Pgiam

(Note: All amounts are in Canadian dollars unless otherwise indicated)

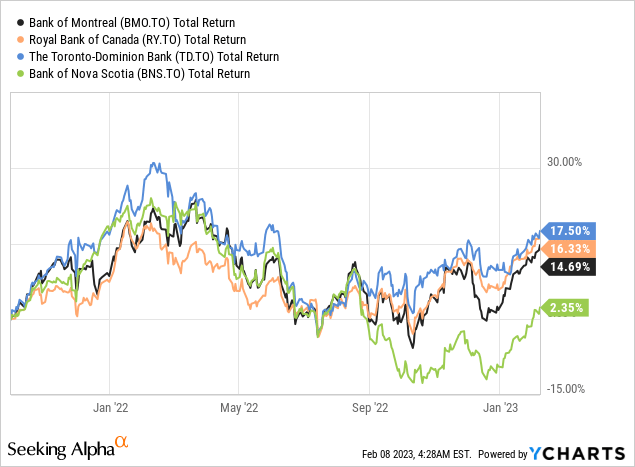

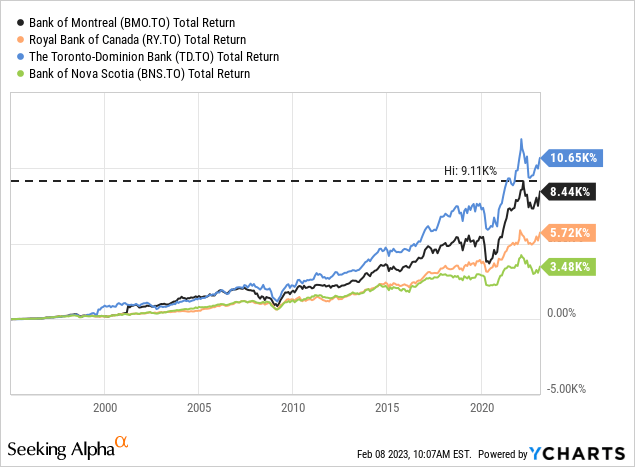

In my last article about the Bank of Montreal (NYSE:BMO), I wrote that the bank might be lagging its Canadian peers. But when looking at the performance of the major Canadian banks since September 2021, BMO outperformed The Bank of Nova Scotia (BNS) and its performance was almost in line with the performance of The Toronto-Dominion Bank (TD) as well as the Royal Bank of Canada (RY).

Valuation Multiples

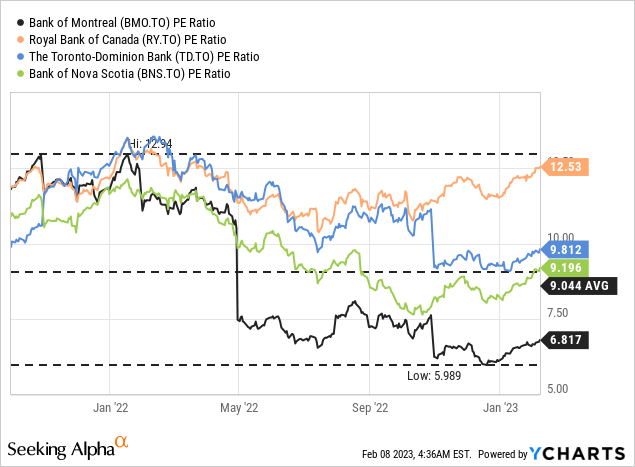

And although the stock price performance is not necessarily the best indicator if a business is lagging or not, the picture might have changed a bit since my last article. When looking at the P/E ratio of the four major Canadian banks (I left out the Canadian Imperial Bank of Commerce (CM) as I did not cover the company yet) all of them were trading more or less for similar P/E ratios in September 2021. Now however, these four banks are trading for rather different valuation multiples. While the Royal Bank of Canada is trading for 12.5 times earnings, the Toronto-Dominion Bank (trading for 9.8 times earnings) and the Bank of Nova Scotia (trading for 9.2 times earnings) are cheaper. However, the Bank of Montreal is trading only for 6.8 times earnings and seems therefore to be a real bargain.

But before we jump to the conclusion that the Bank of Montreal might be a bargain and therefore a great investment, we should look at the reported results first. There is a reason why the Bank of Montreal is trading for such a low valuation multiple in my view.

Annual Results

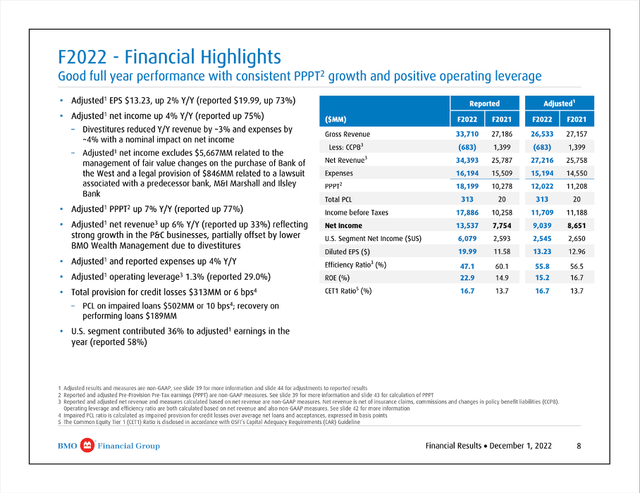

In fiscal 2022 (for BMO the year ended on October 31, 2022), the bank was able to grow its total revenue from $27,186 million in fiscal 2021 to $33,710 million in fiscal 2022 resulting in 24.0% year-over-year growth. And while net interest income increased 11.0% year-over-year from $14,310 million in fiscal 2021 to $15,885 million in fiscal 2022, non-interest revenue increased 38.4% year-over-year from $12,876 million to $17,825 million.

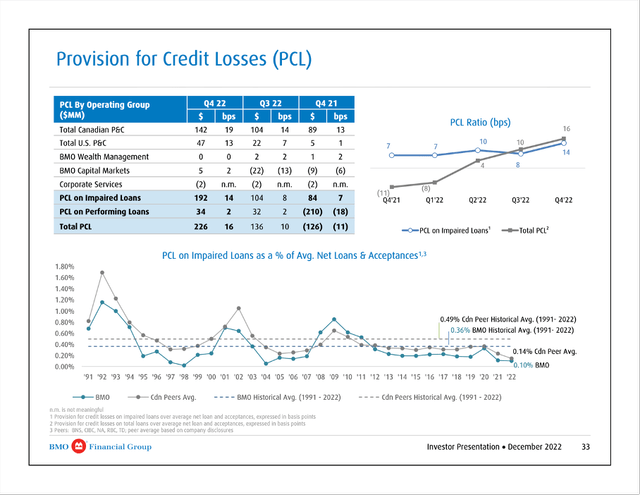

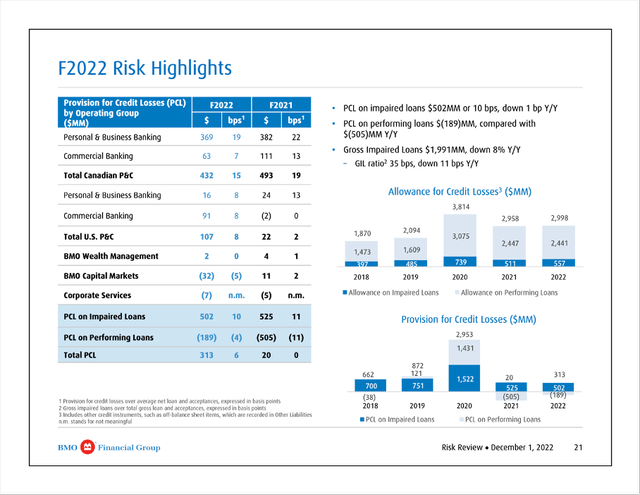

And although provision for credit losses increased also from $20 million in fiscal 2021 to $313 million in fiscal 2022, diluted earnings per share increased from $11.58 in the previous year to $19.99 in fiscal 2022 – an increase of 72.6% YoY. However, when looking at the adjusted earnings per share the amount increased only slightly from $12.96 in fiscal 2021 to $13.23 in fiscal 2022.

The big difference between the GAAP results and non-GAAP results stems from the acquisition of the Bank of the West. Management of fair value changes on the purchase of the bank led to $7,713 million in additional net income and therefore resulting in the extraordinary high earnings per share on a GAAP basis. And especially in the second and fourth quarter of fiscal 2022, Bank of Montreal reported much higher earnings per share, which led to the low P/E ratio (see chart above).

Acquisition

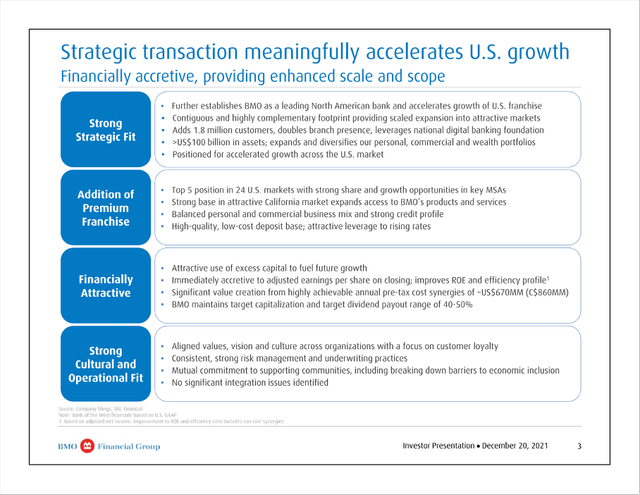

Already in December 2021, the Bank of Montreal announced its intent to acquire the Bank of the West and a few days ago, on February 1, 2023, it was announced that the acquisition was completed. Bank of Montreal paid US$16.3 billion to BNP Paribas and the transaction was primarily funded via excess capital.

BMO Bank of the West Acquisition Presentation

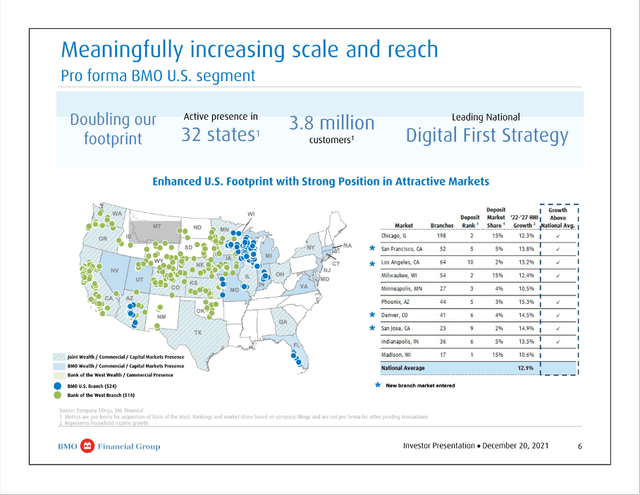

The acquisition will further establish Bank of Montreal as a leading North American bank and with the presence of the Bank of the West in 32 states with more than 500 branches, the Bank of Montreal will double its presence in the United States. The bank now has about 3.8 million customers in the United States. Bank of Montreal is also gaining access to the highly attractive Californian market with 12% of the national population living there and California being responsible for 14% of total U.S. gross domestic product.

The bank was founded in 1874 and wholly owned by BNP Paribas. Bank of the West has more than $100 billion in total assets and about $60 billion in loans which were added to Bank of Montreal’s balance sheet.

BMO Bank of the West Acquisition Presentation

In my opinion, it is quite interesting that all major Canadian Banks are trying to increase the presence in the United States by major acquisitions. As I have written in my last articles about the Toronto-Dominion Bank and the Royal Bank of Canada, both banks also made major acquisitions in 2022. Only the Bank of Nova Scotia is rather focused on South America to grow. It seems like all major Canadian banks have a long-term growth strategy for the United States.

Exposure to Canadian Housing Market

In my last two articles about the Royal Bank of Canada as well as the Toronto-Dominion bank I talked about the exposure of these two banks to the Canadian housing market. And of course, the Bank of Montreal has an exposure as well.

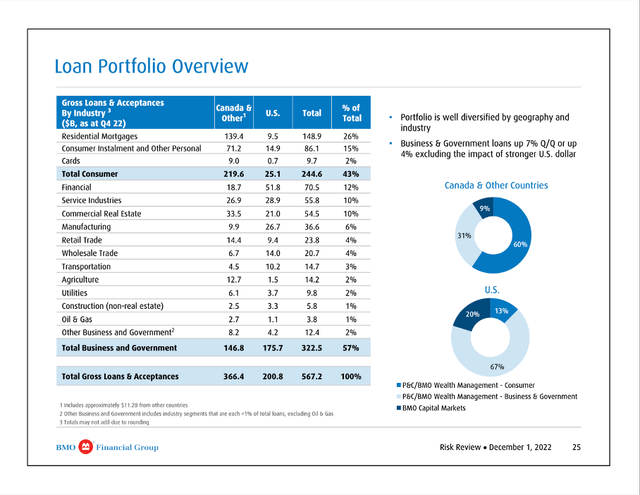

Although the loan portfolio can be described as diversified, residential mortgages (mostly Canadian mortgages) make up 26% of the total portfolio ($148.9 billion in mortgages). And when looking at the business loans, three sectors dominate: Financial makes up 12% of total loans, Service Industries account for 10% and Commercial Real Estate accounts for 10%. Therefore, the combined exposure to the “housing market” is 36% of total loans and although these loans are diversified over different countries (with Canada dominating) we should keep a close eye on this.

Risk

While the Canadian housing market is something we should pay close attention to, we can also describe the Bank of Montreal as financially stable – like other Canadian banks. When looking for an example, using the PCL on impaired loans as a percentage of net loans and acceptances, the Bank of Montreal reported great metrics since the early 1990s and is even outperforming the high standard of Canadian banks.

BMO December 2022 Presentation

And we can see the provision for credit losses increase again leading to a higher allowance for credit losses compared to fiscal 2021 ($2,998 million at the end of fiscal 2022 compared to $2,958 million at the end of fiscal 2021). When looking at the different risk metrics, the common equity tier 1 ratio is now 16.7% compared to 13.7% one year earlier. And with net loans and acceptances of $564.6 billion and deposits of $769.5 billion, we get a loan-to-deposit ratio of 73% (compared to 68% for TD and 67% for RY). When comparing loans to total assets of $1,139.2 billion we get a loan-to-asset ratio of 0.50 (compared to 0.43 for TD and 0.40 for RY). And although the metrics are a little worse than for the two Canadian peers, these metrics are still acceptable and so there’s likely no reason to worry.

The only news that irritated me a little bit was the announcement of the issuance of new shares to raise $3.15 billion after the Canadian regulators announced plans to increase the domestic stability buffer (DSB) requirement. And while it is good that the Bank of Montreal is using the net proceeds to align the company’s capital position with the increased regulatory requirements, it is not the news shareholders like to hear. From Q4/21 to Q4/22 the number of outstanding shares increased from 648.1 million to 677.1 million – an increase of 4.5%. And it is a bit irritating that the Bank of Montreal needs additional cash to meet the requirements.

Not Lagging Peers Anymore

In my last article about BMO, I compared the five major Canadian banks according to different metrics and BMO was certainly not the best picks according to these metrics. But a lot changed in the last 1.5 years and when looking at some metrics again, BMO actually is tempting.

|

Bank of Montreal |

Royal Bank of Canada |

Toronto-Dominion Bank |

Bank of Nova Scotia |

Canadian Imperial Bank of Commerce |

|

|---|---|---|---|---|---|

|

Dividend Yield |

4.18% |

3.81% |

4.14% |

5.59% |

5.47% |

|

Dividend Growth (5-year CAGR) |

8.94% |

7.37% |

8.63% |

5.70% |

-4.33% |

|

P/E ratio (GAAP) |

6.82 |

12.53 |

9.81 |

9.20 |

9.35 |

|

RoE 5-year average |

14.31% |

16.47% |

15.31% |

13.50% |

14.25% |

|

EPS growth 5-year average |

20.34% |

7.91% |

11.48% |

4.32% |

3.52% |

|

Net Income Margin (5-year average |

28.78% |

28.69% |

30.87% |

27.84% |

27.00% |

Especially the combination of high earnings per share growth rates and a moderate P/E ratio (when looking at GAAP numbers it has an extremely low P/E ratio) is tempting. The bank now has a similar dividend yield as the other major Canadian banks and is also reporting a similar return on equity. I would therefore retract my statement about the Bank of Montreal lagging its peers. The bank is also following a similar strategy as the Royal Bank of Canada and the Toronto-Dominion Bank and trying to increase its U.S. presence.

And when looking at the performance since the mid-1990s, the Bank of Montreal performed well. When looking at total returns over these almost 30 years, the Bank of Montreal clearly outperformed the Bank of Nova Scotia as well as the Royal Bank of Canada.

Intrinsic Value Calculation

We already mentioned that the P/E ratio (according to GAAP) is a bit misleading, but the adjusted P/E ratio is also showing that the Bank of Montreal is rather cheap. Additionally, we can also use a discount cash flow calculation to determine an intrinsic value for the stock.

We are also using the adjusted net income as our basis as the GAAP net income is misleading and paints the picture of a much better business. But even when taking the adjusted net income and assuming only 0% growth for the years to come, the intrinsic value would be $133.50 (assuming 677.1 million outstanding shares and a 10% discount rate). With BMO trading for $137 at the time of writing, the stock can be seen as fairly valued even without any growth.

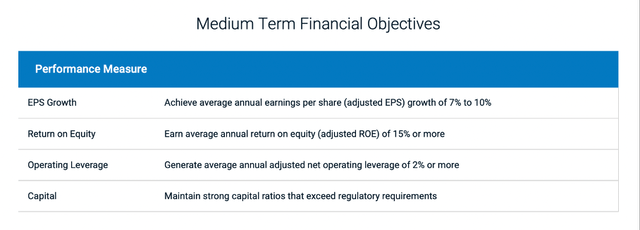

And when taking the lower end of the company’s mid-term growth targets (7% annual growth for earnings per share) for the next ten years followed by 6% growth till perpetuity, we get an intrinsic value of $358.23 and have a real bargain on our hands. In the last 10 years, earnings per share grew with a CAGR of 12.51% and in the last 30 years (since 1992), the Bank of Montreal grew its bottom line with a CAGR of 9.86% so the company’s mid-term targets seem realistic.

Conclusion

After being rather pessimistic about the Bank of Montreal in my last article, I changed my mind. I would now see the Toronto-Dominion Bank as well as the Bank of Montreal as the best two picks (among the major five Canadian banks) right now followed by the Royal Bank of Canada.

Aside from that, my feeling towards the Bank of Montreal are similar as my feeling towards most other banks. Most of them are cheap on a fundamental basis, but I don’t want to buy the Bank of Montreal on the potential eve of a global recession, which could have a huge negative impact on the banking system. And even if banks perform well in the coming quarters and years, the risk of further declining stock prices is high. Maybe I miss out on a great opportunity, but in my opinion, we could get banking stocks cheaper in the coming quarters as banks usually get hammered during a recession and bear market.

Be the first to comment