DNY59/iStock via Getty Images

Have you had a pumpkin latte yet? Enjoyed some ginger snaps? Bought your Halloween candy way too early and then snacked through a bag you’ll now have to replace?

(You were just going to have one piece. Truly!)

Even if you answered no to all three, you’ve probably seen the signs of October all around you.

There are overflowing tables of autumn-themed baked goods at the grocery store. Home Depot (HD), Lowe’s (LOW), Walmart (WMT), Target (TGT), Costco (COST), and similar stores are hawking Halloween paraphernalia.

Plus, you probably have at least one yard in your neighborhood that’s decked out with fake gravestones and other intentionally creepy décor.

Maybe that yard is yours.

Regardless, it’s clear Halloween is right around the corner – the time for scary stories being told and ghosts and jack-o-lanterns coming out to play. Admittedly, in the latter case, they often come in the form of toddlers and other less-than-intimidating dressed-up kiddos.

But still. There are some more legitimately sinister elements lurking around this time of year. And “this time of year” 2022 has an additional reason to worry.

As I write this, the markets are up. Significantly so, for that matter. But considering how nothing much has changed since the last “significantly so” drop, we have to ask two questions:

- How long will the bullish moves last?

- How bad will the next drop be?

With those on our minds – because I know I’m not the only one thinking them – let’s discuss some REITs to avoid.

Don’t Get Turned Into a Frog

There’s always that house you knew wasn’t worth the trek when you were a kid trick-or-treating.

Maybe it was the dentist who gave out toothbrushes. (What kind of a monster does that!?!) Or the miserly neighbor who would give out old candy that he’d gotten on markdown.

Or, worse yet, it was THAT house: the one you and all your friends would whisper about. The one with the creepy woman who had a wart on her nose.

A wart! On her nose! What more proof of absolute evil did you need?

If you ate what she doled out, you’d turn into a frog the next day. Donnie’s older brother – who was 15 and would therefore know – told him that.

Of course, in those cases of childhood woe, there are worse things in life than a toothbrush – especially if you’ve got an entire jack-o-lantern filled with candy.

Come on, kid. Let’s not be greedy.

The same goes for one stale piece out of 50… 75… or more.

As for that woman with the wart, chances are good she wasn’t actually a witch. She might have even been a very nice person who gave out the best treats in the neighborhood.

You wouldn’t know ’cause you never tried. (Except for that one time you took up Donnie’s dare and made it halfway up the driveway before chickening out.)

But the adult world is filled with much more dangerous cases of bait-and-switch. As mentioned earlier – something we all know far too well to some degree or another – that includes in the stock market.

You Need More to Go On Than This

This is hardly a Halloween quote, but I’m still going to reference it since it’s relevant in October. And November… December… January… February…

As well as every other month of the year. “A rising tide lifts all boats” no matter what season it is.

Many people link that statement to President John F. Kennedy. He first used it in 1963 in reference to alleged pork-barrel spending, and it caught on from there.

It’s gone on to become a favorite among bull market skeptics. Sure, they point out. A plethora of all stocks are up on the day or the week or even the year.

But that alone doesn’t make a good stock, especially when everything else is up as well.

It’s a phrase I’ve used over and over again myself, and I’m going to use it again today. Don’t be fooled into buying shady stocks now, no matter how high daily market movements take them.

In the case of real estate investment trusts (REITs) especially, don’t be fooled into buying shady stocks – no matter how high daily market movements take them – even if they’re trading intensely discounted from their January 1 price points.

I’m well aware that REITs as a sector are down year-to-date. And yes, some of them look like absolute bargains, which I’ll make sure to mention in my recent article: “Trick or Treat, Here’s My Favorite REITs.”

But that doesn’t mean you can just bob for any ol’ apple right now. Or ever.

Decide today to be more selective than that. Because in the grownup world where you’re the one paying for the “candy” in question…

As I said before, the consequences of knocking on the right door can be astronomical – a fate more scary than I’d like any of us to experience.

Too Good To Be True

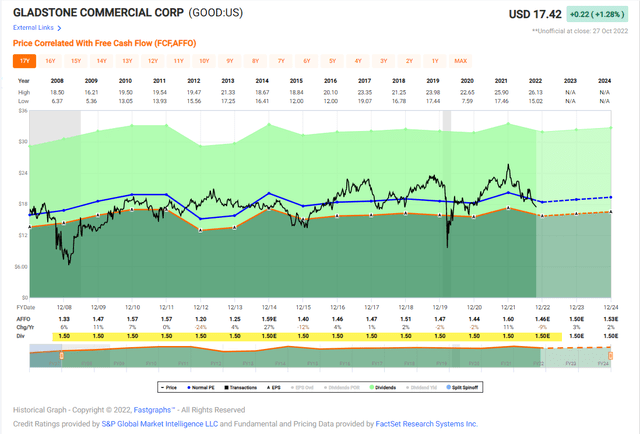

Gladstone Commercial (GOOD) is a net lease REIT that owns 136 properties (17 million square feet) in 27 states.

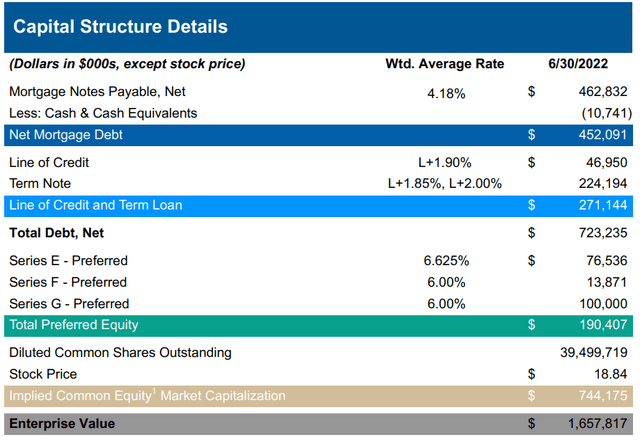

The REIT IOP’d in 2003 and has a market capitalization of around $750 million and Enterprise Value of around $1.7 billion.

GOOD’s occupancy has never fallen below 95% and the current occupancy is 97.3%. Arguably, the company has done a great job with retention as it has had only two tenant defaults since inception.

Most of the portfolio is comprised of industrial (52%) and office (44%) with a fraction invested in retail (3%) and medical office (1%).

It’s true that GOOD has reduced its leverage substantially since 2012, from 63% to around 45%; however, the capital structure of mortgage debt, lines of credit, and preferred issuances is around 55% of the capital stack.

Thus, when you analyze the all-in weighted average cost of capital of around ~7% you have a business model that has modest external growth drivers. Recently the company announced it closed on two industrial buildings at a cap rate of 7.45%.

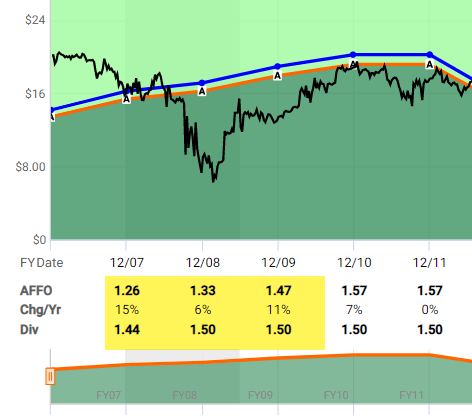

Keep in mind, GOOD has never cut its dividend, and that is admirable, especially when you consider the fact that many REITs either cut or suspended their dividend in 2020. However, GOOD’s business model is not generating much organic growth as evidenced by the flat-line dividend growth seen on the chart below:

How can a business not grow its dividend for such a long time?

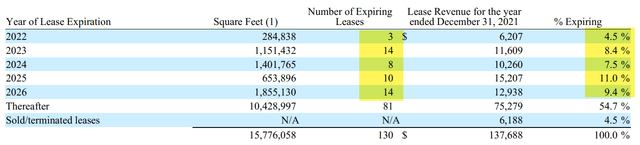

Furthermore, risks are elevated for GOOD post-pandemic as the demand for office space has decelerated. As I mentioned, around 44% of the portfolio has office exposure which means that at some point cap-ex will be required to improve and re-lease vacant space. A total of 47 leases expire before 2027 that represents ~40% of the portfolio.

As you can see below, GOOD did not cover its dividend (based on AFFO per share) in 2007, 2008, and 2009.

FAST Graphs

Now we’re entering another recession, not a great one, but one that has a much greater impact on office landlords, thanks in large part to Covid-19.

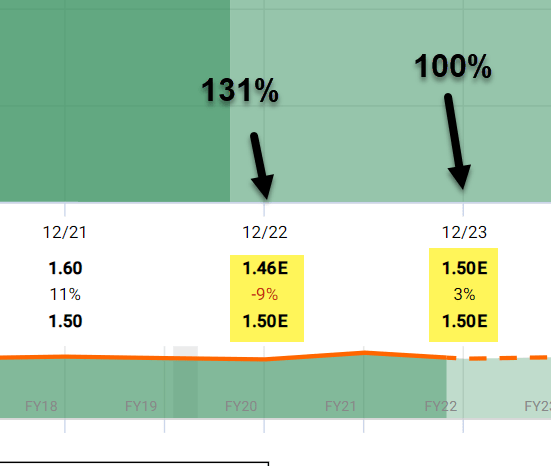

While peers like Orion Office REIT (ONL) have also struggled year-to-date, the management team has maintained a conservative dividend policy to ensure that it can reposition the portfolio when office tenants vacate. As viewed below, there’s no margin of safety with regard to GOOD’s dividend.

FAST Graphs

To be perfectly clear, I’m not trying to spook you into believing that GOOD will cut its dividend anytime soon, although this one is on our watch list. However, my primary gripe with this REIT is the fact that it seen no dividend growth in a long, long time.

Currently the stock is yielding 8.6% and while that may seem attractive on face value, the office overhang is not going away anytime soon, and just to be blunt, there are much better opportunities in the net lease sector right now.

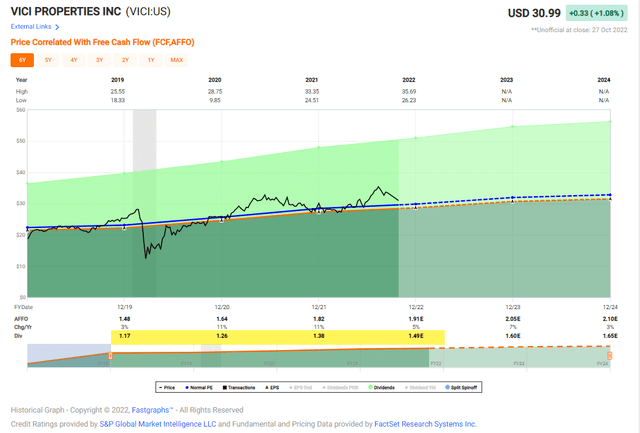

For example, VICI Properties (VICI) just announced a dividend increase of 8.3% (year over year). This specialized net lease REIT has generated best-in-class growth in earnings (AFFO per share) and dividends – in record time.

Also, and this is important, VICI has its own management team, whereas GOOD rents out its management team to Gladstone Management Corporation that is not dedicated exclusively to GOOD’s business.

I recognize that there are advantages for smaller REITs to outsource certain duties (i.e., legal, accounting, etc..) but there’s also a tradeoff that must be considered related to the management teams circle of confidence (with no conflicts of interest).

Not A Necessity REIT

Necessity Retail (RTL) is a shopping center REIT that also owns net lease properties, so I suppose this means it’s a diversified REIT. The $5.1 billion portfolio consists of 113 multi-tenant properties and 944 single tenant properties, representing a combined 29.3 million square feet.

Recently activist fund Blackwells Capital started two different proxy fights at RTL and Global Net Lease (GNL) and Necessity Retail and wants the REITs to oust their outside manager. AR Global.

Blackwells nominated the same two director candidates at the companies and wants the REITs to evaluate possibly selling themselves, according a Reuters report, which cited people familiar. The investor also wants to nominate two more directors at both companies in 2024.

Of course, that’s music to my ears, as I have been a constant suggestivist, as I explained recently,

So, what this means is that AR Global can milk the fees for another decade or so, while investors get the very last bit at the apple…

…there’s zero alignment of interest when you’re a shareholder in GNL, since the external fund manager is more focused on what’s in his pocket, versus Average Joe or Jane.

More importantly, do not let the juicy dividend yield lure you into the buy zone. This is an old trick amongst the Wall Street crowd in which they show off their shiny looking toy, later to dupe the participant into a big fat dividend cut…

Call it what you want – value trap, sucker yield, or lemon – I would not touch this toxic net lease REIT for any reason whatsoever. A dividend cut is likely given the continued dilutive impact (consistent decline in FFO per share) and reckless management structure.

It’s not just the external management that gives me the shivers, but RTL’s business model is seemingly flawed. In Q2-22 it closed on over $1.3 billion in deals with a weighted average cap rate of 8.6%, while the company’s cost of capital is around 10%. Just the equity cost alone is over 16%… yikes!

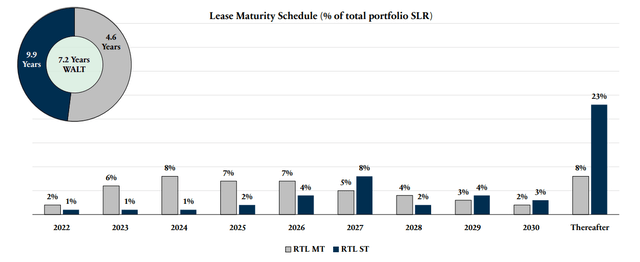

RTL’s mix of long-term single-tenant net lease assets and open-air shopping centers have an average lease term of 7.2 years, yet the multi-tenant leases are around 4.6 years.

Never let a good pandemic go to waste….

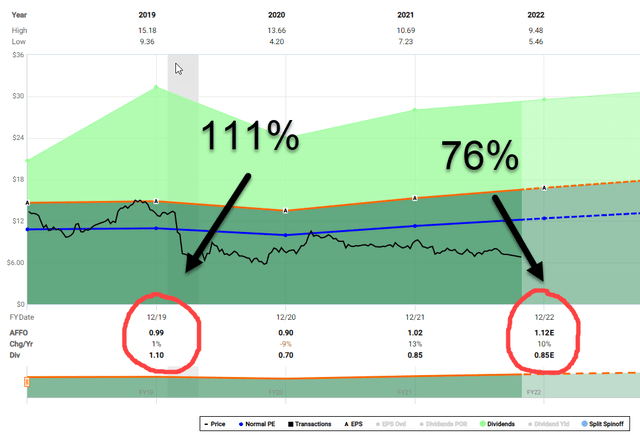

As you can see below, RTL cut its dividend from $1.10 per share to $.70 in 2020 (and has since increased to $.85 per share). Of course, we knew the dividend was in danger before 2020, thus we avoided buying, and hopefully others did too.

Yet, even with a wider margin of safety with the dividend, shares are trading at just 6.2x.

Perhaps the Blackwell group will shake up the external manager, and force RTL to liquidate its portfolio.

Remember, Realty Income (O) has already taken a few bites at the AR Global apple, as they (Realty) purchased American Realty Capital (formerly ARCT) for $2.95 billion in 2012 and Vereit (formerly VER) for $11 billion in 2022.

If Blackwell can force out AR Global, I am certain that Realty Income could easily swoop in to acquire RTL’s 944 free-standing portfolio as well as GNL’s 311 free-standing portfolio (38.2 million square feet).

But wait, and to be clear, I have zero interest in owning either REIT managed by AR Global, because I consider both value traps – plain and simple. I’ll be watching Blackwells Capital from the sideline, watching them flex their activist muscles, which should result in some interesting news…

Trick or Treat?

Thank you for reading my spooky article today and I hope that you continue to practice discipline while divulging in REIT treats. As you know, these are dangerous times and investors should always pay close attention to earnings and dividends.

An investment operation is one which, upon thorough analysis promises safety of principle and an adequate return. Operations not meeting these requirements are speculative. – Benjamin Graham

Be the first to comment