Kittisak Kaewchalun /iStock via Getty Images

The potential for Dow Inc. (NYSE:DOW) shares making any major moves, up or down, is slim. The price is stagnant but seems safe from severe risks. We are still bullish about Dow, as in our previous articles. We own the shares and recommend retail value investors hold their DOW shares or moderately accumulate them at ~$50.

The Company

Headquartered in Michigan, Dow Inc. ranks fourth out of 24 similar companies in the commodity chemicals industry. It operates through Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure, and Performance Materials & Coatings segments selling performance materials used in finished goods produced and sold around the world. For instance, the company announced in November that Dow invented a thermal elastic high-bonding adhesive to assemble EV battery packs. It has advanced silicone ink for improved performance in textile applications. During the pandemic, Dow expanded its hand sanitizer business.

Performance and basic plastics account for 50% of sales. Chemicals are 29% of sales. Dow sells water purification products and technology, agricultural insecticides, herbicides, fungicides, and seeds account for about 7%. Hydrocarbons, energy industry products, and feedstocks comprise 13% of sales.

Quarterly Turnoff

Rumor hints the Dow Jones Industrial Average Index (DJI) might remove DOW from the Index. The stock is lackluster. The company and industry are not glitzy and glamorous. Dow Inc.’s $36.3B market cap has a negligible impact on the $10.35T DJI market cap and its movement. Taken together, DOW exerts a scant influence in moving the major index. There is talk of it being replaced by a fashionable and celebrated company.

Shares are selling near the price when they came to market in March 2019. Since then, shares tumbled to $22 in March 2020 on pandemic fears amidst an economic meltdown. The price subsequently jumped to a 52-week high of $71.86 per share. Shares are down 11% for the year.

The dividend gets a D+ for consistency without a raise in four years. It currently offers a forward yield of 5.43%, which we find attractive in today’s economic environment. For the reasons below, we do not foresee the company cutting the dividend in the next year.

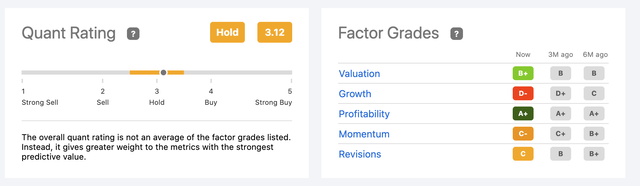

Dow Quant Rating & Factor Grades (seekingalpha.com/symbol/DOW/ratings/quant-ratings)

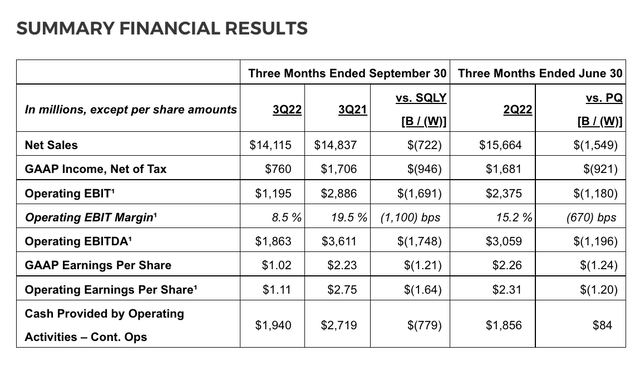

The CEO’s comments on Q3 ’22 earnings, as transcribed by Seeking Alpha, highlight the headwinds Dow Inc. has faced and expects to continue stymying growth. Nothing unusual here: inflation, supply chain issues, China, and spotty lockdowns in Europe and America combined to hurt sales and national infrastructure investments. Energy and feedstock costs skyrocketed eating away at margins. Packaging and Specialty Plastics reported Q3 Operating EBIT Margins of 10.7% in 2022, down from 25.3% in 2021; Industrials fell to 4.1% from 15.9%; Performance Materials and Coatings held about the same Y/Y at 11.4% and was the only segment to have an increase Y/Y in net sales.

Earnings Summary (prnewswire.com/news-releases/dow-reports-third-quarter-2022-results-301654670.html)

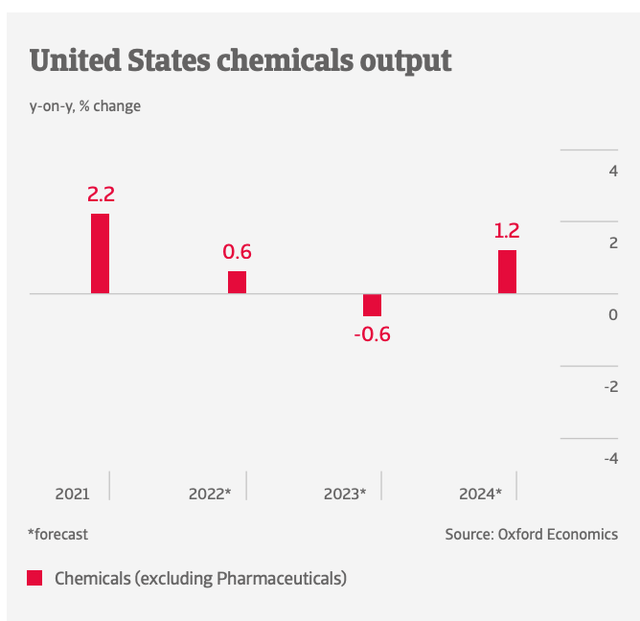

Chemical industry trends are of not much comfort. According to a recent report from Atradius, November 2022, the industry faces tough conditions likely to stretch deep into 2023. U. S. companies are performing better than foreign counterparts and insolvencies are lower. Atradius attributes its “fair” rating for the chemical industry to deteriorating profit margins. We believe it prudent to expect Dow’s earnings to slip -3% over each of the next few years due to lower revenue and increased costs.

Industry Earnings (file:///Users/drharoldgoldmeier/Downloads/Industry%20Trends%20Chemicals%202022.pdf)

One last worry. Railroad union workers are threatening to strike in December. Rail interruption is a particular threat to chemical companies. The $486B chemical industry ships 20% of chemical tonnage by rail. An extend stoppage will cripple the chemical industry and Dow Inc.

Positive Ratings

Dow pays a solid dividend, putting it in the top 25% of U. S. businesses paying a dividend. Earnings cover them. Current shareholders receive an attractive dividend forward yield of 5.43%.

We do not forecast a higher average price target for Dow Inc. over the next six months than $50; it might wander up and down 10% during that time. We think Dow is selling at a good value based on its price-to-earnings ratio of 6×2 compared to the chemical industry of 15x.

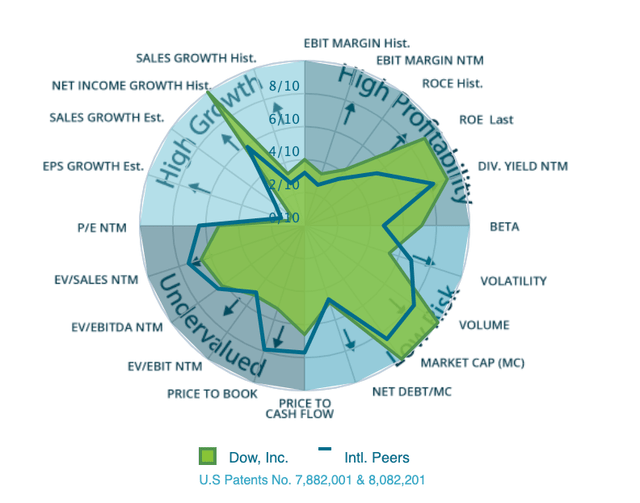

Dow Inc. Rating (infrontanalytics.com/fe-en/30030NU/The-Dow-Chemical-Company/Beta)

Dow Inc. largely enjoys excellent reviews. Factor Grades from Seeking Alpha are stable over six months, though momentum and valuation changed as the share price tumbled from $67 in May ’22. The Quant Rating slipped simultaneously from strong buy to hold but has recently edged up toward a buy rating. Nine out of the last 9 Dow Inc. articles appearing on S A Analysis are bullish.

Hedge funds increased their holdings by 758K shares last quarter, as did corporate insiders. There are about a dozen articles a week addressing Dow Inc., and the sentiment is positive. The levered Beta is 0.88 for the year and short interest hovers at a low 1.4%. Hedge fund share ownership has remained steady, with 47 owning shares in Q2 and four selling off in Q3.

Cash on hand (~$2.6B) and receivables (~$8.6B) that turn to cash on average in 80 days nearly cover the debt. Debt-to-equity improved in mid-2021. The debt then stood at $15.37B and equity was $16.1B. The company worked to change the ratio; debt is now $12.6B and equity is $18.6B. Dow’s debt-to-equity, however, is still high at 54%. EBIT covers interest payments.

Future Picture

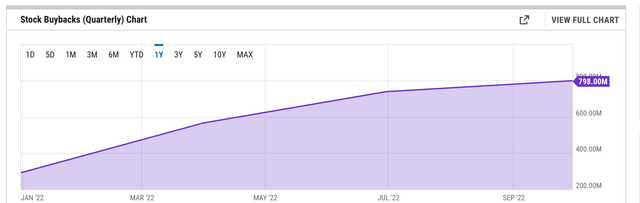

Common economic conditions hurt Dow Inc. sales and margins in Q3 ’22. A recession, higher inflation, and a railroad strike in the next quarter or two will impede any earnings recovery plans. The lugubrious performance of the stock and the switch to a hold rating from bullish reflect concerns. Dow Inc. is planning to cut costs and emphasize selling higher margin products; the company is generating double-digit free cash flow and plans for more debt reduction in 2023. The company is buying back stock according to the plan announced last April. They bought $798M worth of shares back during September 2022.

Buyback Graph (ycharts.com/companies/DOW/stock_buyback)

These actions will not drive up the DOW share price but can potentially keep the dividend yield attractive and undergird the share price. Dow Inc. currently trades at a fair value and below estimates, some analysts peg it at $70 per share. DOW is not a volatile stock and overall is a low-risk investment to consider. Its products are essential to national economic growth. Man is a collection of chemicals, but Dow Inc. is a solid legacy chemical manufacturer with no delusions of grandeur, to paraphrase Ayn Rand.

Be the first to comment