hapabapa/iStock Editorial via Getty Images

Hawaiian Holdings (NASDAQ:HA) has soared on news Amazon (AMZN) has contracted with the airline to operate and manage a fleet of cargo planes. The deal comes with a major catch, and Amazon isn’t known as a great customer. My investment thesis is ultra Bullish on the airlines, but this deal doesn’t pass the mustard for rushing into owning this airline stock.

Cargo Deal

Hawaiian signed a commercial deal with Amazon to operate a fleet of 10 Airbus A330-300 freighters starting in the fall of 2023. The stock jumped on the news, but investors need to take a pause and question the requirement for Hawaiian to issue a large amount of warrants to Amazon to obtain the cargo business.

Hawaiian has long had a volatile business due to a focus on leisure travel. The market appears to think an expanded cargo business will help offset some of the volatility, plus provide the airline with a general revenue boost.

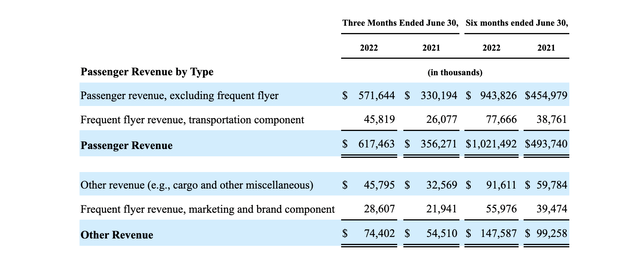

In the 1H22, Hawaiian generated $1.17 billion in revenues with $1.02 billion targeted at passenger revenues including frequent flyer revenue. The airline obtains $74 million in revenues per quarter from non-passenger revenues, with only $46 million from cargo revenues as follows:

Clearly, a revenue base beyond flying to and around Hawaii might be appealing to shareholders. The problem is that Amazon isn’t known as a corporation that hands out far margins to customers.

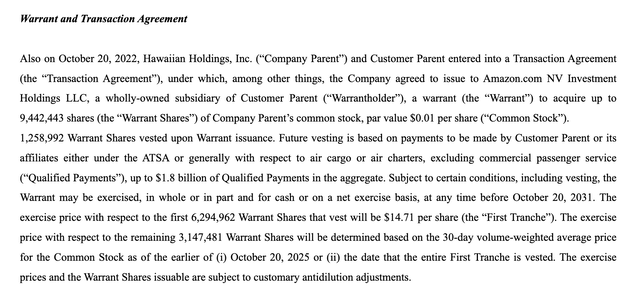

The company hints at a couple of concerns with the deal via the press release. The biggest issue is the requirement to issue Amazon Investment Holdings LLC warrants to acquire 9,442,443 shares, as highlighted in the SEC filing.

The majority of the warrants are exercisable at $14.71 per share. The stock already trades above $15.00 making Amazon a quick buck by agreeing to the commercial agreement while diluting existing Hawaiian shareholders by up to 15% with full exercise of these warrants.

The biggest issue is that normal deals don’t require the issuance of a large amount of warrants that will make the customer money. The deal appears akin to buying a customer.

The other concerning part of the deal is the requirement to prepare for the service for Amazon by hiring a bunch of new pilots, mechanics and other employees while establishing and expanding bases in the continental U.S. Hawaiian was already on a path to return to healthy profits in 2023 and the company will now spend the summer ramping up expenses for the Fall 2023 launch of the cargo service.

The SEC filing appears to suggest the aggregate payments for services could amount to $1.8 billion over the initial term of 8 years. At least, Amazon has to make $950 million in qualified payments over the term to exercise the last 25% of the warrants.

Amazon clearly has every intent to utilize Hawaiian for cargo services with a hope the stock soars based on this deal, but the online retailer is ruthless. The press release and related SEC filing provides limited details on the profit structure of the deal, though the airline could apparently see annual revenues in the $100 to $200 million range, possibly doubling existing cargo revenues.

Affirm (AFRM) signed a similar deal with Amazon back in last 2021 causing the “buy now, pay later” stock to soar. The fintech has seen revenues soar from the deal with the online retailer, but costs have followed the revenues higher.

Similar to the deal with Affirm, investors need to question why Amazon didn’t build the BNPL product internally. As well, why isn’t the online e-commerce giant developing an operations and maintenance base to handle the large cargo operations of Amazon Air.

Amazon already has deals with Atlas Air World Holdings (AAWW), Air Transport Services Group (ATSG) and Sun Country Airlines (SNCY) further questioning the need to expand service with Hawaiian. One has to wonder if Hawaiian wasn’t the only airline willing to accept the terms of Amazon, including the large warrant plan. Atlas Air and ATSG would appear the better partners for Amazon.

Affirm soared to $170 on the exclusive deal with Amazon and the stock trades below $20 now. The fintech faces market and economic issues, but the Amazon deal souring has been a big part of the dip for Affirm.

Odd Timing

The market appears to like the deal with Deutsche Bank analyst Michael Linenberg calling the deal “a game-changer”. The reality is probably far different, and Hawaiian is announcing this deal at an odd time.

United Airlines (UAL) just reported blowout numbers and forecast a 9% pre-tax margin for 2023. The airline is on pace to match or top pre-covid margins.

With Hawaiian trading at $15 and close to the covid lows, the airline needs to focus investors back on the recovery of the airline sector. United Airlines forecast a margin leading to an $11.50 EPS in 2023 while analysts only forecast half the EPS target of management.

Hawaiian has a different business model without a business customer, but leisure travel to Hawaii should expand with travelers having more flexibility with working away from the office. Covid restrictions have held back the recovery of international travel unlike domestic U.S. airlines, where revenues have already soared past 2019 levels, even with reduced capacity.

Current analyst 2023 EPS estimates for Hawaiian are at $0.68 and could easily double based on the United Airlines guidance. The 2024 target of $2.45 could actually turn into a legitimate estimate for next year.

The airline has an immaterial amount of net debt reducing any future benefit of repaying debt and lowering interest costs while a full reopening of international traffic would be positive catalyst for Hawaiian.

Takeaway

The key investor takeaway is that alarm bells go off when a company signs a deal with Amazon requiring a large issuance of warrants to close the deal. In this case, Hawaiian appears to be buying a cargo contract with Amazon by diluting existing shareholders by at least 15%.

The overall airline sector is too appealing to stick with Hawaiian after diluting shareholders on this commercial deal with Amazon.

Be the first to comment