SHansche/iStock via Getty Images

Introduction

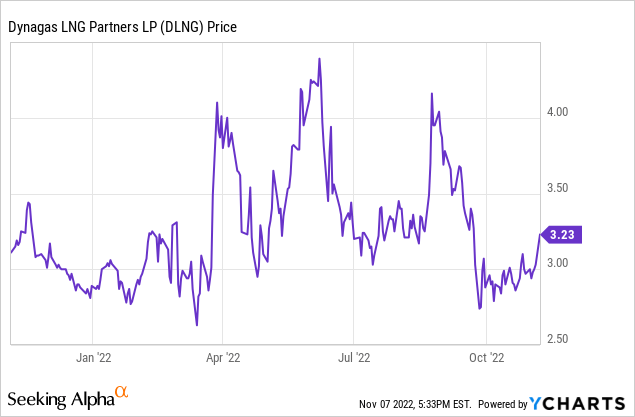

Dynagas LNG Partners (NYSE:DLNG) is a shipping company operating six LNG vessels. This category of vessels is currently in very high demand due to the energy crisis in Western Europe, but as DLNG has deployed all its vessels under long-term charter contracts at a fixed day rate, it’s not seeing the benefit of the higher spot rates and one-year charter rates. This could change in Q3 2023 when the first LNG vessel will be redelivered after its charter period with Equinor (EQNR) ends and if that vessel could be redeployed at a strong charter rate, Dynagas should see its net income and free cash flow increase pretty nicely. In previous articles I was focusing on the preferred shares, and I still think those securities offer an attractive risk/reward ratio.

The second quarter and first half of the year were robust

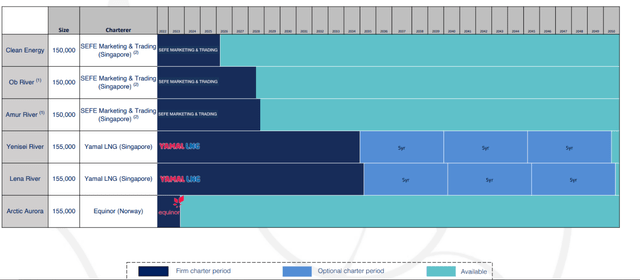

The business model of Dynagas is pretty simple. It owns six LNG vessels which are chartered to three different counter parties.

When the Ukraine-Russian war erupted, there was a lot of uncertainty as to how the LNG tankers would be impacted by the sanctions. The Yamal LNG project is Russian, and three of the vessels were chartered by Gazprom Singapore. Gazprom Singapore actually was a subsidiary of Gazprom Germany, and the German state has actually taken the reigns at Gazprom Germany, re-naming the company SEFE: ‘Securing Energy For Europe’. And on the September conference call, the DLNG management made it very clear the company was in compliance with all regulations.

Also, the partnership’s counter-parties are performing their obligations under their respective time charters in compliance with applicable U.S. and EU rules and regulations. Our vessels named Clean Energy, Ob River and Amur River are on charter to previous Gazprom Marketing and Trading of Singapore, which has been renamed Securing Energy for Europe Marketing and Trading and which we onwards will refer to as SEFE. SEFE has been placed under control of the German government. The parent of SEFE has received a loan commitment of approximately EUR 9.8 billion from the German government. So effectively, the Clean Energy, Ob River and Amur River are trading on routes as directed by SEFE and are no longer sub-chartered by SEFE to Sakhalin Energy.

This article is based on the situation “as is” – assuming there will be no impact from additional sanctions on Dynagas.

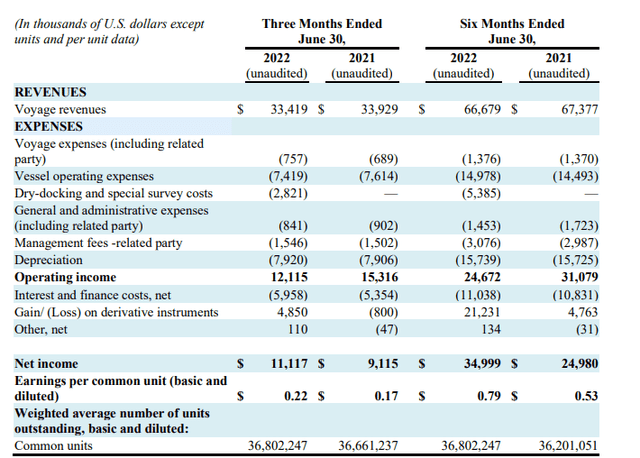

As the charter rates are pretty fixed, Dynagas’ financial results are actually pretty stable as well and the only variable is the total interest expense, which is increasing under the impulse of increasing interest rates on the financial markets.

The total revenue in the second quarter of the financial year came in at$33.4M, resulting in net income of $11.1M. After deducting the preferred dividends, the net income attributable to the shareholders of DLNG came in at $0.22 (note: This includes a $4.85M gain on derivatives).

In the image above, you also see the interest expenses have started to increase. The Q2 interest expenses increased by approximately 10% despite a continuous effort to reduce the gross debt and net debt by hoarding the vast majority of the free cash flow to repay debt.

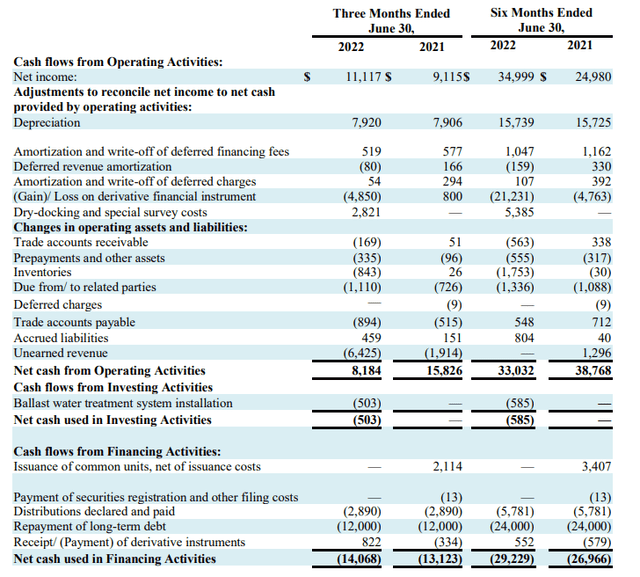

A very important element to determine whether or not Dynagas is attractive right now is the free cash flow. As these LNG vessels have a useful life spanning multiple decades, the depreciation and amortization expenses are weighing on the reported net income but shouldn’t have a meaningful impact on the free cash flow result as the sustaining capital expenditures are pretty low (note: Dynagas has expensed about $2.8M in dry-docking costs).

That’s clearly visible in the cash flow statement. The reported operating cash flow was $8.2M but adjusting this for changes in the working capital position, the adjusted operating cash flow was $17.5M. And after deducting the $0.5M in capital expenditures, the free cash flow result was roughly $17M.

The total amount of preferred dividend payments is $2.9M per quarter, which means the underlying free cash flow attributable to the common shareholders was approximately $14M. The incoming cash flow was integrally used to reduce the net debt and strengthen the balance sheet of Dynagas.

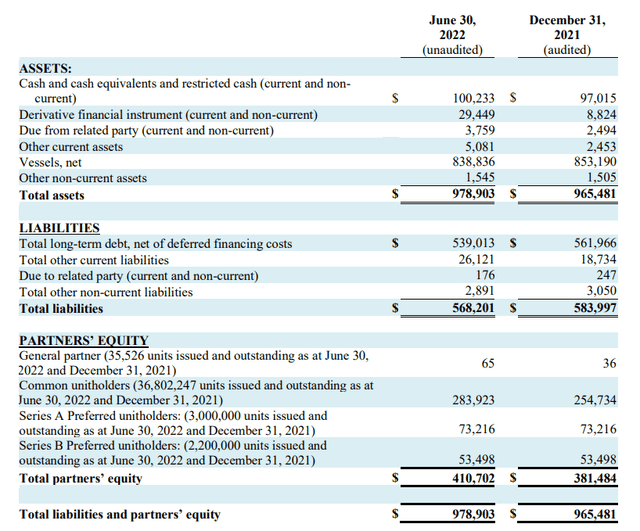

As of the end of June, the balance sheet contained $100.2M in cash and a total long-term debt of $539M for a net debt of approximately $439M. That’s just over 50% of the book value of the vessels and I think that book value is pretty realistic considering a newbuild LNG vessel currently costs about $240M.

The balance sheet is getting stronger by the month thanks to the policy to keep the cash on the balance sheet. That also makes the preferred shares safer: As of the end of June, approximately $280M in equity was ranked junior to the $130M in preferred equity. This means that even if Dynagas would have to take a 30% haircut on the book value of its vessels (highly unlikely, given the current newbuild prices, the market value of the vessels is likely a bit higher than the book value), the preferred shareholders could still be made whole.

The preferred shares are still interesting

Back in September 2021 I definitely preferred the Series A of the preferred shares as those offer a fixed 9% preferred dividend ($2.25 per share, payable in four equal quarterly tranches of $0.5625 per share). The B-Series were interesting but did not offer as much protection as those B-shares will soon offer a floating preferred dividend. From November 2023 on, the quarterly preferred dividend will be set at the 3M LIBOR + 5.593%. The LIBOR will no longer be in use, and the quarterly preferred dividend will likely use the 3M SOFR as benchmark.

With the 3M SOFR currently at approximately 4.20%, the preferred dividend yield could actually come pretty close to 10%. And in other words: As long as the 3M SOFT exceeds 3.16%, the preferred dividends on the B-series will equal or exceed the current payments.

That indeed makes the B-series of the preferred shares more attractive than a year ago. Throw in the fact that the 9% yielding preferred shares are trading almost 10% below par and the choice becomes slightly more difficult. Basically it comes down to the fact that the investors who believe in an even higher 3M SOFR rate should buy the B-series. Those who want additional visibility should purchase the Series A of the preferred shares, trading with (NYSE:DLNG.PA) as ticker symbol.

Investment thesis

While I’m still not interested in initiating a long position in Dynagas’ common shares, the preferred shares are still quite interesting. Perhaps even more interesting than a year ago as Dynagas’ balance sheet has gotten much stronger which means the preferred shares are now “safer” as there’s more common equity which ranks junior to the preferred shares.

The B-Series of the preferred shares will offer an attractive option to speculate on the short-term interest rates, but I still prefer the higher yielding but fixed-rate Series A with a current preferred dividend yield of almost 10%.

I have no position in Dynagas whatsoever right now, but I like the Series A of the preferred shares.

Be the first to comment