funky-data

Dropbox (NASDAQ:DBX) reported solid results in Q2 2022 (quarter ended June 2022). Revenues rose 7.9% YoY to USD 572.7 million in Q2 2022, helped by a 7.6% YoY increase in paying users which reached 17.37 million compared with 16.14 million the same period last year. Average revenue per paying user was flat at USD 133.34 compared with USD 133.15 for the same period last year.

GAAP net income dropped 29% YoY to USD 62 million, largely on the back of a 16% YoY increase in R&D expenses which reached USD 215 million (accounting for 38% of revenues compared with 35% in the same quarter a year earlier), and impairment charges related to real assets as a result of the company’s decision to shift to a Virtual First work model.

Stable near term prospects

Dropbox’s recent price increases (which would affect new customers starting in June and existing customers with renewals starting in July), along with continued year-over-year improvements in customer retention are expected to help support top line growth, offset by currency headwinds associated with the strengthening US dollar and discontinuing new sales and financial sanctions in Russia.

Management expects reported revenues to be around USD 2.308 billion to USD 2.318 billion (revised down by USD 12 million from their previous guidance of around USD 2.320 billion to USD 2.330 billion). On a constant currency basis however, management revised their guidance upwards by USD 8 million to USD 2.342 billion to USD 2.352 billion, up from USD 2.334 billion to USD 2.344 billion previously.

Optimistic long term prospects but stiff competition means much depends on execution

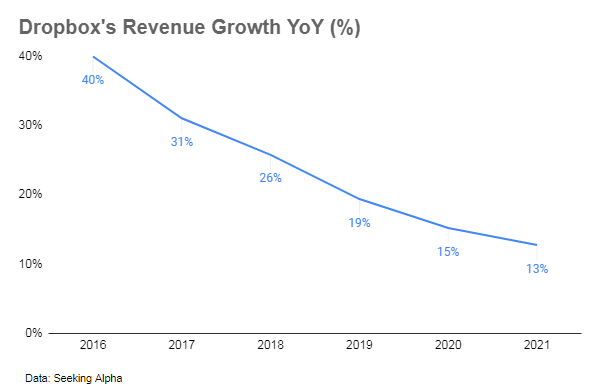

Dropbox’s revenues have been slowing over the past several years and the company’s Q2 2022 full-year 2022 guidance suggests top-line growth would drop to a single-digit figure for FY 2022 compared to FY 2021, a considerable slowdown from previous years.

Author

Source: Author

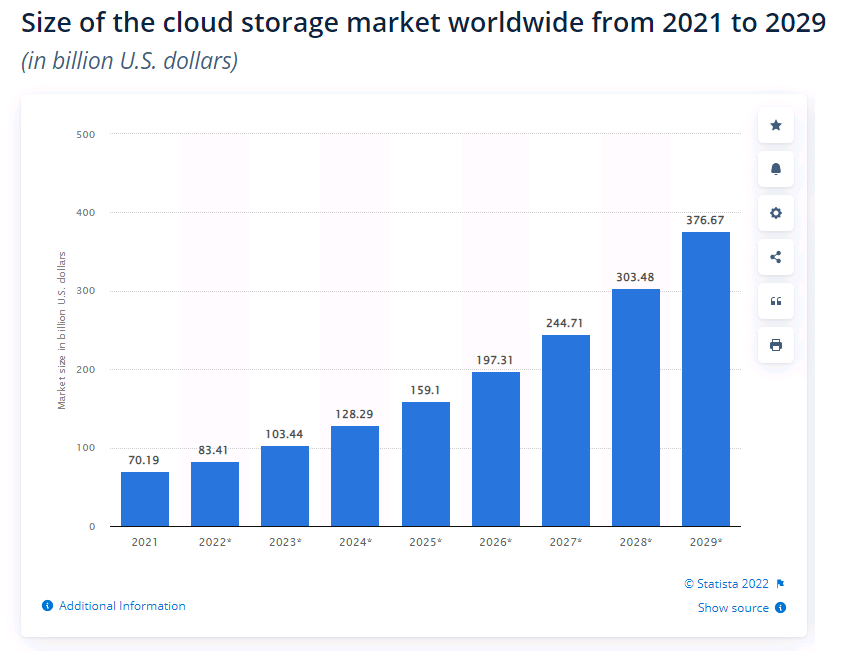

Dropbox’s revenue growth would also lag the broader cloud storage market which is projected to grow at double digit percentage annual growth rates in 2022 and for several years thereafter.

Statista

Source: Statista

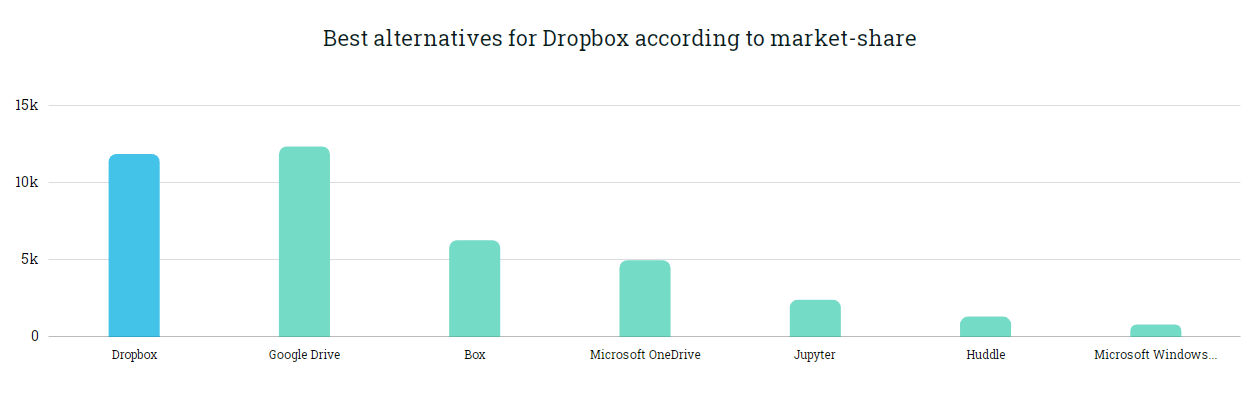

Although this may suggest Dropbox, currently the second-biggest cloud storage provider after Google (GOOGL) according to market share figures from Datanyze, is losing market share to rivals, it could also be suggestive of Dropbox focusing on profit and a differentiated market positioning rather than exclusively focusing on market share in what is essentially a commodity market.

Datanyze

Source: Datanyze

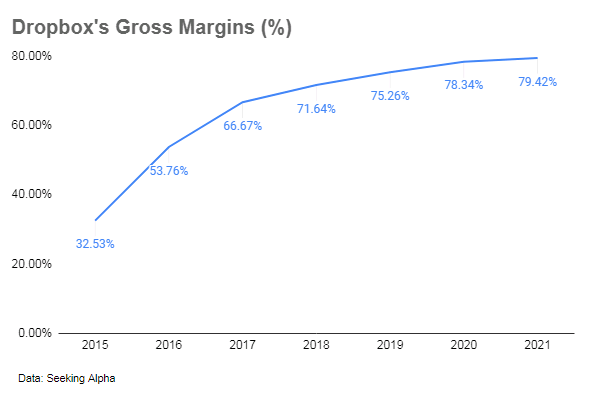

Dropbox’s gross margins have been consistently rising over the years and the company delivered its first full year of profitability last year, in line with its previously stated goal of achieving profitability by 2021.

Author

Source: Author

Going forward, there are reasons to be optimistic about Dropbox’s prospects. The company’s bread and butter business – cloud storage – is on the rise around the world, driven by hybrid working trends and Dropbox’s global presence (about half of its revenues are generated outside the United States) positions the company to capitalize on the opportunity. Although the industry is competitive with many tech giants and numerous smaller players jostling to profit from the growth opportunity, Dropbox’s differentiation strategy could help it carve a niche for itself. Dropbox’s investments to add new functionality such as Passwords and acquisitions such as eSignature startup HelloSign in 2019, document sharing platform DocSend in March 2021, and universal search company Command E in November 2021, not only helps differentiate its product offering by offering customers more than just cloud storage, it also helps entrench Dropbox in customers’ document workflows (thereby increasing customer switching costs) and exposes the company to new growth markets; the digital signature market for instance is expected to grow at double digit growth rates over the coming years.

New strategy to capitalize on booming creator economy

Dropbox is building another differentiation strategy amid increasing competition in the cloud storage space. In April 2022, Dropbox launched a new product – Dropbox Shop – aimed at content creators to sell downloadable digital products. The feature was in response to an opportunity Dropbox had already noticed; digital content creators were increasingly selling their digital wares on marketplace platforms such as Etsy (ETSY) but storing that content on other platforms such as Dropbox, particularly in cases when those files exceeded the size limits imposed by the marketplace. The new feature could position Dropbox to capitalize on the booming creator economy (particularly around rich-media content such as video and high-resolution graphics which rivals such as Google are arguably not ideally suited for currently) and further differentiates its product mix, adding another feature that could lure some of Dropbox’s millions of free users to convert to paying users (less than 3% or about 16.79 million of Dropbox’s 700 million registered users were paying users as of December 2021).

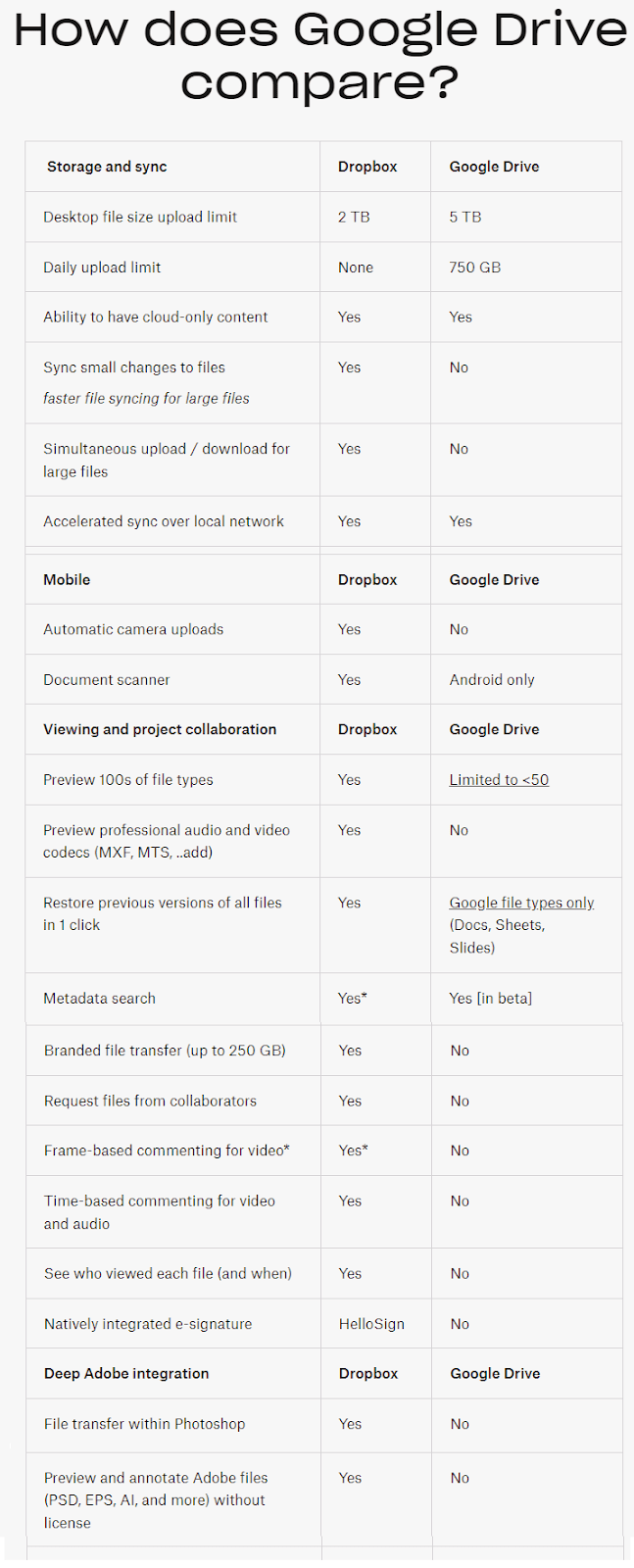

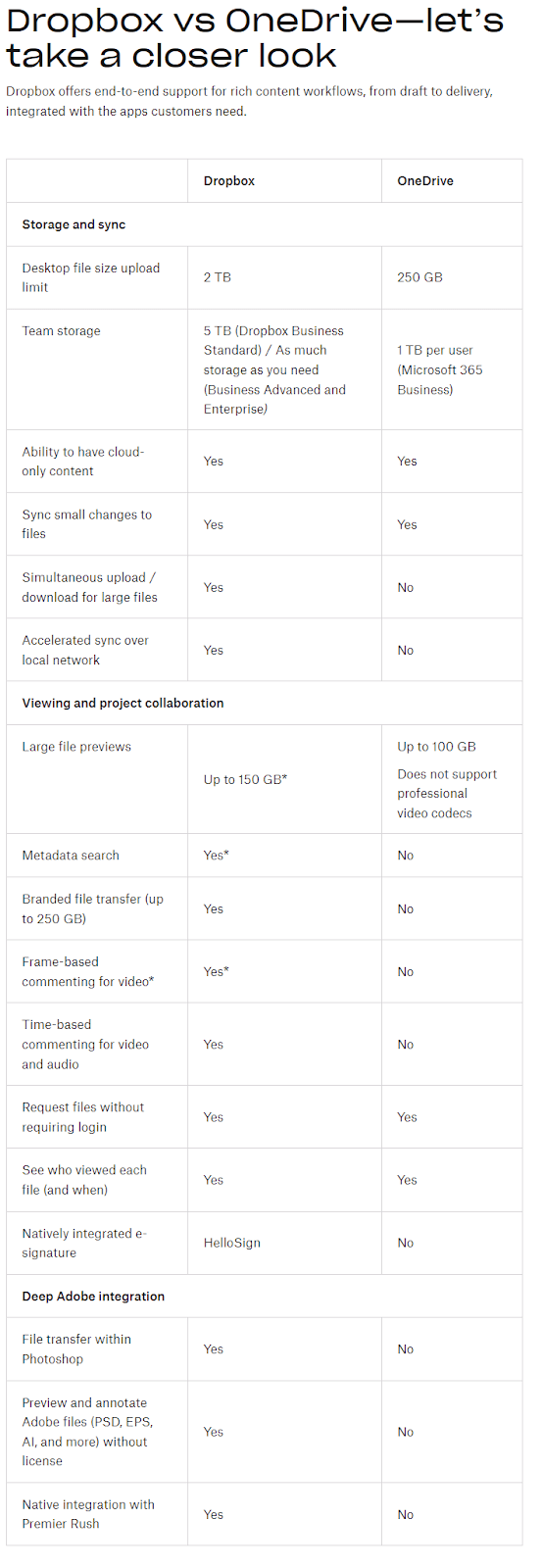

Dropbox’s new eCommerce functionality combined with its recent feature additions (notably eSignature and document analytics) is helping Dropbox emerge as a compelling one-stop shop service provider offering cloud storage, document sharing, signature workflow and storefront facilities for content creators, freelancers and small and medium businesses, a growing niche that so far cloud storage rivals appear to have overlooked; Box (BOX) is heavily focused on larger enterprises while Google Drive and Microsoft’s OneDrive (MSFT) (which offer more storage space for free but no eSignature facilities, and relatively unappealing pricing plans for storage-heavy rich-media content creators) are ahead of Dropbox for individuals requiring basic cloud storage facilities but arguably lag Dropbox for storage-heavy content creators with more complex requirements.

Dropbox

Source: Dropbox

Dropbox

Source: Dropbox

The revenue potential for Dropbox is meaningful; apart from potentially winning over more paying customers, Dropbox could also potentially generate a new revenue stream from transaction fees.

Risks

Dropbox’s strategy of focusing on freelance content creators and SMBs is not without risks. Unlike enterprise customers who are generally stickier (according to one figure, SaaS companies face churn rates of around 31% to 58% for SMBs versus 6% to 10% for enterprises), smaller customers such as small businesses and individuals are more nimble, and given that this segment of customers are likely to be either Google Drive or Microsoft OneDrive users as well (Dropbox founder Drew Houston acknowledged that 100% of their customers are going to be either an Office 365 customer or a Google Apps customer), if these two larger rivals incorporate the very features that Dropbox is offering (and possibly at a more competitive price point given their massive scale and deeper pockets), Dropbox’s customers may end up switching out of Dropbox and turn to those rivals instead, limiting Dropbox’s growth potential. Much would thus depend on Dropbox’s execution.

Additionally, Dropbox’s stock has a high short interest.

Summary

Dropbox’s top-line growth is decelerating but profitability is improving. Cloud storage is a sunrise industry around the world, and Dropbox with its international presence is poised to benefit. The company appears to be losing market share, likely the result of stiff competition from larger rivals such as Google and Microsoft, but it could also be suggestive of the company shifting to a niche market strategy, as well as a focus on profitability; gross margins have been on the rise and the company’s new strategy appears to be focused on the booming creator economy which bigger cloud storage rivals appear to have overlooked. While Dropbox’s new strategy could strengthen its market positioning and potentially generate top-line growth from new revenue streams such as transaction fees, there is the risk that rivals who are deeply integrated with Dropbox’s existing customers, offer equally if not more competitive functionality tailored to suit the demands of Dropbox’s new target market. The stock also has a high short interest.

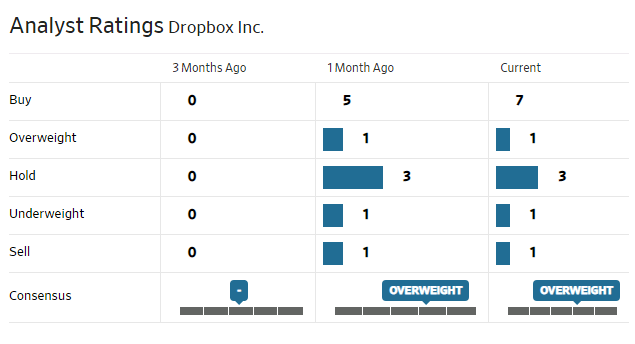

Analysts are mostly neutral on the stock.

WSJ

Source: WSJ

Be the first to comment