JHVEPhoto/iStock Editorial via Getty Images

After having commented on the BHP Group Q4 production report (BHP, OTCPK:BHPLF), today we are looking at BHP’s M&A optionality as we recently did for its closest competitor Rio Tinto (RIO).

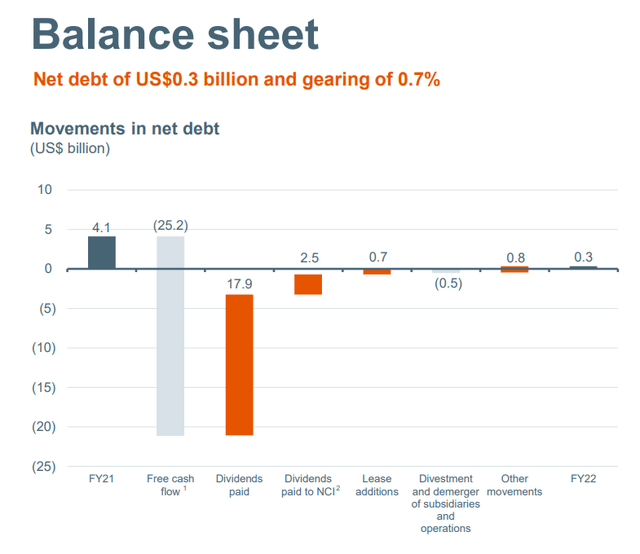

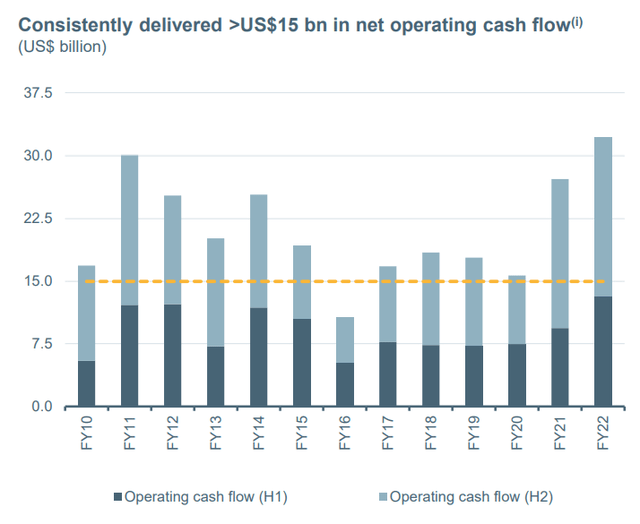

Both companies have a robust balance sheet (fig 1) also supported by a strong operating cash flow generation (fig 2). BHP Group as well as Rio Tinto are actively looking to diversify their EBITDA commodities mix (they shared similar exposure to iron ore, with more than 70% of their respective total EBITDA coming from the single commodity). And funny enough, both companies’ latest acquisition proposals were rejected.

- News broke today that Rio Tinto finally manage to acquire Turquoise Hill Resources asset (after two failing attempts);

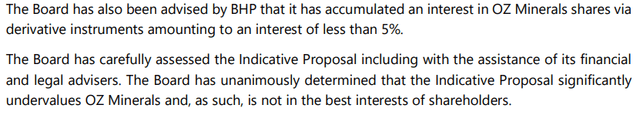

- BHP’s offer to OZ Mineral was rejected too.

BHP net debt development (BHP full-year results presentation (fig 1))

BHP cash flow development (BHP full-year results presentation (fig 2))

OZ Minerals Proposal

Looking at the numbers, our internal team is estimating that the company could increase its offer at a higher price. BHP’s previous proposal was at A$25 per share for a total valuation of $8.4 billion. Aside from the total cash consideration, it is worth a look at the Net Asset Value calculation. According to our estimate, at this spot price, the NAV is set at more than 1.4x and BHP’s EBITDA could only increase by 1.5% in total. Numbers in hand, the mining company could support a higher offer (and BHP’s debt target will be in line with management indication of $5-15 billion), however, we are not in favor. Cross-checking the financial details, BHP’s debt will increase to almost $10 billion, but we should also include the future CAPEX requirements estimate in another A$ 2.5 billion over the next two years. What we fear is BHP’s strong desire to diversify its EBITDA mix and the very high operational synergies that OZ Minerals might offer.

OZ Minerals rejects Indicative Proposal from BHP (OZ Minerals corporate website)

Looking at the press release, the CEO explained how the company has “a unique set of copper and nickel assets, all with strong long-term growth potential in quality locations. We are mining minerals that are in strong demand, particularly for the global electrification and decarbonization thematic, and we have a long-life Resource and Reserve base. We do not consider the proposal from BHP sufficiently recognizes these attributes“.

Conclusion and Valuation

Last year, BHP tried to acquire Norton Resources, but then management decided to walk away. This time might be different. However, BHP’s A$25 per share offer is already expensive on NPV calculation and the company is targeting a business that has always traded at a superior valuation (from a historical perspective, this was due to copper scarcity in the geographical area). As we already mentioned, BHP might feel some pressure to move on with M&A targets after having reduced its coal division and on the way to exiting its oil segment. After our Q4 report analysis, our internal team decided to lower BHP’s target price. Today, we confirm the $40 per share, maintaining a neutral rating. Our valuation is based on the average between a net present value model and a 2023 EV/EBITDA of 4x. Even if the deal goes on, the forecasted EBITDA expansion is minimal. Last time, we also emphasised the potential M&A risks. Within the sector, we still prefer Rio Tinto and Glencore (OTCPK:GLNCY).

Be the first to comment