ipopba

Market Overview

Global equities were dragged lower in the second quarter by steadily rising global inflation, threats to global growth from China’s COVID-19 lockdowns and the ongoing conflict in Ukraine. The benchmark MSCI All Country World Index tumbled 15.66% for the quarter and is down 20.18% year to date. In the U.S., the Russell 3000 Index declined 16.70%, the developed market MSCI EAFE Index fell 14.51% while the MSCI Emerging Markets Index held up better, boosted by a rebound in China, but still declined 11.45%.

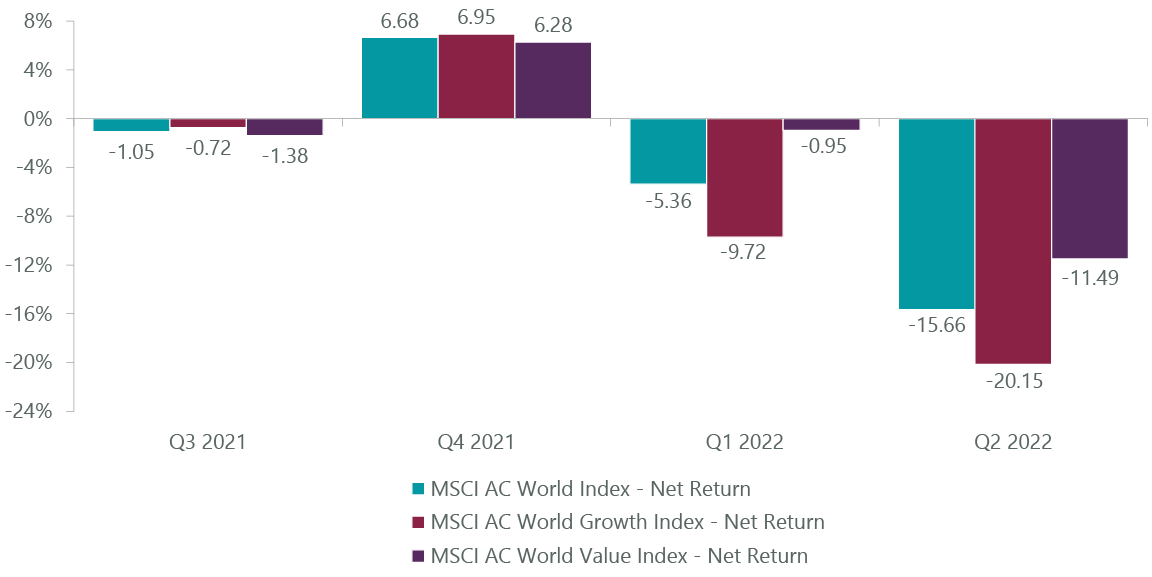

Exhibit 1: MSCI Growth vs. Value Performance

As of June 30, 2022. Source: FactSet.

Growth stocks continued to trail value (Exhibit 1) with the MSCI All Country World Growth Index down 20.15% for the quarter and the MSCI All Country World Value Index off by 11.49%.

We have discussed in recent commentaries the negative impacts of rising bond yields on growth companies. While German 10-year yields climbed nearly 80 bps during the quarter, similar to the rise in the U.S. 10-year Treasury, rates retreated from multiyear highs in mid-June over rising fears of global recession. This action helped growth stocks top value in June and illustrated the appeal of owning quality growth businesses in periods where economic growth could be challenged. We have been carefully positioning the ClearBridge Global Growth Strategy for such conditions.

Financial conditions continued to tighten over the last three months as regions like Europe faced a difficult balancing act in trying to address surging inflation while supporting economies directly impacted by fallout from war in Ukraine. Russia continues to make progress in the east of Ukraine with little hope that the war will end anytime soon. Instead, Europe is consolidating its defenses with plans to admit Sweden and Finland to NATO. Even with a ceasefire agreement, there will be little room for sanctions to be lifted. Oil, natural gas and gasoline prices continued to move up in the quarter due to Russian shipments falling meaningfully.

The increase in energy costs for EU members is around €1.4 trillion or 10% of Eurozone GDP. Governments are assisting lower-income households with subsidies. Eurozone inflation hit a second straight record high of 8.6% in June. The higher-than-expected inflation print has convinced the European Central Bank (ECB) to raise interest rates at its next meeting in late July and likely again in September.

The ECB is falling in line with the U.S. Federal Reserve and the Bank of England, which have ramped up their tightening efforts to battle inflation in their own markets. A worse than expected 8.6% U.S. Consumer Price Index reading for May caused the Fed to raise rates 75 bps in June, the most aggressive hike since 1994, and project ambitious tightening through the rest of 2022. The 10-year Treasury yield climbed 67 bps to finish the quarter at 3.01%, near its highest level in four years.

The U.S. economy contracted in the first quarter and the outlook for GDP growth has tempered as more liquidity leaves the financial system. While consumer demand has mostly held up, a shift in spending patterns from goods to services led to big first-quarter earnings misses and lowered outlooks for several retailers and social media platforms that are leading digital advertisers, actions that had a knock-on effect in further dampening investor sentiment for higher multiple growth companies.

Japan and China remain the largest international markets with no immediate plans to tighten policy. Inflation reached 2.5% in Japan during the quarter but fears that higher rates would stall a nascent recovery have caused the Bank of Japan to stick with its current accommodation. Given that Japan has just emerged from its most serious COVID-19 lockdowns and is reopening travel, we suspect its ultra-easy policy will be harder to continue as it is also importing serious inflation from abroad. China lowered a key interest rate as it struggles with ongoing lockdowns to enforce its zero-COVID policy and works to keep real estate market risks under control.

Initial details of the REPowerEU plan to improve energy security and hasten the transition to renewable energy sources were presented in May. These included faster permitting, higher capacity targets and EU grants or loans. The package could support renewable installations of up to 5x current installations, which should offer a lasting tailwind to renewable energy.

Portfolio Positioning

We increased our exposure to the energy transition during the quarter with new positions in Iberdrola (OTCPK:IBDSF), a Spanish-based integrated utility that is also one of the leading renewable energy developers in the world, and NextEra Energy (NEE), an integrated utility business with a regulated utility operating in Florida and the largest wind business in the U.S. The war has opened the eyes of the world that energy independence is critical. Renewables are for many countries the only way to get to the target. It is expected that existing renewable project pipelines will be executed faster, and more projects added to existing pipelines.

The energy transition would be extremely helpful for climate change and Iberdrola ranks well on our ESG matrix. NextEra, meanwhile, recently raised future earnings forecasts, citing a very favorable macro environment for rapid renewable generation expansion driven by decarbonization of the U.S. economy and the relative attractiveness of renewable generation in the context of high natural gas and power prices.

We further added to our positioning for the accelerating energy transition with the purchase of Schlumberger (SLB), a global provider of oilfield services. As a technology leader, Schlumberger should generate strong free cash flow over the next few years as the industry recovers, using its excess cash to gain market share from smaller players and to expand into new areas of growth. Through its scale, presence, partnerships and technology, Schlumberger is targeting expansion into new large addressable markets such as carbon capture, hydrogen, geothermal and lithium extraction.

While we cannot position for every possible outcome related to inflation, economic growth and geopolitics, we continue to rely on secular and structural growth companies with strong balance sheets and good business models. We remain tilted toward growth but are more balanced than in the recent past with our higher-multiple emerging growth exposure now at less than 10% of assets. The outsized performance of U.S.-based emerging growth names and the fundamental strength in areas like software have prevented us from lowering this segment of the portfolio further.

That said, the recent size of this group also reflects better performance of other parts of our portfolio such as secular holdings Olympus (OTCPK:OCPNF) and UnitedHealth Group (UNH) in health care and structural holdings in energy and financials, two areas we have been adding to selectively.

We added to our health care exposure in the quarter with the purchases of Straumann Holding (OTCPK:SAUHF), a Swiss manufacturer of medical instruments, implants and related supplies for dental procedures, in the secular bucket and U.S. pharmaceutical maker AbbVie (ABBV) in the structural bucket. Straumann is the global market leader in dental implants with 29% overall share, a meaningful position within premium implants and smaller share in value implants. The company is also involved in clear aligners through a series of acquisitions as well as peripheral capital equipment around those businesses.

Growth will come from increasing share in both value implants and clear aligners through expansion in emerging markets on top of market growth in its premium implant business. AbbVie is undergoing a transition in anticipation of loss of exclusivity for its blockbuster Humira in the next several years with several commercial therapeutics, led by Skyrizi for psoriasis and Rinvoq for rheumatoid arthritis.

Disciplined selling is a key component of our risk-based approach, especially among companies with cyclical growth drivers. We have seen good success over the last several years from our semiconductor exposure but have been taking profits in companies such as Tokyo Electron (OTCPK:TOELF) earlier in the year and this quarter in Taiwan Semiconductor (TSM) to reduce overall industry exposure.

Given the exceptional sets of circumstances of semi shortages, double ordering and good growth in end market products including personal electronics and even data centers, we believe a neutral market position to this industry within the tech sector is appropriate.

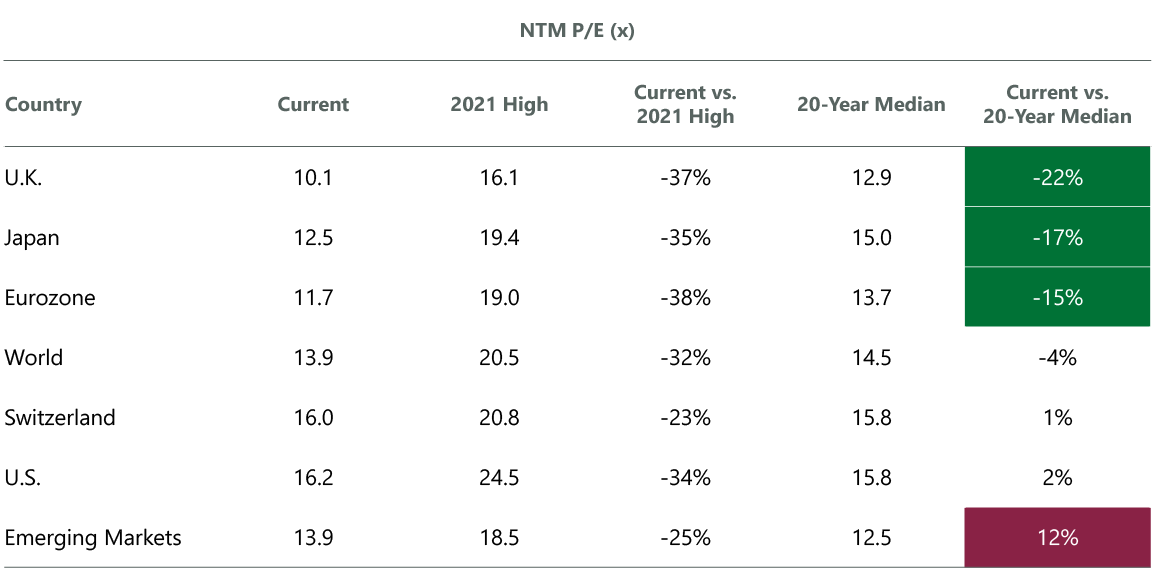

We have already seen significant multiple compression in technology and, while software tends to be more resilient than other parts of tech during recessions, it also did very well during the 2020–2021 period. We exited software makers Elastic (ESTC) and DocuSign (DOCU) to manage overall emerging growth exposure as well as Netflix (NFLX) in communication services. Despite the current headwinds facing the highest-growth areas of international markets, we continue to see compelling valuations that can act as a complement to higher-priced U.S. growth stocks (Exhibit 2).

Exhibit 2: Global Valuations Attractive

Data as of June 30, 2022. Source: FactSet.

Outlook

In the U.S., valuations of growth companies are suffering the most from a wall of worry that keeps expanding. In addition to the rapid normalization from a peak everything economy being hastened by a hawkish Fed, inflation is taking its toll across wide swaths of the equity market. Anecdotally, we are also hearing from our portfolio companies that corporate spending budgets are being scrutinized, as possible offsets to costs creeping into the income statement due to events outside of their control (transportation fuel, supply chain bottlenecks, labor consideration).

Technology spending is a large cost line item in the ever-increasing digital economy and is not immune to this cost management. The modernization of workloads and applications is still an investible theme, but the growth rate is slowing after a torrid pull forward through COVID-19.

What has concerned us recently is that good news on earnings and revenue numbers has been heavily discounted by the market. In other words, good results have been expected and we worry that could change this quarter as earnings will be more challenging. Equities have seen a 25%–35% derating of P/E ratios from the highs in the market in 2021.

While there are known headwinds in the next quarterly earnings season, how companies guide on earnings in a highly volatile market exposed to the impacts of the war and increasing commodity prices will set the tone for the quarter. We believe it will be challenging, but the market seems to have anticipated at least some of this already.

One of the main headwinds is supply chain constraints in China that started in mid-March with COVID-19 lockdowns and that will be felt fully in second-quarter earnings. China emerged somewhat from its zero-COVID policy, though another flare-up could spur another round of lockdowns. We believe the Chinese will need to stimulate their economy again, one of the few central banks in that position.

In Japan, inflation rose above 2% for the first time since 2015. The Bank of Japan is holding the line on potential rate hikes, communicating that prices are unlikely to spike without wage growth. GDP contracted 0.2% in the first quarter but the slowdown was less severe than feared, with polls suggesting the lifting of COVID-19 lockdowns should lead to a growth rebound for the second quarter.

Portfolio Highlights

The ClearBridge Global Growth Strategy underperformed its MSCI ACWI benchmark in the second quarter.

On an absolute basis, the Strategy had losses across the 10 sectors in which it was invested (out of 11 total). The information technology (IT), industrials and consumer discretionary sectors were the primary detractors.

On a relative basis, overall stock selection detracted from performance. In particular, stock selection in the consumer discretionary, consumer staples, industrials, health care and IT sectors and an underweight to energy hurt results. On the positive side, stock selection in the financials and materials sectors and an overweight to consumer staples contributed to performance.

On a regional basis, stock selection in North America and emerging markets as well as an underweight to emerging markets detracted from performance while stock selection in Europe Ex U.K. was beneficial.

On an individual stock basis, the largest contributors to absolute returns in the quarter included Argenx (ARGX), AIA Group (OTCPK:AAGIY), NextEra Energy, Olympus and T-Mobile (TMUS). The greatest detractors from absolute returns included positions in Amazon.com (AMZN), Apple (AAPL), United Rentals (URI), Microsoft (MSFT) and Alphabet (GOOG, GOOGL).

In addition to the transactions mentioned above, we initiated positions in LVMH Moet Hennessy Louis Vuitton (OTCPK:LVMHF) in the consumer discretionary sector and MonotaRO (OTCPK:MONOY) in the industrials sector and exited positions in Samsung (OTCPK:SSNLF) in the IT sector and Adidas (OTCQX:ADDYY) in the consumer discretionary sector.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment