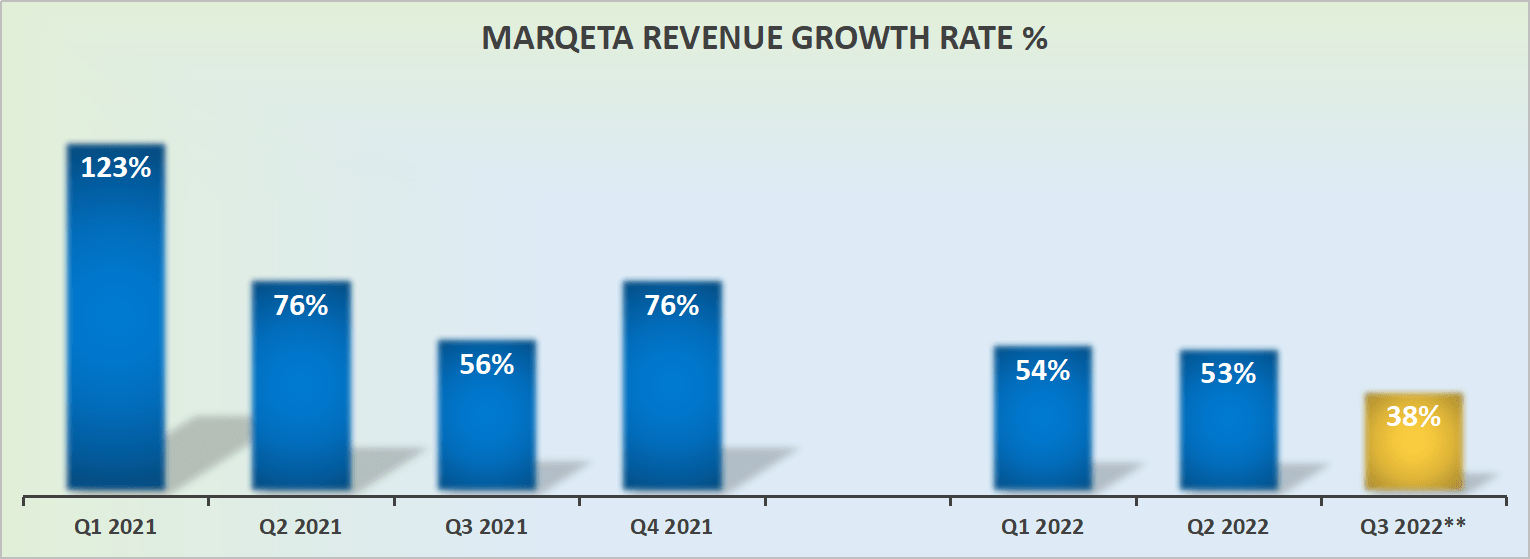

Revenue Growth Rates Are Decelerating

MQ revenue growth rates

The problem as alluded to already is the difficulty in figuring out what’s an appropriate multiple for the stock.

On the one hand, rapidly growing fintech players should be traded at a high multiple.

But on the other hand, if the company was growing at more than 70% in 2021 and is now expecting to exit Q3 2022 at around mid-40% growth rates, investors are right to question what sort of stable growth rates should we expect to see.

Profitability Profile in Focus

Marqeta announces that it’s going to repurchase its own shares. The business has approximately $1.7 billion of cash and equivalents and no debt.

This cash position equates to approximately 40% of its market cap. For a business that still has not figured out how to become sustainably free cash flow positive, one has to wonder whether that’s really the best of cash at this stage.

MQ Stock Valuation — 4x Next Year’s Sales

Marqeta is valued at approximately 4x next year’s revenues. Is that a cheap enough multiple? Are investors too bearish?

I simply don’t know if that’s justified. You can pay 4x sales when the business is stably growing at a fast clip and interest rates are at 0%. But is that justified when interest rates are at 4% and looking to stay there?

I’m not convinced, that there’s enough value here.

The Bottom Line

This is probably one of the most enviable CEO jobs in fintech (Marqeta’s founder Jason Gardner)

Ultimately, this is the reality of where we are right now.

Since May, tech soared only to retrace lower in August. As we stand right now, investors are praying and hoping for a V-shaped recovery. But underneath the prayers and hopes, I can’t see much justification for a large swath of tech stocks, including Marqeta.

Presently, we are investing in unchartered territory. Simply put, I struggle to understand how when interest rates are still raising rates, unprofitable stocks continue to have much hope. There’s simply little sense in the market today.

That being said, in the very short term, capital flows will continue to dominate the very near term. With Marqeta’s stock down more than 70% and the stock with a 6% short interest, investors should continue to expect a lot of withering volatility to percolate through the share price.

Yet, I struggle to get positively enthused by Marqeta’s valuation.

Be the first to comment