Justin Sullivan

Overview

In recent months, the two biggest events that have affected Bausch Health Companies (NYSE:BHC) are its reluctance to IPO its fast-growing aesthetic medical device business Solta Medical and very recently a Delaware court’s ruling, which will effectively make its largest drug Xifaxan go off patent. While the delayed IPO of Solta Medical may have ostensibly reduced shareholders’ returns due to a longer time frame for a multiple expansion, it has not necessarily reduced the company’s intrinsic value. The latter development, however, indubitably and immediately decreases the value of the company and may in fact necessitate dramatic action from management in order to ensure BHC remains solvent. In this article, I will examine how these changes will affect the value of BHC and what actions must be taken to ensure BHC’s solvency and if the stock at present levels is undervalued. In addition, it should be noted that if BHC’s appeal of the recent court ruling is successful, my commentary on the ramifications of the recent court ruling would be rendered mute.

Solta Medical IPO

The intention of the IPO of Solta Medical was simply to reduce BHC’s > $20 billion debt load. In my previous article on BHC, I expected Solta Medical to generate at least $2 billion in proceeds in order to do this for BHC. However, due to the emerging bear market and other macro factors, as cited by management, this IPO has been suspended. I believe this is the correct decision. This is because a desire by BHC to rid itself of a non-essential business should not outstrip its desire to reduce its debt load significantly in the future. In addition, as Solta Medical continues to grow, it may well generate more proceeds for BHC in the event of a future IPO.

Xifaxan Litigation

On July 28, the U.S. District Court of Delaware ruled that BHC’s Salix segment’s patent for Xifaxan was valid for the reduction of risk of the recurrence of HE but its patents for protecting the composition and use of Xifaxan for IBS-D invalid. Being that IBS-D is a much more common disease than HE, this will presumably eliminate the majority of Xifaxan’s revenue. In addition, this will eliminate most of the Salix segment’s revenue and profits given that Xifaxan constituted 79% of its revenue in 2021. This will leave the Salix segment with approximately $500 million left in annual revenue and greatly reduced profit, if any, left after the elimination of Xifaxan’s most important patents. However, BHC is determined to appeal the ruling to the U.S. Court of Appeals. In addition, the Salix segment represented 53.6% of BHC’s self-reported profits in 2021, independent of BLCO. While the Salix segment may still be able to generate approximately $300-$400 million in profits (assuming its margins are equivalent to the rest of the segment’s products), this still would leave BHC non-FCF-generative, assuming remedial actions were not taken by management.

The Risk of Insolvency

If BHC management’s primary objective is to avoid insolvency, they have many options available to them. However, if their primary objective is to distribute BHC’s stake in Bausch + Lomb (BLCO) to shareholders, then the risk of insolvency increases dramatically. I do not believe BHC faces any immediate liquidity problems as their cash on hand is approximately $1.2 billion and they still have credit facilities they can draw upon. In addition, a possibility for BHC is that its product pipeline contains enough products to increase its EBITDA, thereby allowing BHC to retain more of its stake in BLCO. However, the more exotic, and arguably less shareholder-friendly options include a hurried IPO of Solta Medical in order to increase cash on hand and a sale of their stake in BLCO. A sale of BLCO common stock would greatly decrease their liabilities and interest expense to a point at which they would generate a few hundred million in FCF. However, it is also possible that BHC’s interest expense will increase as its EBITDA has gone down making its debt more risky, and that its interest expense can increase by way of the rising interest rate environment.

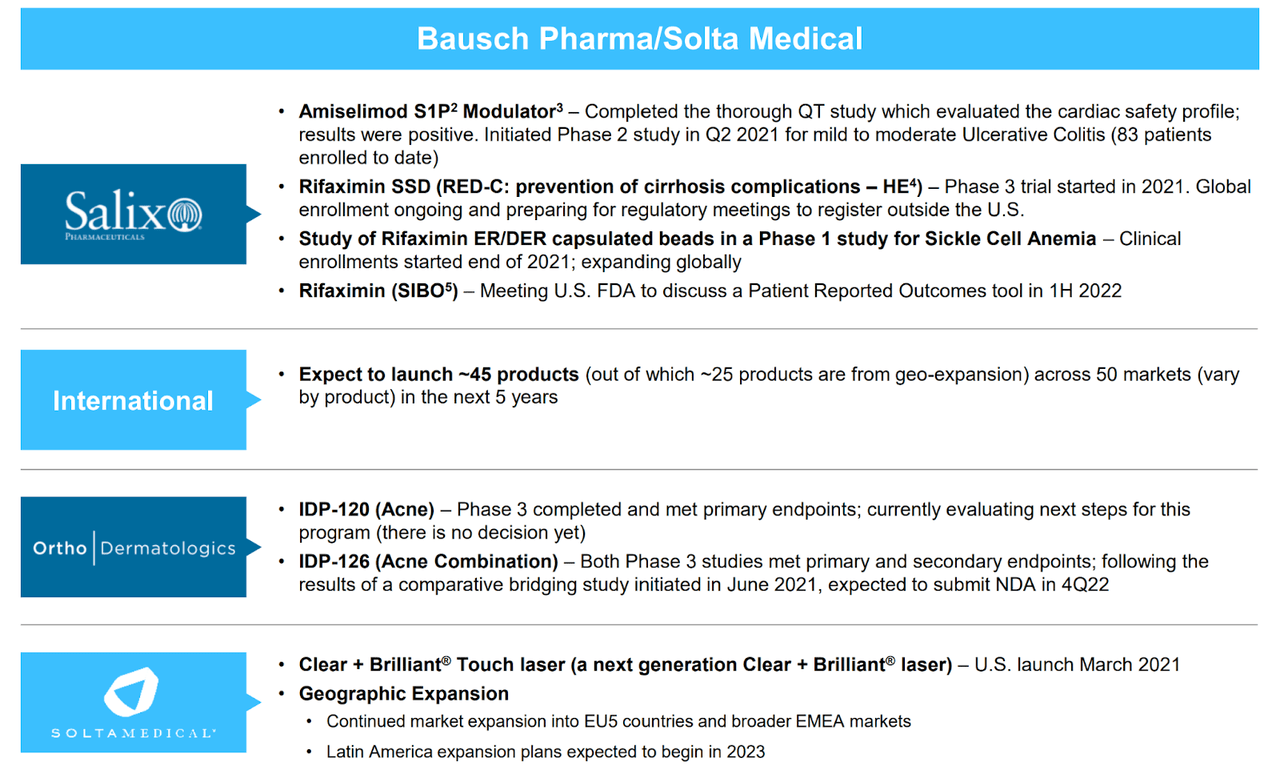

BHC Product Pipeline (BHC Product Pipeline Presentation)

The probability of a distribution of BLCO shares has decreased dramatically with the recent developments. And the time horizon for such a distribution has certainly increased. This is because it would almost be impossible to shoulder BHC’s debt load without BLCO distributing its FCF to its shareholders, and therefore BHC. It should be noted that BHC has discretion to make this decision as it is the majority shareholder in BLCO. As previously mentioned, BHC could also unload its stake in BLCO partially or in its entirety to shoulder its debt, while of course rendering mute the potential for an 80% distribution of BLCO shares to shareholders.

BLCO Spinoff Prospects

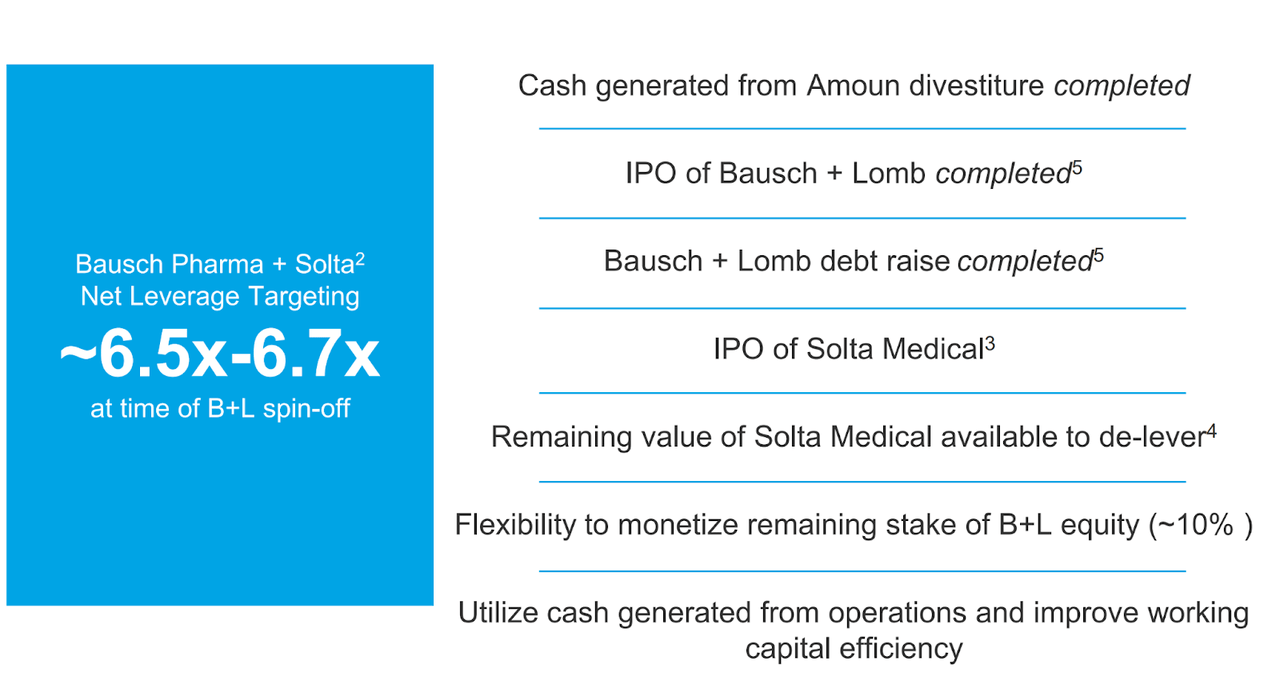

BHC must achieve its target leverage ratio of 6.5-6.7x EBITDA in order for the distribution of 80% of BLCO shares to be distributed to BHC shareholders. By my preliminary estimates, BHC loses at least $1 billion in EBITDA by the recent court ruling, making BHC necessarily reduce its debt by even more in order for the spinoff to take place. Therefore, assuming BHC avoids insolvency, returns for shareholders have necessarily been reduced. Furthermore, it is possible that if BHC needs to unload much of its stake in BLCO to remain solvent, then BHC shareholders will receive a smaller stake in BLCO than they otherwise would have.

Being that BHC must reach its target leverage ratio of 6.5-6.7x, it must now reduce its debt of $16.415 billion by management’s most conservative estimate of 2022 EBITDA less my estimate of Xifaxan patent’s contributions to EBITDA. Therefore, BHC must reduce its net debt by $5.5 billion. Therefore, it is my opinion that management could achieve such a deleveraging by IPOing Solta Medical, selling some of its stake in BLCO, perhaps reducing the stake available to be distributed to shareholders, or leveraging BLCO further to reduce BHC’s debt. These options would likely not raise the $5.5 billion necessary to distribute its stake in BLCO to shareholders, but it will free up more cash flow from operations to deleverage the remainder of the debt necessary to achieve the distribution. However, with current market conditions, BHC will likely have to wait until market conditions normalize for an IPO of Solta Medical to obtain a reasonable valuation and should also wait until the end of the current bear market to begin to unload their stake in BLCO, that is unless this is necessary for short-term liquidity needs.

BHC Leverage Targets (BHC Q1 2022 Presentation)

Conclusion

The recent court ruling has severely damaged the value of BHC as an independent entity and reduced the probability of a BLCO distribution and at least necessarily increased the time horizon for such a distribution. In addition, the current bear market has rendered BHC’s stake in BLCO as less valuable and the probable success of a current IPO of Solta Medical mute, thereby justifying its suspension. While insolvency is unlikely, rising interest rates and poor operating performance render it a possibility. Due to the necessary achievement of BHC’s target leverage ratio of 6.5-6.7x EBITDA, and the current bear market’s continuity, it is likely that the BLCO’s distribution will take perhaps a couple years to take place. Furthermore, if BHC has to dispose of more than its anticipated 20% of BLCO in order to meet short-term liquidity needs, the payout to shareholders will be reduced. With the recent court ruling, BHC may only be left with a few hundred million of FCF, and although BHC has growth prospects, it also bears an uncomfortable amount of leverage.

That BHC can reduce its leverage sufficiently to allow for a distribution of BLCO is still a possibility, however, the time horizon for the distribution has increased. And while BHC is likely to remain solvent, that it can do so without destroying shareholder value is more questionable. There is simply little room for error or disaster if a distribution of 80% of BLCO to shareholders is to take place. However, if BHC uses all the options at its disposal to remain solvent and reduce its debt load, including unloading most of its shares in BLCO, then BHC is likely to remain solvent, and even generate a reasonable amount of FCF due to decreased interest expense. Therefore, the best outcome for shareholder value is of course that the distribution takes place, but the worst outcome is a growing and deleveraged pharmaceutical and aesthetic device company generating a reasonable amount of FCF that would be undervalued at today’s market cap of approximately $2.8 billion. Therefore, assuming management does not allow BHC to fall into bankruptcy, at least for now, the market has mispriced the calamities.

Be the first to comment