We Are

It is unlikely that anyone reading this is unaware that the Federal Reserve has been rather aggressively raising interest rates over the past several months in an effort to combat the incredibly high inflation rate currently plaguing the United States. These rate hikes have been pushing down the values of both equities and fixed-income securities and ended the bull market that has dominated for the past ten years. However, there are some assets that will perform well during times of rising interest rates. One good example of this is corporate loans since their floating rates cause the amount of money paid by the borrower in interest to raise as the Federal Funds rate climbs. These loans can be difficult for retail investors to purchase but there are a few ways. One of the best is by investing in a closed-end fund that purchases these loans. These funds benefit from professional management and can in many cases use certain strategies that allow them to earn and pay out yields that are well in excess of the underlying loans. In this article, we will discuss one of these funds, the BlackRock Debt Strategies Fund (NYSE:DSU), which currently yields an impressive 9.22%. Admittedly, this fund is not exclusively a floating-rate loan fund but it does include them in its portfolio. This is one of the reasons why the fund has been able to increase its distribution recently, which is a feat that very few funds have managed to accomplish this year. Let us investigate and see if this fund could be a reasonable fit for your portfolio.

About The Fund

According to the fund’s webpage, the BlackRock Debt Strategies Fund has the stated objective of providing investors with a high level of current income. This is certainly not surprising as most fixed-income closed-end funds have this as their goal. After all, fixed-income securities are not like stocks as they do not deliver much in the way of gains as the issuing company grows and prospers. Rather, these securities deliver nearly all of their returns through direct payments made to the investors. As this fund invests in those securities, we can expect that the same will be true of it. The strategy that the fund uses is not exactly what would be expected from a fixed-income fund, though. The BlackRock Debt Strategies Fund specifically states that it invests in below-investment-grade fixed-income securities, including corporate loans (leveraged loans). In other words, this is a combination junk bond and leveraged loan fund. These securities are admittedly somewhat riskier than most traditional bonds because they have a higher risk of default. In exchange, the securities pay a much higher interest rate than investment-grade fixed-income securities so investors are compensated for taking on this higher risk. As we will see over the remainder of the article, this tends to work pretty well and it is unlikely that investors in this fund will be exposed to too much default risk.

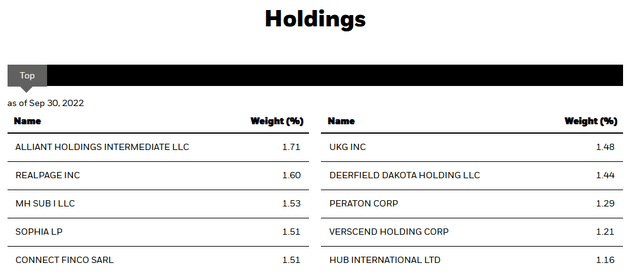

One of the biggest ways that a debt fund can reduce or even eliminate its risk of losses due to defaults is by only having a relatively small percentage of its total assets exposed to any individual issuer. The BlackRock Debt Strategies Fund does this quite well as we can see from simply looking at the largest positions in the fund. Here they are:

As we can see, even the largest position in the fund only accounts for 1.71% of the fund’s total assets. In fact, most of the fund’s positions account for much less as it has a total of 1,283 positions. This ensures that the fund will not lose very much money if any individual company goes into default. The only real thing that would hurt it would be if an entire sector encounters financial trouble or if a massive wave of defaults sweeps across the entire economy. If that were to happen, the nation would have bigger problems than just a few investors losing money. So overall, this is not something that we really have to worry about and the fund should be reasonably safe for even risk-averse investors.

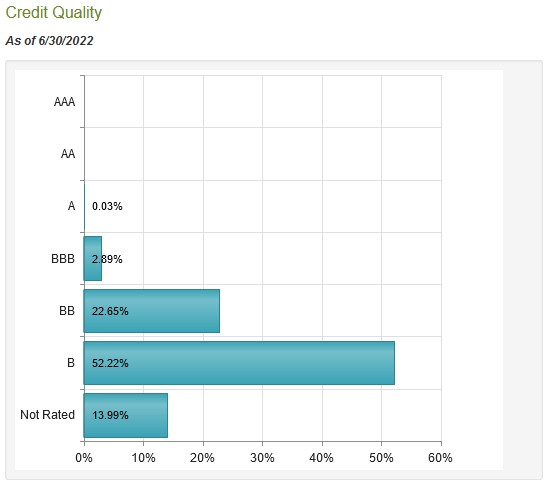

We can see even more evidence that the fund should not be affected too much by defaults by looking at the credit quality of the assets held by the fund. As many readers likely know, credit quality is simply a letter grade from AAA (highest) to C (lowest) that ostensibly measures the risk that a given company has to default on its debt. The overwhelming majority of the fund’s assets are BB or B-rated:

CEF Connect

This is something that should be fairly comforting to see, even though anything lower than BBB is considered to be below investment grade. However, BB and B ratings are the highest level of non-investment-grade debt and assets with those credit ratings account for 74.87% of the fund’s total assets. According to the official bond rating scale, companies with these credit ratings enjoy the financial ability to meet their current obligations but may be more adversely impacted by economic shocks than companies with an investment-grade rating. Thus, the default risk of most of the assets in the fund’s portfolio is fairly low. When we combine this with the significant diversification that the fund possesses, there is very little that we really need to worry about here.

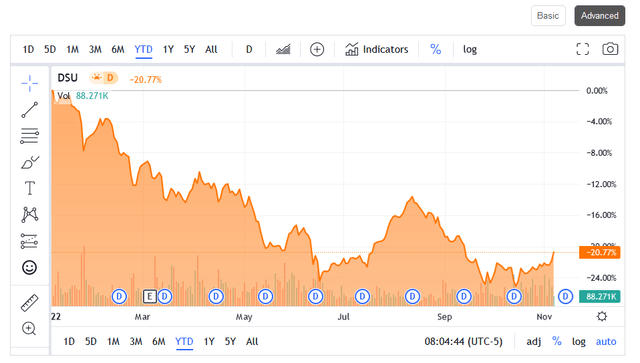

As we all know, the Federal Reserve has been raising interest rates fairly aggressively over the past year in order to combat the threat of inflation. Jerome Powell’s latest comments seem to imply that the Federal Reserve will continue to do so and I’ve seen recent predictions stating that the Federal Funds rate will be above 5% by the end of 2023. This has been putting pressure on anything in the fixed-income market. The reason for this is that fixed-income securities tend to move inversely to interest rates because the value of existing bonds will adjust so that they offer the same yield-to-maturity as newly issued bonds. We can see that by looking at the fund, which is down 20.77% year-to-date:

As stated earlier in the article though, the BlackRock Debt Strategies Fund does not invest only in high-yield bonds. It also invests in corporate loans and these are assets that we actually want to be holding during times of rising interest rates. This is because corporate loans tend to be floating-rate investments that actually have their interest rate increase regularly if the Federal Funds rate is going up. Thus, the amount of money that these assets pay to the fund has been climbing over the last year and they should hold their value much better than ordinary bonds in such an environment. The presence of these things in the portfolio might be one reason why the fund was able to increase its distribution this year. That would also be a nice position to be in during inflationary times because the higher amount of money that we receive from the fund helps us to maintain our purchasing power in such an environment.

Leverage

In the introduction to this article, I stated that closed-end funds have the ability to use certain strategies that allow them to pay out higher yields than the underlying assets possess. One of these strategies is the use of leverage. Basically, the BlackRock Debt Strategies Fund is borrowing money and then using that borrowed money to purchase high-yield debt. As long as the interest rate paid by the bonds and loans that it purchases is higher than the interest rate that it has to pay on the borrowed funds, this strategy works pretty well to boost the overall portfolio yield. As the fund can borrow at institutional rates (which are much lower than retail rates), this will normally be the case. However, the use of leverage is a double-edged sword since it increases both gains and losses. Thus, we do not want the fund to use too much leverage since that would expose us to too much risk. I typically like to see leverage under a third as a percentage of the fund’s assets for this reason. The BlackRock Debt Strategies Fund fulfills this requirement quite well as it currently has a leverage ratio of 31.43% as a percentage of assets. Thus, it appears that the fund is striking a fairly reasonable balance between risk and reward.

Distribution Analysis

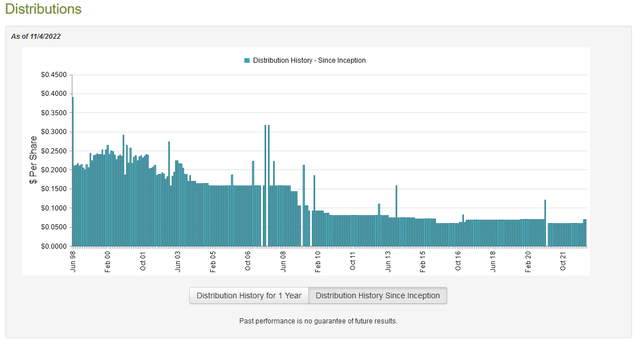

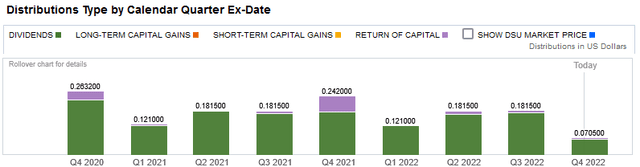

As stated earlier in this article, the primary objective of the BlackRock Debt Strategies Fund is to provide its investors with a high level of current income. In addition, the fund operates a leveraged portfolio of high-yield bonds and corporate loans so we can assume that it possesses a reasonably high distribution yield. This is certainly the case as the fund pays a monthly distribution of $0.0705 per share ($0.846 per share annually), which gives it a 9.22% yield at the current price. This is certainly a high enough yield to appeal to anyone that is seeking a relatively high level of income from the assets in their portfolio. The fund has varied its distribution a few times over the years due largely to changes in interest rates. It increased it back in October though:

As we can clearly see, the fund has generally raised its distribution when interest rates increased and cut it shortly following a cut in the Federal Funds rate. Although this sort of history may not be appealing to some investors that are seeking a safe and secure source of income that can be used to pay their bills, the fact that the fund increases its distribution in rising rate environments could still be nice for new money buying today. Another thing that might be appealing is that the majority of the fund’s distributions are considered dividend income, with minimal capital gains or return of capital:

The fact that the fund’s distributions include a minimal return of capital is attractive because a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. The lack of capital gains is somewhat appealing because capital gains are not guaranteed so we do not want to count on them for our income. As I have pointed out in the past though, it is possible for these distributions to be incorrectly classified. Thus, we do want to investigate and see exactly how the fund is financing these distributions so that we can ensure that they are as sustainable as they appear to be.

Fortunately, we do have a relatively recent report that we can consult for this purpose. The BlackRock Debt Strategies Fund’s most recent financial report corresponds to the period ending June 30, 2022. As such, this will give us a pretty good idea of how well the fund performed during the initial stages of the Federal Reserve’s interest rate hiking campaign, which was devastating to the bond market. During this six-month period, the fund received a total of $47,466 in dividends and $17,926,542 in interest from the assets in its portfolio. When we combine this with a small amount of money from other sources, the fund had a total income of $18,161,731 during the period. It paid its expenses out of this amount, leaving it with $14,410,886 available for investors. This alone was enough to cover the $14,099,627 that the fund paid out in distributions. Overall, it does appear that the fund is basically just paying out its net investment income to the investors, which is exactly what we want to see. The fund’s distribution is going to depend on interest rates but it does not appear that it is distributing more than it can actually afford.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Debt Strategies Fund, the usual way to value it is by looking at its net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them for a price that is less than the net asset value. This is because such a scenario implies that we are acquiring a fund’s assets for less than they are actually worth. That is fortunately the case with this fund. As of November 7, 2022 (the most recent date for which data is currently available), the BlackRock Debt Strategies Fund had a net asset value of $10.39 per share. However, it currently trades for $9.31 per share. This gives the fund a 10.39% discount to the net asset value. Although this is not as attractive as the 12.16% discount that the fund has had on average over the past month, it is still a very appetizing discount that represents an excellent deal for investors. Overall, the price seems to be quite reasonable here.

Conclusion

In conclusion, the BlackRock Debt Strategies Fund could be a good way to take advantage of the rising interest-rate environment. This is because its income and distributions tend to increase when rates do. The fund has admittedly taken a few losses this year and it is possible that it will go down in price a bit more as rates continue to rise but it seems that the worst is likely behind it. It could be a good fund to dollar-cost average though and today’s price is certainly attractive. When we pair this with the very high and sustainable 9.22% yield, this fund could be a good addition to an income-focused portfolio.

Be the first to comment