Joey Ingelhart/E+ via Getty Images

Comstock Resources (CRK) should be able to significantly deleverage in 2022. At current strip prices, it is projected to reduce its net debt to a bit over $2 billion by the end of 2022, which would give it net debt of around 1.3x EBITDAX. It also looks capable of reducing its leverage further to 1.0x or lower by the end of 2023 at strip.

As it pays down its debt, Comstock’s common stock should benefit from its reduced risk profile. Comstock’s common stock should be worth in the low double-digits in a longer-term $3.25 to $3.50 Henry Hub natural gas scenario.

2022 Outlook

Comstock is now expecting to average approximately 1,420 Mcfe per day in production in 2022. This is around a 4% increase from its average 2021 production level, although the increase would be around 6% after excluding the production from the Bakken assets it sold. With that divestiture, nearly all of Comstock’s production is natural gas. Only 0.2% of its PDP reserves are oil now.

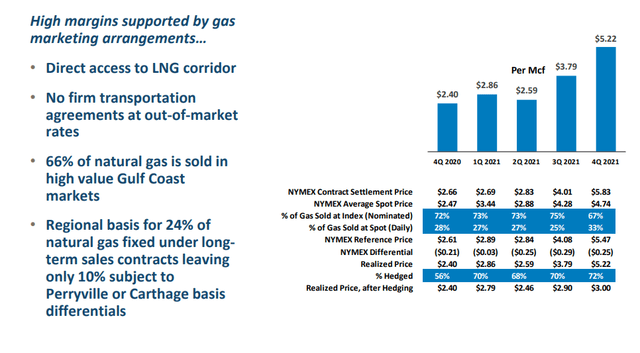

The current 2022 strip is approximately $4.50 for Henry Hub natural gas. Comstock should be able to realize approximately $4.25 for its natural gas at current strip.

Comstock’s Differentials (comstockresources.com)

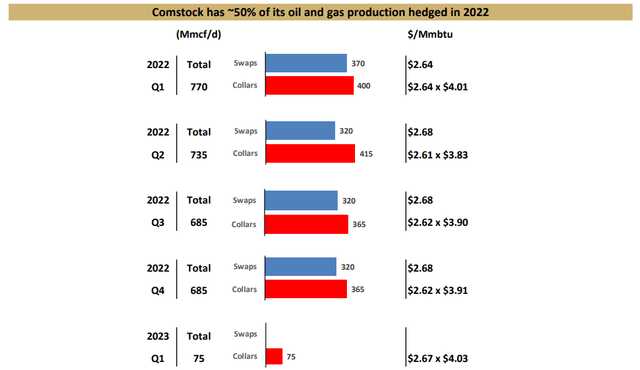

This leads to a projection of $2.206 billion in revenues before hedges at $4.50 NYMEX gas in 2022. Comstock’s hedges have an estimated value of negative $301 million for 2022. It has swaps covering around 23% of its natural gas production, with an average swap price of $2.67. It also has collars covering approximately 27% of its 2022 natural gas production, with an average ceiling price of $3.91.

Comstock’s Hedges (comstockresources.com)

Comstock currently has minimal hedges in place for 2023.

|

Type |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Revenue ($ Million) |

|

Oil (Barrels) |

60,000 |

$85.00 |

$5 |

|

Natural Gas [MCF] |

517,940,000 |

$4.25 |

$2,201 |

|

Hedge Value |

-$301 |

||

|

Total |

$1,905 |

Source: Author’s Work

Comstock is now projected to generate $615 million in positive cash flow in 2022 with a budget of $785 million for development capex and leasing. Comstock is attempting to partially mitigate higher service costs (an estimated 10% increase) by doing longer laterals, which are more capital efficient. Comstock’s average lateral length in 2022 is expected to be 10,484 feet, a 19% increase compared to 2021.

|

$ Million |

|

|

Lease Operating Expense |

$104 |

|

Production and Other Taxes |

$62 |

|

Gathering and Transportation |

$135 |

|

Cash G&A |

$30 |

|

Cash Interest |

$156 |

|

Series B Preferred Dividends |

$18 |

|

CapEx and Leasing |

$785 |

|

Total Expenses |

$1,290 |

Source: Author’s Work

Debt Situation

Comstock ended 2021 with $2.664 billion in net debt. The $615 million in positive cash flow it is projected to generate in 2022 would reduce its net debt to approximately $2.05 billion by the end of the year. This would be around 1.3x Comstock’s projected 2022 EBITDAX.

Comstock appears to have a path to reduce its net debt to 1.0x EBITDAX or less by the end of 2023 at current strip, and should be able to pay off its credit facility debt and 2025 notes via operational cash flow.

Notes On Valuation

I estimate that Comstock is worth around $8.70 per share at long-term $3.00 NYMEX gas, assuming that it can reduce its net debt to $2.05 billion by the end of 2022. This also assumes 277 million shares outstanding if the Series B Preferred Stock is converted into common stock.

Comstock’s estimated value increases to around $10.50 per share at long-term $3.25 NYMEX gas and $12.30 per share at long-term $3.50 NYMEX gas.

Another way to look at it is that Comstock’s proved reserves have a PV-10 of $6.8 billion at SEC pricing ($3.60 NYMEX gas). A 0.8x multiple to this would give it an estimated value of approximately $12.25 per share after subtracting its projected year-end 2022 net debt. Around 55% of Comstock’s proved reserve PV-10 comes from PUDs though, so it will need to continue developing its assets to unlock the value.

Conclusion

Comstock’s debt situation should improve significantly over the next couple years at current strip prices, with a path to reducing its leverage to 1.0x or lower by the end of 2023. It has pushed out the bulk of its debt maturities, and should easily be able to pay off its credit facility debt and 2025 notes. With its next debt maturity after that not until 2029, Comstock should have ample time to develop its Haynesville and Bossier assets and put itself in a good position to deal with its end of decade debt maturities.

Comstock appears to have decent upside in a long-term $3+ NYMEX gas environment, with an estimated value of $12.30 per share at long-term $3.50 NYMEX gas.

Be the first to comment