Bill Pugliano

Investment Thesis

Ford Motor Company (NYSE:F) designs, manufactures, and markets trucks, cars, SUVs, and luxury vehicles worldwide. They have been the backbone of the industry for several decades, and they are about to hit another growth spurt with the EV boom. Ford’s management has set ambitious goals towards the EV transition. The EV versions of Ford’s iconic truck (F-150 Lightning) have been getting rave reviews from experts and consumers alike. With their experience in manufacturing, distribution, and marketing, I believe Ford will thrive during the EV transition. Currently, Ford’s stock is unreasonably low and presents a great investment opportunity. I believe Ford is a great choice because:

- EV transition is well underway, and Ford is in a great position to ride the boom.

- Sales and profit performance has been strong, even despite supply chain challenges and Covid-19 lockdowns.

- Recent stock market turmoil created a great opportunity to buy Ford at a bargain price.

EV Transition Is On The Way

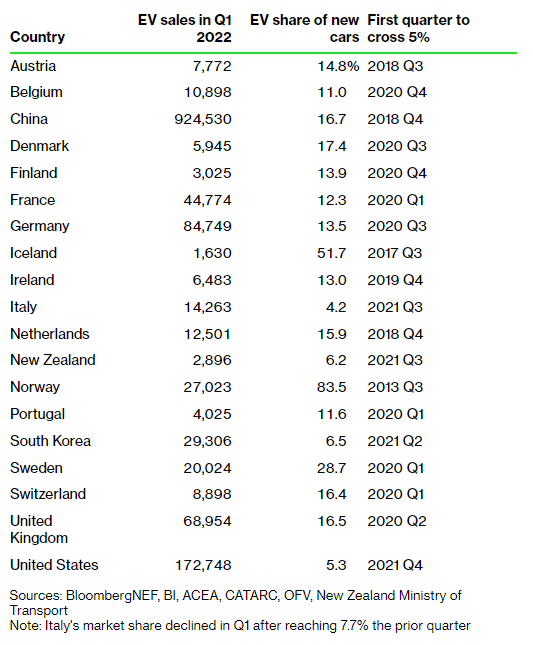

It’s not exactly news that the EV transition is on the way, and the U.S. is actually lagging other regions. China and Europe are leading the transition while the U.S. only just crossed the 5% mark in new car sales. There is plenty of speculation about why the U.S. is slower to adopt the technology: infrastructure is not ready yet, gasoline and diesel price is (relatively) cheap, and, etc. But I believe the lack of a popular EV model for trucks and SUVs is another major reason. These are the vehicles that Americans love to drive, so Ford will change the landscape with the new F-150 Lightning.

EV Sales by Country (Bloomberg)

The introduction of the Ford F-150 Lightning excited the automotive industry and the public. Equipped with traditional features that appeal to the customer (e.g., horsepower and torque) and features that are not available on gasoline-powered models (e.g., front trunk and ability to serve as a backup home generator), the F-150 Lightning has impressed many experts. Ford is ramping up production to meet the strong demand (200,000 reservations so far).

Given that the F-150 is the second-highest revenue generator among American consumer products in 2020, trailing only the iPhone, the F-150 Lightning has the opportunity to re-write American perceptions and shift preferences toward EV. Also, Ford is expanding the Rouge manufacturing site, and its completion will allow the center to produce 150,000 of the F-150 Lightning trucks per year, representing over 20% of total F-series sales (726,000 in 2021), and further boosting the sales percentage of EV.

Strong Performance Even Among Challenges

It’s no secret that Ford and many automotive companies are struggling with supply chain issues (most notably due to chip shortages) and Chinese Covid-19 lockdowns. Ford reported the worst quarterly sales in China since early 2020, so the parts shortage has been pressuring manufacturing capacity for well over a year at this point.

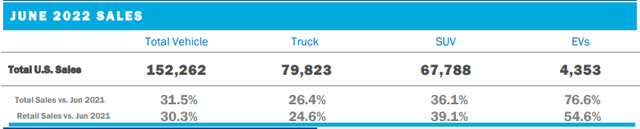

All these challenges just make the June 2022 U.S. sales results look even more impressive. Ford’s U.S. sales were up 31.5% YoY, and a highly favorable product mix (F-Series, Expedition, Explorer, and Navigator) enabled Ford to outperform the market. Ford’s average transaction per vehicle in June was about $1,900 higher than May, whereas their competitors increased transaction per vehicle by only $150.

Ford June 2022 Sales (Ford Investor Relations)

A couple of highlights show the strength of Ford’s line-up and the bright future growth trajectory of the company. First of all, Ford Transit’s sales grew by 74% YoY, and it has been the best-selling commercial van in the U.S. The aforementioned F-150 Lightning had its first full month of sales, and 75% of these customers had previously owned a competitor’s vehicle. Therefore, their leadership position will grow even stronger in the future. And luxury brand Lincoln SUV sales grew 43.6% YoY. As you can see, strong sales is not limited to just one segment. Ford’s whole line-up is performing well and expanding market share.

Favorable Valuation And Margin Of Safety

The market-wide volatility and fear of recession brought Ford’s stock price down to an unreasonably low level. The P/E ratio (TTM) of 3.93x is simply too low for a company like Ford, especially with the great growth prospects offered by combining their traditional portfolio with an industry-leading EV line-up.

DCF model estimation also shows the gross undervaluation of Ford. Even with a very conservative calculation (minimal growth rate and high discount rate), Ford is undervalued by a large margin, and I expect the market to realize this mispricing in the near future.

For the estimation, I utilized operating cash flow ($10.2B) and WACC of 10.0% as the discount rate. For the base case, I assumed operating cash flow growth of 1% for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed free cash flow growth of 2% and 3%, respectively, for the next 5 years and zero growth afterwards.

|

Price Target |

Upside |

|

|

Base Case |

$22.56 |

100% |

|

Bullish Case |

$23.43 |

107% |

|

Very Bullish Case |

$24.33 |

115% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 10.0%

- Operating cash flow growth rate: 1% (Base Case), 2% (Bullish Case), 3% (Very Bullish Case)

- Current operating cash flow: $10.2B

- Current stock price: $11.56 (07/11/2022)

- Tax rate: 20%

Cappuccino Stock Rating

| Weighting | F | |

| Economic Moat Strength | 30% | 4 |

| Financial Strength | 30% | 3 |

| Growth Rate vs. Sector | 15% | 5 |

| Margin of Safety | 15% | 5 |

| Sector Outlook | 10% | 4 |

| Overall | 4.0 |

Economic Moat Strength (4/5)

Ford has a clear economic moat defined by a long history of success, and their accumulated technological and business know-how cannot easily be imitated by other companies. Some of their models (e.g., F-150 and Mustang) command a loyal customer base that won’t go anywhere.

Financial Strength (3/5)

Ford is a financially stable company with a balance sheet that is in line with peers. They do carry a high debt level ($135B of total debt vs. $28B of total cash), but the high covered ratio (5.7x) indicates that they are well away from any financial distress.

Growth Rate (5/5)

I expect Ford to outpace the overall industry for a while. Their traditional line-up is performing very well, and their new EV line-up is showing great growth so far. I expect the F-150 Lightning to be very successful and serve as the core of their growth. Also, the growth of the F-150 Lightning will boost EV adoption rate in the U.S.

Margin of Safety (5/5)

The recent drop of Ford’s stock price is presenting a great investment opportunity for investors. The stock is being traded far below its intrinsic value. Ford’s growth prospects, profitability, and strong business fundamentals will win out in the long run.

Sector Outlook (4/5)

Even though the automotive industry is struggling with supply chain and parts shortage for now, I think the industry will see outperformance for the next several years that we haven’t seen for a while. The EV transition will bring great growth to the overall automotive industry.

Risk

There was a recall of the Ford Mustang Mach-E. Ford notified dealers to stall delivery, citing a safety problem. As EV is still in its early stages, I expect there will be some growing pains until the technology matures and manufacturing gains experience. Even though recalls are quite common in the automotive industry, safety-related recalls or incidents on the road could sour customer sentiment toward EV, which could negatively impact Ford’s growth.

Ford experienced a large decline in sales in Greater China area due to supply chain and Covid-19 lockdowns. China continues to struggle with Covid-19 surges, so this could drag on sales for a while. China is the largest vehicle market and also is leading the EV transition as well. Therefore, prolonged challenges in the Chinese market could create a multitude of problems for Ford. Therefore, the investor should monitor the overall status of the Chinese market and Ford’s response to these challenges.

Conclusion

Ford has been a stellar company for a long time. With the ongoing EV transition, I believe the automotive industry will see large growth during the next several years, and Ford will greatly benefit from the transition. Their technology and deep resources will serve them well for a long time. Growing pains through the EV transition and Covid-19 related challenges in China could present problems for Ford, but I expect them to ultimately handle them. I foresee substantial gains for Ford shareholders going forward.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment