We Are/DigitalVision via Getty Images

Vinco Ventures, Inc. (NASDAQ:BBIG) is in a sweet spot, with many catalysts working in its favor. Among other things: 1) Lomotif, its global short video-sharing networking platform (similar to TikTok), is going from strength to strength; 2) Cryptyde (TYDE), its crypto arm that will be spun off, has a new distribution date just around the corner; 3) the company is now part of the Russell 3000 Index; and 4) the company’s financial position is solid, with exponential revenue growth and a strong balance sheet flooded with cash, which provides tremendous financial flexibility. Lets go into more detail on each catalyst (note all dates mentioned below relate to 2022 unless otherwise stated).

1. Lomotif

Lomotif allows users to create videos with their favorite music, video clips and images with a best-in-class video editor app for Facebook, Instagram, Twitter and TikTok. So far, more than 225 million creators worldwide have downloaded and used Lomotif, and momentum is building. For instance, during Q1 2022, Lomotif was highly successful in expanding its user base and related digital properties in part due to livestreaming events such as Shaq’s Fun House in February and the Okeechobee Music Festival in March. Lomotif has more than 310,000 ratings with an average score of 4.6 on the Apple App Store.

Lomotif on the Apple App Store

In contrast, TikTok has an average score of 4.8 with 12.8 million ratings. The good news is that Lomotif is constantly improving its offering and, combined with its increasing popularity, suggests that both its average score and number of reviews will continue trending up, at a fast pace. This, in turn, will translate into greater revenue generation and cash flow growth. It is no coincidence that Lomotif constantly makes it on the top lists for the best TikTok alternatives.

2. Cryptyde

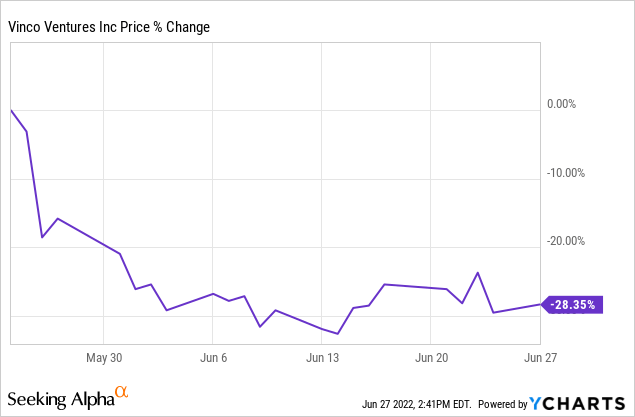

On 25 May, BBIG investors were caught by surprise. As a result of contractual and regulatory conditions, BBIG’s Board of Directors decided to delay the distribution date for the spin-off of Cryptyde.

This was no doubt a major blow at the time. In fact, since 25 May, BBIG’s share price has fallen by almost 30%.

Even though the markets are in turmoil, there is little doubt that the delayed spin off of Cryptyde created a lot of selling pressure. In other words, its more BBIG specific rather than general market sentiment.

The good news is that we now have a new distribution date, and it’s just around the corner. Specifically, on 23 June, BBIG announced that its Board of Directors has set 29 June as the distribution date for the dividend of shares of its common stock of Cryptyde. The even better news is that shareholders can still get shares of Cryptyde even if they purchased BBIG common shares after the previously announced record date (18 May).

The reason for this is that after the record date there have been 2 markets in Vinco common stock: a “regular-way” market under the core ticker BBIG and an “ex-distribution” market under the ticker BBIGV. Shares that trade on the “regular-way” market trade with an entitlement to receive shares of Cryptyde common stock in connection with the distribution whereas shares that trade on the “ex-distribution” market trade without an entitlement to receive shares. In other words, if you sell (or have sold) BBIG on the “regular-way” market after the close of business on the record date and up to and including through the distribution date, you will be selling (or have sold), your right to receive shares of Cryptyde.

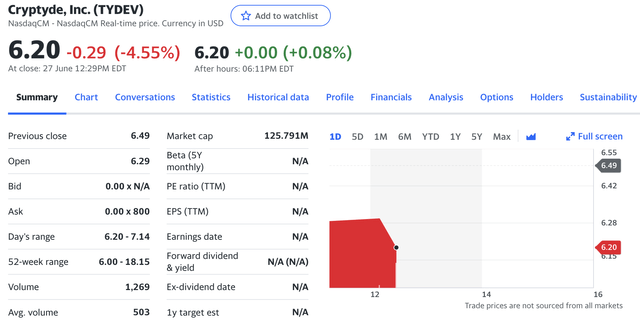

On the distribution date, eligible shareholders will receive 1 share of Cryptyde common stock for every 10 shares of Vinco common stock held. For example, if eligible shareholders own 15,000 shares of BBIG, they will receive 1,500 share of Cryptyde. Based on the closing share price of $2.05 on 27 June, 15,000 shares of BBIG are currently worth $30,750. Regarding Cryptyde, there is currently some low-volume trading taking place. At market close on 27 June, Cryptyde’s share price was $6.2 with an implied market cap of ~$125 million.

Based on this information, 1500 shares of Cryptyde could be worth $9,300 on the distribution date. This is 30% of BBIG’s current value, which is quite high. In my view, the market is not valuing properly the explosive growth story of Lomotif and AdRizer. In fact, as mentioned previously, since the delay announced on 25 May for the spin-off of Cryptyde, BBIG’s share price has lost almost 30% in value. However, the spin-off now appears to be a done deal, since the distribution date is tomorrow. It is as if the market believes that there will be another last minute delay. What are the odds? Extremely low in my opinion. As such, it is my belief that we will see a significant upward re-rating in BBIG shortly after the distribution date.

3. Russell 3000 Index

BBIG is now included in the Russell 3000 Index, as part of the 2022 Russell indexes reconstitution. This is effective as of 27 June, after the U.S. market opened. Membership in the US all-cap Russell 3000 Index, which remains in place for 1 year, means automatic inclusion in the large-cap Russell 1000 Index or small-cap Russell 2000 Index as well as the appropriate growth and value style indexes. This is good news for BBIG. Inclusion in the Russell 3000 Index is an important milestone that will provide increased visibility and exposure to the investment community.

4. Solid Financial Position

BBIG’s balance sheet is in good shape, providing significant financial flexibility. Cash and cash equivalents, including restricted cash, exceeds $210 million at the end of Q1 2022 (exceeding the debt relating to convertible notes which is less than $70 million). To put things into perspective, the company’s cash position reflects almost 50% of the current market cap, a sign of undervaluation. What’s more, revenue increased by almost 350% compared to Q1 2021, reflecting the impact of the inclusion of AdRizer which was acquired on 11 February.

It is important to note that we have yet to experience an entire quarter including AdRizer’s performance baked into the financials. Going forward, revenue is expected to increase dramatically, driven by Lomotif, and AdRizer will play an ever-increasing role. As a side note, it might appear that BBIG’s expenses and debt levels are elevated, but this is mainly due to warrant accounting requirements. For instance, the impact of warrant-related expenses accounted for 87% of BBIG’s net loss of $372.9 million during Q1 2022. When adjusted for the warrants, underlying performance is going from strength to strength.

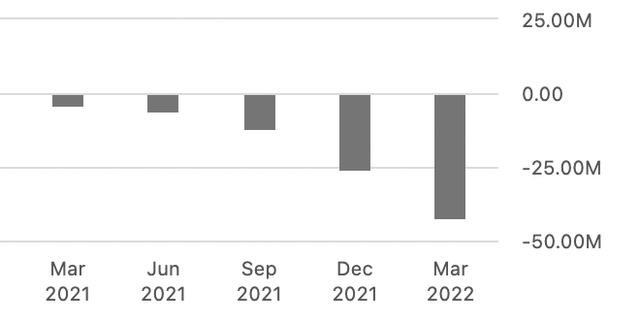

In closing, there are many good things happening at BBIG. Lomotif is growing rapidly and globally, also capitalizing on TikTok’s ban in several countries. For example, Lomotif launched in India in partnership with Socialkyte. In just a few months, Lomotif has reported more than 40 million active users in India alone. These are huge numbers, suggesting that BBIG’s valuation should be in the billions of dollars (the current market cap is less than half a billion). That said, there are risks. Cryptyde seems to be in the mind of most BBIG investors, as the spin off distribution date for Cryptyde has been delayed several times already. Therefore, it is logical for investors to be traumatized. Also, even though BBIG is making progress on multiple fronts it is still bleeding cash every quarter.

Net cash in operating activities has been consistently negative, albeit at a manageable position relative to the company’s sizeable cash balance. In other words, there is no immediate danger. In fact, the company has the capacity to go on for a long time without running out of cash, all else constant. Eventually, cash flow from operations will turn positive given the substantial progress made at Lomotif and AdRizer. It is a matter of when, not if.

Another concern in the mind of shareholders is the special shareholder meeting to take place on 1 July. The agenda includes a proposal to approve an increase in the number of authorized shares of common stock from 250 million to 750 million and a proposal to increase the number of authorized shares of preferred stock from 0 to 30 million. In other words, shareholders fear dilution. However, this is something that many growth oriented companies are doing, and it can be a great tool to create shareholder value, if used wisely. A good reference point is AMC-backed Hycroft Mining (HYMC). As Hycroft’s CEO stated:

We also disclosed we would be authorizing an additional 1.0 billion shares of common stock under our charter. The Company’s authorized share capital did not provide us with the necessary flexibility to improve our capital structure and it was prudent to increase the authorized share capital for a variety of corporate purposes. These purposes may include financing transactions as well as adopting additional stock plans or reserving additional shares for issuance under existing plans. While the Company has sufficient cash on hand to conduct our planned activities at the Hycroft Mine thanks to our successful recent financings, we need to have the flexibility to move promptly should opportunities arise as we develop Hycroft for the long term.

I view BBIG being in a similar situation. It is of significant importance to be able to play the game of financial engineering in a smart way, to be in a position to raise accretive capital via ATM offerings (at-the-market offerings). This is something that AMC (AMC) managed to do extremely well, but then ran out of authorized shares to issue. Specifically, in its last ATM offering round, AMC managed to sell 11.55 million shares at a sky-high average price above $50 per share.

At the time, AMC’s CEO Mr. Aron wanted to be in a position to raise even more capital at those prices, but investors were against this prospect, citing dilution. However, in my view, this would have been accretive dilution, to the benefit of common shareholders. If investors had been more accommodative to increase the authorized share capital, then AMC could have raised way more capital at way more inflated prices well above fair value, and AMC would have been debt free. Arguably, AMC’s share price would be way higher in such a scenario versus $14.13 currently. Again, I believe this is a good tool for BBIG provided that it is used wisely in the form of accretive share offerings at much, much higher prices.

Lastly, the much awaited ZASH-Vinco merger is still pending. So far, we have only seen the repositioning of management teams across the ZASH family group of companies. We are still waiting for everything to be consolidated, including changing the name of Vinco Ventures to ZASH. In any event, there is a lot happening at BBIG and investors stand to benefit tremendously if various events play out as planned, including the Cryptyde spinoff, acquisition of remaining 20% of Lomotif, integration of AdRizer and of course the ZASH-Vinco merger. This is what BBIG had announced on 20 October 2021:

Upon closing of the merger between ZASH and Vinco, ZASH will be a public company and controlling shareholder of Vinco, making Lomotif one of the top global, pure play video-sharing social networking platforms to be owned by a U.S. publicly traded company, competing with TikTok and Kuaishou in the space. Lomotif is one of the fastest growing video-sharing social networking platforms in its category over the last three years, with 225+ million installations of the Lomotif app globally in over 200 countries in 300+ languages. Over 300 million videos are watched on the platform per month and over 10 billion atomic clips (User Generated Content (UGC)) have been used to create more than 750 million videos on the platform since its launch.

There is no doubt that we have faced significant delays. But things are finally starting to fall into place, starting with tomorrow’s spinoff of Cryptyde.

Be the first to comment