Ninoon

(Note: This article was in the newsletter on December 3, 2022.)

A few months back, a substantial bear raid was underway at Medical Properties Trust, Inc. (NYSE:MPW). Bears usually begin by attacking something specific like MPW tenant Steward Health Care System. But the underlying theme is that management is not doing its job or “the basics” so that the bear raid can become more generalized and spread a lot more fear. Overall, a bear raid needs to be recognized as a group of opinions that may or may not have sound backing in actual facts.

So much of the real estate investment trust (“REIT”) industry is based upon people and trust. So, from the point of view of short-seller, the goal is usually to destroy the trust part, which sends the company to a cash basis that makes it almost impossible for the company to do business. In this fashion, a bear raid success can really cause a company to fail. Sometimes, these raids succeed because management has not done the proper construction of relationships. So, those business relationships begin to fray when doubts are raised.

In this case, the bear raid was ostensibly aimed at Steward. But the real aim was to shake the faith of investors that management did due diligence with operators in general. After all, if you can make a mistake with something as vital as the Steward partnership, then were you not sloppy about the whole business? Investors then need to decide what to believe and what action to take. Due diligence is never more vital.

Recovery Beginning

In this case, the original bears may have taken their profits while leaving others (shorts, that is) to some extent “holding the bag” in terms of the short position.

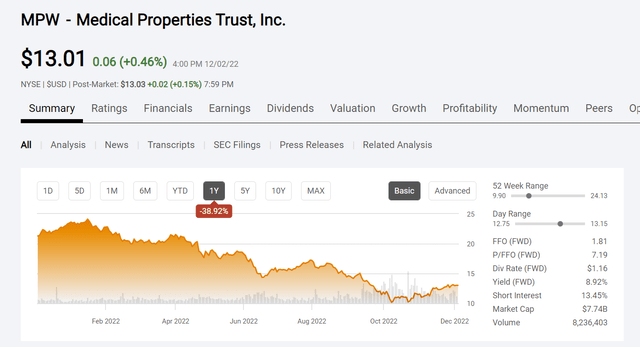

Medical Properties Trust Common Stock Price History And Key Valuation Measures (Seeking Alpha Website December 3, 2022)

The original bear raid on Medical Properties Trust, Inc. clearly gained momentum around June 2022. It also clearly reached its peak around October. Somewhere in there, the perpetrators most likely took profits. However, the damaging effects of any bear raid, like rumors and statements without a sound basis, will take time to undo or fade.

It takes a while for the market to begin to trust that things are really ok with the company. Anytime you see a loss of value like the above chart shows, stocks generally do not quickly bounce back. So, there is time to read the annual report and anything else relevant.

But it does look like the bear raid has either passed or at least is losing steam. So as long as some of the restrictions on profitable lines like surgeries do not come back during the current surge of seasonal illnesses, there is every chance that the recovery will continue.

Management Basics

Management did their best to answer the question as to whether they were doing the basic checking and “kicking the tires” before heading into a transaction. More importantly, management probably did some extra steps to decide whether to increase the business with a main partner like Steward.

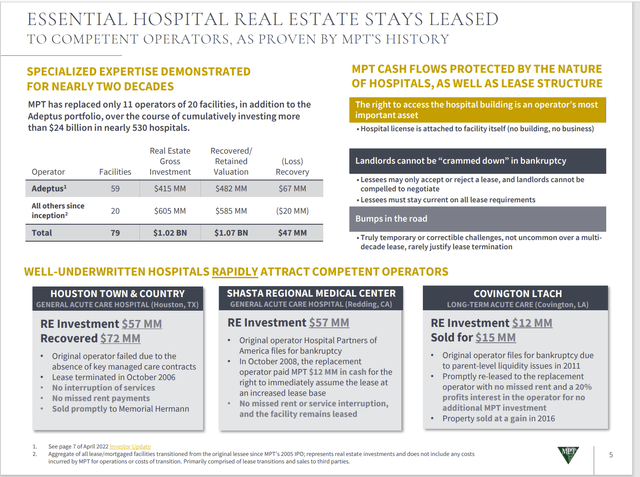

Medical Properties Trust Description Of Past Operator Challenges And Actions Taken (Medical Properties Trust August 2022, Corporate Presentation)

Management took the time to explain the main pathway when a crisis happens. But really, the ability to go the route shown above was first determined by evaluating a hospital as critically needed. The old real estate saying about “location, location, and location” immediately comes to mind.

In order for the Steward business to completely fall apart as the bears stated, management would have had to make several misevaluations about location. Given the history of the company, it is certainly possible to end up with one hospital in the wrong location. But a whole business (or multiple deals) to fall apart is extremely unlikely and certainly not to be assumed from the company history.

Steward Bank Line Uproar

Back in September, 2022, it was announced that Steward received a temporary bank line extension subject to some specific performance criteria (paperwork) and further evaluation by the lenders for a longer extension. As the stock price history above shows, that was not exactly a popular announcement.

However, for as long as I have followed troubled companies, banks rarely cause a lot of trouble. The reason is that a bank line is usually superior to just about any other line of credit or bond outstanding. The bank is, therefore, in a very strong position to completely recover its loan.

Generally, if the bank feels at all threatened, then that lender withdraws, and private equity comes in. This notifies shareholders that the risk of the investment just went up. But this only happens usually “towards the end of the road.”

It is far more usual for a bank to want more paperwork and then charge fees and raise the interest rate first. Steward would have had to endure “eye-popping” financial deterioration for things to go from normal to high-risk (bankruptcy threatening) while skipping the rising interest rates and more fees step. On the way to the corporate graveyard, I have seen some interesting things over the years. But I have never seen a jump that big.

Banks love to make money. So that additional fees and higher interest rates covers a lot of territory.

Generally, the bankruptcies I have covered most often were either forced by a payable’s entity wanting money or by management looking forward to what was about to happen if they did not file. I have really yet to see a bank force a customer to file bankruptcy.

Ownership Investment

Somehow, in the bear raid, it became a negative to have an equity interest in some of these operators. But that equity interest allowed management a far better view of operator operations. That actually could be part of an “early warning system” as most of these operators are private. So, an equity interest, even if passive, could be a valuable tool to be used to evaluate future business proposals as well as current business strategies.

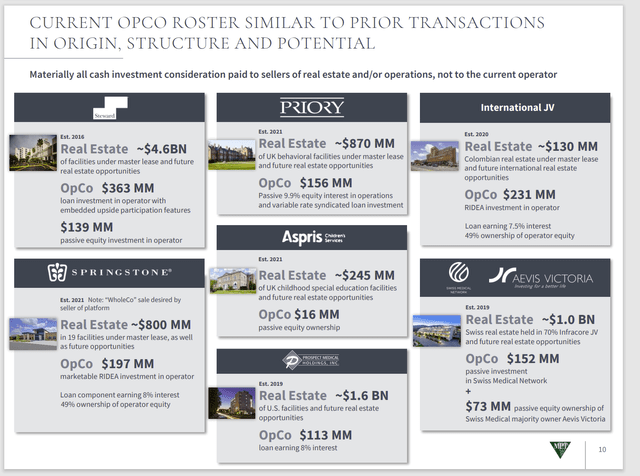

Medical Properties Trust Description Of Ownership Strategies For Operator Clients (Medical Properties Trust August 2022, Corporate Presentation)

So, at least to me, the company was actually ahead of the bears in that management first of all made sure that no operator received any money. Instead, the equity interest was there to aid a deal that got done because the operator was probably the best choice for the proposed deal.

What was probably left out of the discussion was how these operators needed cash in the first place. Such a situation comes about when a growth opportunity exceeds the ability of the operator finance it. I follow companies all the time that sell stock to keep the financial leverage low (as part of an acquisition) so the risk of failure from that leverage remains within company limits. This is really no different.

Too Much Leverage

When the market or the lenders perceive there is too much financial leverage, the reaction is nearly immediate.

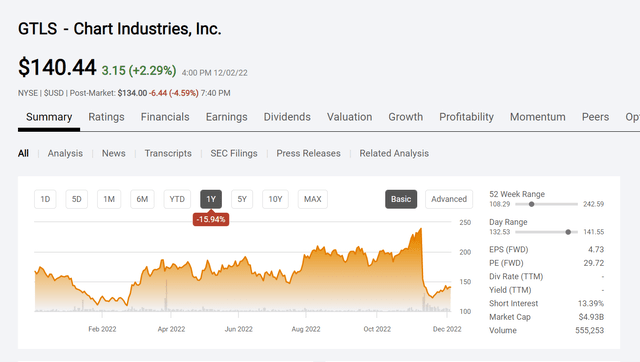

Chart Industries Common Stock Price History And Key Valuation Measures (Seeking Alpha Website December 3, 2022)

The above stock price reaction in November 2022, was for an announcement of a relatively large acquisition involving preferred stock and debt. The result was that the market value was nearly cut in half to account for the increased financial risk from all the leverage. This was followed by calls from numerous articles that stock should be sold to reduce that financial risk.

Private operators may not have to worry about a stock market reaction like the one above. However, the debt market has its limits. So, at a certain point, equity is needed to get the deal done is satisfactory fashion.

Medical Properties Trust has so far supplied that equity with satisfactory results. There is no reason to think the successful record of management will undergo a drastic change for the worse in the future.

Steward History

Management defended themselves with a history of the business relationship with Steward.

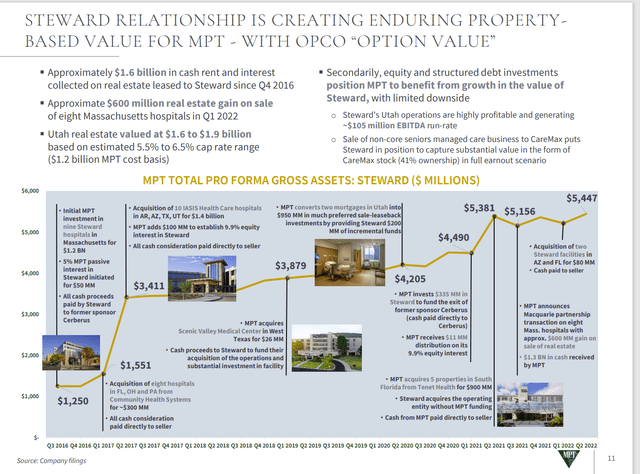

Medical Properties Trust History Of Business Relationship With Steward (Medical Properties Trust August 2022, Corporate Update)

When management states that the partnership is productive, they are also stating that they have done their homework ahead of time before they did any of these deals and that they intend to monitor the current relationship to produce similar results in the future. The controls that were put into place along with periodic re-evaluations do not stop just because the short sellers implied that was the case.

A material change in operator conditions without usually months (and sometimes years) of material warnings is highly unusual. The pandemic itself was definitely a scary experience for many of us. But it is also clear that we are past those days even if this winter proves to be busy and the threat remains. The difference now is that people are getting back to normal out of necessity more than anything else.

Another thing to consider is most industries are set to make it through a pandemic type of situation in their industry. Now maybe they cannot do two of them. But for as many industry “scares” that I have seen, I have never seen two in a row that are both very severe. I have seen some imitations (so to speak) that sure start out like that. But due diligence and nerves of steel are part of the requirements for investing.

We have better medicine, we have vaccines, and enough people got sick that even with the resurgence of Covid, the flu and another bug, we are handling the situation. It would help of course if we were more careful. But as it is now, the hospital system is handling the influx and it is likely that we are not going to approach anything close to the crisis of 2020.

The Future

The next twelve months are likely to prove to be confidence-building months. Covid is still out there and so is the flu. Hospitals are filling up. But it is vital for many to prove that we can get through this without the extreme measures needed the last time around. I happen to think we are up to the challenge.

That is not to minimize some very real threats. Hospitals are going to be very busy. But I think we will not have the levels of busy we had in 2020 or really anything close to that. We have had bad winters in the past without resorting to extreme measures. This winter is very likely to be one of those.

In the meantime, Steward has not fallen apart as the bears predicted and there is no sign of elimination of profitable parts of the business to handle a lot of sick patients as had occurred in 2020. Steward will likely continue to recover from a very nasty 2020.

Medical Properties Trust management is not sitting still, either. Instead, management has sold some of its business and announced a potential share repurchase along with debt reduction. The third quarter report did not have any indication of large impairments on the way. If anything, more progress was noted along with the potential to raise the dividend in the future. The dividend coverage noted is on the conservative side.

It will take some time for the stock to regain the market trust it had. But management does not have to do anything spectacular to regain that trust. Instead, it needs to keep doing what it has been doing all along. At some point, bears move on to a perceived more profitable target. The stock price action indicates that may already be the case.

There is considerable recovery potential in the stock price combined with an outstanding dividend yield. That is very unusual for this type of investment. The downside risk is very low because of the bear raid. But the recovery potential is considerably greater because management does not need to do anything extraordinary for Medical Properties Trust’s stock price to recover.

Be the first to comment