funky-data/iStock Unreleased via Getty Images

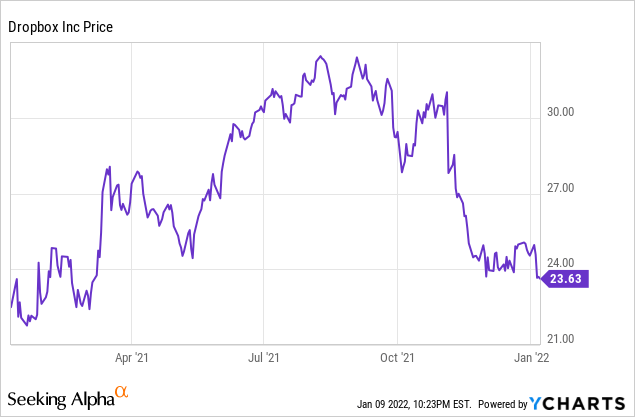

Like many other software stocks in the market, Dropbox (DBX) has fallen victim to the recent rotation, causing the stock to pullback over 25%. Interestingly, the stock is trading just north of their original IPO price of $21, closing this last Friday at $23.63. Nevertheless, the company continues to post solid financial results each quarter, typically beating and raising expectations along the way.

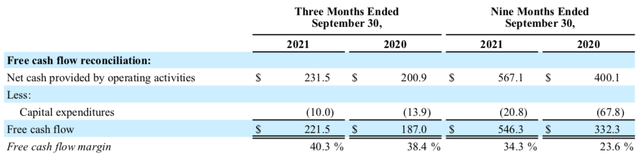

In the most recent quarter, revenue beat estimates by over $5 million and non-GAAP operating margins improved an impressive 600 basis points compared to the year-ago period, now standing at 29.3%. On top of that, free cash flow has remained very strong and YTD, free cash flow margin of 34.3% has expanded from 23.6% in the same period last year. Clearly, management has been able to run a solid business throughout the pandemic and there are several growth drivers to further expand revenue and profitability.

Along with the stock’s pullback, valuation has now approached a level that makes me very bullish about the company long-term. Using a combination of consensus expectations and my conservative estimates, the stock is currently trading at just 3.3x FY23 revenue and 13x FY23 EPS. Considering the company is likely to continue growing revenue 10%+ with strong operating margin expansion and free cash flow conversion, this screens as a strong buy.

As described below in more detail, Dropbox also has several growth drivers, such as expanding their paid conversion penetration, continuing to grow their ARPU, and using their solid free cash flow for further growth investments.

As a result, the recent stock pullback has caused me to become quite bullish and believe anything under $25 is a good point to pick up some shares. In a realistic scenario, assuming valuation multiple return to more historical levels, I could see the stock doubling in the next 12-18 months.

Solid Recurring Business Model

Over recent years, Dropbox has continued to evolve their subscription business model, thus offering more services to both individuals and businesses. Operating under a “freemium” model, the company does a great job provide a base level of services for free, while offering numerous upgrade options for more advanced users.

In the era of user experience and personalization, it’s important for solution providers to offer a free experience to potential customers before encouraging them to sign up for more premium paid services. This marketing strategy is seen at the consumer level. For example, many TV streaming services offer a free trial, then a tier-1 upgrade (for example, $5.99/month) as well as a tier-2 upgrade (for example, $10.99/month). In this scenario, the service provider as customers across all parts of their subscription plans, thus giving them a clear line of sight into revenue and potential growth opportunities.

For Dropbox, this has resulted in 90%+ of revenue being recurring, thus making revenue highly visible. On top of that, once a business (or individual) starts using Dropbox, this recurring revenue becomes very sticky and is not likely to leave.

Source: Company Presentation

Source: Company Presentation

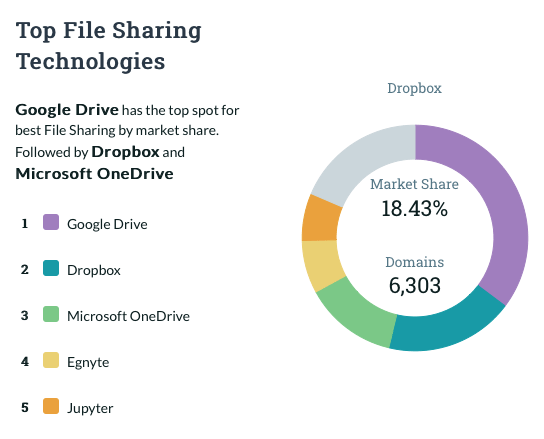

Not surprisingly, Google Drive has been noted as the top file sharing technology leader. Given the fact that Google offers their Google Drive services to anyone who has a Gmail account, it’s not a surprise they are the market leader. However, Datanyze also notes that Dropbox’s market share is just below 20% and is the clear #2 player in the market, ahead of Microsoft, Egnyte, and Box. Part of the reason Dropbox is able to maintain a large market position is that they compete very well in their niche part of the market and may not focus on the mega-businesses, of which Google competes for.

Source: Datanyze

Source: Datanyze

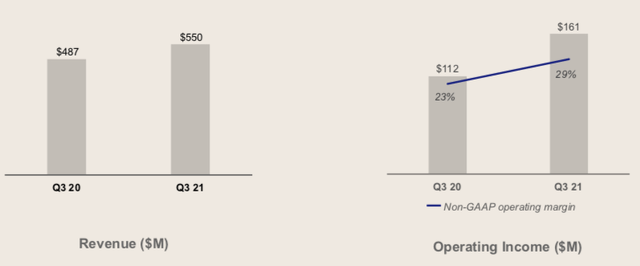

Briefly reviewing the company’s recent quarterly report, Dropbox reported revenue of $500 million which grew 13% compared to the year ago period and handily beat consensus expectations by $5.5 million. Non-GAAP operating margins remained very healthy and expanded to 29%, up from 23% in the year-ago period and helped drive non-GAAP EPS of $0.37, which beat consensus estimate of $0.35.

Why Now Is A Good Buying Opportunity

While the company’s fundamentals have remained very strong, the stock is down over 25% from all-time highs, largely driven by investors pivoting away from high-growth, high-valuation names in recent months.

Was this pullback warranted? A little bit yes. Valuation across many software stocks started to become a bit excessive and with many high-growth names starting to face difficult growth comparisons from 2021, I’m not overly surprised to see this part of the market pullback quite a bit.

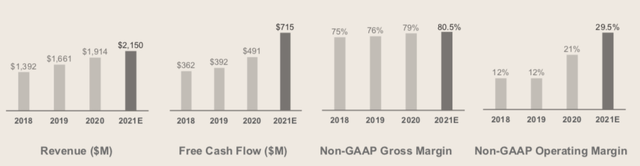

However, Dropbox remains fundamentally sound and long-term investors should feel confident in the growth opportunities here. First, the company has strong margins with non-GAAP gross margins remaining around 80%, which is quite typical for software/subscription companies. Impressively, non-GAAP operating margins have expanded to over 29% in the most recent quarter, putting the company on pace to achieve a Rule of 40 benchmark.

Source: Company Presentation

Source: Company Presentation

It’s important to note that Dropbox has very strong free cash flow dollars and margins, which can help with counter-cyclicality. As investors shift away from growth stocks, historically those with more recurring revenue (subscription) and stronger free cash flow have recovered quicker. This is because the business model is more mature and investors can see actual profits flow through the business each quarter.

That being said, Dropbox is likely to see 2021 free cash flow of more than $700 million and have a Q3 YTD free cash flow margin of 34.3%. The company has previously talked about achieving $1 billion of annual free cash flow by FY24, which seems highly achievable given the company’s revenue growth profile and cash flow conversion.

The strong free cash flow also gives Dropbox the opportunity to either re-invest in their organic growth profile or make accretive acquisitions.

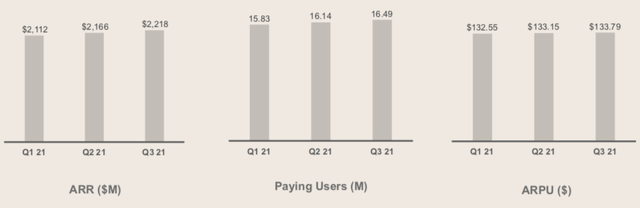

The company has over 700 million registered users and at the end of Q3, they had ~16.5 million paying users, representing a conversion rate of just over 2%. This remains a massive growth opportunity because in theory, Dropbox could not sign up any more registered users and solely focus on converting existing users into paid users. If they were to convert just 0.1% of existing users each year, this would add 700k paying users per year.

In addition, average revenue per user (ARPU) has continued to increase each quarter, reaching $133.79 at the end of Q3. This remains another opportunity for growth. As more registered users convert to paying users, Dropbox has the opportunity to upsell customers to more premium plans, which results in higher ARPU.

Another growth opportunity for Dropbox is to continue to expand their ecosystem. While they already work with Zoom, there are many other third-parties that could directly integrate Dropbox into their operations. In the case of Zoom, users are able to directly share files via Dropbox and this use-case has only accelerated as a work-from-anywhere model seems to be the new norm in the corporate world.

Valuation

Over the past few months, the stock has pulled back over 25% as investors have pivoted away from growth stocks given valuations were at quite extreme levels. While 25% seems like a lot, other fast-growth software names have seen their stocks pullback in excess of 50%.

Valuation can be a little difficult to gauge given there is no clear benchmark in terms of an appropriate revenue multiple. However, Dropbox has provided their target operating model which expects non-GAAP gross margins around 78-80% (near current levels) and non-GAAP operating margins to expand towards 28-30%. In addition, the company is expecting $1 billion of free cash flow generation over time, which provides a nice floor to valuation.

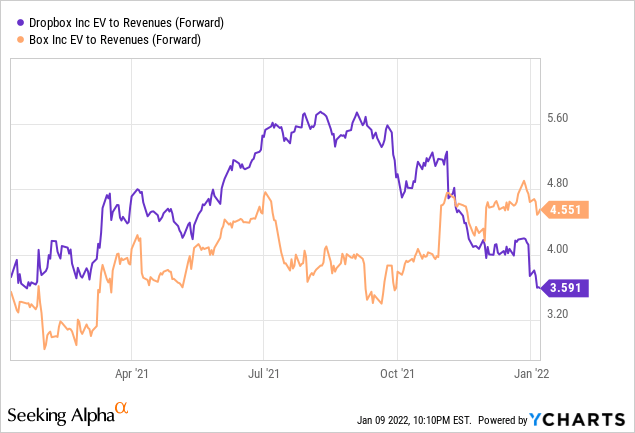

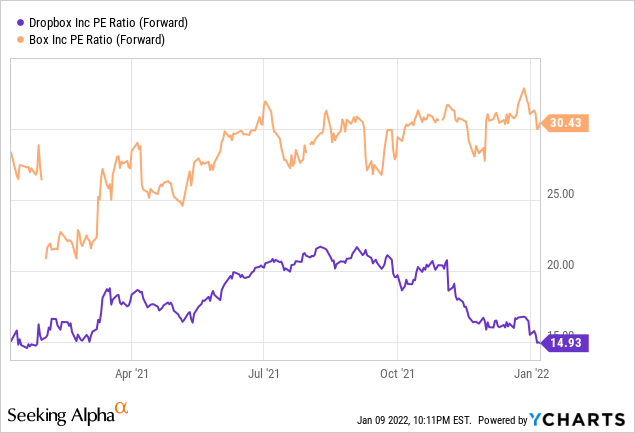

Interestingly, the company’s forward revenue multiple has contracted quite a bit and is now below their competitor Box’s forward multiple. Historically, Dropbox has traded at a relative premium given their combination of revenue growth and margin profile, and I believe the recent pullback provides a great buying opportunity for Dropbox.

On top of that, free cash flow could be close to reaching $1 billion at that time (would assume ~38% FCF margin), and that would imply a FY23 FCF multiple of just 8.7x.

While not many software-focused investors look at P/E multiple for SaaS companies, Dropbox is quite unique and has a solid history of strong margins. Consensus is expecting FY22 EPS of $1.60 and if we assume a 15% growth in FY23 (assumes 12% revenue growth plus some margin benefit), we could see FY23 EPS of ~$1.85, resulting in a FY23 P/E of just 13x. Considering the broader market trades at a forward P/E of over 20x, I believe the recent pullback has provided a great buying opportunity.

Be the first to comment