Chip Somodevilla

Investment Thesis

Meta Platforms’ (NASDAQ:META) mission is ‘to give people the power to build community and bring the world closer together’, and whilst the latter is somewhat debatable, the company has certainly changed the way we interact and connect forever.

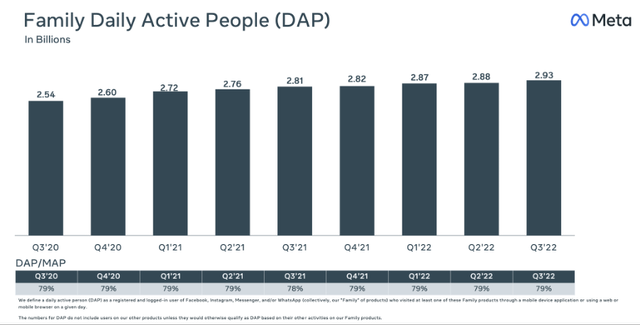

Meta’s core business revolves around its family of four apps: Facebook, Instagram, Messenger, and WhatsApp, which have a combined 2.93 billion daily active people – that is, ~37% of the world’s population use at least one of these apps on a daily basis. The company makes most of its money through advertising right now, with advertisers being able to showcase products across Meta’s Family of Apps to these 2.93 billion pairs of eyeballs.

Meta Q3’22 Earnings Presentation

Aside from its Family of Apps, the next evolution of this business is expected to be within the metaverse; a buzzword that was placed at the forefront of investors’ minds last year when Facebook changed its name to Meta. Whilst this undoubtedly is an exciting opportunity, it involves a whole host of risks, with CEO Mark Zuckerberg describing it as ‘obviously a very expensive undertaking’, and there’s certainly no guarantee that it will pay off any time soon (if at all!).

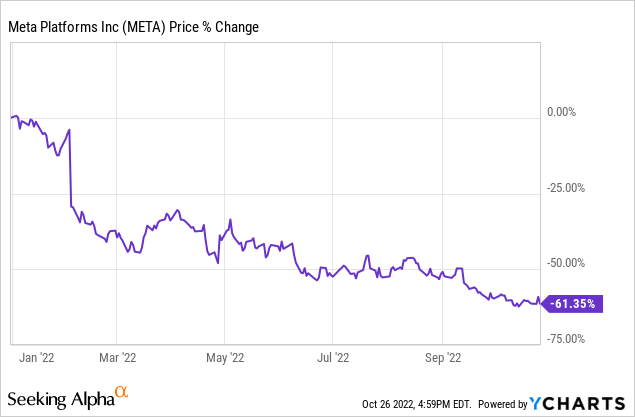

Unfortunately, 2022 has been a very difficult year for shareholders in Meta. Not only has the core business seen a substantial slowdown (and even decline), but the share price has been tumbling.

Going into Meta’s Q3 earnings, the expectations for this company were extremely low; but, were they low enough? Let’s take a look.

Meta Earnings Overview

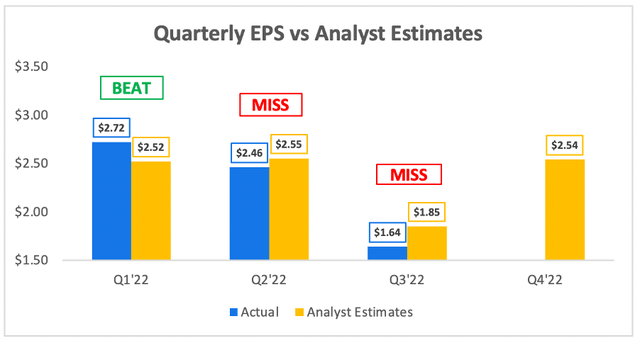

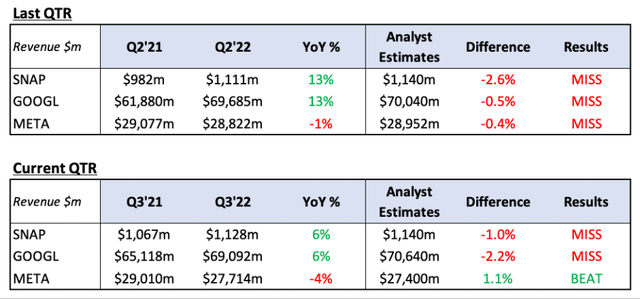

Starting from the top, and Meta saw its revenue decline by 4% YoY to $27.7B, although this did actually come in ahead of analysts’ expectations of $27.4B – I did say the bar was set pretty low, but at least Meta managed to clear it.

There were plenty of revenue headwinds for Meta this quarter, as there have been in plenty of past quarters, but a difficult macroeconomic environment combined with a strong US Dollar hurt the top line. Excluding the impact of foreign exchange headwinds, Meta would have actually posted 2% YoY revenue growth.

Seeking Alpha / Meta / Author’s Work

The revenue guidance offered up by management for Q4 was a range of $30-$32.5B, with analysts’ estimates of $32.23B sitting at the high end of this range; so it wasn’t great guidance, but I’m still surprised that the analysts’ estimates did sit within the range.

It’s important to note that Meta successfully cleared the bar this quarter that neither Alphabet (GOOGL) (GOOG) nor Snap (SNAP) managed to clear, by actually beating analysts’ estimates on revenue. As per the below table, it’s not all good news for Meta – they are still the only company of the three to post consistently declining revenue figures – but they were the only company of the early reporters to come out ahead of analysts’ revenue estimates.

Moving onto the bottom line, and Meta posted EPS of $1.64, which fell short of the analysts’ consensus estimate of $1.85.

Seeking Alpha / Meta / Author’s Work

It’s not a complete surprise; when costs and expenses rise 19% YoY, and revenues fall by 2%, then EPS is clearly going to suffer.

But if I were a Meta shareholder (having seen Alphabet’s earnings the day before), then I would be relatively pleased with these top-line results; the bar was set extremely low, and Meta appears to have cleared that bar.

Key Metrics Continue To Decline

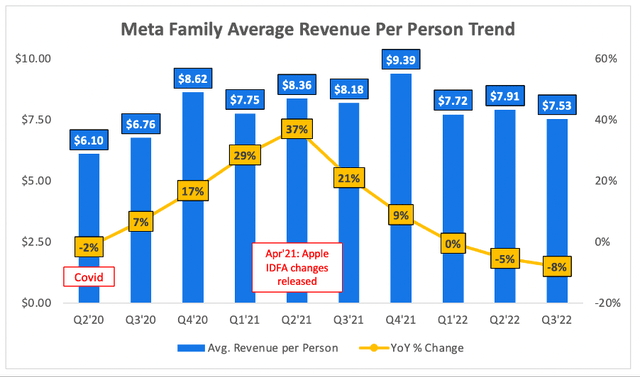

A key metric for Meta is the Family of Apps’ average revenue per person, which helps investors understand exactly how much value Meta is able to extract from its users. Sadly, for Meta, the growth rates of this ARPP have been on the decline ever since Apple introduced its privacy changes – and Q3’22 continued this trend.

ARPP declined 8% YoY, the biggest annual decline over the past few years, and fell to a low not seen since Q3’20. This goes hand in hand with the fact that Meta actually increased ad impressions across its Family of Apps by 17% YoY, but the average price per ad decreased by 18% YoY.

Clearly, companies are pulling back on ad spend, but Meta is also unable to provide as high an ROI for advertisers as it used to. This is driven by Apple’s privacy changes, which have made it much harder for Meta to track and effectively target its users. The ARPP trend is certainly something that Meta shareholders should keep an eye on, but the figure reported today is disappointing and does not bode well for the underlying business. Investors may want to ask the question: what if Meta keeps struggling to provide investors with the ROIs they require?

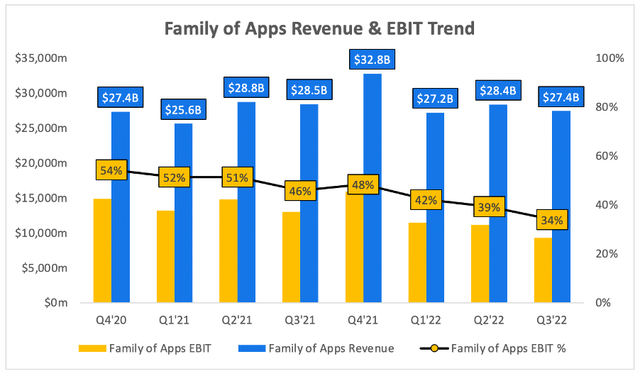

I also took a look at the operating income from Meta’s Family of Apps cash cow (rather than the cash burning Reality Labs), and it seems as if this cash cow is showing signs of drying up. EBIT margins have been on the decline ever since Q4’20, which is understandable; 2020 and 2021 were booms for digital advertising and the economy as a whole, but the economy in 2022 could not be more different.

Yet this seems to be a decline that Meta has been unable to stop, with EBIT margins for its Family of Apps hitting a new low of 34% this quarter – that’s a decline in margins from 54% to 34% in just under two years. I’m sure there’s a level of seasonality, and I expect Q4’22 to be stronger on this front as advertising picks up around the holidays, but still… it’s a pretty shocking decline, and worrying that it shows no signs of easing up.

Meta Stock Valuation Remains Attractive

Meta’s shares have come crashing down in 2022, but the company does remain very financially resilient. I know it’s been talked about as a value play, so how appealing does its valuation look right now?

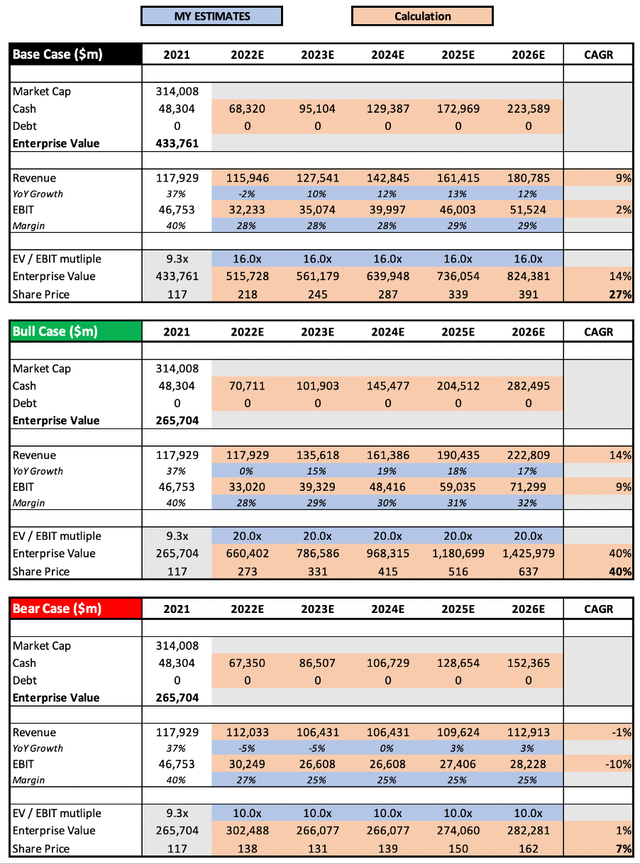

Following the latest earnings release, I have lowered the 2022 revenue assumptions used for Meta in my previous article. I have also made the bear case slightly more negative, as I am seeing a few warning signs within the business itself that could spell longer-term problems.

Put that all together, and I still think Meta shares could achieve a CAGR through to 2026 of 7%, 27%, and 40% in my respective bear, base, and bull case scenarios – so, I can understand why the value investors like this one!

Bottom Line

I wrote an article on Alphabet’s earnings earlier today, where the top line results looked terrible, but the underlying business look reasonably sound; for Meta, the roles are reversed. I don’t think the market expected Meta to actually beat expectations for revenues, and the EPS miss wasn’t too bad – yet there are underlying metrics that worry me.

Users did grow from 2.88 billion to 2.93 billion, which was impressive, but that average revenue per person decline should worry Meta shareholders. This is the core of the business, Meta’s bread and butter, but its growth has been in freefall since Apple’s privacy changes – as have EBIT margins, meaning that Zuckerberg’s metaverse fund is printing less and less money, with no signs of this decline easing up.

Whilst I see the attraction of Meta shares right now, there are signs that the business may be in a death spiral; it operates integral platforms, but the financials are eroding fast, and it feels like the metaverse is a last gasp attempt to rejuvenate the company.

Clearly, I could be wrong, and if Meta does turn around its advertising performance, then its current price looks incredibly attractive! I can completely understand the bullish thesis, but I will remain firmly on the sidelines, and reiterate my previous ‘Hold’ rating.

Be the first to comment