Bradley Caslin /iStock Editorial via Getty Images

Throughout the airline industry, we are seeing some recurring topics, these are inflation, fuel prices, and staff shortages. These three elements provide some headwinds to the ability of airlines to translate pent-up demand in revenue growth as well as profit expansion. In this report, I analyze the H1 2022 results and provide comments on the significant pressure that easyJet (OTCPK:EJTTF)(OTCQX:ESYJY) is experiencing at two airports in particular.

The Tale Of Pent-Up Demand

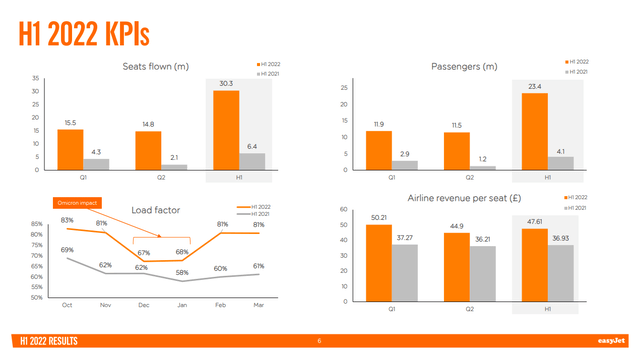

The KPI shows the story of H1 2022. Capacity was roughly 5 times that of H1 2021, while passengers flew was nearly six times that of H1 2021. That means that easyJet Flew more occupied seats as well which shows in the passenger load factors. Apart from the COVID-19 dip in December 2021 and January 2022, load factors exceeded 80%. Those strong numbers were coupled with higher airline revenue per seat with a 9% total yield compared to pre-pandemic levels resulting in revenues being 6.25 times the revenues of H1 2022.

The increase of £1,258 million was partially offset by higher fuel costs and costs related to increased flight activity. This cost increase was around £1 billion was 68% driven by Airline EBITDAR costs and 27% driven by the combination of increased fuel costs and fuel consumption.

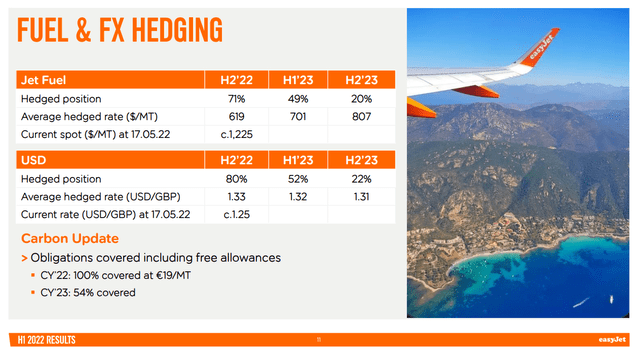

Fuel hedge easyJet H1 2022 (EasyJet)

For the second half of the year and into 2023, fuel hedging likely going to provide a damper on the increase in fuel costs as a significant percentage of the fuel consumption is hedged against attractive rates and we have seen little sign of fuel prices dropping below the hedged rate for the foreseeable future. So, that together with absorption of fuel-efficient aircraft is providing somewhat of a relief on the fuel bill.

Liquidity And Cash Flow

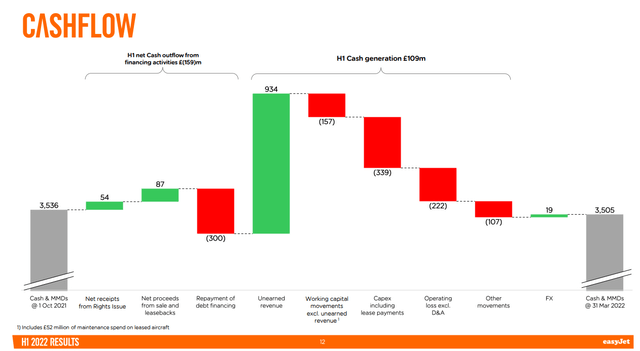

Cash flow easyJet H1 2022 (EasyJet )

During the first half, bookings provided a strong uptick in cash generation. Operating cash flow came in at £448 million before FX adjustment, and adjusted free cash flow was £109 million. The cash position remained more or less stable in the first half of the fiscal year for easyJet, driven by strong bookings, while the company also repaid £300 million of its debt, bringing its net debt position to £0.6 billion down from £2 billion a year ago. So, the progress is strong with no further debt maturing until FY’23.

The Downside

Overall, I am liking the easyJet strategy where the company hedges fuel but also realizes that adding fuel-efficient aircraft also is a way to hedge against higher fuel prices. 18% of the fleet consists of next-generation aircraft and that percentage is set to grow. That is not going to happen at an extremely fast pace, but in FY’22 and FY’23, easyJet will receive 10 fuel-efficient aircraft and the company recently exercised options to acquire 56 aircraft to be delivered between FY’26 and FY’29.

So, where is the downside? I wouldn’t say it is so much into the easyJet recruiting mechanism. There indeed is some lag as staff is in the pipeline and getting staff screened and approved is a bit delayed due to COVID-19 infections. However, the downside risk is brought upon easyJet by airports. During the H1 2022 discussion, easyJet showed off with 22 slots added on Gatwick and daily flights added to and from Amsterdam. Both of these airports are slot-restricted airports, so securing slots to operate flights is a big thing and those additions layered into the carrier’s plan to operate 90% of pre-pandemic capacity in Q3 and 97% in Q4.

Reality, however, will be different for easyJet. Exact number of flight cancellations is not known, but easyJet will only reach 87% of its capacity in Q3 and that is going to hit the company’s topline partially offset by possible higher load factors and somewhat increase the unit cost compared to a 90% capacity plan. This is driven by the airport caps at Gatwick and Schiphol Airport. At Gatwick, where easyJet normally has 80 or 25% of its aircraft based, the number of daily departures is capped at 825 flights per day in July and 850 flights per day in August down from the normal 900 daily flights it normally handles. At Schiphol Airport, the cap is imposed on passenger numbers and capped per airline on a pro rata basis. With nine aircraft based in Amsterdam, easyJet can expect that it will have to cancel some of its flights to meet the overall 13,500 reduction in passengers per day at Schiphol.

What is unfortunate is that these reductions are primarily due to staffing issues at airports. Airports, just like airlines, have had years to prepare for an uptick in demand and they are failing miserably. From experience, Amsterdam Schiphol Airport is an airport that showed it lacked a realistic view in every sense. The airport increased airport charges to compensate for the pandemic disruption to its income but subsequently failed to provide the required services to airlines to support their flights. So, airlines are paying an increased fee and are not receiving appropriate services from the airport. At Schiphol Airport, this mostly becomes clear at the security lanes, where at the worst of times, waiting times exceeded several hours and people had to queue outside of the terminal.

In February, I flew from Amsterdam Schiphol on a relatively quiet day, but even then, security staff managed to create a queue as they did not call for an additional security lane to be opened in time, and once the call was made, it took another 15 minutes at least for the lane to open. If airport management would have paid at least some attention, they would have seen that they weren’t ready for a busy summer season.

Share Volume Risk

It was observed that Lufthansa shares have a rather limited trading volume of several thousand shares per day which for me is a reason to provide a word of caution on the volume: Due to the low volume there might be a lack of liquidity, which makes quick buying and selling at constant prices more challenging and could possibly result in higher volatility when buying or selling occurs. This provides opportunity for investors, but associated risks should also be kept in mind.

Conclusion

Just like many airlines, easyJet is on a strong recovery trajectory supported by pent-up demand being released into the marketplace. This shows in the company’s revenues and unearned revenues. However, the company will not be able to execute its initial capacity plans due to airport caps imposed at Gatwick and Schiphol Airport. For airlines and their travelers as well as shareholders, it is a source of frustration that airports had the time to attract and train staff and with a busy summer season ahead are now figuring out that they don’t have enough proficient staff members to support the flight volumes.

Be the first to comment