letty17

One of the biggest problems facing America today is the incredibly high rate of inflation. It has gotten so bad that we currently have many individuals taking on second jobs or searching for other sources of income simply to keep their bills paid and food on the table.

Fortunately, as investors, we have other options that we can utilize to boost our incomes in the current environment. One of the best options available to us is to invest in a closed-end fund (“CEF”) that specializes in the generation of income. These funds enjoy the benefits of professional management and can in many cases use certain strategies that allow them to have a higher yield than any of the underlying assets.

In this article, we will discuss one CEF that could be used as a source of income, the Eaton Vance Tax-Advantaged Global Dividend Income Fund (NYSE:ETG). This fund yields 7.93% as of the time of writing and trades for a bit less than its fair value. I have discussed this fund before, but more than a year has passed since that time, so a great many things have changed. This article will, therefore, focus specifically on these changes and provide an updated analysis of the fund’s results.

About The Fund

According to the fund’s webpage, the Eaton Vance Tax-Advantaged Global Dividend Income Fund has the stated objective of providing investors with a high level of after-tax total return. This is not exactly surprising for an equity fund, since equities are by their nature a total return instrument. After all, anyone that buys securities is generally looking for both capital gains and dividend income.

As the name of the fund implies, Eaton Vance Tax-Advantaged Global Dividend Income Fund seeks to achieve this goal by investing in dividend-paying common and preferred equities from around the world. The fund states that it actively seeks out things that will allow it to enjoy favorable federal tax treatment, which likely means that the fund will attempt to hold the stocks long enough to have the dividends taxed at the capital gains rate as opposed to the income tax rate.

The fund is not purchasing things that get even better tax treatment like master limited partnerships, however. Regardless, paying fewer taxes is always nice, but, of course, if the fund is held in a retirement account, then taxes are not something that we normally have to worry about anyway. It is still a good objective, though.

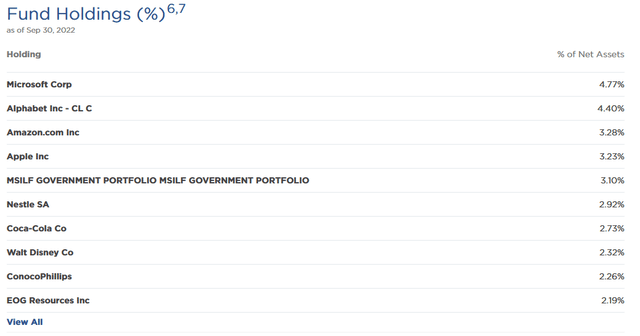

The fund’s portfolio is certainly not what we would expect from the objective. Here are the largest positions in it:

The two positions that stand out to me are that 4.40% of the portfolio is invested in Alphabet (GOOG, GOOGL) and another 3.28% is invested in Amazon.com (AMZN). The fund specifically states that it invests in dividend-paying stocks, yet nearly eight percent of its portfolio is invested in these two companies, neither of which pays a dividend. We also see both Microsoft (MSFT) and Apple (AAPL) occupying similarly large positions despite the fact that both of these companies have very minimal dividend yields. This is something that is a bit of a hallmark among Eaton Vance’s funds, and it has proven to be a fairly big handicap for these funds this year. This is partly because all four of these companies have significantly underperformed the S&P 500 index (SPY) this year:

|

Company |

YTD Return |

|

Apple |

-25.90% |

|

Amazon |

-48.58% |

|

Alphabet |

-39.76% |

|

Microsoft |

-32.93% |

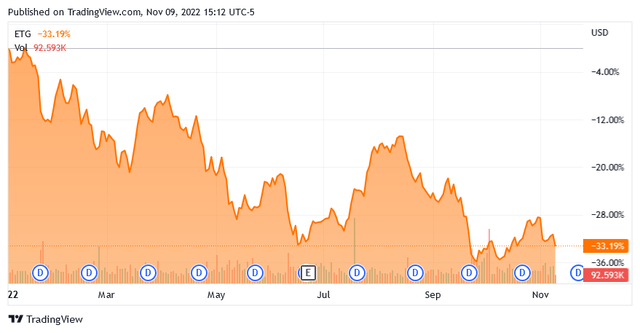

The S&P 500 (SP500), meanwhile, is only down 21.66%. When we consider that these four stocks account for 15.68% of the fund’s assets, we can see a tremendous drag on the ETG fund’s performance. If these stocks were to be replaced with things that have a much higher yield (or any yield at all), it would likely have given the fund better year-to-date performance. This is particularly true if the fund had invested in energy companies as there are a number of shale companies that have not only delivered positive returns year-to-date but also boast dividend yields approaching 10%. The fund’s focus on the mega-cap technology stocks is not only somewhat in contradiction to its stated objective but is hurting its performance. We can see this in the fact that the fund is down 33.19% year-to-date:

To put it simply, the ETG fund needs to better decide what its strategy is and invest accordingly.

With that said, many of the other positions that made the largest positions list are ones that are somewhat uncommon to see among a fund’s largest positions. This is nice because it helps reduce the concentration risk that many funds will create in an investor’s portfolio. Concentration risk comes about when an investor holds multiple funds in their portfolio believing themselves to be diversified, but the investor is actually not diversified because all the funds are holding the same things. We commonly see this with most funds being heavily weighted toward the mega-cap technology stocks but to this one’s credit, the other six positions are somewhat unusual. Thus, the Eaton Vance Tax-Advantaged Global Dividend Income Fund may help an investor improve the diversification of their portfolio overall.

There have been a few changes to the fund’s most heavily held positions over the past year, although all four of the mega-cap technology stocks remained the same. The most significant changes were the removal of Bank of New York Mellon (BK), Meta Platforms (META), ASML Holding (ASML), and adidas (OTCQX:ADDYY) in favor of Coca-Cola (KO), ConocoPhillips (COP), and EOG Resources (EOG). The MSILF Government Portfolio is also a new addition, which is an institutional money market fund managed by Morgan Stanley (MS). Thus, it appears that this fund is holding a substantial amount of cash relative to this same time last year.

Overall, most of these changes appear very reasonable. Meta Platforms has notoriously underperformed this year, and the rising interest rates have generally been putting downward pressure on the financial performance of many banks. Meanwhile, energy is one of the only sectors actually up year-to-date, so it is nice to see that the fund is including a few of these in the portfolio now. I will admit that I can think of some better uses for that cash than putting it into a money market fund, but that option is nowhere near as bad as deploying it into a consumer discretionary or technology stock as the economy continues to weaken and it seems unlikely that it will improve in the near future. The money market position should also increase the fund’s income as interest rates rise so that is always a good thing.

The fact that only four of the fund’s largest positions changed may lull many people into thinking that this fund has a low turnover. That is not the case as its 111% annual turnover is on the high side for an equity closed-end fund. This could be an issue because it costs money to trade stocks or other assets, which is billed to the shareholders. This creates a drag on the fund’s performance and forces management to have to overcome these expenses and generate sufficient extra returns to deliver the performance that investors expect. This is a task that few managers are able to do consistently. This is the reason why index funds have become so popular as their minimal trading and low expenses make it easy for them to give investors very close to the performance of the benchmark index. This does not mean that a high turnover will prevent a fund from beating the market, but it does make it much more difficult for management. As we just saw, the Eaton Vance fund has substantially underperformed the S&P 500 index year-to-date so the management has generally failed at this task.

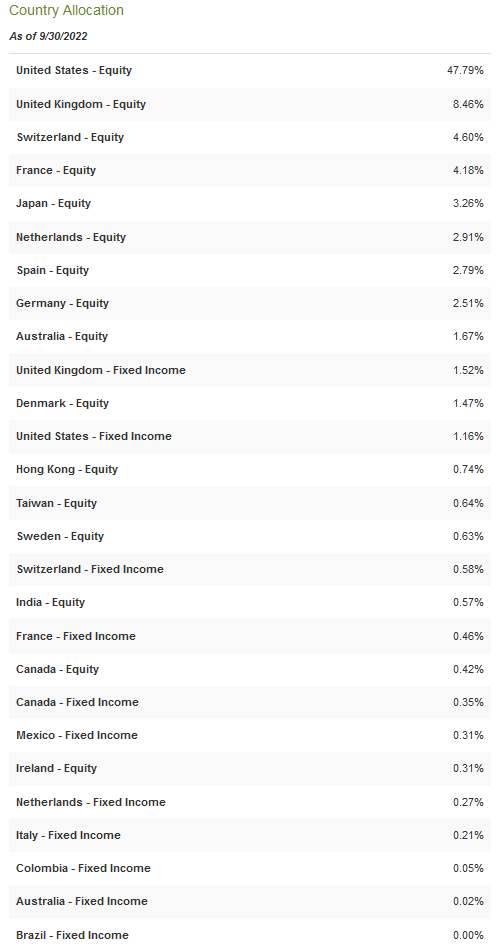

As stated in the name of the fund as well as earlier in this article, the Eaton Vance Tax-Advantaged Global Dividend Income Fund invests in assets from around the world. However, a look at the largest positions in the fund shows only one foreign company. Thus, one might think that this fund is very heavily weighted toward the United States and only invests in non-American companies as an afterthought. This is however not the case. In fact, less than half of the fund’s assets are invested in domestic companies:

CEF Connect

As we can see, 47.79% of the fund is invested in American companies. This is a much lower weighting than the 60%+ that most global funds have toward this country. With that said though, this position still represents an overweight as the United States accounts for less than 25% of global economic output. It is still better than most funds though and should help investors increase their international exposure. The reason why that is nice is because of the protection that it provides us against regime risk. Regime risk is the risk that a government or some other authority will take some action that proves to have an adverse impact on a company in which we are invested.

We saw an excellent example of regime risk last year, when the incoming Biden Administration unilaterally canceled the permits for the construction of the KeystoneXL pipeline and caused all the money that TC Energy (TRP) invested into it to be completely wasted. The only realistic way to protect ourselves against regime risk is to ensure that only a relatively small percentage of our assets is exposed to any individual nation. This fund provides investors with a good way to do that, especially if it is held alongside a purely international fund.

Distribution Analysis

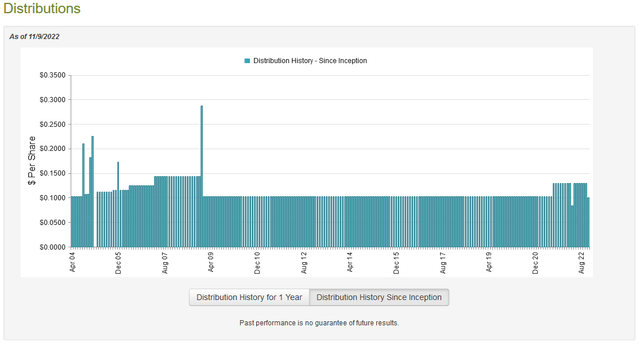

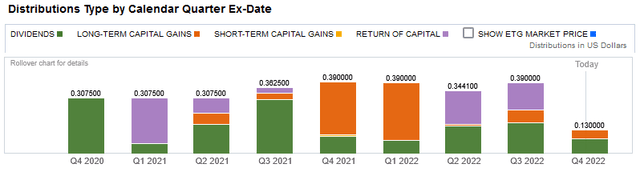

Although the Eaton Vance Tax-Advantaged Global Dividend Income Fund is specifically targeting total return as its objective, the name of the fund implies that it can provide investors with a source of income. As such, we might expect it to boast a reasonably attractive yield. This is indeed the case, as the fund pays out a monthly distribution of $0.1001 per share ($1.2012 per share annually), which gives it a 7.93% yield at the current price. The fund has historically been reasonably consistent with its distribution, although it did cut it in the most recent month:

This distribution cut is discouraging, to say the least and it could very easily have been prompted by the severe underperformance of a sizable portion of the portfolio as we discussed earlier. With that said, the cut only brought the distribution back to just below the level that it had for many years ($0.1025 per share vs $0.1001 per share today). It still may be a bit of a turn-off to an investor that wants a safe and steady source of income to use to pay their bills and finance their lifestyles. Another thing that may be a concern to more conservative investors is that a not insignificant proportion of the fund’s distributions are classified as return of capital:

Admittedly, we do not see nearly as high a return of capital as we do in some other funds but we see enough that it may be a concern for some. The reason why this may be a concern is that a return of capital can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any kind of extended period. However, there are other things that can cause a distribution to be classified as a return of capital. The most prominent of these things is the distribution of unrealized capital gains, which is something that this fund might be doing. As such, we should analyze the fund’s finances to determine exactly where these distributions are coming from and how sustainable they are likely to be.

Unfortunately, we do not have a particularly recent report with which we can do that. The fund’s most recent financial report corresponds to the six-month period ending April 30, 2022. As such, it will not have any information regarding the fund’s performance during the market volatility over the past several months. However, the market was still rather weak during the first four months of the year so we can get some insight into how well the fund handled that from this report. During the six-month period, the Eaton Vance Tax-Advantaged Global Dividend Income Fund received $26,850,943 in dividends and another $4,785,762 in interest from the investments in its portfolio. When combined with a small amount of income from other sources, the fund had a total income of $33,149,556 during the six-month period. It paid its expenses out of this amount, leaving it with $22,763,417 available for investors. This was not anywhere near enough to cover the $59,517,012 that the fund actually paid out during the period. At first glance, this is certainly concerning as the fund appears to be overdistributing.

There are other methods that the fund can use to obtain the money that it needs to pay for its distribution. One of these is capital gains, which is likely expected. Unfortunately, this fund failed miserably at that during the reporting period. The Eaton Vance Tax-Advantaged Global Dividend Income Fund reported net realized gains of $34,096,223 but this was more than offset by $303,115,802 net unrealized losses. Overall, the fund’s assets declined by $305,315,861 after accounting for all inflows and outflows. Unlike what we have seen in some other funds that I have discussed recently on this site, this one did not have sufficient realized capital gains and income to cover the distribution. This explains the recent distribution cut and is probably caused by its less-than-optimal portfolio. Time will tell if it can maintain the distribution at the new lower level but as it seems unlikely that the market will stabilize in the near future, there remains considerable concern here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Eaton Vance Tax-Advantaged Global Dividend Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of the fund’s assets minus any outstanding debt. Thus, the net asset value is the amount that the fund’s shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can obtain it at a price that is less than the net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is fortunately the case with this fund. As of November 9, 2022 (the most recent date for which data is currently available), the Eaton Vance Tax-Advantaged Global Dividend Income Fund had a net asset value of $15.70 per share but the shares only trade for $15.15 per share. This gives the fund a 3.50% discount to net asset value at the current price. This is far more attractive than the 1.75% premium that the shares have traded at on average over the past thirty days. Thus, the price today appears to be reasonable.

Conclusion

In conclusion, the Eaton Vance Tax-Advantaged Global Dividend Income Fund appears to have a reasonable strategy, but the portfolio is not particularly attractive for the current environment. In particular, the heavy focus on underperforming technology stocks and stocks that have no dividends is greatly hurting its income and returns. This has gotten to the point that it was forced to cut its distribution as it can no longer afford the old one. It is possible that ETG’s current distribution is still too high and it might be forced to cut it again due to losses on these stocks. While the price is right for ETG, caution should be urged here.

Be the first to comment