peshkov

(Note: This article was in the newsletter on July 1, 2022, and has been updated as needed.)

Earthstone Energy (NYSE:ESTE) had announced the Titus acquisition. This comes after several significant acquisitions that have enlarged the company to several times the size before the shopping spree began. The stock price is beginning to reflect concerns about so many acquisitions as well as the handling of more stock outstanding. Investors need to keep in mind that sellers that receive stock often sell that stock. That will depress the stock price until the large seller exits.

The market also has concerns about management making so many significant acquisitions in such a small space of time. This management may prove those worries unfounded as because the management has built and sold companies before. Nonetheless, it is clear that the market is factoring more risk into the stock price.

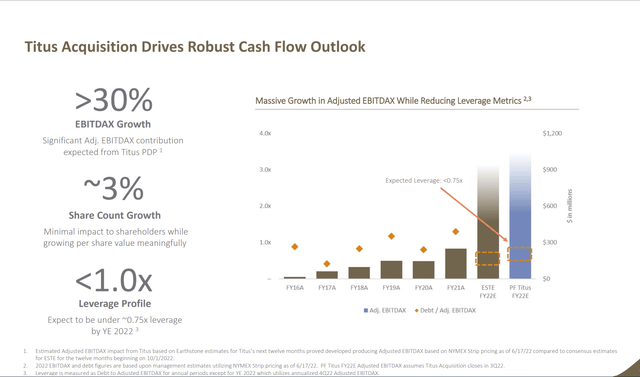

Earthstone Energy Titus Acquisition Benefits (Earthstone Energy Titus Acquisition Presentation June 2022.)

The current debt measures shown above are clearly conservative. The worry is that debt is growing at a very fast rate and the company is rapidly expanding. Therefore, the reported trailing debt ratio will not reflect the numbers above until a full year of operations with all the acquisitions is reported.

This market is seeing ghosts all over the place. Nothing is a worse nightmare for the market than a high debt ratio. Even though there is production on the latest purchased leases (and hence established cash flow), management still has to report essentially mixed numbers until the company operates one year.

The market is concerned when there is one major acquisition about risks like the logistics of combining major acquisitions into an optimal combination. Here, there are now several large acquisitions. So those concerns are beginning to multiply.

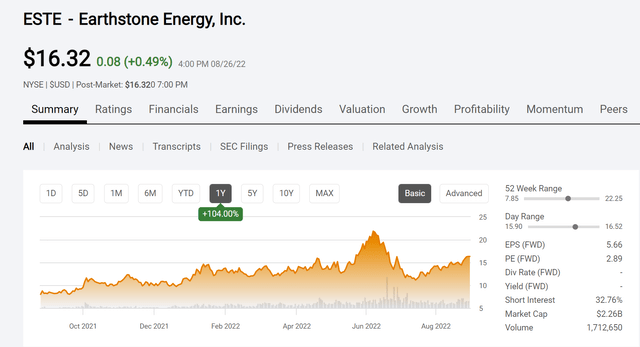

Earthstone Energy Publicly Traded Stock Price History And Key Valuation Measures (Seeking Alpha Website August 27, 2022)

Clearly the market reaction to the latest acquisition announcement has been less than stellar. Some of that has to do with the recent decline in the price of oil and other market worries about the industry.

Another worry is that the series of transactions is creating large shareholders from the stock issued through these transactions. One of these, Warburg Pincus just announced holding a sizable amount of stock. A large shareholder can depress the price of the stock considerably until the sales pressure declines. This company has issued a lot of stock to acquire a fair number of properties. An additional risk is that some of those large sellers will liquidate their holdings to delay an appreciation of the stock when combined results would indicate a stock price rally.

But the accelerating pace of debt growth also has the market worried. The first order of business will likely be to pay down that debt as quickly as possible. Admittedly, management may use some of the cash flow initially to combine the acquisitions and optimize operations. But if the cash flow is as generous as management states, then debt repayment should begin rather quickly.

This is a notoriously low visibility industry that often has unpleasant surprises. Even though the current recovery appears to be sustainable for a while, long term readers know we have been down that road before only to be quickly disappointed. Therefore, it may be time to slow down the shopping spree to allow the market to see the benefits of the “new” Earthstone Energy.

Probably a concern is not the debt ratio in the current pricing environment, but the debt ratio when commodity prices are much lower. Having gone through some severe situations in both 2008 and 2020 (and less severe ones like 2015), this market has an increasingly concerned view of debt.

On top of that, the market has been disappointed by the “one decision” stocks that are no longer as “safe” as the market thought they were. This generally leads towards a swing towards safety where Mr. Market goes overboard as usual. That means that the management experience may not be valued as it would in other market climates (or situation).

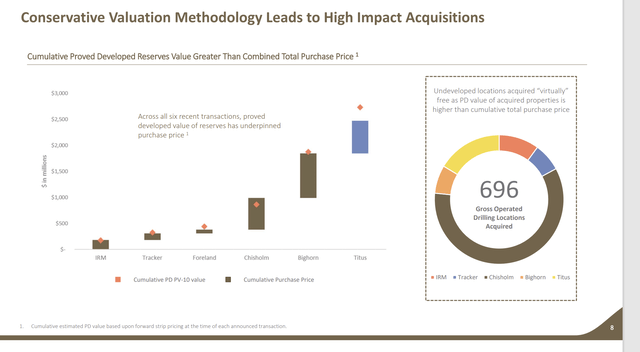

Earthstone Energy Valuation Method Cushion (Earthstone Energy Titus Acquisition Presentation June 2022.)

Management is clearly countering these concerns by explaining the valuation method that they use. It does help that many of these acquisitions arrive with infrastructure and transportation commitments in place. Most likely the company retains necessary personnel as well because this reduces the risk of new personnel that are not familiar with the lease operations.

The real key for the market will be the performance of the company during the next downturn. All the acquisitions have made this a materially new company without a public operating history. Therefore, investors should expect some stock pricing actions along the lines of other new issues (rather than an established company) until there is ample evidence of superior performance.

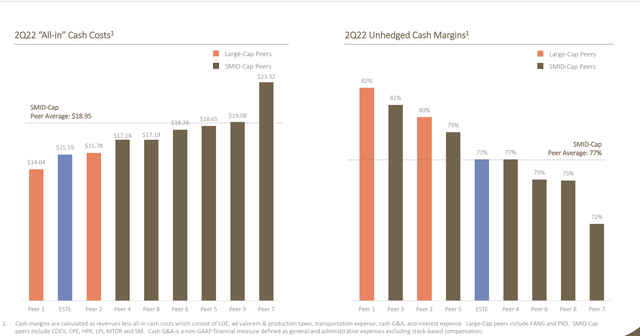

Earthstone Energy Comparison Of All-In Costs (Earthstone Energy Second Quarter 2022, Corporate Presentation)

One of the keys to better market performance will be the maintenance of the low costs shown above combined with at least expected well performance data. If management is able to keep up with the technology changes sweeping the industry to maintain the cost leadership shown above, then superior pricing action is likely to result.

Management has clearly acquired some excellent acreage. The worries would be about the logistics that rapid growth entails. An inexperienced management can easily lose control of costs or quality (which would cost customers fast in a commodity business). This is also part of the worry about servicing the debt.

The Future

The stock price is likely to underperform the rest of the industry until it is apparent that management can report satisfactory (or better) results from the combined company. This latest acquisition is supposed to add economies of scale in one of the more profitable regions of the Permian.

Many times, synergies are hard for individual investors to ascertain. But what will get the market attention is wide margins, low costs, and of course above average profitability.

Management has lowered the risk of all of the acquisitions by purchasing established production. Management further lowered the risk by keeping the number of rigs constant while allowing for an additional rig once they understand all the new acquisitions.

The debt ratio remains low at in the current environment. But the market will likely want proof of a low debt ratio at considerably lower commodity prices. The established production from the purchases gives management a huge head start on that requirement.

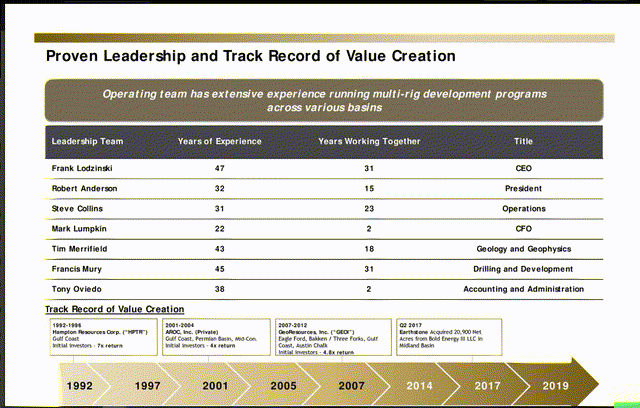

Earthstone Energy Management Experience Building And Selling Companies (Earthstone Energy June 2019, Investor Update)

Here is at least some of the past experience of management and what they have done for investors. This management has been together for a long time and is still doing what it knows best.

Despite the market concerns, the best asset on the side of shareholders is this management and their experience (along with the success shown above). Clearly this stock is not for everyone. But good management can usually surprise to the upside. This appears to be very good management.

Be the first to comment