InfinitumProdux

Thesis

Golden Ocean Group Limited (NASDAQ:GOGL) stock has underperformed the market on a total return basis (including its recent dividend payout) as investors focused on recessionary themes. However, we urge investors not to bail out now. Like its leading dry bulk peers, Golden Ocean needs to go through this period of normalization after a massive growth phase in 2021, as multitudinous tailwinds underpinned its business.

Therefore, some reversal of the tailwinds should be expected as port congestion eases, coupled with China’s unpredictable and harsh COVID lockdowns in Q2. As a result, China’s economy weakened further in Q2, causing more mayhem in the commodity markets and inciting fear of demand destruction.

However, management remains confident that the medium-term outlook in its business remains robust, coupled with regulatory tailwinds. Hence, we view the recent post-ex dividend capitulation move as a solid opportunity for investors to consider adding more positions.

Accordingly, we reiterate our Buy rating on GOGL.

Investors Are Justifiably Concerned With Recessionary Headwinds

Q2 was challenging for Golden Ocean, as tough comps and worsening macro headwinds impacted the market’s confidence in the leading dry bulk players sustaining their elevated time charter equivalent (TCE) rates.

China’s COVID lockdowns-driven and property-related headwinds have also continued to hamper the recovery of the world’s second-largest economy. As a result, China’s steel industry has slowed tremendously, affecting iron ore demand markedly. Industry analysts/insiders were also concerned that it could portend a structural decline, as Nikkei Asia/Caixin reported:

The property sector, which accounts for over one-third of the country’s steel consumption, has been squeezed by a liquidity crunch and sliding sales since the end of last year. This comes amid an ever-expanding mortgage boycott by disgruntled homebuyers over stalled construction projects. [China Baowu Steel Group] said that the steel market is facing a steeper downturn than in 2015, with no end or bottom in sight. “The contradiction between steel supply and consumption will be a long-term issue. As China’s urbanization and industrialization advance, the overall demand for steel will gradually decline,” [said the China Iron and Steel Association]. – Nikkei Asia

Golden Ocean’s Growth Has Normalized Further

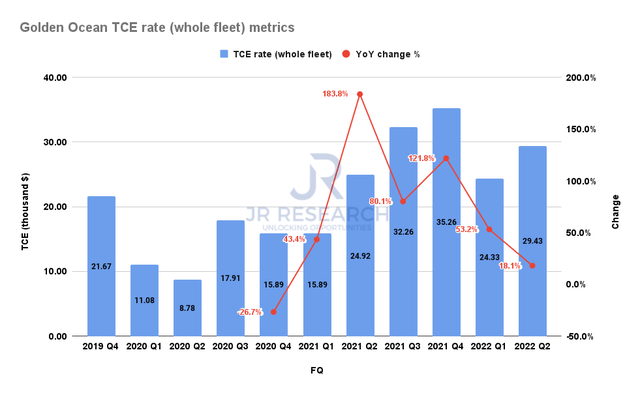

Golden Ocean TCE change % (Company filings)

As a result, the growth in Golden Ocean’s time charter equivalent (TCE) rates slowed dramatically in Q2, up just 18.1%, down from Q1’s 53.2%. It was also the second consecutive quarter that its growth rates have decelerated. Therefore, we believe there’s little doubt that challenging comps and a much harsher macro environment impacted its TCE growth cadence.

Furthermore, management’s guidance for H2 suggests that TCE growth rates could slow further and even decline, given touch comps against Q3’21, as seen above. Management highlighted:

Looking at this quarter, Q3, we have so far secured $28,000 per day for 80% of our Cape days, $27,000 per day for [96%] of our Panamax days. Looking into the next quarter, Q4, we have secured $29,000 per day for 25% of our Cape days and $22,000 per day for 27% of our Panamax days. In other words, we have taken out fixed paying cover at good rates for the remainder of the year to hedge against near-term uncertainty. (Golden Ocean FQ2’22 earnings call)

As a result, we believe investors have been adjusting their expectations, given expected TCE rates compression in H2’22. Hence, investors should not be surprised by the weakness in GOGL’s price action.

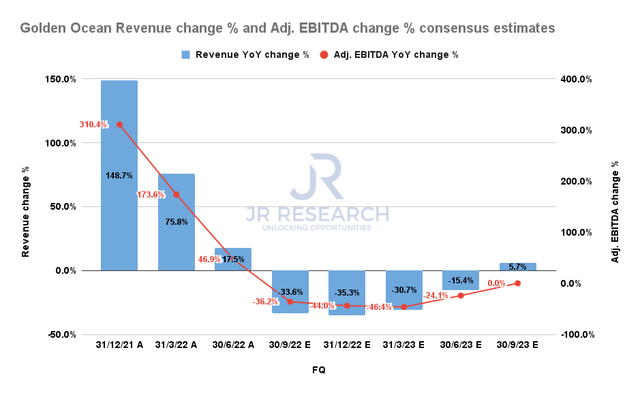

Golden Ocean revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Consequently, we surmise the consensus estimates (bullish) are credible, suggesting Golden Ocean’s revenue and adjusted EBITDA growth should turn negative in Q3’22. But, it also indicates that the moderation is likely transitory, with GOGL lapping FY22 comps by Q3’23 before recovering from its nadir.

Therefore, investors need to ask themselves whether they believe in the medium- to the long-term structural narrative for Golden Ocean’s business. Management was unequivocal in its earnings commentary, accentuating its confidence in the structural tailwinds undergirding its recovery. It added:

Despite the uncertain macroeconomic context, dry bulk fundamentals are constructive, driven mainly by an attractive supply side. In this segment, the order book is below 6% of the global fleet and at 30-year lows. Combined with inefficient coal and grain trades, [the] impact from the IMO regulations in 2023, it is practically impossible to have a negative view on supply. We believe the dry market will be challenged in the short term until China’s growth normalizes and the rest of the world has battled inflation. Having said that, a rebound from the current levels is likely before the turn of the year. While we acknowledge macroeconomic factors, we do not expect the type of deep prolonged recession that would have an overweight impact on the demand side of the equation. (Golden Ocean earnings)

We are confident that management’s confidence is credible, as we could be nearing the worst of the macro headwinds. The market has already priced in an 87% probability (as of September 8) of another 75 bps rate hike by the Fed in the upcoming September meeting. Yet, the broad market has held its June lows in the recent pullback.

Furthermore, China is committed to reviving its economy, as it tempered its hawkish rhetoric and regulatory adjustments on its tech behemoths. Moreover, it also unleashed CNY1T of infrastructure stimulus in late August to help boost the economy. In addition, there’s also a possibility that China may “revise” its harsh zero-COVID policy after Chinese President Xi Jinping wins his unprecedented third term in the upcoming October’s 20th National People’s Congress. Singapore’s former Foreign Minister also weighed in recently, highlighting that he also sees the potential for revision. Therefore, we believe sufficient upside surprises could help reverse the downcast sentiments in dry bulk shipping moving ahead.

Is GOGL Stock A Buy, Sell, Or Hold?

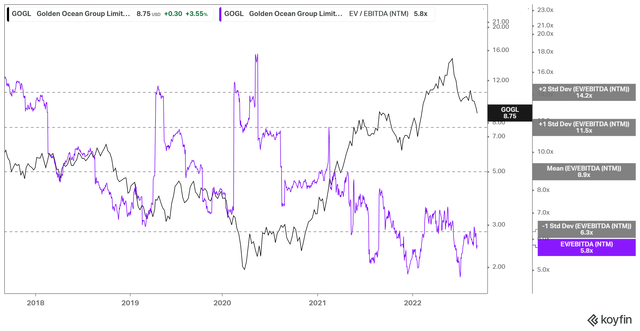

GOGL NTM EBITDA multiples valuation trend (koyfin)

GOGL last traded at an NTM EBITDA multiple of 5.8x, well below its 5Y mean. Notwithstanding, we deduce the market has de-rated GOGL, given the growth normalization and the macro headwinds discussed earlier.

Hence, we urge investors to consider a generous margin of safety below its 5Y mean for an appropriate entry level.

Our analysis suggests that GOGL has found robust support since 2021 whenever it fell below the one standard deviation zone below its 5Y mean. Hence, investors can consider using it as a benchmark to assess a suitable entry zone for GOGL.

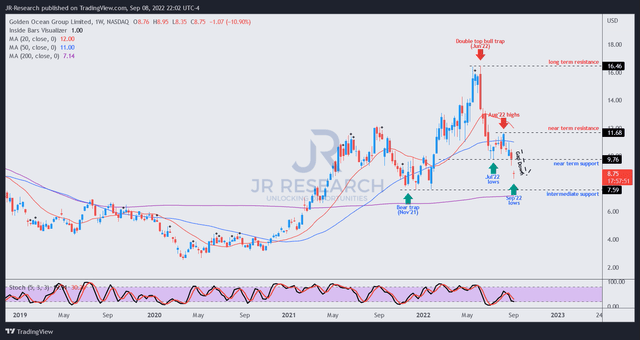

GOGL price chart (weekly) (TradingView)

As seen above, GOGL’s “gap down” price action coincided with its ex-dividend date on September 6. Its price action also indicates a capitulation move as it adjusted to its recent dividend payout. Therefore, we believe the intermediate support zone should offer robust buying support to GOGL, even if it falls further.

Notwithstanding, we believe the current zone offers investors an opportunity to layer in, as its medium-term structural drivers remain robust, coupled with its recent battering.

Accordingly, we reiterate our Buy rating on GOGL.

Be the first to comment