Oat_Phawat

The gold mining industry is having a difficult year. Although most miners are still profitable, rising production costs and falling Au prices have squeezed margins, compared to 2021 and share prices have fallen as a result. As geopolitical tensions are very high and I’m doubtful about the prospects of central banks to continue with the rate hikes or even sustain the current elevated levels for a long time, gold seems to me as a good opportunity. That being said, picking individuals miners is not an easy task – most of the ones that look undervalued have assets in jurisdictions that are deemed risky, therefore the discount might be justified to an extent. However, there are some exceptions like Dundee Precious Metals (OTCPK:DPMLF)(TSX:DPM:CA). The two operating mines of the entity are based in an EU member state, yet the current enterprise value is well-below their combined estimated NPV and the company trades at significant discount to the sector.

Company overview

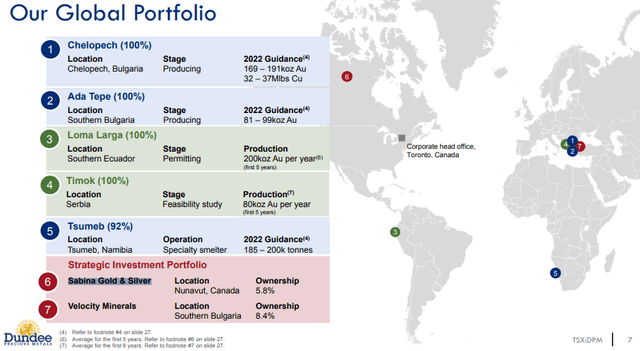

Dundee Precious Metals, as suggested by its name, is a mining company with a focus on gold, registered in Canada. Its flagship asset – the Chelopech copper-gold mine, located in Bulgaria, is expected to produce 161-191koz of gold and 32-37Mlbs of copper in 2022. The second operating mine of the company – the Ada Tepe mine, which is also located in Bulgaria, is expected to add 81-99koz of gold to this year’s total production. DPM also has 92% stake and operates Tsumeb – a smelter plant in Namibia. The expansion strategy of the company includes two development projects – Loma Larga in Ecuador and Timok in Serbia. DPM also has minor stakes in Sabina Gold & Silver (OTCQX:SGSVF) and the micro-cap exploration company – Velocity Minerals (OTCQB:VLCJF).

DPM’s portfolio (Dundee Precious Metals)

DPM has a simple shareholder structure, which consists of 190.8M of shares and no warrants. Institutional investors hold the majority of the float with Blackrock having the biggest stake (12.7%), followed by Van Eck Associates Corporation (9.4%) and First Eagle Investment Management (7.0%). According to data from Yahoo Finance, insider ownership is very low at only 0.46%. And while there’s a share-based part of management’s compensation package this figure is kind of disappointing. According to the 2021 annual report, the majority of management’s remuneration is in the form of salaries and bonuses, while share-based compensation is considerably lower.

Strong performance in 2022

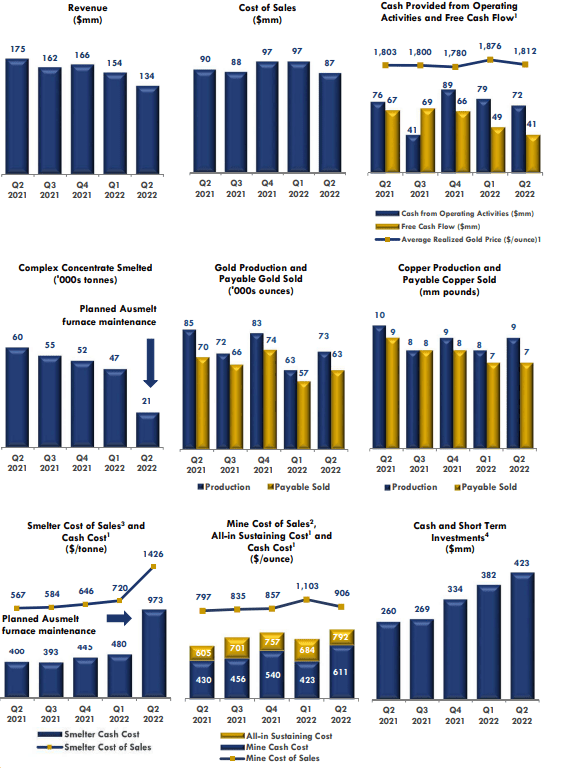

After the record-breaking 2021, when DPM generated US$252M of free cash flow (FCF), the FCF generation continues, although at slower pace, due to cost pressure and lower YoY production. Speaking of cost pressure, Q2’22 AISC reached US$792/oz (+30.9% YoY), which is still a lot lower than the industry average, which jumped to US$1,289/oz (+18.0% YoY). The increase for Dundee Precious Metals was primarily due to higher transportation costs and lower by-product credits. It has to be noted, that since the beginning of the year DPM has benefited by the introduction of high electricity prices compensation scheme by the Bulgarian government, by receiving US$7.5M YtD (US$3.4M in Q2’22 alone).

DPM’s operational highlights (Dundee Precious Metals)

In terms of production, the company is on track to meet its 2022 guidance. In Q2’22 72.9koz of gold were produced (135.8koz YtD) and the average realized price was US$1,812/oz (+0.5% YoY; -3.4% QoQ). Copper production amounted to 8.8Mlbs in Q2’22 (16.5Mlbs YtD) with average realized price of the metal of US$4.42/lbs (+10.8% YoY; -3.5% QoQ). Total revenue for H1’22 came at US$288.3M (-7.8% YoY), while net income from continued operations amounted to US$60.3M (-31.6% YoY).

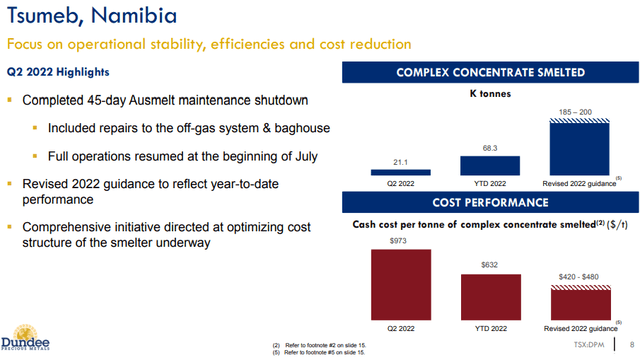

Unfortunately, Tsumeb was again a serious drag on performance, which contributed to US$16.2M reduction of the H1’22 bottom line. DPM has been conducting restructuring of the facility, including a 45-day maintenance shutdown. For the remainder of the year DPM expects smelting activity at Tsumeb to pick up pace, which to reduce the cash costs per tonne smelted.

Tsumeb’s performance (Dundee Precious Metals)

The recently published Q3’22 operational update reaffirms that the company is on track to meets its 2022 guidance. While it will be important for the full quarterly results to be released in order to assess the cost dynamics, it’s encouraging to see that activity in Tsumeb has picked up pace and the facility smelted 63.8Kt of concentrate in Q3’22 alone, almost as much as in the first six months of the year.

DPM has a shareholder return program in place as it pays a quarterly dividend of US$0.04/share (annual dividend yield around 3.5%). Also, since the beginning of 2022, almost 2.5M shares were repurchased.

Expansion plans and liquidity

The main challenge for DPM going forward would be maintaining or even better expanding production. While the life of mine (LOM) of the flagship asset – Chelopech was recently extended to 2030, production in the smaller operating mine – Ada Tepe is expected to enter into a steep decline in 2024 and eventually go to zero after 2026. Of course, brownfield exploration efforts at both sites are ongoing, but in order to ensure long-term value creation for its shareholders, the company needs to expand even further.

Currently, DPM is in an excellent position to do so. The strong performance in 2021 and 2022 YtD has strengthened the balance sheet, which enjoys cash and equivalents position of US$423M as of the end of Q2’22. The company has no debt outstanding and US$150M available under a credit facility. The stakes in Sabina Gold & Silver and Velocity Minerals have value of around US$27.5M as of end-October, taking into account latest market prices. All of this puts DPM in an excellent position to fund its future growth.

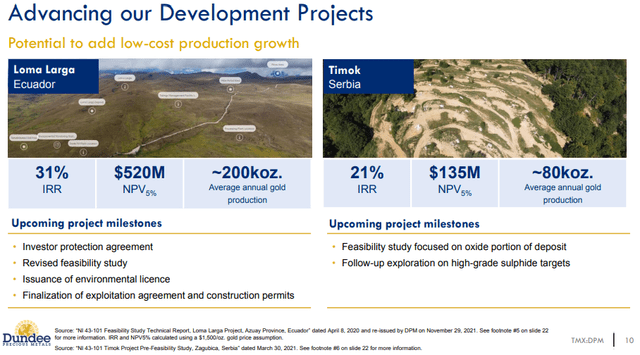

DPM’s development projects (DPM)

Currently, the development part of DPM’s portfolio consists of two projects – Loma Larga and Timok, which if successfully put into operation could double current production. The former has larger resources and more impressive economics with estimated NPV of US$520M, discounted at 5% and using a gold price of US$1,500/oz. However, there are challenges related to the realization of the project. In July 2022, a judge confirmed DPM’s permits regarding Loma Larga, after they were challenged in court. However, the decision also clearly stated that prior consultations with the local indigenous communities must be conducted before moving the project towards production. This may be a huge problem, as generally indigenous communities are hostile towards mining projects in their area. Furthermore, a recently published independent review, revealed serious environmental risks, including potential for arsenic contamination, if the projects is moved forward with the current mine plan. All of this makes me really skeptical if the project could be advanced in the foreseeable future or even ever.

Nevertheless, the available liquidity of more than US$600M puts DPM in a very comfortable position and allows it to be flexible. In an environment of rising interest rates and higher discount rates, the company could look for new additions for its development portfolio at a bargain.

Share price and valuation

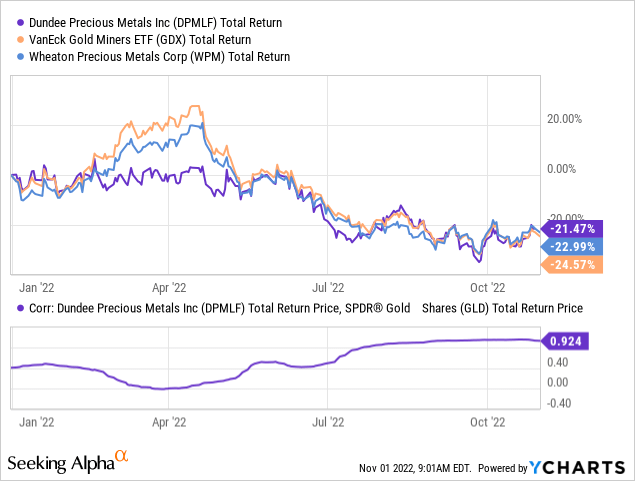

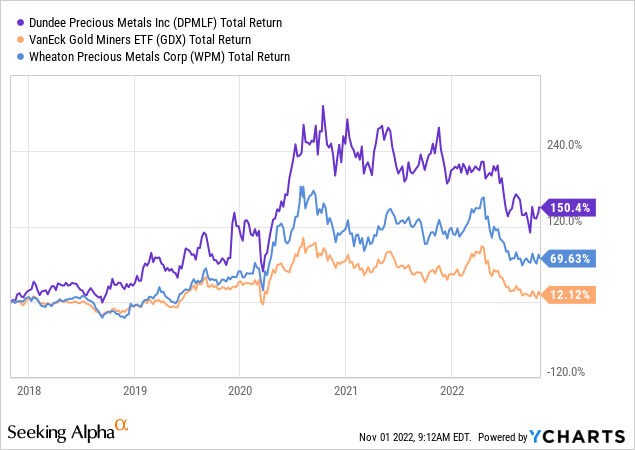

Since the beginning of the year, DPM’s performance is slightly better, but generally in line with the industry, represented by the VanEck Vectors Gold Miners ETF (GDX) and even the lower-risk streaming company Wheaton Precious Metals (WPM), which I covered extensively here. The correlation with the gold price, represented by the SPDR Gold Trust ETF (GLD) is also very strong at more than 0.9. However, if we zoom out and look at a longer time frame of 5 years, DPM significantly outperforms both the industry and the streaming business model, represented by WPM.

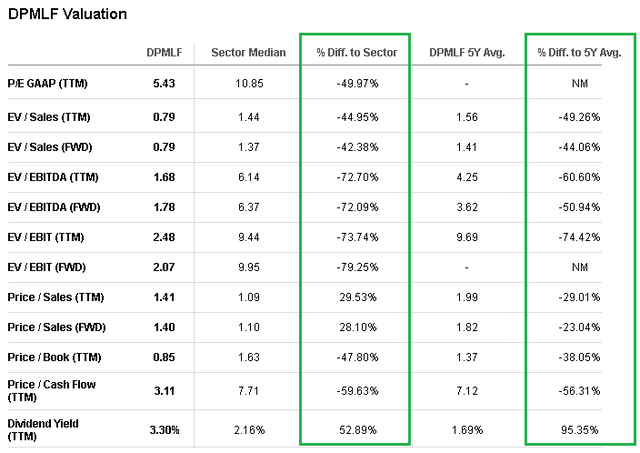

So could this impressive performance continue? In order to assess that, I’ll look at the multiples of DPM, compared to the sector and its own 5-year historical averages. The company appears to be trading at significant discount to both. Only the P/Sales ratios are higher than the sector, but this is likely to the high cash position of DPM, as evident from the EV/Sales ratios.

DPM’s multiples (Seeking Alpha)

Moreover, the discount couldn’t be attributed to jurisdictional risk, as the two operating assets are located in Bulgaria, which has a lot stronger property rights than mining jurisdictions in Africa or Latin America. The country is an EU member and ranks 29th on the economic freedom index of the Heritage Foundation. I’d argue that the company could even be trading at a premium for this reason.

Valuation could also be approached from the standpoint of the company’s assets. In order to be conservative, I’ll leave Tsumeb, which doesn’t have history of stable cash flow generation history and the development projects in Ecuador and Serbia out of the picture. According to the latest Technical report of Chelopech, it has an estimated after-tax NPV of US$552M, discounted at 5% at gold price of US$1,540/oz and copper price of US$2.75/lbs. Since the Technical report of Ada Tepe is a bit older and dates from 2020, I estimated the NPV of the project on my own for the 2022-2026 period using the production plan in the report and bumping AISC to US$850/oz. At gold prices of US$1,540/oz and discounted at 5%, I get estimated NPV of US$190M. Combining the two operating projects’ estimated NPVs with the market value of the equity stakes in Sabina Gold & Silver and Velocity Minerals I get EV of US769.5M. For comparison, the current EV is around US$468M or 64.4% less.

So how the what appears to be quite a considerable valuation gap close? I think that a rise in gold prices will put more eyes on the sector and eventually DPM will be discovered by a wider investor audience. The share price move in 2020, visible on the above graphs is quite telling of the leverage that DPM could have in a rising Au price environment. Besides, the large cash position gives management room to be more aggressive with the buyback, which could create a demand pressure as well.

Risks

Political risk – In the case of DPM, I think political risk is more relevant for the development project in Ecuador. For the two operating mines, while Bulgaria is not politically risk-free, I think it’s a lot safer than typical mining jurisdictions in Africa and Latin America.

Interest rates risk – The inverse relationship of gold prices and interest rates is well-known by investors. On the other side, the debt-free balance sheet limits the cost effects of higher interest rates on DPM. As discount rates rise and valuations fall, the large cash pile may be put towards acquisitions at attractive prices, creating value for shareholders. So I don’t see higher interest rates as entirely a negative for Dundee Precious Metals.

Costs risks – This is a risk, that has materialized for the whole industry in the last year. However, DPM has a lot leaner cost structure than the industry and can absorb further cost pressure better than the sector.

Conclusion

Dundee Precious Metals offers investors low cost production profile in a stable jurisdiction. While the development project in Ecuador looks quite difficult to be put into production, the strong balance sheet and available liquidity gives the company the luxury to be active on the acquisition market. DPM appears to be undervalued when compared to the sector, its 5-year average multiples and the combination of its two producing assets estimated NPVs.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment