Pgiam/iStock via Getty Images

In this current bearish market, generating a 16 percent yield with monthly distribution, surely deserves attention. Not only that, DoubleLine Income Solutions Fund (NYSE:DSL) has also recorded an average yield of almost 11 percent since 2015. This multi-sector fixed income closed ended mutual fund (CEF) has performed exceptionally well even during the covid-19 pandemic. The fund generated a yield of 12 percent and 9 percent during the past two calendar years, although the monthly pay-out has decreased from $0.15 to $0.11. The portfolio has the potential of delivering strong and steady income on the back of its strong coupon income. The fund however has been disappointing in terms of price growth and is far from its pre-pandemic price level of $20. As the fund is currently trading at a discount to its net asset value (NAV), it looks like a good option for income seeking investors.

DSL’s Capability of Generating Strong Yield Makes it a Lucrative Fund

DSL is a multisector bond fund launched and managed by DoubleLine Capital LP. It earns an average coupon of 7.13 percent on its assets under management (AUM) of $1.35 billion. Interestingly, this fund doesn’t benchmark itself with any market index. It uses leverage, but the leverage is under 30 percent, which is fair. The only thing investors may be concerned about is its exceptionally high expense ratio of 1.83 percent. However, the kind of yield the fund has generated on a consistent basis after paying these expenses, makes investors confident.

DoubleLine Income Solutions Fund has a sizable exposure to floating rate debt in the form of loans, non-agency Residential Mortgage-Backed Securities (RMBS) and collateralized loan obligations (CLOs). RMBS are debt-based securities, backed by the interest paid on residential loans. CLO is a single security backed by a pool of debt. The portfolio has a high degree of risk in the sense that 90 percent of its investments are not of investment grade, i.e. rated BB or lower. Besides the increasing interest rates, fears of a potential recession bring significant credit risk for the investors. Both these factors are working against DSL.

DoubleLine Income Solutions Fund at present has largely been invested in emerging markets’ debt securities and U.S. high yield securities. Most of its emerging market debt is in the form of holdings in Latin American markets such as Mexico, Argentina and Brazil. Emerging market debt continues to trade cheaper than US corporate debt while boasting stronger leverage metrics. The overweight to emerging markets has been a recurring feature of this fund, and is a particular concern for conservative investors. Thus, this fund is more suitable for those who have a higher tolerance for volatility.

The other recurring characteristic of this fund is holding around 450 bond securities. That makes the weightings to any one position relatively small and helps this fund to diversify its risks. Top 25 holdings of DSL’s portfolio hold only 22.5 percent of this fund. For a portfolio consisting mostly of junk-rated bonds, this is considered the best approach. DoubleLine Income Solutions Fund also diversifies across industries and issuers so that a handful of securities cannot decide the fate of this fund. These characteristics will also help this fund to be more stable in case the recession sets in.

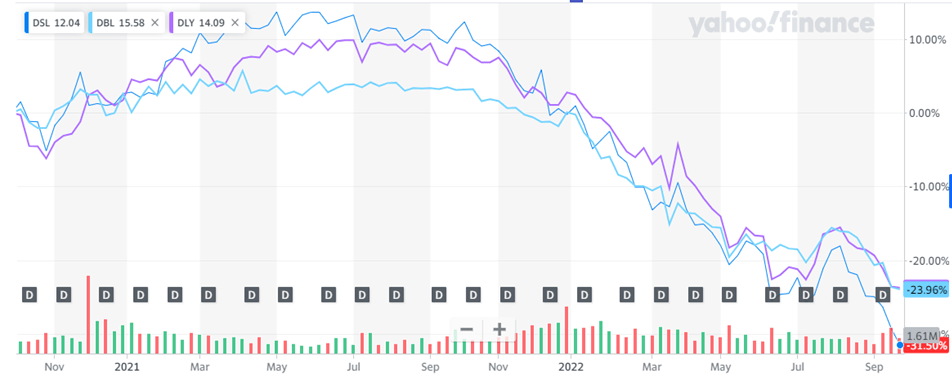

Comparison of DSL with Two Other DoubleLine Multi-sector CEFs

I tried to compare the DoubleLine Income Solutions Fund with two other DoubleLine multi-sector CEFs managed by Jeffrey Gundlach – DoubleLine Opportunistic Credit Fund (DBL) and DoubleLine Yield Opportunities Fund (DLY). While DSL tends to favor overweight exposure to emerging markets, DLY is more of a traditional multi-sector bond fund and DBL is highly concentrated on Mortgage Backed securities (MBS) and CLOs. MBS is an investment similar to a bond that is made up of a bundle of loans bought from the banks that issued them. A comparison in their market price over the past two year reveals that DSL, which achieved the maximum growth in the earlier months, is now lagging behind the other two funds in terms of growth. A probable reason might be the poor credit quality of DSL’s bond portfolio.

price performance (Yahoo Finance)

At a time when investors are fearing a recession, bonds with poor credit rating tend to suffer the most due to a higher probability of default. DBL’s portfolio could be considered the safest and is less volatile, too. DSL’s portfolio is the most junky and speculative grade. heaviest in the most speculative holdings. DLY’s portfolio falls in between, but is leaned towards junkier portfolio. DSL’s portfolio also has performed the worst during the nine months of 2022. Investors probably are discounting DSL for what might happen in a worst-case scenario. The fund thus trades a higher discount due to the perceived higher risk of a recession.

Investment Thesis

DoubleLine Income Solutions Fund is a multisector closed-ended fund focused on emerging markets debt and U.S. high yield. The fund has severely been impacted this year due to widening credit spreads in the emerging markets, as well as by the rising rates by the U.S. Fed. DSL’s bond portfolio has a low credit rating, mostly non-investment grade, and thus is vulnerable during a period when investors are fearing a recession. Probably, due to these factors, the fund is currently selling at a discount to its NAV.

On the other hand, this fund has consistently generated exceptionally high yield, and is less likely to have a distribution cut, as its investments generate a high coupon. The fund has allocated 20 percent in debt of energy firms – an effective investment given the upward trend in energy prices. The fund is trading at a discount, which makes it attractive to the income seeking investors. In a bearish market, this fixed income CEF surely stands out. I recommend this fund for long-term income seeking investors.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment