funky-data

Thesis

It is no secret that over the past 6 months or so technology stocks, especially those with aggressive valuation multiples and lack of profitability, have been on a free fall, creating turbulence for the broader market. With many headwinds in play, including inflation, rising rates, global peace concerns, and persisting supply chain disruption, the stock market is fighting off mounting selling pressures.

Investors are now looking for reliable businesses that can consistently generate cash flows, and stand out among competitors while maintaining long-term growth prospects. They also place a great deal of emphasis on valuations.

While most would steer away from the technology sector in order to identify those opportunities, still, a handful of companies in the space share those characteristics. Dropbox, Inc. (NASDAQ:DBX) is one of those companies that is bound to outperform, after a few underwhelming years on record. In this analysis, the attractiveness of the company as an investment opportunity is examined.

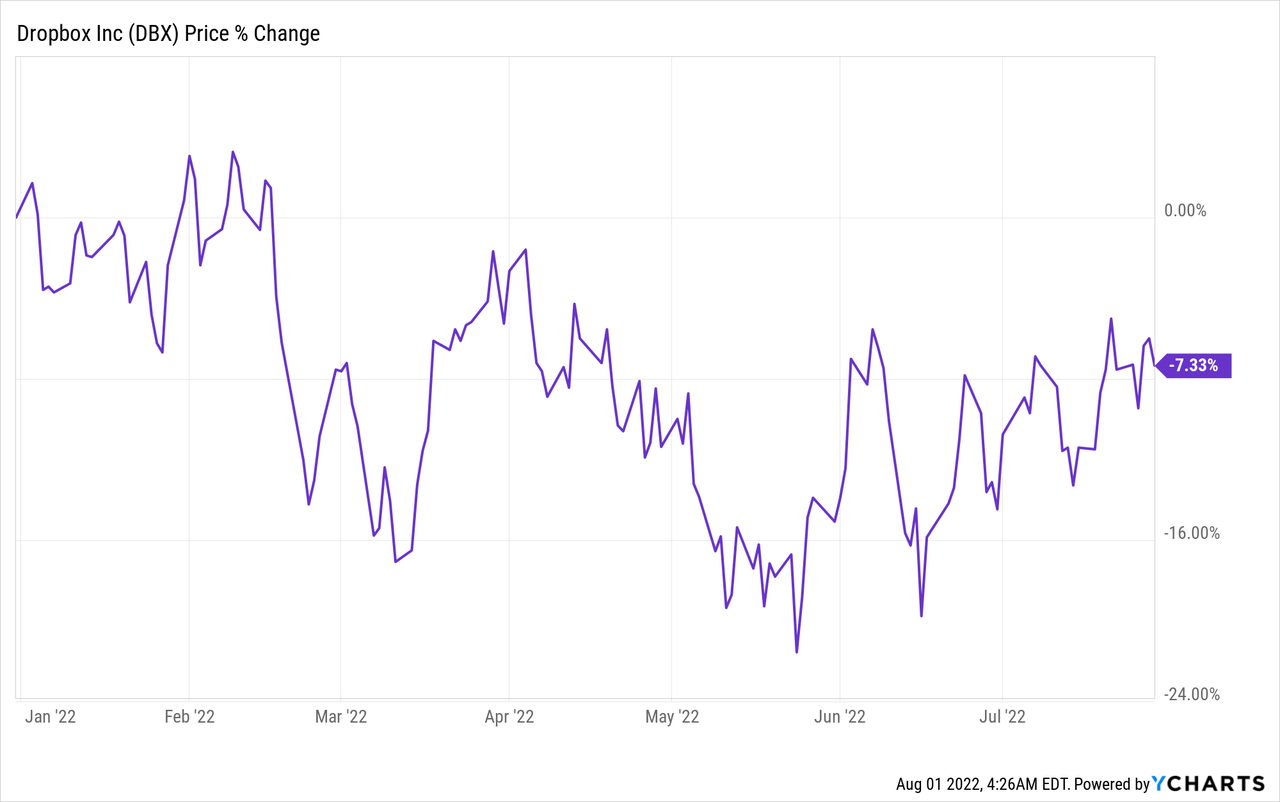

Stock Performance

While Dropbox has performed decently over the past few months, in the midst of a tech-led, prolonged market rerating, on a longer-term basis the stock’s record has been underwhelming. For the trailing 5-year period, DBX has recorded a loss of -24%, during a period when most established technology stocks were marking impressive gains. Currently, DBX trades at $22.75 ($8.5B market cap) and pays no dividend.

While for a few years we have been used to operating in a low-interest rate market, where aggressive growth in sales was rewarded with very generous valuation multiples, leaving slower-growing tech stocks like Dropbox behind, today’s market is very different. A return to more conservative, principle-based investing where consistent cash flow generation becomes a top priority is very likely to benefit Dropbox.

Business Prospects

At the heart of Dropbox’s strategy regarding the company’s future lies the transformation from simply offering file storage services to becoming an integrated collaboration platform aiming to help businesses automate tasks, interact seamlessly and increase efficiency.

The Dropbox platform caters mostly to small and medium-size businesses, while its simplicity makes it stand out. The platform also offers an open ecosystem that can work across almost all devices and can integrate with many partners including Microsoft (MSFT), Zoom (ZM), and Google (GOOG, GOOGL). Maintaining high levels of security for user data is another top priority for Dropbox.

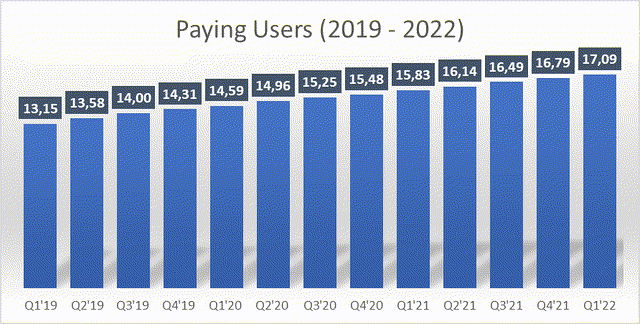

Subscriber Growth & Pricing

Dropbox generates revenue through its subscription plans and therefore subscription growth and effective pricing are the key components to the company’s financial success and longevity. Subscriptions offer recurring revenue, generally on a monthly or annual basis.

As of March 31, 2022, Dropbox claims 17.09M paying users, compared to 15.83M a year ago (8% increase YoY). The average revenue per paying user, amounted to $134.63, compared to 132.55 in 2021. The total number of paying users has increased for more than 12 consecutive quarters, as shown in the graph below.

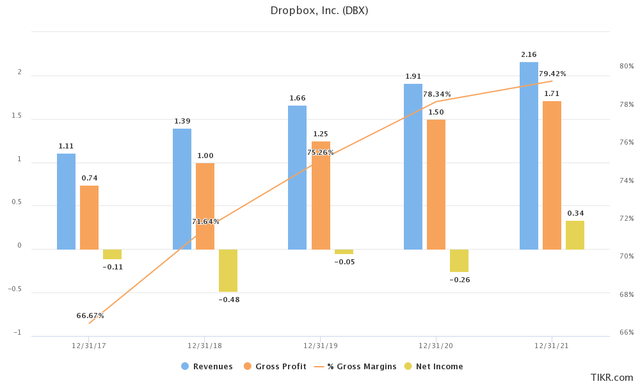

Financial Strengths

Even though Dropbox’s financial performance in terms of revenue growth might appear underwhelming compared to other names in the technology sector, it is still rather good. Despite intense competition, the company has managed to grow its revenue at a 5-year 19.67% CAGR, reaching $2.16B in sales for the fiscal year 2021. The sought-after, bottom-line profitability objective has also been achieved in 2021, easing any sustainability and longevity concerns. Gross profit margins are impressive, standing at over 70%, while 2021’s 16% net margin is expected to continue to improve over the next few years.

Apart from a respectable growth record, Dropbox also displays significant sales diversification. As of the first quarter of 2022, Dropbox’s sales from outside the United States accounted for approximately 47% of total revenue.

Unlike many companies in the sector, cornered by aggressive R&D and marketing spending, Dropbox has been cash flow positive for years. In fact, free cash flow (“FCF”) generation is arguably one of the company’s most desirable attributes. In 2021, DBX generated $685M of Unlevered FCF, compared to $200M in 2016. The recurring revenue and asset-light nature of the business seem to be able to provide investors with ample amounts of cash flow. As profitability improves further, FCF generation is expected to follow.

For the three months that ended on March 31, 2022, FCF reached $131M, compared to $109M ( 20% YoY increase) for the three months that ended on March 31, 2021.

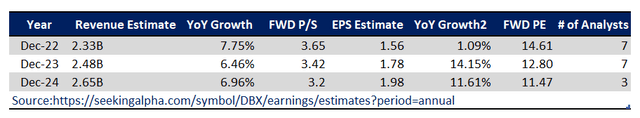

For the next few years, analysts remain optimistic regarding both revenue and earnings growth. Sales are expected to grow in the high single digits while EPS, with the exception of the fiscal year 2022, is projected to record annual increases between 10 and 15%.

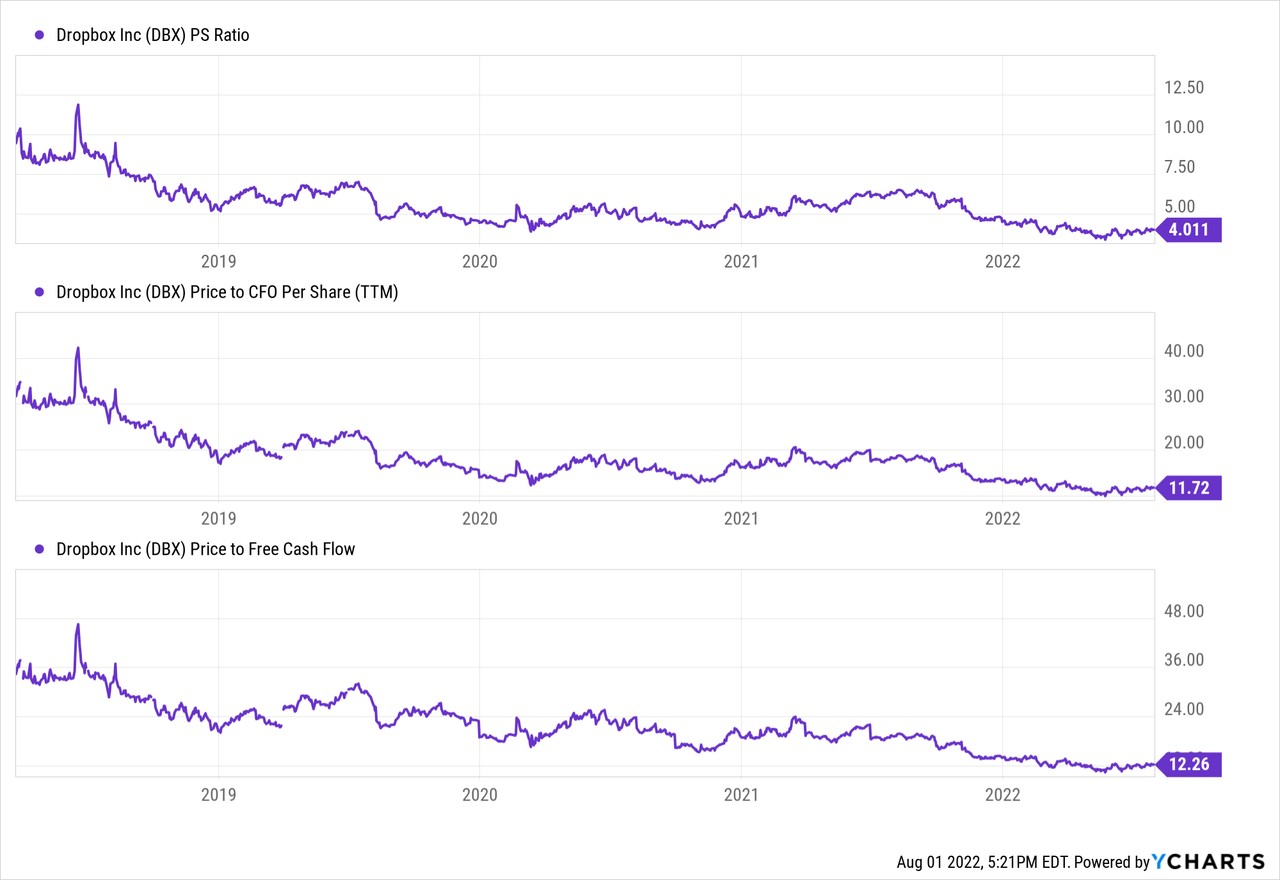

Valuation

Even as valuation multiples across the marker have contracted since the beginning of the year, Dropbox is still reasonably valued on a relative basis. Currently, Dropbox trades at a 14.6x TTM P/E multiple, compared to a 19.0x sector average. Furthermore, the stock trades significantly lower than its 5-year P/S, P/CFO, and P/FCF multiples. Considering the company’s historical capacity to generate free cash flows, as well as its revenue and earnings growth prospects the 12.3x P/FCF assigned to the stock appears inexpensive.

Risks

Dropbox is facing intense competition, as many of the company’s offered features are also available to businesses and individuals through companies like Microsoft, Amazon (AMZN), Google, and others. As new technologies are introduced in the industry, management expects competition to intensify over the next few years. Both profitability and growth capacity could be damaged as a result. Dropbox might also lose some of its pricing power, having to discount its services in order to remain competitive.

Competitors like the ones mentioned have a unique ability to invest in innovation due to the scale of their businesses. It is possible that a smaller, more niche company like Dropbox gets left behind in the race for constant service and user experience improvement and therefore its offerings become outdated. Losing access to third-party platforms (many controlled by competitors) would also significantly hurt Dropbox’s ability to reach end-users.

Finally, considering the recent macroeconomic developments, we should mention that in the case of a recession, both businesses and individuals are likely to cut back on non-essential services to conserve expenses. To the extent that Dropbox’s offering can be viewed as such, the company should expect setbacks in revenue growth and profitability.

Dropbox is scheduled to report its Q2 earnings on 4 August after the market close.

Final Thoughts

After all things are considered, despite risks related to competition, technological innovation shortfalls, and macroeconomic factors, Dropbox is well-positioned (and fairly valued) for the next few years. A stable, growing revenue stream, combined with efficient cash flow productivity will be the key to achieving market-beating performance over the mid-term. Currently, I would rate Dropbox as a buy.

Be the first to comment