Jelena Safronova/iStock via Getty Images

Dear readers/followers,

I’ve written two previous articles on Orkla (OTCPK:ORKLY). Neither of them was particularly well-visited or frequently read, but this is not a qualifying factor for what I look at when I write about a company. I like writing about businesses that I view as underappreciated, and I do believe that Orkla qualifies as such here.

Let’s give an update on Orkla here, and see what the appeal can be after a few years of sub-par development on the part of this business.

Revisiting Orkla and its upside

The company was founded nearly 400 years ago. Initially, Orkla was in the business of mining pyrite and later expanded to copper, which in 1845 was abandoned.

The company’s long history in mining lead it to be founded as a commercial mining company back in 1904, where it founded and constructed the first electric railway in Norway.

The company was listed on the Oslo stock exchange as early as 1929, and it proceeded over the next 50-80 years to perform M&As, takeovers, and investments.

As I’ve mentioned when reviewing this company, Orkla has owned mining operations, newspapers (Orkla Media was once one of the largest media companies in Norway), consumer goods, seafood, alcohol, and others.

Today, very little of that storied past remains. The company’s primary focus today is the acquisition and development of consumer goods.

Its portfolio consists of over 300 brands across the Nordic and Baltic regions, owning many of the most well-known and ubiquitous brands and products. This is in fact the company’s target. Orkla is only interested in owning #1 or similar-positioned market products and brands. Its current position and this ambition mean that it’s by far the #1 leading branded consumer goods company in the Nordic and Baltic regions.

It doesn’t matter if you’re talking about juices, cookies, chips, or prepared meals – the company owns most of the #1 or similar-positioned brands, with their products sold in over 100 nations across the world.

Orkla Portfolio (Orkla IR)

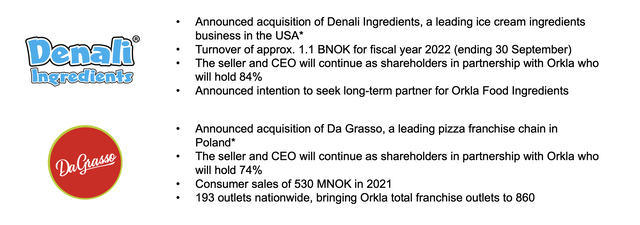

Since my latest article, the company has done a number of changes to its portfolio, and the company continues to be an active M&A’er.

Orkla IR (Orkla IR)

The heart of its new strategy is to speed up value creation and the process it’s been working to perfect, and reduce the complexity of the project. Also, the company wants to create more active portfolio management, allowing less independence on the part of portfolio companies, and refocus Orkla ASA with a very straight ownership focus. The company wants to establish autonomous portfolio companies, but also business service companies.

The advantage for M&A targets when it comes to being part of the Orkla family is simple – and they’re several.

Orkla IRA (Orkla IRA)

The company takes a long-term ownership perspective. When Orkla has bought something, it’s very rare for them to divest a holding. It applies its global expertise, scale and combination with entrepreneurship to try and be one of the most appealing owners out there.

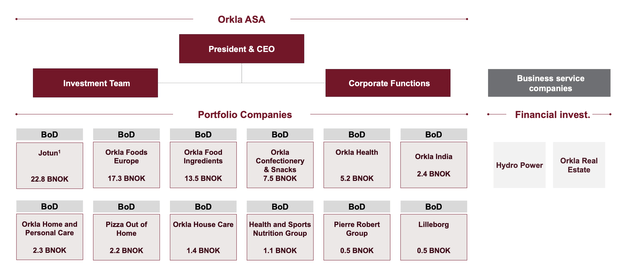

Its current target is the following corporate structure, which is expected to go into effect in early 2023.

Orkla IR (Orkla IR)

As you can see, foods, ingredients and snacks are going to be the main business areas still, with another big area in the Jotun BoD. When speaking about Orkla, it’s crucial, for a non-Scandinavian, to understand just how ubiquitous the brands the company holds are on our domestic markets. Allow me to use company material to try and bring this point across with some examples.

Orkla IR (Orkla IR)

When looking into many of these brands, for a customer to buy a different brand of product is, for many, almost unthinkable. The brand positioning for the company’s larger brands is rock-solid – not just in Sweden, but across all markets. The company owns most everything a consumer puts into their shopping cart. They own the largest seafood provider, the largest juice/syrup maker, the largest cookie manufacturer, the largest sauce company, the largest tv-dinner company, frozen pizzas – everything which is not a store-brand in Sweden and you find in the store, there’s a 50/50 chance that Orkla owns the brand. Many of the brands I have in my pantry at this time are Orkla brands. there are key exceptions – I use Heinz (KHC) ketchup, for instance, and Hellman’s Mayo, but most other key products including juices and the like are Orkla.

More importantly, and as I said, these brands are extremely well-liked, as shown by their market position. My knowledge about their degree of love in other nations is more limited, but going by company market position, this seems to be true in more than just Sweden and Norway.

The company has been in a bit of a valuation doldrums for the past year and more. This is not a result of its sales trends. The company has recorded very decent sales growth and EBIT growth, even if parts of that EBIT growth have come not from its foods, but from the insane trends currently going on in power generation – and Orkla after all has a Hydropower segment.

Profit after tax is up 16.7% for 3Q22 YoY, and EBIT is up nearly 30%. On a 9M basis, company cash flows are down quite significantly YoY due to WC changes and higher investments as well as higher D&A. The company has been pushing heavier into investments, but also buying back shares and paying out large dividends, which has put a strain on the debt.

But, as of now, net debt is still no more than 1.7x to EBITDA, which is conservative when looking at the company as it is.

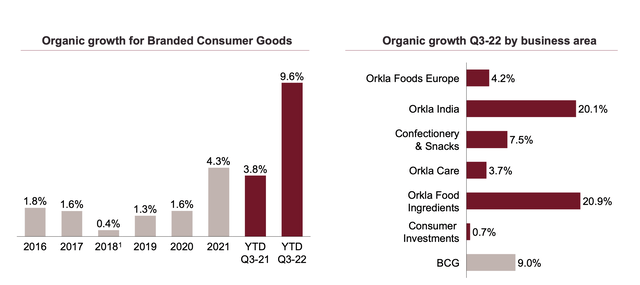

The company has managed to increase its pricing levels to allow for production costs and inflation offsets, with slightly negative volumes as some consumers are moving to sub-premium brands. The company did manage to boost its organic growth across most of its key segments – take a look.

Orkla IR (Orkla IR)

The company’s target is to grow its consumer health segment by 50% until 2025E, with 28% managed growth thus far this year, also growing the Out of Home pizza brand, and its plant-based investments more than it currently is.

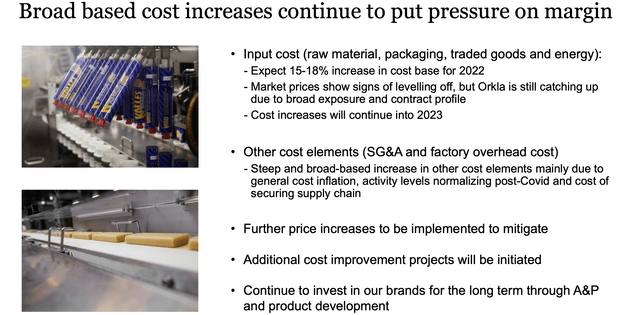

Current cost increases are a serious business here.

Orkla IR (Orkla IR)

The short and skinny of it is that if you want the foods and products you’re used to and love, and that are of slightly higher quality, then you’ll have to spend a larger portion of your income on these products. Not exactly strange, but Orkla is seeing these trends as well. This is diluting the profit somewhat, with EBIT down around 11.4% YTD, and margin down around 190 bps.

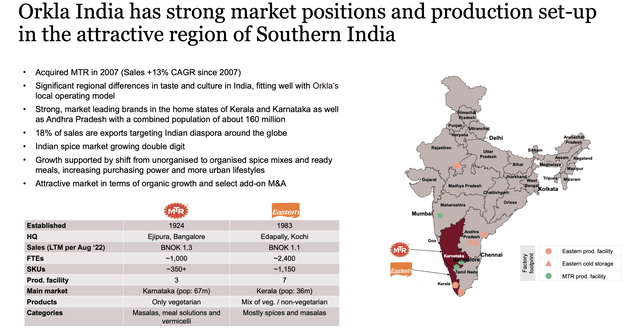

The company has made a strong push into India – and so far, this has gone very well.

Orkla IR (Orkla IR)

Price continues to drive the company’s top-line growth – and this is likely to continue to happen as market conditions remain some of the most challenged they’ve been in a number of years. Every single Orkla sub-segment is seeing cost inflation impacts, and the pressure seems unlikely to let up in the near term here.

So – revenues and EBIT aren’t so much the problem for the latest quarter – it’s current margin trends, with purchasing power, supply uncertainty and high-cost inflation that are driving the current trend for Orkla here. Meanwhile, things like Jotun are doing very well with solid paint ales growth in all segments driven by both top-line and bottom-line growth due to good cost control.

The company also has its power safety net in the form of Hydro, which has seen YTD sales revenue of nearly 1,700MNOK for the company.

So, for the right price, this company is definitely a “BUY” here.

Let’s take a look at valuation trends.

Orkla’s Current Valuation

Because of the company’s past, valuing Orkla at any one specific juncture presents a challenge.

The historical data is laced with one-offs and a special dividend from the sale of SAPA, making historical comparisons to peers somewhat moot – it simply isn’t the company it once was any longer.

The fairest way, in my view, to evaluate the company today is a peer comparison added with what we may expect, as well as what the past few quarters have brought.

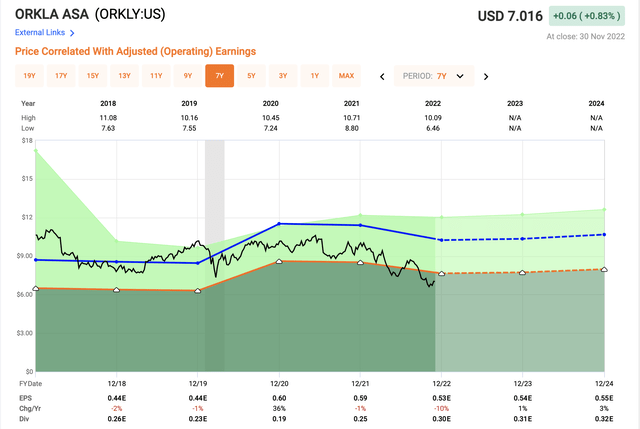

The first thing we see on a multi-year comparison is that the slump caused by poor results in previous years is more or less over, with the company having recovered to its more historical valuation.

Had you invested earlier, you may have bought shares at something closer to 16-17 times earnings, but those times are now over. The fact is that we’re seeing Orkla trading at levels we have not seen in a very long time. Take a look at the ORKLY ADR.

Orkla Valuation (F.A.S.T Graphs)

I view the company’s brands to be worth far more than this very conservative multiple. While I’m no longer comfortable assigning a 20-25x P/E premium to the brand collections as I might have been in the past, I do believe the company is worth at the very least a range of 15-18x P/E. Forecasting a midpoint of around 16-17x presents us with a potential upside of nearly 19% annually, with a 44% total potential RoR to a 2024E which is good enough for me to become interested.

Orkla lacks an institutional credit rating, but given my deep knowledge of the company’s brands, this does not really bother me.

Analysts forecast Orkla at a valuation range starting at 64 NOK on the low end, going up to around 90 NOK for the top valuation PT from seven analysts currently following the company. the average here is around 76 NOK, which gives us a native PT upside of around 10%. Competition comes in the form of only much, much larger businesses such as Nestle (OTCPK:NSRGY), Danone (OTCQX:DANOY), and others. However, Orkla is much cheaper, trading at half the P/E at a current 12.5x P/E native, and less than 10x to EBITDA, with the aforementioned costing more than twice that multiple for a chunk of their business.

Orkla is a smaller, scrappier play in the segment – but one that dominates key Scandinavian markets with very solid brands and comes with an excellent ownership background.

On that background, I give Orkla the following thesis and consider it a “BUY” here.

Thesis

Here is my current thesis on Orkla:

- Orkla is a class-leading Scandinavian portfolio manager of attractive foods, a large paint company, and enhanced with some hydropower operations. It’s a 350-year-old Norwegian giant that’s family-owned, and with very motivated owners that also include an attractive, 2-4% dividend.

- At the right price, this company is a “must-BUY” to me, and that price is close to 60-65 NOK, which is very close to where we currently are.

- I consider Orkla to be a solid “BUY” here, and my intention is to once again expand my holdings with a 1-2% allocation target in the long term.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative and well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

As you can see, I think Orkla fulfills all of my current investment criteria.

Be the first to comment