jetcityimage

Investment thesis

Duke Realty Corporation (NYSE:DRE) is well-poised to benefit from the double-digit increase in rental rates and the rise in demand for its strategically located high-quality industrial real estate properties. 52% of the company’s new developments have already been pre-leased. In addition, DRE has great expansionary efforts and a strong balance-sheet position. The only downside is that the company trades at the fair valuation of the Prologis (PLD) acquisition with a very low dividend yield at the moment.

Duke Realty’s business model

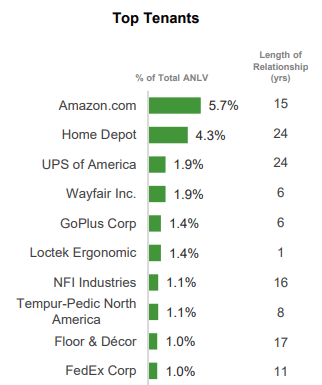

DRE is a U.S.-only logistics REIT. The company is a member of the S&P 500 index. The management’s main goal is to acquire, develop and rent out top-tier logistics facilities across the country. They have a highly reliable tenant base, their Top 10 tenants include Amazon (AMZN), Home Depot (HD), and UPS (UPS). DRE’s portfolio of modern (the average year of the properties is 13 years old) and high-quality logistics facilities (they have the largest square foot properties among the company’s peers) makes it well-poised to capitalize on growing and favorable industrial real estate market fundamentals.

Company Presentation

External trends

In the last 2-3 years the warehouse market was booming like never before. The demand was very high due to the pandemic and the e-commerce businesses expanded rapidly. In addition, the supply was tight and there were relatively few quality warehouses in great locations. Now developers starting to notice that tenant demand is cooling, due to numerous new warehouse developments finished in recent years the supply has been rising and the U.S. economy shows signs of weakness. This means investors have to notice the short-term trend change and adjust their REIT portfolios accordingly. However, I would not consider massive logistics REIT selloffs due to this upcoming short-term bust cycle. Prologis expects rent growth of 22% in the U.S. during the year with vacancy rates remaining near all-time lows of 3.3%. Duke’s portfolio is stable and its new developments concentrate in very low vacancy areas. I believe that during the next years rental rates will keep rising above inflation, which means investors can expect nice FFO and CAD figures. At the same time, I also expect that vacancy rates will increase not because the current tenants will leave but because newly built warehouses could be harder to rent out in a recession. But even if vacancy rates increase by 50-100 basis points the elevated rental income will compensate and investors will see shareholder value growth.

Valuation

Duke Realty maintains a robust balance sheet position, it has a conservative 65-75% AFFO payout ratio and its development pipeline is already 52% pre-leased. The company ended the second quarter with more than $40 million of cash and cash equivalents and has no significant debt maturities until 2026. It also has a favorable credit rating of Baa1/BBB+, which enables DRE to borrow at a favorable rate. This credit rating might be even better after the Prologis-Duke merger. This gives Duke Realty enough financial flexibility and facilitates its development activities.

In terms of valuation, Prologis made a clear valuation of the company when it offered $26 billion for the company. Duke Realty shareholders will receive 0.475 of a Prologis share for each Duke Realty share owned. This means that the current valuation is spot on (PLD – $123*0,475= $58.425). DRE is trading almost exactly at this price. Of course, the price of PLD will change until the acquisition happens, it is expected to close in the fourth quarter of 2022 but I do not believe much stock price appreciation will happen to PLD. This valuation is also supported by the dividend yield. An under 2% dividend yield is anything but attractive for DRE. I would consider it a great buying opportunity above a 3% dividend yield.

Company-specific Risks

Duke Realty is in a stable position. I see no existential threats to its business model or its financial health. There are only small risk factors that investors should be aware of. A development boom in the warehouse market and among logistical properties may increase competition and curb pricing power. Amazon has started to cancel lease agreements for the future which might sound scary but Amazon represented only 1% of Duke Realty’s new leasing and 3% of development starts. The rising supply of warehouses and vacancy levels might cause some pressure in the upcoming quarters. It is also worth mentioning that its huge development pipeline exposes the company to various operational risks such as construction cost overruns (especially with soaring material costs and labor costs) and lease-up risks.

DRE’s dividend

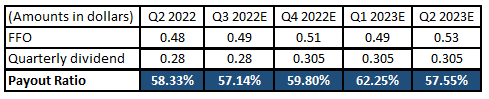

The company has been a consistent dividend payer for 27 years. In addition, the management has been raising the dividend for 7 consecutive years. Its FFO payout ratio is well covered, it is approximately around 60%. Its AFFO payout ratio is at healthy levels of about 65-75%. Analysts estimate a 9.8% increase which is very close to the current and past months’ U.S. CPI. In this high inflation environment, we can safely say that DRE is a good choice for income investors.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

However, there is a special situation we need to take into consideration. Prologis and Duke Realty are merging which means the future of the dividend depends on Prologis’ management team and their policy toward income investors and dividends. Luckily for income investors, Prologis’ management team has been maintaining a very similar income investor-friendly. They have been paying dividends for 23 years consecutively and their dividend increasing streak (8 years) is very similar to DRE’s 7 years. I also expect an 8% dividend increase in PLD in the first quarter of 2023. That is why I believe that the PLD acquisition will have no significant impact on DRE’s income investors and the future of the dividend is in safe hands.

Final thoughts

DRE is a great company with numerous advantages for current shareholders. The company maintains a robust balance sheet, low AFFO and FFO payout ratios, half of the new developments are already pre-leased and the company will be able to capitalize on the double-digit rise in rental rates. Existing shareholders have a diamond in their hands but in my opinion, the current valuation is too expensive for new investors who want to buy DRE. That is why I am neutral on DRE.

Be the first to comment