AzmanJaka/E+ via Getty Images

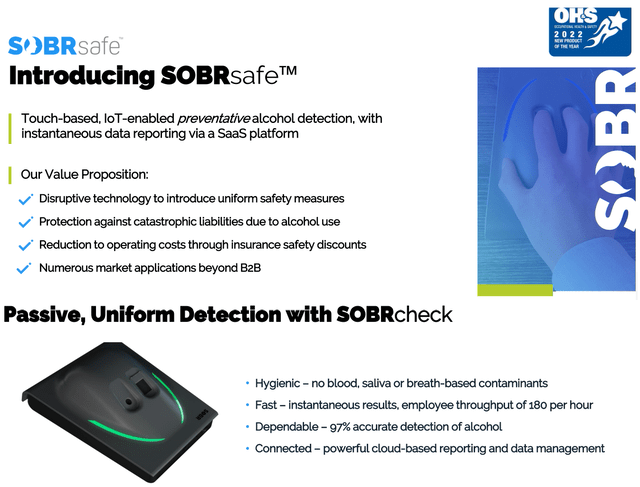

SOBR Safe, Inc. (NASDAQ:SOBR) offers a touch-based alcohol detector meant as a preventative workplace safety tool along with applications for the criminal justice system and patient rehabilitation. Compared to traditional breathalyzers, the patent-pending “SOBRcheck” fingerprint scanner-like device is non-invasive and allows for integration into a data-management platform. Some of the first customers include vehicle fleet operators and construction companies where substance abuse is a potentially major liability.

The good news is that SOBRcheck is real and by all indications represents a disruptive technology that should sell itself considering the ease of use and even insurance incentives. At the same time, it’s important to recognize that the stock with a current market cap of around $100 million remains highly speculative with an outlook for recurring losses and negative cash flows in the foreseeable future. Several operating announcements highlight a certain buzz about the market opportunity, but we’ll need to see some real financial momentum before getting behind this wheel.

What Does SOBR Safe Do?

The SOBRcheck device features two sensors: one confirms the user’s identity through a fingerprint biometric while the other senses alcohol released through the pores of the fingertip. The idea here is that a user entering a facility will check into the system, which provides a real-time alcohol detection result logged into the cloud-based software. This is particularly important for workplaces where alcohol impairment is dangerous around vehicles and heavy equipment.

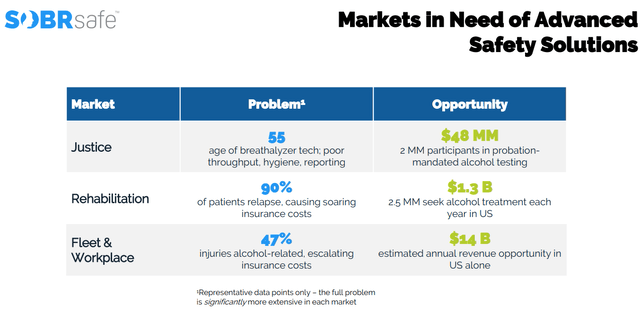

One use case example would be a major transportation or logistics provider where a driver arrives at the depot for work on a daily basis and the system would work as a quick check of sobriety. Indeed, SOBR Safe sees the fleet and workplace market as representing a $14 billion opportunity where 47% of workplace injuries are alcohol-related. Notably, there are ongoing talks with insurance companies to recognize the platform to secure corporate discounts adding to the product’s value proposition.

In criminal justice, SOBRcheck has the potential to replace legacy breathalyzers which are recognized as slow and non-hygienic. There are currently upwards of 2 million people in the U.S. under probation-mandated alcohol testing where the technology could work.

Finally, the rehabilitation market also represents a major opportunity. In this case, the company offers “SOBRsure”, a mobile smart wristband type of monitoring device that patients would wear with any relapse triggering a cloud notification. The company also intends to market the product for parents to prevent underage drunk driving in teens. Putting it all together, the key here will be the commercialization strategy with a focus on expanding distribution as quickly as possible.

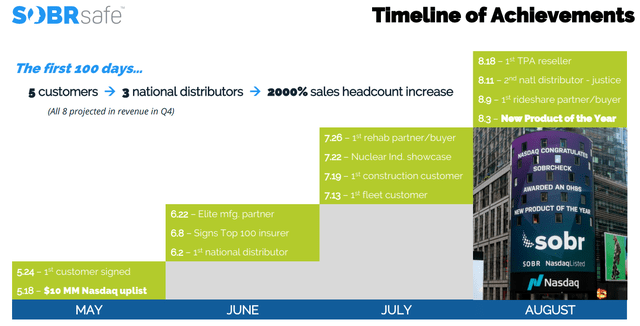

On this point, SOBRsafe has made impressive progress this year. Announcements this year include securing a manufacturing partnership with a U.S.-based “BGM Engineering” for supply chain services along with a partner in charge of packaging, order fulfillment, and customer service. Through August, the company has claimed 5 customers while onboarding 3 national distributors for specialized markets. The efforts are expected to be captured in Q4 financial results.

SOBR Key Metrics

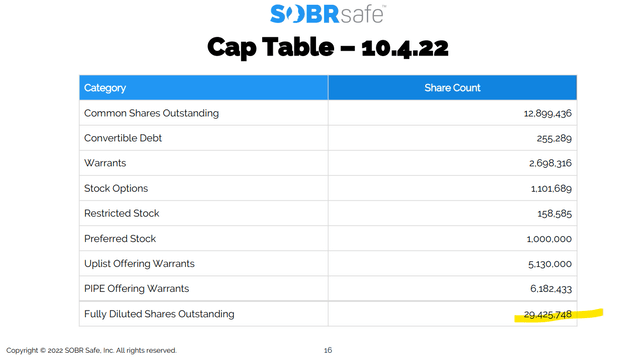

SOBR remains a nano-cap with a fully-diluted market value of around $100 million considering 29 million shares outstanding and the current stock price of around $3.50. The company uplisted into NASDAQ back in May with an equity offering, raising about $10 million, while the capital structure also includes some convertible debt and warrants.

With the product just launching in Q2, SOBR Safe has yet to report any revenues. The last quarterly financial statement highlighted a loss of -$5.8 million through the first six months of the year leaving a current cash position of $3.9 million against zero debt. Notably, subsequent to the Q2 report, SOBRsafe announced a separate capital raise.

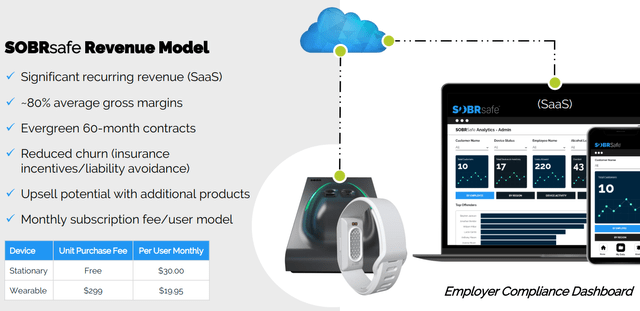

As it relates to the revenue model, the plan is to charge a $30.00 per-user fee on a monthly subscription basis or $19.95 for the wearable following an initial $299 purchase price. Putting it together, we can approximate that the company would need to reach around 275,000 registered monthly users for the stationary device in total to approach $100 million in annual revenue and an implied 1x price-to-sales valuation multiples.

For context, one SOBRsafe’s first announced customers was a food-management company “Continental Services” with 1,800 employees total while it’s unclear how many would be subject to the contract and regular alcohol testing. Certainly, it’s a step in the right direction but many more of these types of “wins” will be necessary to start moving the needle. Hitting $1 million in annual revenue will be an important milestone for the company reachable by next year.

The bullish case long-term for SOBRsafe is that the devices and platform become the industry standard and a critical tool for major corporations with millions of users. A best-case scenario would be for a market delivery/ logistics leader, or even one of the major ride-share operators, as embracing the technology through a multi-million dollar contract. Our take is that such a path is at least possible, but far from certain.

SOBR Stock Price Forecast

As market analysts and investors, we’ve seen these types of “story stocks” before particularly among micro-caps. One name that comes to mind is Wrap Technologies Inc. (WRAP) which offers a non-lethal “lasso” type of device intended for police departments as an alternative to tasers. The parallel with SOBR is simply that both companies are marketing at “disruptive” and game-changing technology ready to capture a billion-dollar market opportunity.

In the case of WRAP, despite being used by over 800 police agencies and the company generating over $6 million in revenue last year, the stock has gone nowhere, down more than 70% year to date. What often ends up happening with these types of start-ups is that the commercialization strategy faces hiccups with a slower rollout as demand doesn’t quite meet the loftiest of expectations. What we can say is that SOBR has a very interesting proposition with a wide appeal, but there is room to be skeptical.

With the stock more than doubling just in the last month, the opportunity here is reserved only for aggressive traders or investors prepared for a long road of volatility for an opportunity that may take years to play out. The risk here to consider is that the company runs into cash flow issues requiring further equity issuances or other types of financing that ultimately dilute current shareholders. Any setback in the commercialization strategy would also open the door for the stock to reprice lower.

Be the first to comment