Sean Gallup

Investment Thesis

PayPal (NASDAQ:PYPL) reported Q2 results that saw the stock jump 11% after hours. There were two big takeaways.

PayPal was able to reiterate that its revenue growth rates will accelerate in the second half of 2022.

And equally important, or perhaps even more important, PayPal upwards revised the midpoint of its full-year EPS estimate by $0.04.

By my estimates, the stock is now priced at 20x next year’s EPS. This seems to me to be a very fair entry point, given that PayPal is so free cash flow generative.

In sum, I rate this stock a buy. This is an upgrade from my previous neutral position on the name.

PayPal’s Revenue Growth Rates Expected to Accelerate

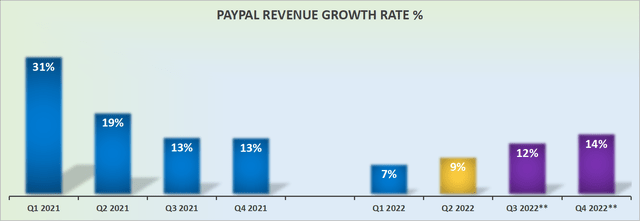

PayPal’s revenue growth rates

PayPal guides for accelerating revenue growth rates so that by Q4 2022, its revenue growth rates on an FX-neutral basis would be up 14% y/y.

Needless to say that H2 2022 should be easier for PayPal, particularly as it comes up against much easier comparables than H1 2022.

What’s more, there was a time when PayPal’s FX-neutral and reported revenues were closely aligned. Today that’s no longer the case.

For PayPal, its currency headwinds are likely to dampen reported revenues by as much as 200 basis points in the second half of 2022.

PayPal’s Near-Term Prospects

Looking back, it now feels like a lifetime ago that PayPal had its investor day.

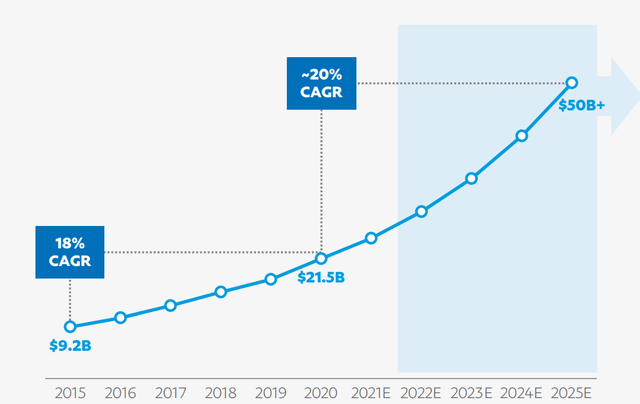

PayPal Investor Day February 2021

As you can see above, PayPal in February 2021 was forecasting that it could not only grow its CAGR in line with 2015 to 2020 at 18% but that it could actually accelerate its revenue growth rate.

That being said, since then, the stock fell more than 70%. Hence, it could be said that this is now old news.

With the benefit of hindsight, this was either managerial arrogance or incompetence, as PayPal’s revenue growth rates today run at approximately half of what it guided for just last year.

Nevertheless, PayPal put on a brave face and spoke bullishly about its near-term prospects. Pointing out to investors that its business has an unmatched scale with 429 million active accounts and that it sees a path to improve its operating margin leverage in the second half of 2022 that ”will continue to grow in 2023”.

PayPal’s Profitability Profile

The bull case for any investors considering PayPal has to be its ability to print significant free cash flows. As a reference point, Q2 2022 saw its free cash flow reach $1.3 billion, up 22.0% y/y from $1.1 billion in the same period a year ago.

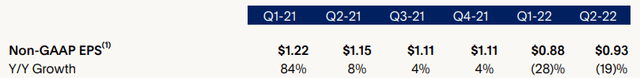

Furthermore, it’s noteworthy that PayPal’s EPS numbers appear to have finally improved sequentially:

PayPal Q2 2022

For investors, this sequential improvement in EPS couldn’t have come at a better time. There’s been such a barrage of concerns facing PayPal from inflation, energy costs, and geopolitical concerns, to name just a few.

PYPL Stock Valuation – Priced at 20x 2023 EPS

PayPal is guiding for $3.95 of EPS at the high end. Needless to say that this is a non-GAAP figure with plenty of stock-based compensation added back. This puts its current share price at 25x this year’s EPS.

With 2022 now nearly at a close, investors will have to form some view of 2023. If we were to presume that PayPal grows its bottom line EPS numbers by 20% to 25% next year, this would put its EPS next year at $4.74 to $4.94, or probably closer to $4.90.

This would put PayPal priced at 20x forward EPS. This is not the cheapest stock out there, but there again, PayPal is a secular growth stock. It doesn’t have much in the way of material risk factors. It’s a blue-chip fintech stock, a real OG to the sector.

When we consider that even today many other fintech companies are still being valued at 6x to 10x forward sales, with no clear sight towards bottom-line profitability, in comparison, PayPal is very much more adequately valued.

The Bottom Line

There are certain stocks that simply don’t go on sale. PayPal used to be such a stock. Now, PayPal has been on sale for more than 1 year.

Looking ahead to Q4 and beyond, eBay (EBAY) will stop causing negative comparables to PayPal’s revenue growth rates, positioning PayPal for a much-improved revenue growth rate path in 2023.

Consequently, from this valuation, at 20x next year’s EPS, I believe that investors are significantly more likely to see PayPal trading at $150 than they are $50 over the twelve months. Hence, I rate this stock a buy.

Be the first to comment