JHVEPhoto

Investment Thesis

I think eBay (NASDAQ:EBAY) is a value trap. Yes, shares look undervalued by several metrics. But under the surface, the company is struggling to generate meaningful growth. The core business has given back almost all of its pandemic gains.

Management has put together an interesting strategy to get the company back on track. But I think the risk is too high when considering the company’s weak execution in the past. I recommend avoiding this stock.

Declining Growth

The story of eBay’s last decade has been one of uninspiring revenue growth and mediocre fundamentals. The company stagnated for years, struggling to find a sustainable growth strategy. Management has guided for 2022 revenue of $9.75 billion at the midpoint. This is down from $10.4 billion last year and $9.9 billion in 2017.

During the last quarter, the company reported $2.42 billion in revenue. This is down almost 10% year over year. When comparing eBay to its competitors, I think this is very concerning. Etsy (ETSY), MercadoLibre (MELI), and even Amazon (AMZN) are still reporting solid year-over-year revenue growth.

Compared to its competitors, eBay’s pandemic gains seem transitory. Active buyers on the platform totaled 135 million during the quarter. This is down sharply from 187 million in the first quarter of 2021.

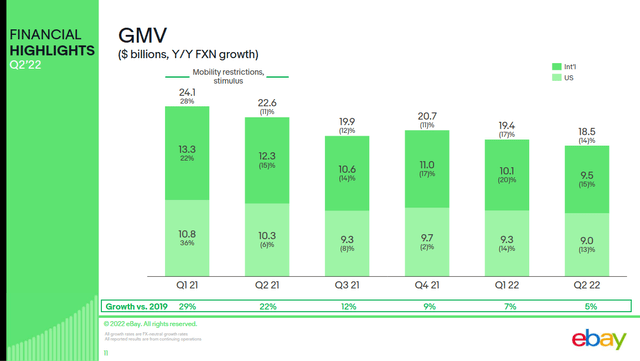

The business’s core metric is its gross merchandise volume. This is the total of all transactions on the platform. GMV jumped immediately following the 2020 lockdowns. Since then, it has been slowly reverting to pre-pandemic levels. Even worse, management guided for further declines in the third quarter. GMV is expected to dip to a midpoint of $17.3 billion. This is even worse than the company’s 2019 results.

A lot of the increased cash generation in the past few years has not been scalable. One example is eBay’s rollout of its proprietary payments solution. The company took PayPal’s cut of revenue, but it’s a one-time boost that won’t repeat or scale. A lot of the obvious shifts have already been taken. The company has to find a way to generate scalable organic revenue growth.

Difficult Competitive Positioning

In most cases, I’d give a company the benefit of the doubt when they say declines are temporary. But eBay has a long track record of mediocre growth. I’m not sure that eBay is competitively positioned in the current market. Many of its competitors are cheaper and have better platforms. The online marketplace business is brutal, and eBay has struggled to differentiate itself.

At their investor day this year, the company announced their strategy to change that.

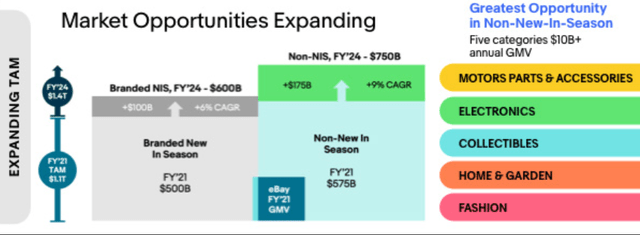

The business has shifted to target higher value buyers. The company is focusing on specific verticals, especially “non-new-in-season” categories. These include motor parts and accessories, electronics, collectibles, home and garden, and fashion. The company has introduced features catering to these customers. Their collectible markets, for example, benefit from a range of authentication services. This helps eBay mitigate the long standing issue of counterfeit goods on their platform.

The company has gone on an acquisition spree in these verticals. In the last quarter alone, the company bought an automotive parts seller management tool, an online trading card community, and launched a series of exclusive Funko Pop! products. The company also jumped into the NFT space by buying a marketplace.

I think it’s great that the company has put together a strategy. But I’m not sure what the appetite for these markets will be in the future. The consumer electronics market has taken a hit recently. The NFT market has declined massively. I think the company’s focus on highly discretionary categories may actually increase the risk of this investment. While it’s good that management has a strategy, I think it’s better to wait and see how this plays out.

Profitability Issues

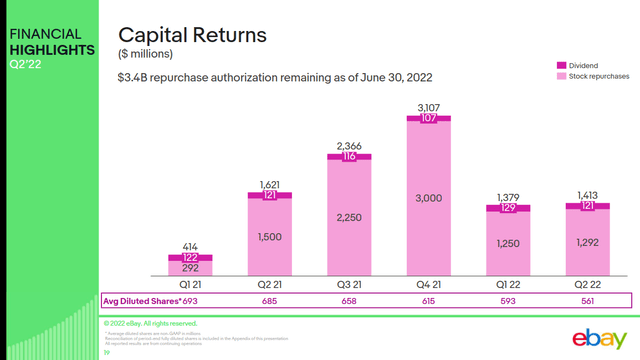

The company has remained decently profitable, at least compared to its revenue numbers. For example, the company’s non-GAAP EPS has been relatively flat over the last couple quarters. This seems promising at first, but I don’t think these margins are organic or viable without better top-line growth. First, increases in EPS are partly due to large share buybacks not being funded by free cash flow. Second, these profitability gains are largely from increases in take rate. The company is increasing its cut of transaction revenue to compensate for lower gross merchandise volume and declining user numbers.

Yes, this may boost financial performance in the short term. But I don’t think this is a sustainable strategy. The company can’t just keep increasing their take rate without eventually reducing sales and seller quality.

It’s A Value Trap

Shares of eBay currently trade at a cheap valuation. The stock is priced at 12.5 times free cash flow. Adjusting for debt, the company trades at 9.3 times EV/EBITDA. This is normally within the range of what I’d be willing to pay for a company with this profile, but eBay’s fundamentals are quite weak.

The business has been aggressively returning cash to shareholders. Over the past five years, eBay has spent a whopping $30 billion on buybacks and dividends. This is more than the current value of the entire company. The company has reduced its shares outstanding by almost half. But because of weak fundamental performance, shares still underperformed the S&P 500 by a wide margin.

I don’t see any catalyst that would cause multiple expansion or a widespread reassessment of the stock. The only way eBay’s share price is going to increase is through strong top-line growth. Since that’s the main thing eBay is struggling with, I don’t think the valuation is covering the risk.

Final Verdict

Over the past few years, eBay has struggled to generate meaningful growth. The company has relied heavily on unsustainable strategies to offset declines in buyers and GMV.

The company does have a promising turnaround strategy. But the business’s extended stagnation in a growing vertical makes me think the risk is too high. I’m avoiding eBay’s shares for now. I wouldn’t recommend buying unless the company makes serious progress on its turnaround strategy.

Be the first to comment