jarun011

When I was a kid my parents moved a lot, but I always found them.” – Rodney Dangerfield

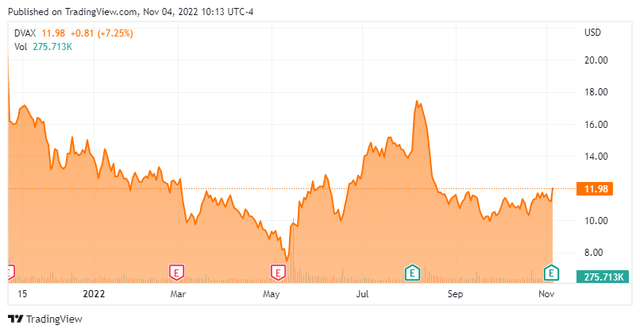

Dynavax Technologies (NASDAQ:DVAX) blasted through third quarter expectations as it posted quarterly numbers after the bell on Thursday. Despite consistently beating quarterly results, the stock has largely languished in 2022 on fears that its Covid adjuvant sales will fall sharply in 2023 as the Covid pandemic ebbs. However, the company is an intriguing ‘sum of a parts‘ story that doesn’t seem to be getting the proper respect from the markets right now. An analysis follows below.

Company Overview:

Dynavax Technologies is based just outside of San Francisco. Its core long term product is HEPLISAV-B. This is a vaccine for Hepatitis B, which is rapidly taking market share as it is more effective (95% versus 81%) from the previous standard of care Entergis-B. It also can administer via two doses over a month rather and three doses over six months, thus achieving a much higher level of compliance. HEPLISAV-B was developed off Dynavax’s toll-like receptor [TLR] immune modulation platform.

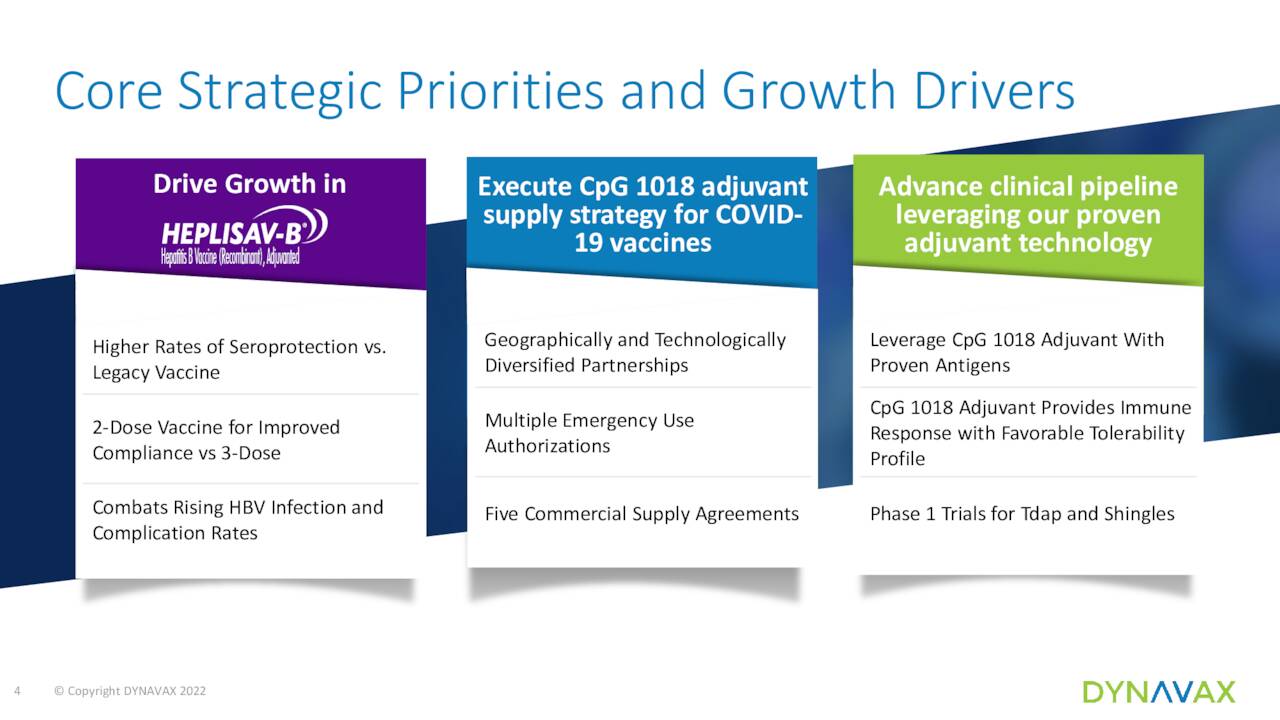

November Company Presentation

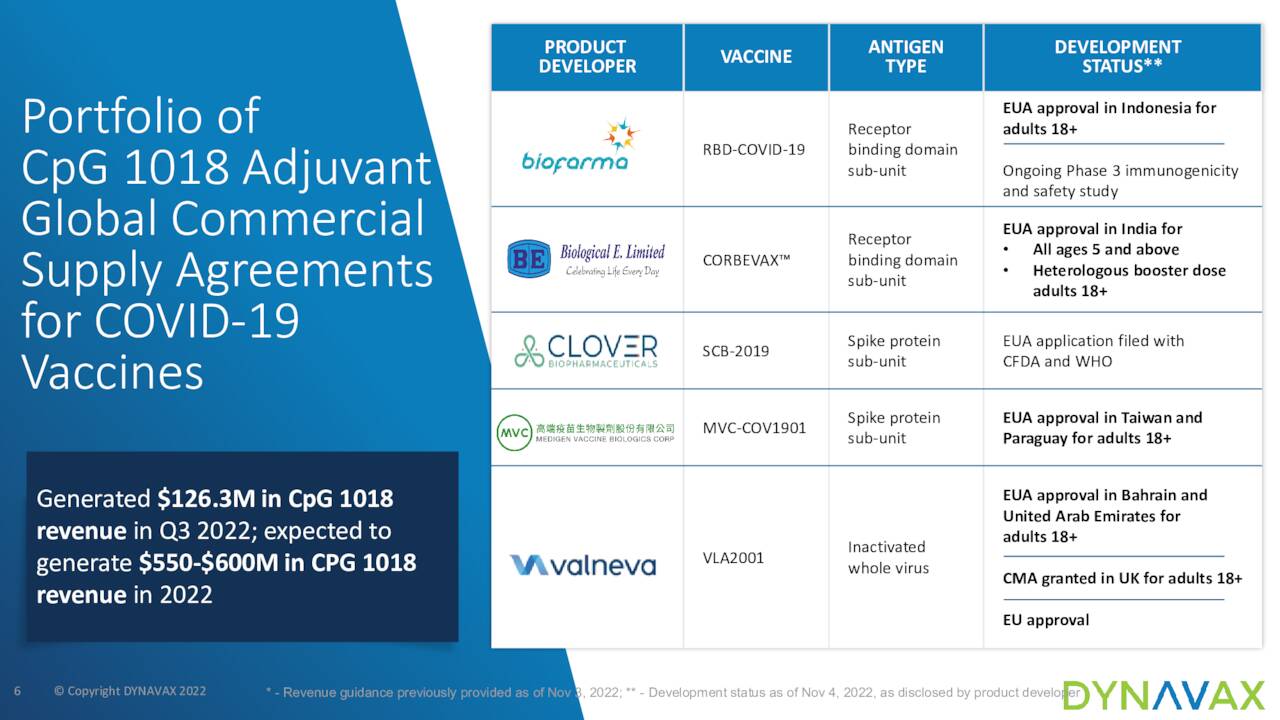

However, what is currently powering growth and profit for the company right now is an adjuvant (CpG 1018) Dynavax developed that has become a core part of several COVID-19 vaccine products outside of the United States primarily. Currently the stock sells around twelve bucks share and sports an approximate market capitalization of just under $1.5 billion.

Third Quarter Results:

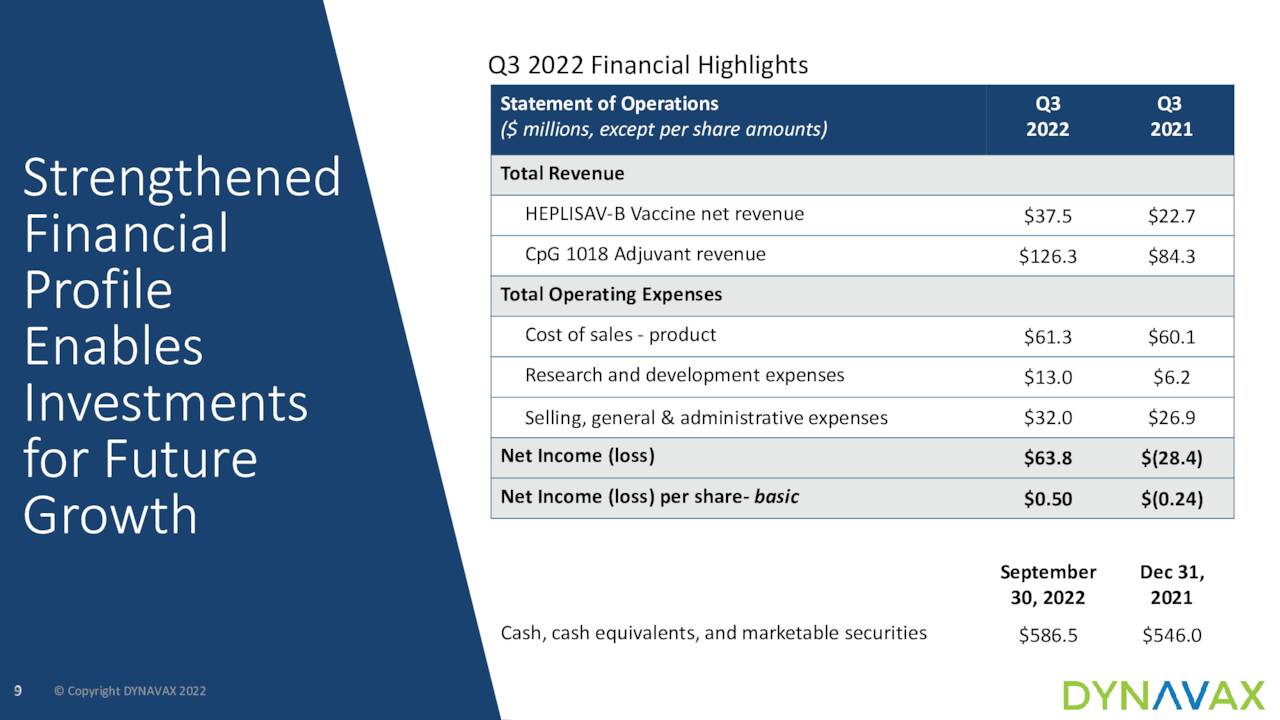

Thursday, the company posted third quarter numbers. Dynavax had GAAP earnings of 43 cents, a dime a share above expectations. Revenues rose 55% on year-over-year basis to $167.8 million, besting the consensus by approximately $8 million.

November Company Presentation

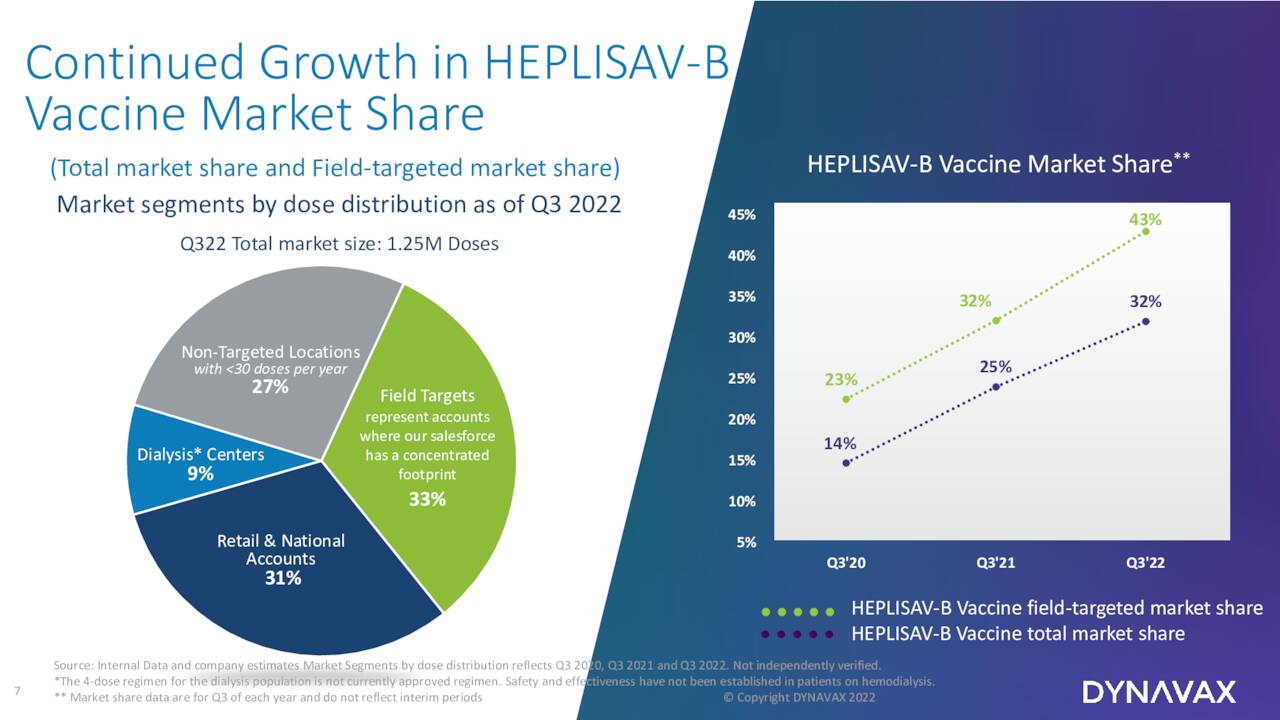

The bulk of overall revenue during the quarter came from CpG 1018 adjuvant sales. They came in at $126.3 million versus $84.3 million in the third quarter of 2021. However, HEPLISAV-B vaccine product revenue saw a greater year-over-year rise percentage wise. Net sales during the quarter were $37.5 million, compared to $22.7 million in the same period a year ago. HEPLISAV-B has grown in overall market share to 32% from 25% as well.

November Company Presentation

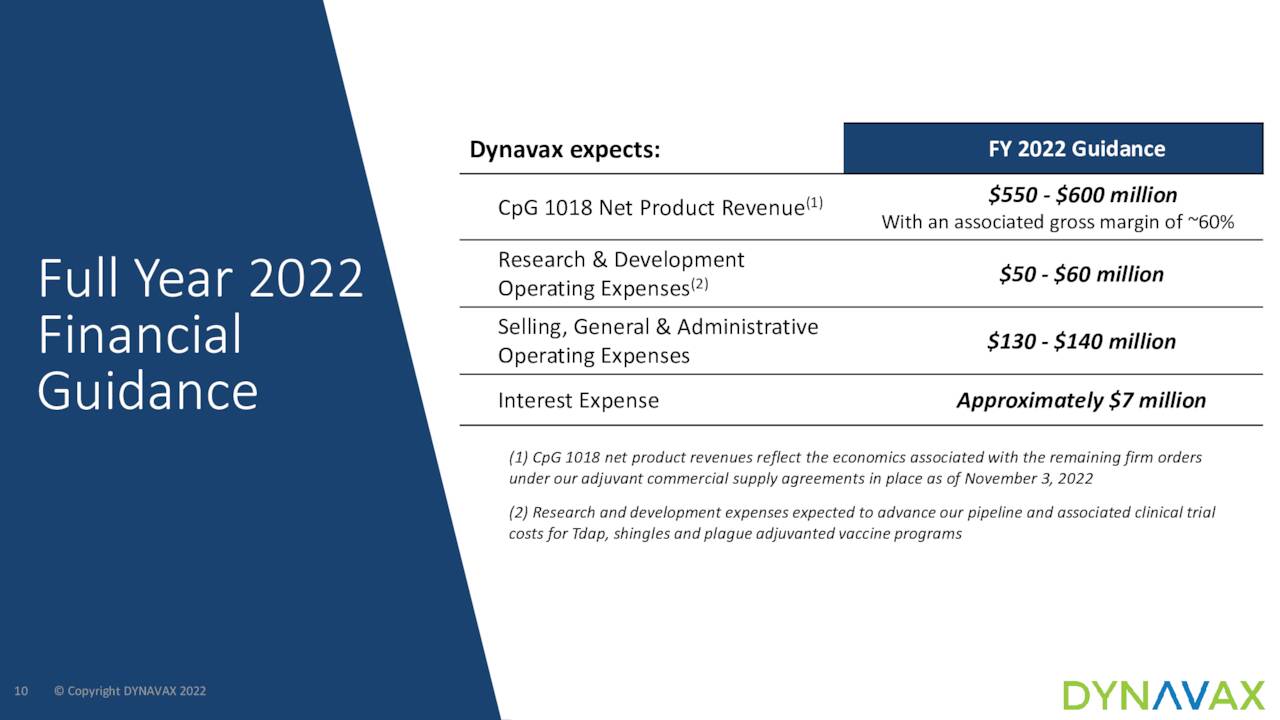

Management also provided the following forward guidance to investors for FY2022.

November Company Guidance

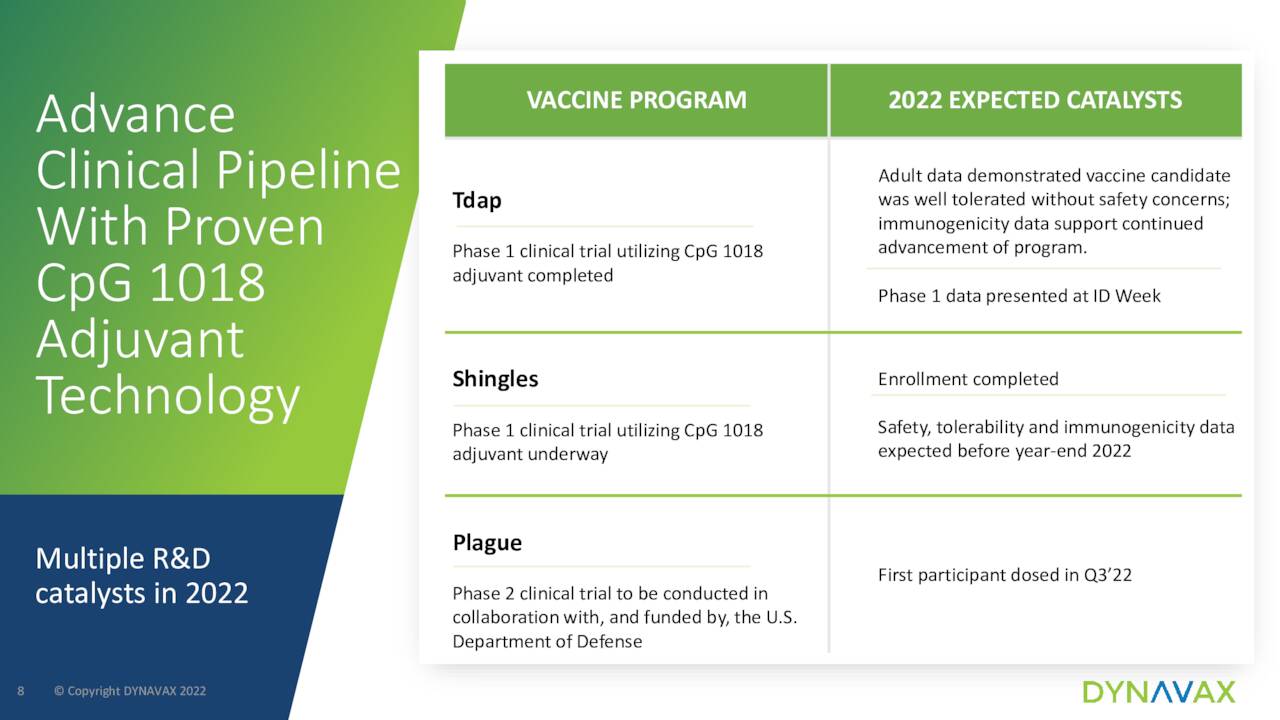

Finally, the company continues to advance two early/mid-stage vaccine candidates for Shingles and Tdap using its CpG1018 adjuvant technology.

November Company Presentation

Analyst Commentary & Balance Sheet:

Since third quarter results have posted, Goldman Sachs ($21 price target), JMP Securities ($22 price target) and H.C. Wainwright ($28 price target) have all reissued Buy ratings on the stock.

Surprisingly, nearly 14% of the outstanding float in the stock is currently held short. One director sold off nearly $45 million of his shares in mid-August at just under $15.00 a share, but still retain just over 60% of his holdings. Other insiders have disposed of roughly $3 million in aggregate of their shares so far in 2022. The company ended the third quarter with just over $585 million in cash and marketable securities on its balance sheet against just over $200 million of long term debt.

Verdict:

The current analyst consensus has the company making $1.70 a share in profits in FY2022 as revenues rise nearly 60% on a year-over-year basis to $695 million. They project Dynavax to have a slight loss in FY2023, thanks to falling adjuvant sales that pushes revenues down 40%. There is wide divergence next fiscal year, both around sales and profit estimates, it should be noted.

There is a lot to like about the long term story around Dynavax. Its core HEPLISAV-B vaccine continues to take market share. The company has a huge net cash hoard and is developing a couple of other vaccines using its proven CpG 1018 adjuvant technology platform. The core question for investors is how fast do CpG 1018 Covid vaccine sales fall off by 2023 as the pandemic ebbs globally.

November Company Presentation

The one large insider sale in August is somewhat concerning, but the stock is far below analyst firm price targets that have come out over the past 24 hours. Given the company’s recent quarterly beats, there is a good chance Dynavax remains profitable in FY2023 as HEPLISAV-B continues to take market share and the company further advances its vaccine pipeline candidates.

The options around this equity are both liquid and lucrative, therefore I continue to hold most of my core stake in DVAX via covered call positions. This has been a profitable strategy for a couple of years now, and I expect it to continue to be so as Dynavax continues to produce better results than the company receives respect in the market.

The way my luck is running, if I was a politician I would be honest.” – Rodney Dangerfield

Be the first to comment