grandriver/E+ via Getty Images

Earthstone Energy (ESTE) has been aggressive in growing itself via acquisitions. It had an enterprise value of around $1.2 billion several months ago, and since then it has made $1.46 billion in acquisitions.

As Earthstone is funding its most recent acquisitions primarily with cash, Earthstone’s risk has temporarily increased. If oil and gas prices average near current strip prices during 2022 though, it should end the year with a reasonable amount (under $700 million) of net debt.

Bighorn Acquisition

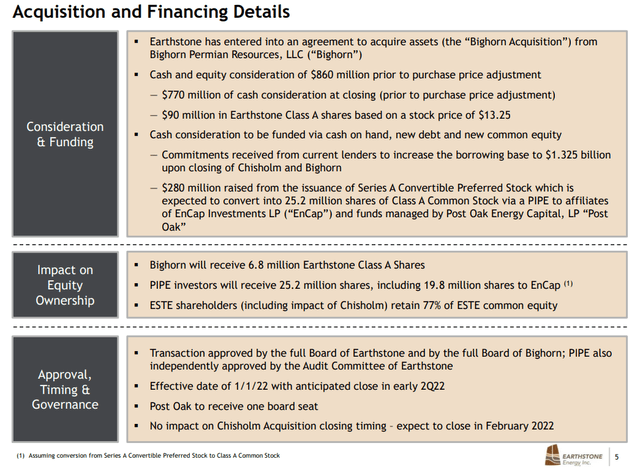

Earthstone is paying $770 million in cash and 6.8 million common shares for the Bighorn acquisition, which is expected to close in mid-April 2022. It also entered into a private investment in public equity agreement with EnCap and Post Oak Energy Capital that will see it effectively issue 25.2 million shares in exchange for $280 million.

Thus the net effect is that Earthstone is paying $490 million in cash and 32 million common shares for Bighorn.

Earthstone’s Bighorn Acquisition (earthstoneenergy.com)

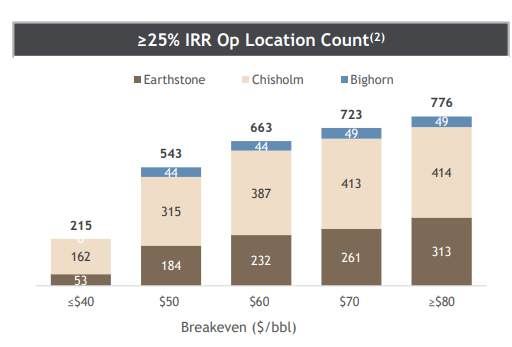

The Bighorn acquisition is mostly for PDP value, as it has limited development value. Earthstone indicates that Bighorn will only add 44 gross locations that are economic at $60 WTI oil. The Bighorn assets had 42,400 BOEPD in production with a relatively low oil content (25% oil, 57% liquids) around November 2021.

Earthstone’s Drilling Inventory (earthstoneenergy.com)

The purchase price is 0.85x PDP PV-10 at January 18 strip (low-$80s WTI oil and approximately $4.10 NYMEX gas for 2022). In addition to having limited development value, the Bighorn assets have relatively low margins per BOE due to the low oil content combined with lease operating expenses that may be $8+ per BOE. Despite this, at low-$80s WTI oil, Earthstone should still be able to generate $30+ per BOE margins from Bighorn.

This acquisition is basically a bet that oil and gas prices remain relatively high over the next year or two. At January 18 strip prices (which are similar to current strip prices), Earthstone may be able to cover around 40% of the total purchase price (and around 70% of the $490 million net cash cost) via first year cash flow.

2022 Outlook

Earthstone is now expecting to average 66,000 BOEPD (41% oil, 67% liquids) in production during 2022, assuming that the Bighorn transaction closes in mid-April.

At current 2022 strip (approximately $85 WTI oil and $4.60 NYMEX gas), Earthstone is projected to generate $1.230 billion in revenues before hedges, while its hedges have around negative $99 million in estimated value..

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 9,876,900 | $84.00 | $830 |

| NGLs (Barrels) | 6,263,400 | $35.00 | $219 |

| Natural Gas [MCF] | 47,698,200 | $3.80 | $181 |

| Hedge Value | -$99 | ||

| Total Revenue | $1,131 |

Source: Author’s Work

This results in a projection that Earthstone can generate $362 million in positive cash flow in 2022 at current strip prices.

| Expenses | $ Million |

| Lease Operating | $181 |

| Production Taxes | $95 |

| Cash G&A | $33 |

| Cash Interest | $35 |

| Capital Expenditures | $425 |

| Total Expenses | $769 |

Source: Author’s Work

Debt Situation

Earthstone had $600 million in net debt at the end of 2021, proforma for the Chisholm acquisition. It also owes $70 million in deferred cash consideration related to that acquisition.

Earthstone’s net cash cost for the Bighorn acquisition is $490 million, while the purchase price adjustment could be substantial (potentially around $110 million based on current strip)

| $ Million | |

| YE 2021 Net Debt | $600 |

| Deferred Cash Consideration | $70 |

| Net Bighorn Consideration | $490 |

| Less: 2022 Cash Flow | -$362 |

| Less: Purchase Price Adjustment | -$110 |

| YE 2022 Net Debt | $688 |

Source: Author’s Work

This results in a projection that Earthstone will end 2022 with $688 million in net debt, including $30 million of deferred cash consideration that would get paid in early 2022.

Notes On Valuation

Earthstone may be able to average around 80,000 BOEPD (41% oil) in production in 2023 if it continues with a four-rig development program. This represents low-single digits production growth compared to 2H 2021 levels.

If we use longer-term assumptions of $65 WTI oil and $3.25 NYMEX gas prices, it would be able to generate $1.116 billion in oil and gas revenue.

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 11,972,000 | $64.00 | $766 |

| NGLs (Barrels) | 7,592,000 | $27.00 | $205 |

| Natural Gas [MCF] | 57,816,000 | $2.50 | $145 |

| Total Revenue | $1,116 |

Source: Author’s Work

Earthstone would also be able to generate $776 million EBITDAX and $316 million in positive cash flow in this scenario.

| Expenses | $ Million |

| Lease Operating | $219 |

| Production Taxes | $86 |

| Cash G&A | $35 |

| Cash Interest | $20 |

| Capital Expenditures | $440 |

| Total Expenses | $800 |

Source: Author’s Work

At a 3.3x EV/EBITDAX multiple, this would make Earthstone worth approximately $13.60 per share at long-term (after 2022) $65 WTI oil. This assumes $688 million in net debt and 139.1 million shares outstanding. Earthstone would have a bit over 10 years of drilling inventory (from 2023 onwards) at a long-term $65 WTI oil price.

At long-term $70 WTI oil, Earthstone’s estimated value would improve to around $15.50 per share.

Conclusion

Earthstone has continued its acquisition spree, with the $860 million Bighorn acquisition being its biggest one so far. Earthstone is betting on oil and gas prices remaining quite strong through at least 2022, allowing it to extract value out of the PDP wells from this acquisition. The Bighorn assets have limited development potential, so near-term commodity prices will largely determine whether this acquisition pays off.

At its current price, Earthstone appears to have a bit of upside in a long-term $65 to $70 WTI oil scenario, assuming that 2022 commodity prices are stronger (with WTI strip at $85).

Be the first to comment