JHVEPhoto/iStock Editorial via Getty Images

Rising interest rates have generally hurt stock markets around the world, but one domestic capital market and broker/dealer stock has enjoyed the trend.

LPL Financial Holdings Inc. (NASDAQ:LPLA) sports massive one-year alpha along with a slew of EPS upgrades in the last few months. Are shares poised for more upside after earnings Thursday night? Let’s investigate the valuation and technical perspectives.

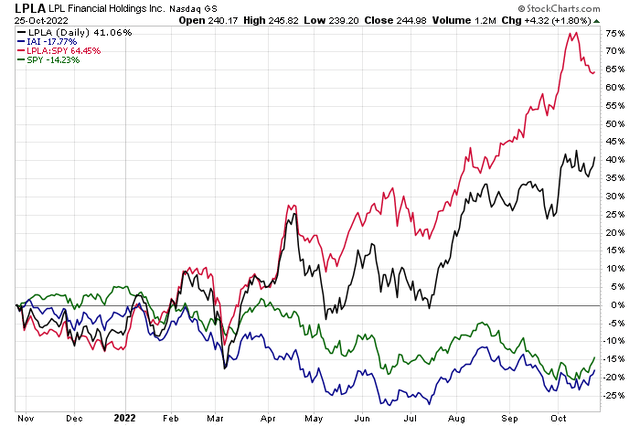

LPLA: Crushing Its Industry ETF & The Broad Market

According to Bank of America Global Research, LPL Financial is the largest independent broker-dealer in the United States, with roughly $1Tn in client assets. The firm supports more than 18,000 financial professionals and 450 independent RIA firms nationwide, through several services including brokerage and advisory, investment solutions, technology and cybersecurity platforms, operational support, and compliance oversight.

The California-based $19.2 billion market cap Capital Markets industry company within the Financials sector trades at a high 39.6 trailing 12-month GAAP price-to-earnings ratio and pays a scant 0.4% dividend yield, according to The Wall Street Journal.

The company has solid growth with minimal capital levels, which helps to drive good margins. While organic growth has been impressive in recent years through its RIA businesses, LPL has lately been pursuing M&A activities to access other segments as competition grows. With interest rate sensitivity, the firm has benefitted this year, and strength could grow if the yield curve eventually turns less inverted. Financial leverage is a downside risk should rates retreat.

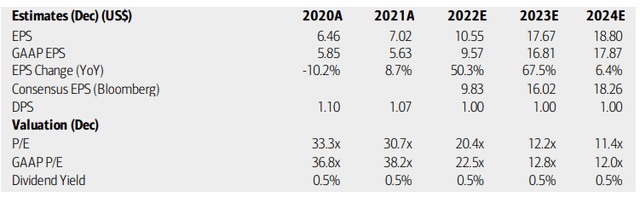

On valuation, BofA analysts see LPL earnings growing big in 2022 and 2023 before moderating two years out. The Bloomberg consensus forecast is about on par with what BofA sees. LPLA’s dividend, however, is not expected to increase in the coming years, perhaps as capital is used for inorganic growth opportunities. Still, strong per share profit growth creates the potential for very favorable forward P/Es. Overall, Seeking Alpha rates the company’s valuation as an F, but that’s deceiving since it’s a high-growth stock in a low-growth industry. Hence, its forward operating PEG ratio is very attractive at 0.52.

LPL Financial: Earnings, Valuation, Dividend Forecasts

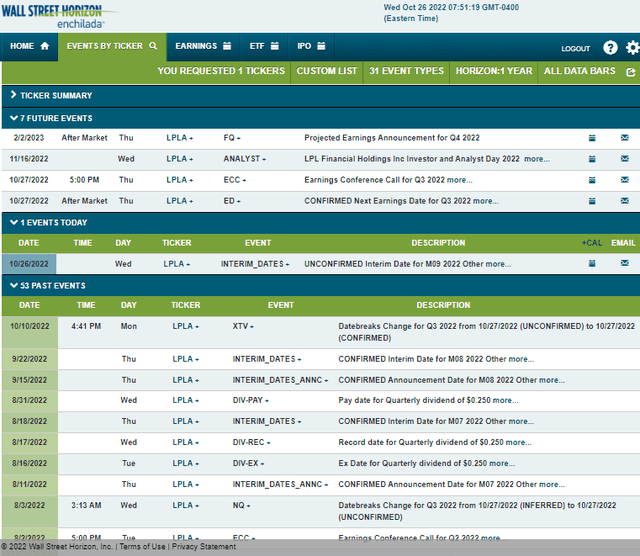

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 earnings date of Thursday, Oct. 27 AMC with a conference call immediately after results hit the tape. You can listen live here. Also, a volatility catalyst is LPLA’s analyst meeting that takes place on Wednesday, Nov. 16.

Corporate Event Calendar

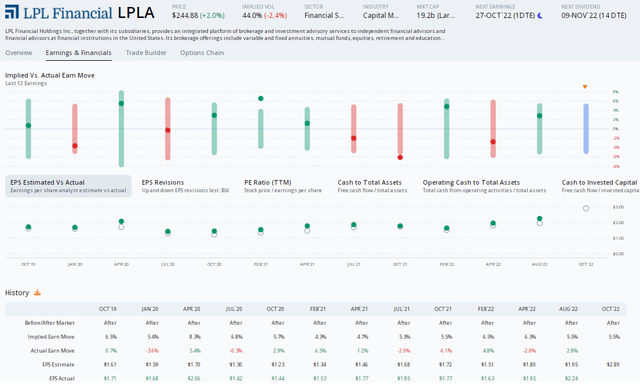

The Options Angle

Data from Option Research & Technology Services (ORATS) show a consensus Q3 EPS forecast of $2.89, which would be a massive 63% increase from per share profits reported in the same quarter a year ago. Moreover, ORATS reports that there have been a whopping seven upward EPS revisions since the August earnings release. Another bullish factor is LPLA’s track record of beating bottom line estimates in each of the prior 12 quarters.

Meanwhile, options traders have priced in a near-average 5.5% share price swing post-earnings. That implied move is figured using the nearest-expiring at-the-money straddle. LPLA does not have a volatile history around previous earnings reports, so no major moves are expected this time.

LPLA: An Impeccable EPS Beat Rate History

The Technical Take

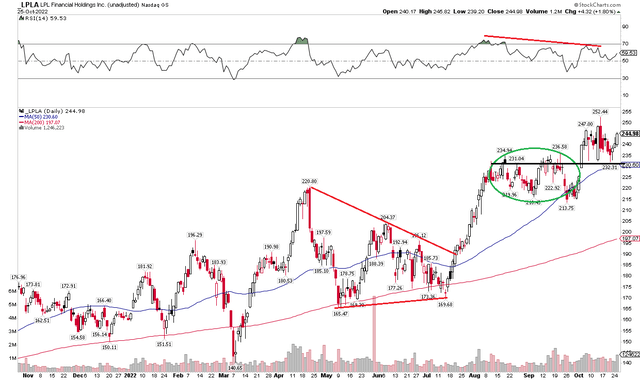

LPLA shares are up 64% on the S&P 500 in the last year, total return. That relative strength is a primary bullish factor for technicians. Moreover, the stock has done all the right things in recent months. Notice in the chart below that the stock featured a bullish breakout from a symmetrical triangle pattern in July. Shares then rallied more than 20% to $235 before consolidating in a bull flag pattern.

Recently, there has been some bearish negative divergence, but that can be negated if we see strong price action this week and next post-earnings. I see support near the $230 spot, the October range lows and where the rising 50-day moving average lies. Long here with a stop under that spot could make sense, or more cushion could be taken with a stop-loss order under $210 (the September low). Longer-term traders might even decide to hold the stock so long as it is above its longer-term 200-day moving average, which is way down under $200.

LPLA: Shares Stair-Stepping Higher, Eyeing Bearish Divergence

The Bottom Line

LPL Financial has among the best relative strength performances of any stock this year. With solid EPS growth expected and benefitting from higher rates, I think shares can continue up. A 15 multiple on 2024 earnings would yield a price target of about $280, and with a trend of upward EPS revisions in the market, that might be conservative.

Be the first to comment