PrathanChorruangsak

Originally posted on December 4, 2022

I recently watched the movie 21 on Netflix. Inspired by the New York Times best-selling book Bringing Down the House, it tells the story of six MIT students who were trained in card counting and took casinos for millions. This group was referred to as the MIT blackjack team.

Generally in blackjack, low cards are bad and high cards are good, and by tracking the number of high and low cards that have been dealt, you can identify when the odds are tilted in your favor. When there are a disproportionate amount of high cards left, that is a favorable count.

The team used spotters to track the counts and would signal for a team member to start making larger wagers when the deck was stacked in their favor. Once it cooled, they would pick up their chips and move to another table with a favorable count. The MIT blackjack team made millions of dollars by betting more when the odds were in their favor.

The same rules used to profit in casinos can also be applied to investments. When the outlook is less favorable, portfolio managers tend to decrease exposure. And, when there are catalysts, or the environment is improving, it is prudent to take more risk. After a brutal twenty-one-month decline, there is a potential significant catalyst for cannabis stocks in the form of SAFE Banking.

The SAFE Banking Setup

The prolonged decline in cannabis stocks started with an exaggerated runup following the democratic sweep in the 2020 elections. Investors thought that democrats would swiftly act on campaign promises to pass cannabis legislation. One of the primary pieces is SAFE Banking.

SAFE has passed the House on seven different occasions, but each time it has been stripped out by the Senate. With the House flipping republican, it won’t be as easy to move cannabis legislation forward once the new Congress takes effect in January. Thankfully, we have one last shot during the lame-duck session.

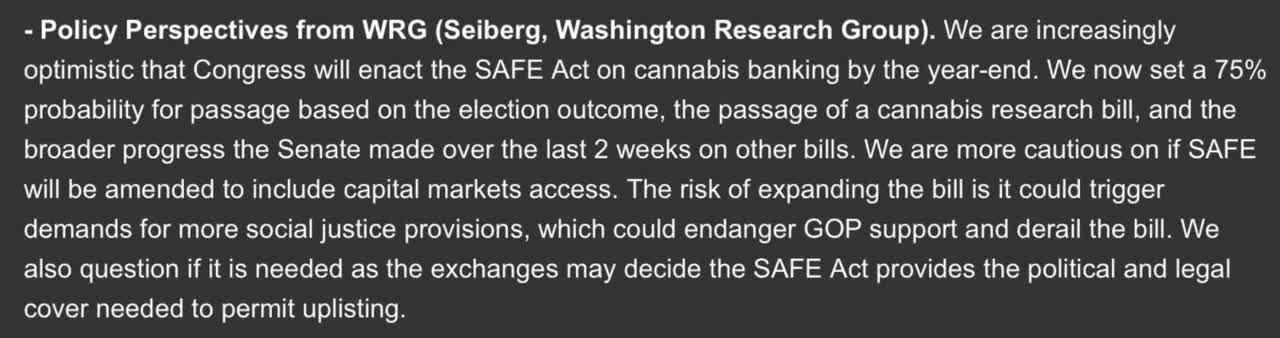

Consensus odds of SAFE passing started at a 50/50 and increased with the split congress coming out of midterms. Some switched to 60/40 and most recently respected voices are as high as 75%. Below are a few pieces of recent speculation.

Here is a note from Cowen on the odds of SAFE passing.

Cowen

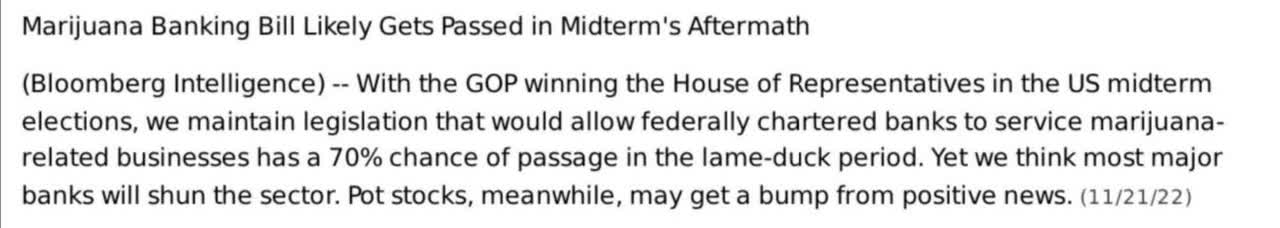

Here is the latest from Bloomberg Intelligence.

Bloomberg Intelligence

And, a Tweet from Weldon Angelos speculating on timing. Weldon is actively involved in Washington DC’s lobbying efforts around social justice.

Yesterday, Brady Cobb said we could see news as soon as Monday.

How I’ve Been Playing the Stacked Deck

As I became increasingly confident that SAFE would pass, I noticed this was not being reflected in stock prices. Because SAFE has passed the house seven times, investors are justifiably skeptical that it will once again be shut down in the Senate. But, with social equity programs in desperate need of basic banking and the House flipping red, I sensed there was more urgency to get SAFE done this time.

To capitalize, I refocused my portfolio on quality names with strong technicals and also built a position in MSOX – AdvisorShares MSOS 2x Daily ETF. This ETF provides 2x exposure to MSOS. I used MSOX for a trading vehicle, but longer term believe PSDN – AdvisorShares Poseidon Dynamic Cannabis ETF is their top offering and it is currently 1.3x levered. To learn more about the cannabis ETF landscape, please read my article Evaluating AdvisorShares Cannabis ETFs.

As we enter the week where SAFE Banking may pass, I own Green Thumb Industries (OTCQX:GTBIF), Curaleaf (OTCPK:CURLF), TerrAscend (OTCQX:TRSSF) and a trading position in MSOX.

So Far, So Good

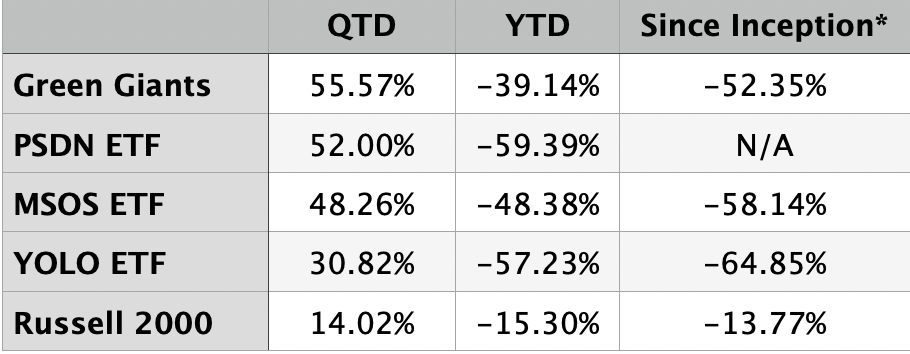

Below is a table showing Green Giants’ performance versus popular ETFs.

While absolute returns remain miserable year-to-date and since inception, the recent move is encouraging. Since launching in October 2021, Green Giants is outperforming every cannabis ETF I’m aware of, including the list above plus CNBS, MJ and MJUS.

Moving Forward

Today is Sunday, December 4th and current speculation is that SAFE Banking will be included in the National Defense Authorization Act (NDAA). The NDAA has passed congress for 60 straight years. This means that if SAFE is included, it will almost certainly pass. But, this is pot stocks, so disappointment is possible and I will remain glued to my screens and ready to take off risk should a negative surprise take place.

If SAFE is included, I expect a meaningful move over the next few days. Because SAFE has failed seven times in the Senate, investors have been cautious about making bets in advance. A Twitter poll of some of the most dedicated cannabis investors shows that less than half increased exposure ahead of potential SAFE news.

Outside of our bubble, Google Trends interest for “cannabis stocks” and “SAFE Banking” also indicate interest has remained low.

These are overdue exciting times for cannabis investors. I’ve been more active on Twitter and have been hosting a series of interviews using Twitter Spaces. Below is a link to my recent Spaces about cannabis stocks and technical analysis with Dan from The Chart Guys.

Thank you for your ongoing interest and I suspect you’ll be hearing more from me “soon”.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment