Scott Olson

Investment Thesis

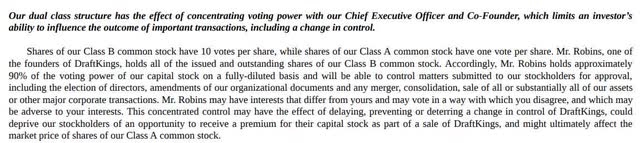

DraftKings (NASDAQ:DKNG), a digital sports entertainment and gaming company, went public in April 2020 through a SPAC merger according to the company’s annual 10-K filing. The Company has two share classes — Class B shares come with 10 votes each, while the public Class A shares come with just 1 vote. One of the Company’s co-founders, Jason Robins, holds 90% of the overall voting power through his 100% ownership of the 10 vote/share class B shares.

Historically, the company earned its revenue from the daily fantasy sports business, but now it earns an increasingly large portion of its revenue from online sports betting (OSB) and Igaming, an online casino platform. To a lesser extent, the Company also sells various advertising placements and non-fungible tokens (NFTs).

DKNG was the beneficiary of a U.S. Supreme Court ruling in May 2018 which opened the door for states to determine the legality of sports betting on a state-by-state basis. The ruling allowed DKNG to enter the nascent mobile sports betting market in August 2018. According to the company’s 10-K, 29 U.S. states have legalized some form of sports betting and 23 states have legalized online sports betting specifically.

Some investors may be tempted by the ~58% drop in DKNG shares over the last year, but I believe they should avoid DKNG for the following reasons: a weak balance likely reliant on outside funding within the next year or two, an overly competitive industry in which DKNG lacks a competitive advantage, lack of insider purchases of the stock amid a substantially lower share price, and at times, financial reporting from which investors may not get the complete picture. The Company maintains a $6.5B market capitalization and $6.4B enterprise value, according to Seeking Alpha. In my view, the Company has an unclear path to sustained positive free cash flow.

Current Financial Position

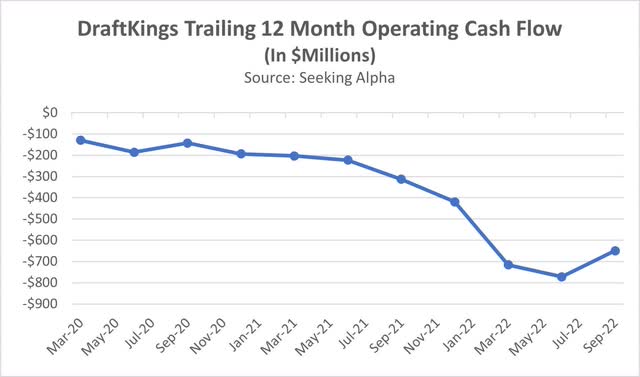

Before analyzing the company’s position within the entertainment and gaming industry, I believe it’s important for investors to understand the state of the company’s balance sheet and ability to sustain itself via operating cash flow. As shown in the second chart below, the company has spent significant sums as it expands its offerings as part of the “gold rush” into states with newly legalized online sports betting.

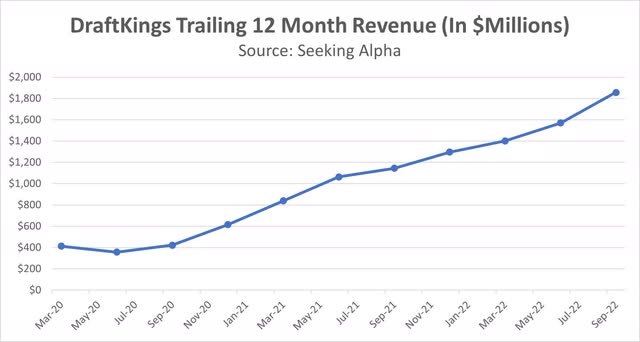

DraftKings Trailing 12 Month Revenue (Seeking Alpha, Author Generated Image)

DraftKings revenue is rising rapidly while it loses more money.

DraftKings Trailing 12 Month Operating Cash Flow (Seeking Alpha, Author Generated Image)

In my opinion, the central issue facing DraftKings and its stock price surrounds the company’s ability to simultaneously maintain its rapid revenue growth and premium valuation while seeking to achieve positive free cash flow generation for its investors. The company has historically spent significant sums on marketing and sales, which in my view, will be needed to sustain rapid revenue growth given a lack of competitive advantage over other sports betting platforms. Over the next few quarters, I believe investors will learn a lot more about the Company’s ability to achieve this balance between free cash flow and growth. The Company’s CEO addressed this challenge during the third quarter earnings call held on November 4, 2022:

And we believe we are striking a great balance between maintaining an aggressive and customer-focused growth plan, while simultaneously working to manage expenses. This combination of revenue growth and expense management creates a clear path of profitability that is consistent with the long-term gross margins and adjusted EBITDA margins that we have consistently articulated.

– DraftKings CEO Jason Robins

Based on the company’s current cash balance of $1.4B and trailing twelve month operating and investing cash outflows of $649.3m and $248.3m, the company would have limited cash levels in ~2 years assuming similar spending rates and no outside financing. During the most recent earnings call, management did not appear very concerned as the CEO stated that the cash flow burn would not be as severe going forward:

Last, I’ll touch on our liquidity position. With close to $1.4 billion in cash as of September 30 and our guided adjusted EBITDA range for the fourth quarter combined with expected other usages, we are poised to exit the year with between $1.1 billion and $1.2 billion of cash. Based on our 2023 adjusted EBITDA guidance and other expected cash usages next year, we expect to end 2023 with more than $500 million in cash on the balance sheet. It’s important to note that a significant amount of our 2022 cash outflows such as $97 million in net cash paid for GNOG are not expected to recur in 2023. Looking out to 2024, we would expect adjusted EBITDA to be roughly breakeven on a full year basis under most reasonable legalization and launch scenarios.

– DraftKings CEO Jason Robins

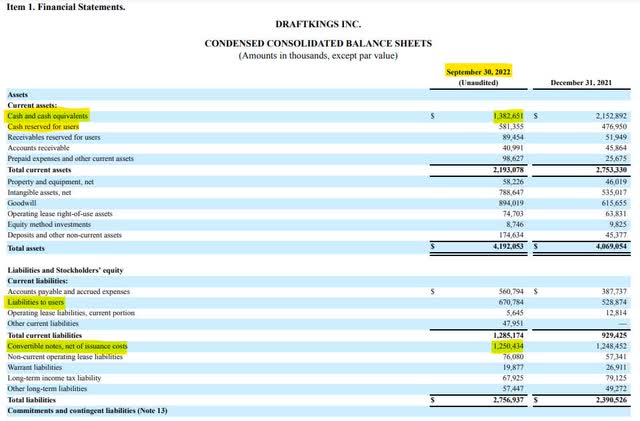

In March 2021, while the stock was reaching all-time highs, the Company was able to raise $1.1B of convertible debt at a 0% interest rate. In my view, it remains to be seen if the company can raise affordable capital in the future given previous losses, a declining stock price, and rising interest rates initiated by the Federal Reserve.

DKNG Balance Sheet 9.30.22 (10-Q SEC Filing)

Sports Betting Industry Landscape

The online sports betting industry is highly competitive as evidenced by FuboTV’s announcement last month to close its sportsbook operation due to unprofitability as the company stated in its filing with the SEC that the “challenging macroeconomic environment would impact our ability to reach our longer term profitability goals.” A full list of competitors in the OSB field can be found here via the sports betting information site Action Network. The industry is about to get even more competitive as Fanatics is set to expand its operations into sports betting. The sports e-commerce company is entering the sports betting market in January and has the financial backing of several large institutions, according to CNBC. DraftKings disclosed the following regarding competition in its 10-K this past February:

There is intense competition among online gaming and entertainment providers. A number of established, well-financed companies producing online gaming and/or interactive entertainment products and services compete with our offerings, and other well-capitalized companies may introduce competitive services. There has also been considerable consolidation among competitors in the entertainment and gaming industries and such consolidation and future consolidation could result in the formation of larger competitors with increased financial resources and altered cost structures, which may enable them to offer more competitive products, gain a larger market share, expand offerings and broaden their geographic scope of operations.

DraftKings sits behind FanDuel in the U.S. online sports betting and online gaming market. Fanduel, which is part of a larger, Ireland based parent company called Flutter Entertainment, crowned itself in its 2021 Annual Report as the United States’ “clear market leader in online sportsbook.” Fanduel said scale and its “superior product offering” brought the U.S. business “towards” profitability in 2021. Many analysts expect consolidation in the online sports betting sector and in my view, DraftKings position in a potentially consolidating industry is uncertain as a number two player facing increasing competition.

Amidst a highly competitive sports betting market, it remains unclear to me what, if any, competitive advantages DraftKings has in its markets. The Company had a first mover advantage in daily fantasy sports and mobile sports betting along with FanDuel, but beyond that it’s unclear how the company will differentiate itself going forward. As the online gambling market matures, we will learn more about DraftKings’ ability to differentiate itself, if at all.

Lack of Recent Insider Buying

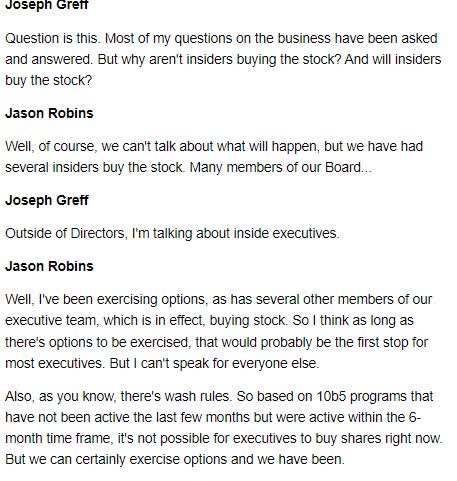

As others have pointed out, DraftKings insiders have been noticeably inactive in the stock despite the share price coming way down from the highs seen in 2021. An analyst asked CEO Jason Robins about this during the Q4 earnings call:

DKNG Q4 2021 Analyst Question (Seeking Alpha)

Insider sale rules aside, the lack of open market buying (not including options exercises or director purchases) by executives over the last year is surprising given the large share price decline. Readers can review the insider buy/sell history using the link here from SecForm4.Com.

Shareholder Dilution

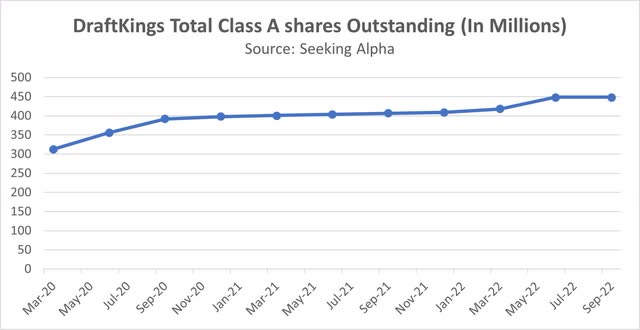

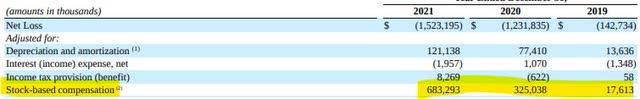

Since going public, the Company has incurred significant stock-based compensation expenses and, as a result, diluted shareholders as shown below:

DKNG Class A Total Shares Outstanding (Seeking Alpha) Annual Stock-Based Compensation (DKNG 2021 10-K)

Corporate Governance

Unfortunately for shareholders interested in voicing their opinion against any corporate actions, they have limited to no influence over the Company’s behavior other than to sell the stock as CEO Jason Robins holds 90% of the voting power. The 10-K highlights this risk:

Dual Class Structure (DKNG 2021 10-K)

Financial Reporting

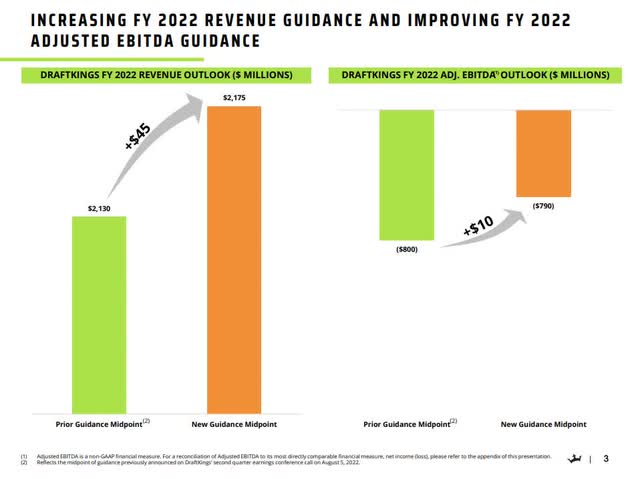

As mentioned in the introduction, the Company’s use of adjusted EBITDA to convey performance should be concerning to shareholders. In my view, investors should also take note of the omission of cash flow statements or balance sheets in the Company’s published investor materials, including its investor presentations. I believe the company’s most recent investor presentation gives an inadequate picture of financial performance, as shown by the example below:

DKNG Q32022 Investor Presentation (DKNG Investor Relations)

Investors may get the impression from the chart that the increases — a 2% increase in the annual revenue outlook and a 1.25% improvement in adjusted EBITDA outlook — are much larger than they are. While the numbers are presented accurately, the sizes of the bars in the chart could be interpreted inaccurately. I encourage potential investors to read through the entire presentation to assess the clarity of the financial reporting for themselves

Valuation

With the lack of visibility into future earnings, a precise value for the stock is difficult to determine. In my view, unless the Company is able to turn profitable, the Company will struggle to operate as a standalone company and some form of M&A is likely to take place. Based on the Company’s financial statements, competitive positioning, and industry outlook, I believe that would likely occur at a much lower price than today’s levels.

Conclusion

Going forward, I believe it will be difficult for DraftKings to balance the Company’s apparent desire to maintain its high growth stock valuation while cutting the level of expenses needed to achieve profitability. Consistently high sales and marketing spending will have to be cut at a time when competition is fierce, which could lead to slower revenue growth and a lower multiple placed on the stock. Additionally, I believe the Company will likely need to raise additional capital in the next year or two while the debt market is demanding higher interest rates forced by the Federal Reserve. In my view, management has many upcoming challenges and could be forced to make some difficult decisions.

Be the first to comment