landbysea/E+ via Getty Images

About six months ago I wrote an article on Eagle Bulk Shipping (NASDAQ:EGLE), explaining why it had the potential to severely outperform the market. Since then, the stock has provided a total return of 40% to its shareholders. The question that I keep listening increasingly often is this: Is the price rally over? In the following paragraphs I will outline the reasons why I think that the answer to this question is negative.

Reason #1: Russia – Ukraine tensions pose more of an opportunity than a threat to Eagle Bulk Shipping

The ongoing conflict between Russia and Ukraine has the potential to create tectonic changes to the whole world, in multiple levels. One of its most direct implications is the contribution to worldwide inflationary pressures, which have made central banks accelerate the tightening of their monetary policies. Many investors and analysts are afraid that such actions will have a direct impact on shipping companies and their profitability, as they will deliberately slow down the global economy. They are partially right. What they are missing, though, is what is called in physics a “horror vacui”. In plain English, it could be translated as “nature abhors a vacuum”. We have seen that global shipping is not a straightforward industry. Shipping rates are not exclusively affected by macroeconomic conditions, but their formation is a result of a multivariate process. Vessel supply and supply lag, geopolitical agreements (i.e. AUKUS) are some of these variables. While, indeed, the Russia – Ukraine conflict has closed a shipping door, a window is opened from alternative markets. For example, in the company’s Q4 2021 earnings call, the company’s CEO, Mr Vogel, that there is the first time Eagle Bulk Shipping secures two time charter contracts for the transportation of coal from Indonesia to Europe, at a rate of $32k per day. These radical freight route changes come with an additional bonus: Increased tonne miles. It is a distorted picture similar to that created by the AUKUS deal. In addition, higher rates are expected to be achieved due to the increased war premium. So, as cynical as it may sound, it is true that Eagle Bulk Shipping is benefiting from the Russia – Ukraine conflict.

Reason #2: Less volatile fleet class

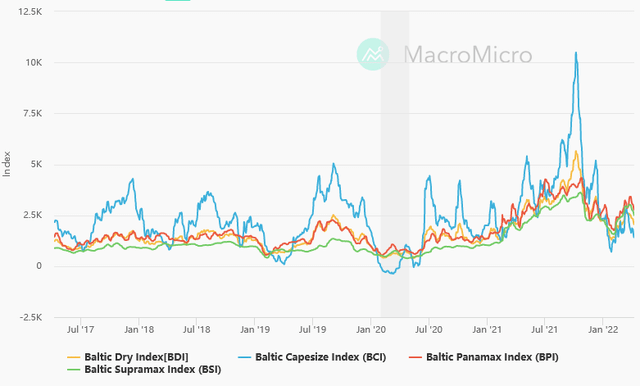

Eagle Bulk Shipping owns solely vessels falling under the Supramax / Ultramax categories. Traditionally, smaller vessels are associated with less freight rate volatility. As it is shown in the graph presented below, Capesize rates are the most volatile among the dry bulk vessel types. Historically, the BCI has shown steep spikes and bottoms, as compared to different vessel types.

Different dry bulk indices and their correlation (MacroMicro)

On the contrary, the BSI seems to provide the least volatility among dry vessel types. We can clearly see that while BPI almost mimics the general BDI, movements of the Supramax index are generally smoother. This happens for a variety of reasons including:

- The reluctance to execute large commodity orders due to commodity price volatility.

- Increased suitability for the transportation of minor bulk, including bauxite, metal ore and fertilizer.

- Increased flexibility, as these vessels are able to unload their cargo using on – board equipment, meaning that they can dock in a wider variety of ports and terminals.

In that sense, the exposure solely on the Supramax / Ultramax segment is a factor that reduces the overall volatility, in a traditionally volatile sector, which is something that more risk – averse investors may find appealing.

Reason #3: Modern and fuel efficient fleet

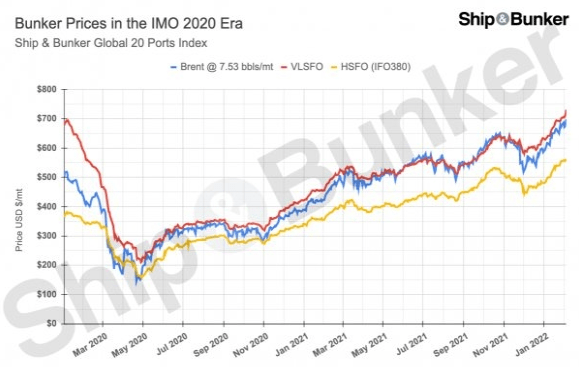

A variety of reasons, including the Russia – Ukraine conflict, have contributed in the rising fuel costs. In addition, there are certain emission standards that vessels have to comply with. Eagle Bulk Shipping owns a total of 53 vessels, 47 of which are scrubber fitted. This means that they are allowed to operate on HSFO, which is heavier, dirtier and, thus, cheaper than its low sulfur alternative. The increase in oil prices has also increased the HSFO / VLSFO price differential in absolute terms, which is a good thing for companies operating scrubber fitted vessels. According to the company’s latest investor presentation, the total excess value to be obtained by this fact reaches $39 million per year.

Ship & Bunker

Right now the price differential stands at an even higher point, of $235, which stands for approximately $3k per day per scrubber fitted vessel in terms of cost improvement, though it is expected to stabilize at around $165 during 2022.

Reason #4: Cash rich and dividend-friendly

Inflationary pressures are not about to subtract any time soon. That means, that investors with a high exposure in shares are looking for higher income opportunities. An increased dividend yield opportunity equals a significant cushion to one’s portfolio, not to mention the inflation hedge. Combine this with a trending shipping market and you have a brilliant investment opportunity that will continue to be supported by investors, despite the associated sector volatility.

The company currently pays out at least 30% of its net income as a dividend. Based on the share’s latest price and the latest announced dividend, we’re talking about a dividend yield of 12.3%. As it was expected, the company said that for the time being they are willing to store their excess cash and exploit them opportunistically, which is fine by me and adds an extra level of dividend security in an overall volatile industry.

Bottom line

Despite the recent run in the share price, I continue to be bullish on Eagle Bulk Shipping. Despite the global geopolitical and economic uncertainty, the company is in pretty good shape, regarding its fleet status and overall balance sheet. Profitability is set to benefit from a variety of factors, ranging from increased tonne miles and alternative markets to the higher HSFO / VLSFO price differential. Having run a monstrous course during the last year, some form of corrective wave may be imminent. However, fundamentally, it is definitely a buy, at least for the remainder of 2022.

Be the first to comment