Oundum/iStock via Getty Images

There are those who believe that a well-constructed set of algorithms could be predictive of anything, anytime, anywhere with a high degree of accuracy. All you need do is categorize the variables in nice little boxes, assign a weighting to each, feed them all into a computer, and presto – you have your pick of guaranteed money-making moves in the stock market, or for that matter, for life decisions in general.

What’s wrong with this assumption? In brief, everything. What it does not do, nor can it ever do, is factor in the emotions, egos, life experiences, quirks of personality and fears of the individuals involved in the process at a given moment.

When a company or activist investor zooms in on a target deemed worthwhile to run at, it can unleash armies of numbers crunchers from banks. They can build any scenario for a takeover that creates a floodtide of fees and impregnable rationales for pursuit of the target. But these efforts often go afoul because the human element at one point or another commands attention and, in the end, is the ultimate reason a deal got done or didn’t get off first base.

That was the case with my alma mater, Caesars Entertainment Inc.(CZR). In 2008, it sold itself to private equity firms at a bloated price that was little more than a birthday party for insiders. The debt load taken on, and exacerbated by the financial crisis of 2008-2009, was compounded by one management blunder after another and sealed its fate. The stock eventually tumbled into single figures. But nobody moved. What should have been obvious, apparently wasn’t: CZR was undervalued. CZR went bankrupt in 2015, taking all the fancy algorithms that propelled its sale and operations thereafter down the drain.

Finally, it took savvy activist Carl Icahn to recognize a sitting duck when it quacked Buy Me! He bought in, fired caretaker management, and found a partner in El Dorado Resorts’ Tom Reeg. Together, they took a run at the company, got it, and by September of last year, the stock had risen to $119 from under $10 where Icahn had averaged for his initial stake. It has fallen off since, but so has the entire sector due to the bearish market.

What Icahn saw was compounded of undervalued realty not yet in a REIT, a data base for Caesars Reward cardholders of 55m who were part of a proven system feeding rewards customers from over 50 properties around the country to its Vegas flagships.

Many of the tempting weaknesses spotted by Icahn at Caesars are to be found in the numbers of DraftKings Inc. (NASDAQ:DKNG) today. As I have previously written on DKNG, in my view, the only reason to own the stock now was to await an Icahn, a competitor, or a company eying the sector, to step up to the plate. No such player has entered the game to date.

And if no one does before the end of this year, sell – because other than getting a premium in a deal, you are looking at a very tough road for the stock ahead.

Where are the tire kickers?

It’s hard to believe there have not been any visible tire kickers on the stock given the prospects going forward. There could well have been quiet, off-the-reservation tire kicking now and then, considering the tempting target DKNG should present. But no takers yet. So our only conclusion can be this: it most likely could be that DKNG management and board have not heard from the right people with the right deal yet.

Or more probably, the word might be floating around that DKNG has said: NO THANKS to possible acquirers.

The management drill:

Our hopes remain high, our business is thriving.

It’s just a matter of time when we decide to lock the vault and stop throwing mountains of cash around generating low-value registered users in new states. That could well be the case.

That may play well with many investors who, regardless of realities of the moment, keep the flame of passion going fully believing salvation and a gold mine awaits them ahead. That’s fine-sit it out if you will until the cavalry rides to the rescue.

Where it doesn’t play, in my view, is in the hard realities of a sector that is not only overcrowded and profitless at the moment, but one likely to get worse.

To whit: As I mentioned in a prior SA article, it was baffling to me that Disney (DIS), via ESPN, was totally asleep at the switch by not moving fast and deftly into sports betting at least three years ago. Now, we have ESPN’s president telling a reporter this week that sports betting is a “must have” for the company. It appears the sports content leader expects to enter the business. But four years after the Supreme Court decision, they still don’t appear to know how, or when, to enter, or whether they prefer a partner in an existing platform, or rather do one themselves. Slumber on guys because, guess what? There’s another player about to come up to bat:

FANATICS, the sports gear giant privately owned by Mitchell Rubin, valued at $27b, is on the cusp of no toe dip here, but a deep dive into the sports betting pool.

Rubin, who deserves kudos for building an ecommerce empire off t-shirts and team jerseys, has recently added the Topps sports card business, buying it for $500m. But Rubin apparently lives in the same Never-Never land of the delusional sports betting pom-pom twirlers. He has now upped the dream world estimates of its potential. He has said that sports betting would be a $100b business by 2025. It’s a fantasy number one can reasonably expect to roll off the tongue of an entrepreneur hustling a possible IPO.

Credit to Rubin, whose success lives off savvy hype. Fanatics is a company built off the presumption of hype that is so much a part of sports fandom and, by extension, the passion that has driven Fanatics into a heady $27b valuation. Good for Rubin, good for Fanatics. Not so certain its good for an already fractured industry forced to throw billions around on player acquisition programs.

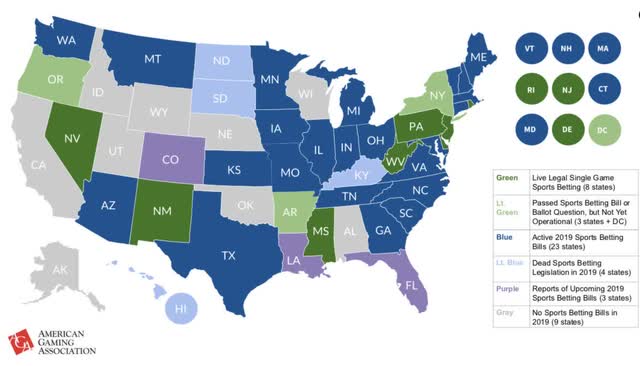

Those of us who try to live with real world expectations, including several banks, have put the endgame revenue potential at somewhere between $25b to perhaps $35B, probably shared by a consolidated group of tier one operators. There are now 31 legal states with four more in various stages of legislative bumping around which could join the party by 2023 or 2024.

Sitting in the what-if stage is California which has a November ballot initiative that would approve retail-only sports betting. Opposition to mobile is strong from many quarters, and there is a long road ahead for the debut of a ready-to-roll retail and online industry. We may see California as a retail-only state by late next year. Going mobile stretches the imagination, but realistically may either never happen, or if it does, it could be 5 years away.

But don’t look for any panacea that suggests a business not anywhere near the estimates of Rubin and the pomp pom twirlers. According to the research firm Eilers and Krejcik, a fully mature retail and mobile industry in California could yield $500m in annual revenue. Compare that to either New Jersey or Pennsylvania as a large population state paradigm:

Since inception at May 2018, New Jersey has won $1.8b from bettors. That’s over four years in the making. Pennsylvania has won $1.1b. Both these states have seen monumental media spend by DKNG and its many competitors. Rubin, who is a proven rainmaker in ecommerce, is allowed his bloviating for certain. But his forecast of revenue and assertion that Fanatics will achieve the #1 share of market once its customer base is heard from remains to be seen-and probably never will if the 14 present occupants of the space have anything to say.

The probable entry of Fanatics into sports betting was given as the core rationale as to why Rubin last week sold his interests in the NBA Sixers and the NHL Devils. The proceeds of that sale are estimated at $300m to him, just about enough to pay for one quarter of a sports betting advertising program. Whatever numbers Rubin analysts may have crunched about an entry into sports betting are probably either wrong, or conversely, Rubin, ever the entrepreneur, wants to believe his own numbers.

The four top-tier platforms now command more than 70% of the market today. They can’t be shoved off their collective perches by newbies like ESPN or Fanatics because both entities are so later to the party.

There is little question that the customer base of Fanatics will furnish a great foundational data base to cull. Whether it will prove as viable as DKNG and Fan Duel’s Daily Fantasy Sports customers is problematical. DKNG and FD did first-class jobs in transitioning DFS customers to their real money platforms. It would seem to us that a deal for DKNG for either ESPN or Fanatics would make imminently more sense.

So, there remains these questions:

Why hasn’t ESPN moved their sponsorship deal with DKNG beyond just empty-calorie marketing value to either buying the company, or partnering with it on a real money platform? Both companies need a real-world management change that recognizes a fast-moving train speeding in the wrong direction.

Below: An odd mix of partnerships that have not advanced into an obvious takeover move by either a major casino operator or ESPN.

The numbers could be daunting to a would-be acquirer.

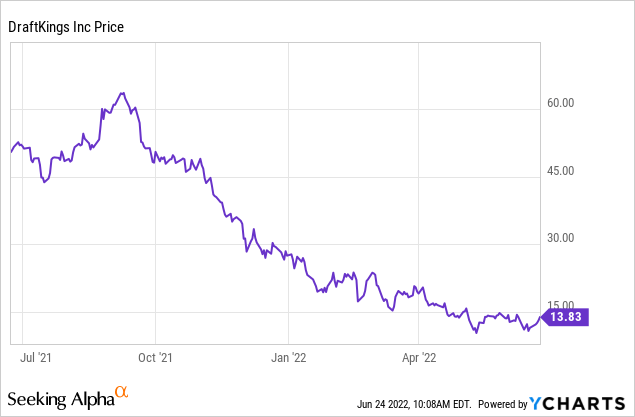

- DKNG price at this writing is $12.70 against a 52-week range of $9.77 — $64.58 with a market cap of $5.55b sporting an analyst PT of $28. Its ttm revenue is $1.4b with management forecasting a rise to over $2b going forward. We don’t dispute this, but it’s the same old, same old mantra: DKNG revenue gains are bought at a crippling price.

- Last year the company spent near $1b on customer acquisition in promotions and media. That was the primary factor in its booking a negative cash flow (ttm) of ($716m) and a net loss of $437M. The company is on record saying it was prepared to spend $650m to market its platform in California. Considering that E&K’s realistic estimate of that state’s mature market is $500m, its par-for-the-DKNG-course of what cheerleading investors have seen since it departed its SPAC origins in late 2019.

- Supporting the bull case all along has been some analysts pointing to its cash position, at ttm sitting at $1.77b. At the current burn rate, even without the ballooning possibility of California spend and other pending states, it’s a piggybank with a well-aimed hammer swinging down on it unless management gets religion, stops chasing revenue of questionable long term value, and focuses on making a buck.

- DKNG debt (mrq) sits at $1.32b with a current ratio of 2.63, neither of which suggests a firesale price to a buyer right now, but is trending in the wrong direction. With 437.m shares outstanding, DKNG may have to take an equity dilution route downstream to shore up its cash and feed its marketing maw.

That does not bode well for current holders per se. The stock can inch up or down, but does not appear to get anywhere near its all-time highs in the 70s.

The case for an acquirer to be:

- DKNG is a well-established tier one operator. It may see its share of market gyrating periodically from 2d overall in share below Fan Duel, even slumping below BetMGM in some markets, but overall, it will remain a leadership brand long term.

- Its registered users number over 1m, a customer list bought at a punishingly high price but nonetheless viable going forward and its share of market gyrating periodically from 2d overall in share below Fan Duel, even slumping below BetMGM in some markets. But, overall, it will remain a leadership brand long term.

- Its registered users would be hyper-costly to duplicate for a would be new entrants.

- Its tech stack and site-friendly features are among the best in the business, but bring nothing proprietary to the party.

Their DFS business is good, their IGaming potential steady as that platform grows for the industry.

The stock is currently trading ~59% below a consensus PT with a recession looming over the macro economy. Core bettors with modest budgets who primarily bet big events are not likely to depart in a recession. But huge numbers of marginal bettors in both the sharps segment and clueless fan passion customers could reduce their wagering budgets. That’s a prospect which could attack the stock and its peers in a general market swoon if a big-time recession hits.

So, given the possibility that DKNG will inhabit the range around $9 to perhaps $15, recession or not, on some positive news flow out of new state legislative victories, there is plenty of room for an acquirer to tag on a nifty premium and go at it.

Valuing a premium that would be attractive to management, the board and Mr. Market would have to be found in a set of assumptions by an acquirer that would plan a gradual reduction of marketing costs off DKNG’s near-$1b customer acquisition spend last year. Then set a revenue and market share target not fixated on sheer numbers, but one that was designed to produce the best case EBITDA production inside the knowable competitive grid. It would envision reaching viable market shares in new states and a customer retention percentage laid against a real-world estimate of long term customer value.

Assuming an acquirer would apply those disciplines post takeover, DKNG can deliver big time.

Management would need an overhaul with new top players who can pivot the business model on a speedier road to profitability than what the current occupants of the c-suite believe can be achieved.

We see a premium of $6 a share as equitable and attractive now, while the cost of money has not yet risen to where many FED watchers believe it will ultimately land. That would position the stock at ~$18 to generate a bull case, beyond that could take it considerably higher over a five-year time frame.

Be the first to comment