mbbirdy

Just over nine months ago, I wrote on Wheaton Precious Metals (NYSE:WPM), noting that the stock had another strong year of earnings growth ahead and that the $40.00 level was likely to provide a floor for the stock. In hindsight, this was a terrible call, with precious metals peaking shortly after my March update, the stock losing not only the $40.00 but also the $30.00 level, and earnings on track to decline year-over-year after silver spent most of Q2 and Q3 below the $22.00/oz level. Adding insult to injury, it was a tough year for two of Wheaton’s largest contributors, Salobo and Stillwater. The result is that WPM will be lucky to earn $1.20 in annual EPS, down from $1.31 last year.

Fortunately, 2023 is setting up to be a much better year as Salobo III appears to be complete, a massive project that will significantly increase throughput at the Brazilian Mine, with full production in late 2024. Meanwhile, precious metals prices have firmed up since their Q3 lows, and Wheaton should have a better year at Stillwater after flooding in Montana significantly impacted operations. So, with easier comps on deck starting in Q2 2023 and a sharp rise in attributable production year-over-year, I see Wheaton Precious Metals (“Wheaton”) as a solid buy-the-dip candidate if we see any sharp pullbacks.

San Dimas (Wheaton Stream) (Company Presentation)

Q3 Results

Wheaton released its Q3 results in November, reporting attributable quarterly production of ~159,900 gold-equivalent ounces [GEOs], a 13% decline from the year-ago period. The sharp decrease in GEO volume was related to a sharp decline in gold ounces produced by its partners, a more significant decline in palladium ounces, and a ~7% decline in silver ounces. The latter was partially related to a dip in attributable production at Newmont’s (NEM) Penasquito Mine, the suspension of mining at Stratoni, and lower production at Aljustrel due to a decline in grades. Finally, mining was completed at the 777 Mine in Manitoba, creating somewhat difficult comparisons vs. 96,000 attributable ounces of silver in the year-ago period.

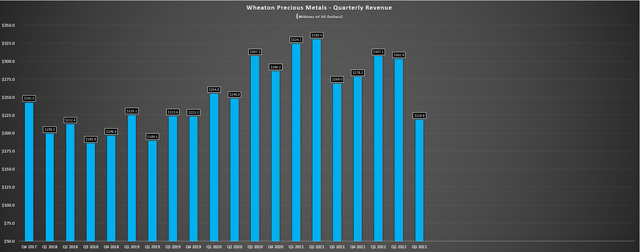

Wheaton Precious Metals – Quarterly Revenue (Company Filings, Author’s Chart)

Given the sharp decline in production volumes combined with lower average realized metals prices, revenue declined significantly, dropping to $218.8 million, a 19% decline year-over-year. This was Wheaton’s lowest revenue figure in nearly three years, and the weaker margins also impacted cash flow. Operating cash flow plunged to just $154.5 million, a 23% decline from Q3 2021 levels due to the weaker commodity prices, and is now trailing 2021 levels on a year-to-date basis, with cash flow per share of $1.27, down from $1.44 in the first nine months of 2021. Still, while these results are certainly disappointing, they reflect issues outside of the company’s control, including short-term challenges at key assets and mostly commodity price weakness.

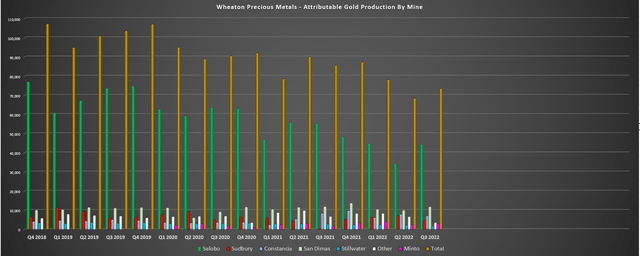

Wheaton – Attributable Gold Production (Company Filings, Author’s Chart)

Digging into the results a little deeper, the lower production at Salobo due to lower grades and throughput significantly impacted total attributable gold production, which was related to planned and corrective maintenance. However, the silver lining is that Salobo III was 98% complete as of the end of Q3, which will increase throughput by 50% to 36 million tonnes per annum once in full production. Given that this is Wheaton’s largest gold contributor, the expansion (which appears to be complete) will positively impact gold production in 2023 as it ramps up, with an incremental boost to production in H2-2024 as it reaches full capacity.

Looking at other assets, the closure of the 777 Mine impacted production from the Other category. Elsewhere, Constancia saw a sharp decline in production due to lower grades being mined, which was related to mine sequencing. Finally, Stillwater saw a meaningful decline in gold production year-over-year. The Montana asset was impacted by regional floods that led to a seven-week suspension of operations, with operations resuming in late July. Hence, with Salobo not running at anywhere near its full potential and other issues across the portfolio, this more than offset the benefit of Sudbury seeing an increase in production and easy comps due to the labor dispute, which impacted Q3 2021 production.

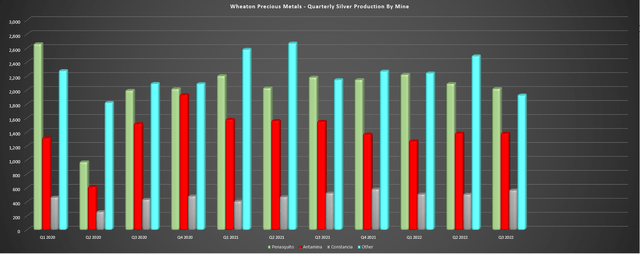

Wheaton – Attributable Silver Production (Company Filings, Author’s Chart)

Moving to silver production, the main contributor in the quarter was Penasquito, with ~2.18 million attributable ounces produced, a 7% decline from the year-ago period. Meanwhile, Antamina also saw lower production due to a decline in grades, which was planned and consistent with the mine plan. Finally, and as noted previously, lower production at Stratoni (care and maintenance), the termination of the Keno Hill Silver Stream in line with Hecla’s (HL) acquisition of Alexco, and lower grades at Aljustrel all impacted Wheaton’s attributable silver production in the quarter.

Clearly, there weren’t many positives in the Q3 report from a headline standpoint, with declines in revenue, production, and cash flow. That said, despite a second consecutive soft quarter, Wheaton ended the period with a strong balance sheet, sitting on ~$500 million in net cash and ~$2.50 billion in liquidity, giving the company lots of flexibility if it chooses to do any major streaming transactions. The good news is that this is certainly the market to be flush with cash, given that developers are having a more difficult time raising money through equity issuances unless they’re willing to dilute at multi-year lows, as Marathon Gold (OTCQX:MGDPF) did recently.

2023 Outlook & Recent Developments

While the most recent quarter certainly left much to be desired, the good news is that Q2 and Q3 were so weak that it’s perversely positive, given that Wheaton will now be up against much easier comps in 2023. This has placed the company in a position to see a significant increase in revenue, attributable production, and cash flow per share when lapping these easier comparisons, which should be embraced by the market (assuming sentiment in precious metals doesn’t worsen). In addition to these easier comps from a production standpoint due to one-time issues, Salobo should have a much better year in 2023 as it ramps up toward a much higher throughput rate.

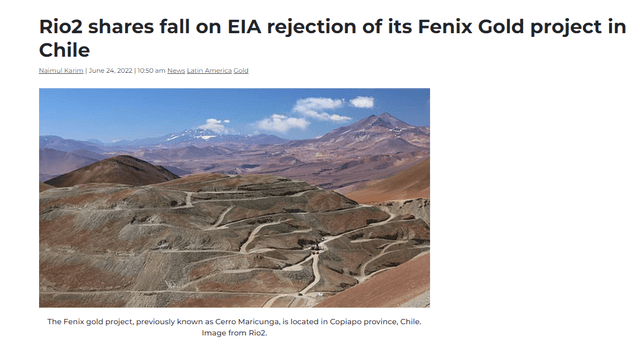

Given that this is Wheaton’s main contributor, I would not be surprised to see a record year ahead for cash flow if metals prices cooperate. Typically, the best time to buy miners is when they’re out of favor, and their results are soft as long as this isn’t related to a material change in the business or a negative long-term development at one of its assets. This certainly isn’t the case for Wheaton. In fact, its main contributor will enjoy a significant increase in production, and its development pipeline continues to see solid progress, except Rio2’s Fenix (OTCQX:RIOFF), which has undoubtedly been a disappointment. Fortunately, this was the smallest bet by Wheaton ($50 million) in a string of deals valued at ~$1.5 billion over the past two years.

Rio2 Fenix EIA Rejection (Mining.com, Rio2)

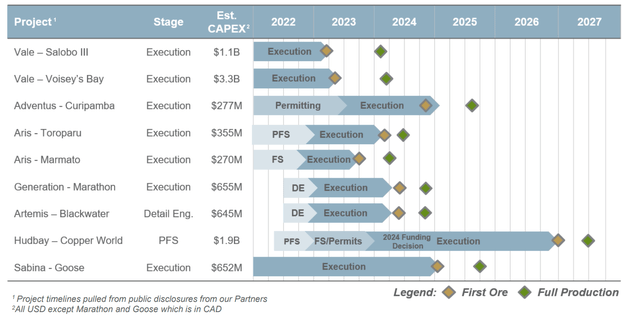

If we dig into the pipeline a little closer, we can see that the Salobo III Expansion is complete, and multiple other projects are heading toward construction in 2023. These include Curipamba, which recently received an Investment Contract with the Ecuadorian Government, the Marathon Palladium Project, which the Government of Canada recently approved, and imminent construction starts for Goose (Back River) and Blackwater in Nunavut and British Columbia, respectively. Finally, Hudbay’s (HBM) Copper World could be a major contributor later this decade, with full production expected by 2027, which could have a ~45-year-mine life, providing a meaningful and long-lasting incremental boost to Wheaton’s attributable production profile.

Wheaton – Development Project Timeline (Company Presentation)

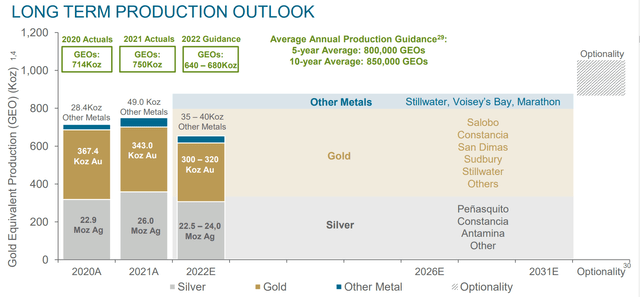

The result of this growth from newly acquired streams and organic growth at assets like Salobo is that Wheaton expects its 5-year average annual production to come in at 800,000 GEOs (5-year period ending December 2026) and 10-year production to average 850,000 GEOs. This would represent a significant increase in attributable production from its FY2022 guidance mid-point of ~660,000 GEOs, and I wouldn’t be surprised to see Wheaton’s attributable production increase at least 13% next year. So, if metals prices can cooperate, it should be a phenomenal year for the company, suggesting any sharp pullbacks ahead of these easier comps post Q1-2023 will provide a nice buying opportunity. Let’s take a look at WPM’s valuation:

Wheaton – Long-Term Production Outlook (Company Presentation)

Valuation

Based on ~453 million fully diluted shares and a share price of $40.00, Wheaton trades at a market cap of ~$18.1 billion, just behind the largest royalty/streaming company in the sector, Franco-Nevada (FNV), at ~$26.3 billion. This represents a large discount to Franco-Nevada’s valuation despite the two companies having similar production profiles. This is partially attributed to Franco-Nevada’s higher margins, superior diversification (112 producing assets vs. 20 producing assets), and increased optionality with a much deeper portfolio of hundreds of royalties in different stages vs. ~30 streams owned by Wheaton. Hence, I see the premium multiple that Franco-Nevada has commanded as justified.

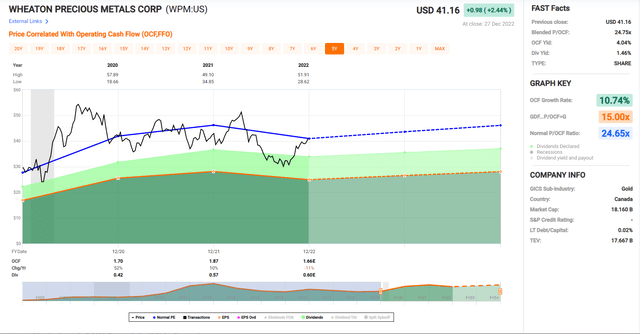

Wheaton – Historical Cash Flow Multiple (FASTGraphs.com)

That said, the slight underperformance of Wheaton vs. Franco-Nevada over the past two years has created a larger valuation gap between the two, and Wheaton is also becoming attractively valued vs. its 5-year average multiple, especially when factoring in its future growth after it went on a deal spree from Q1 2021 to Q1 2022. As we can see above, WPM’s 5-year average cash flow multiple is ~24.6, and I would argue that the stock can command a cash flow multiple of 25.8 or a 5% premium, given the significant growth on deck and improved diversification following a busy two years of streaming deals.

Looking at FY2022 cash flow estimates of $1.66, Wheaton may not seem that undervalued, trading at ~24.1x cash flow or only a slight discount to its 5-year average and a fair multiple of 27.2. However, this was an off year for the business with weaker metals prices and a significant guidance miss. Looking ahead to FY2023, we should see cash flow per share increase to ~$920 million ($2.03 per share) with significantly higher gold production from Salobo and a better year ahead from Stillwater. So, from a forward cash flow standpoint, Wheaton trades at just ~19.6x cash flow vs. a fair value of $52.40 (25.8x FY2023 cash flow estimates).

Salobo Phase III (Vale Presentation)

This represents a 31% upside from current levels or closer to a 33% upside on a total return basis, given Wheaton’s dividend of $0.60 annualized. While this upside case is nowhere near what some riskier pre-cash flow names in the sector offer, like Osisko Mining (OTCPK:OBNNF), it is a respectable upside case for one of the lowest-risk companies sector-wide with a long history of outperformance. In addition, the upside looks much more attractive relative to Franco-Nevada, which trades at ~25x FY2023 cash flow estimates and more than 2.1x P/NAV, which translates to just a 17% upside even using a generous cash flow multiple of 29.0. Hence, I see WPM as the more attractive name currently.

However, from a contrarian and valuation standpoint, I continue to see Sandstorm Gold (SAND) as the most attractive value in the royalty/streaming space. This is because it has superior diversification from a NAV standpoint and a much stronger growth profile, yet it trades at barely half WPM’s P/NAV multiple (0.90x for SAND vs. 1.65x for WPM). The caveat is that it doesn’t have WPM’s strong balance sheet ($400 million in net debt vs. $500 million in net cash), which will impede its ability to do major deals in this market. That said, the company doesn’t need to grow with a path to doubling attributable GEO production by 2026.

Summary

Wheaton has had a challenging year due to factors outside of its control, which is one of the negatives of having one asset being such a significant contributor to its annual attributable production. However, the company has done an excellent job diversifying across several highly attractive development projects over the past two years. Plus, it has the liquidity to support another major deal at a favorable time when valuations are attractive among developers and also quite attractive among smaller royalty/streaming companies. Hence, I wouldn’t rule out another deal by WPM over the next 12 months.

That said, I prefer a large margin of safety when buying, and I currently see Osisko Gold Royalties (OR) and Sandstorm (SAND) as the most undervalued names in the royalty/streaming space. Hence, if I were anxious to put new capital to work and wanted exposure to the lowest-risk area of the sector, these are my current preferences, and I plan to continue to accumulate positions in these stocks on weakness, given that I expect at least a 60% upside re-rating over the next two years.

Be the first to comment