Fritz Jorgensen

Author’s note: Written by Stanford Chemist for Cash Builders Opportunities.

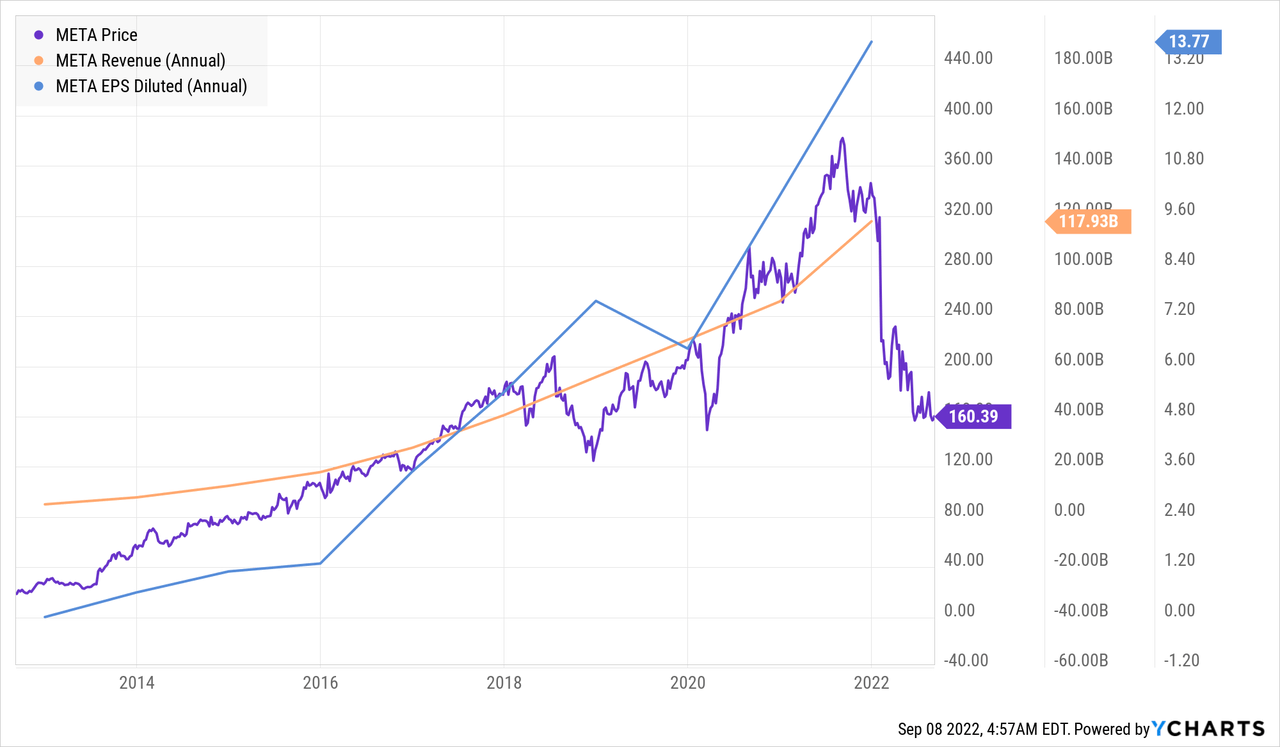

Meta (NASDAQ:META), previously known as Facebook (FB), can’t seem to catch a break. META posted both top and bottom line misses for Q2, as well as its first year-on-year revenue decline as a public company (see Meta Platforms shares sink as ‘ongoing challenges’ shake investors’ faith).

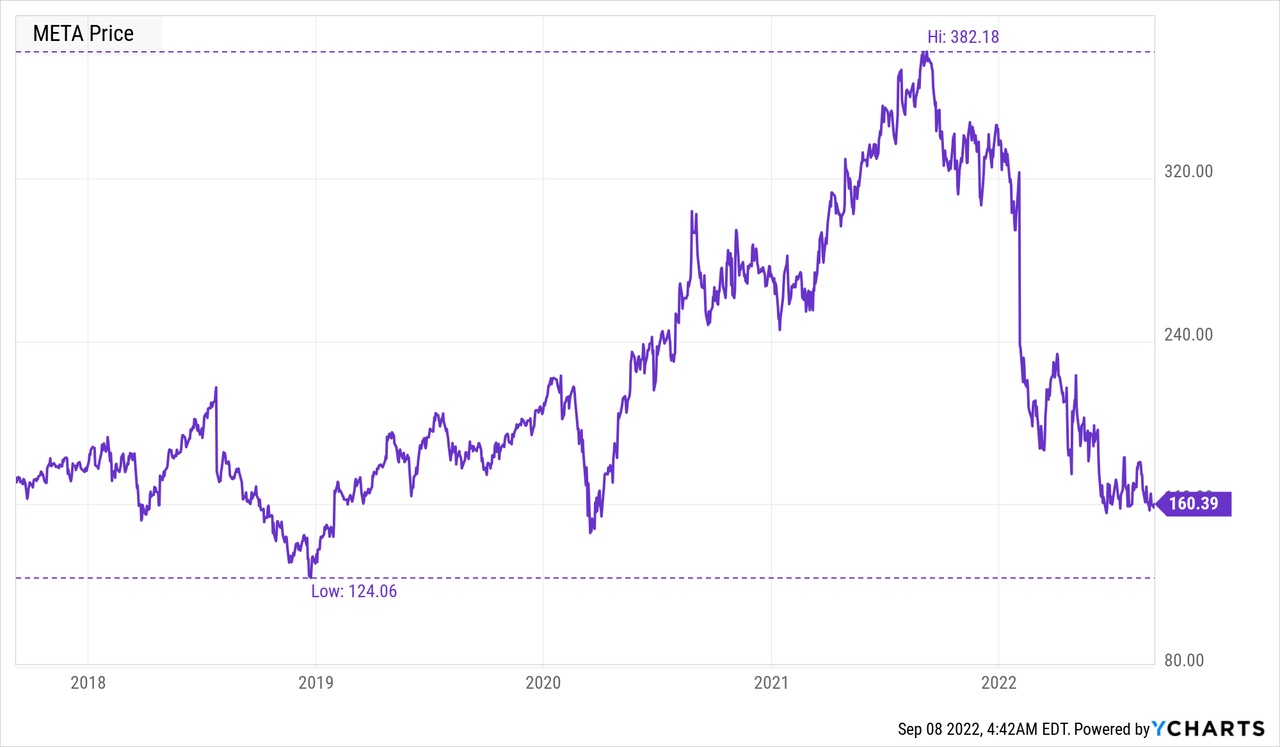

A large part of the revenue decline was due to Apple’s recent privacy settings changes that is estimated to wipe out billions from Facebook’s annual revenues. META is now trading at a mere 40% of its all-time high share price of $384 reached back in September 2021, and is only around 8% higher than its March 2020 low of $146.

Despite this, earnings growth for META is still expected to be robust, although the numbers have been revised downwards significantly since earlier this year. The consensus EPS estimates for META are $9.80 in FY2022 and $12.46 in FY2023 respectively, which would put its forward 2022 P/E ratio at 16.4 and 2023 P/E ratio at 12.9 respectively based on its current stock price of $160.39.

Option writing: win even if the stock goes down

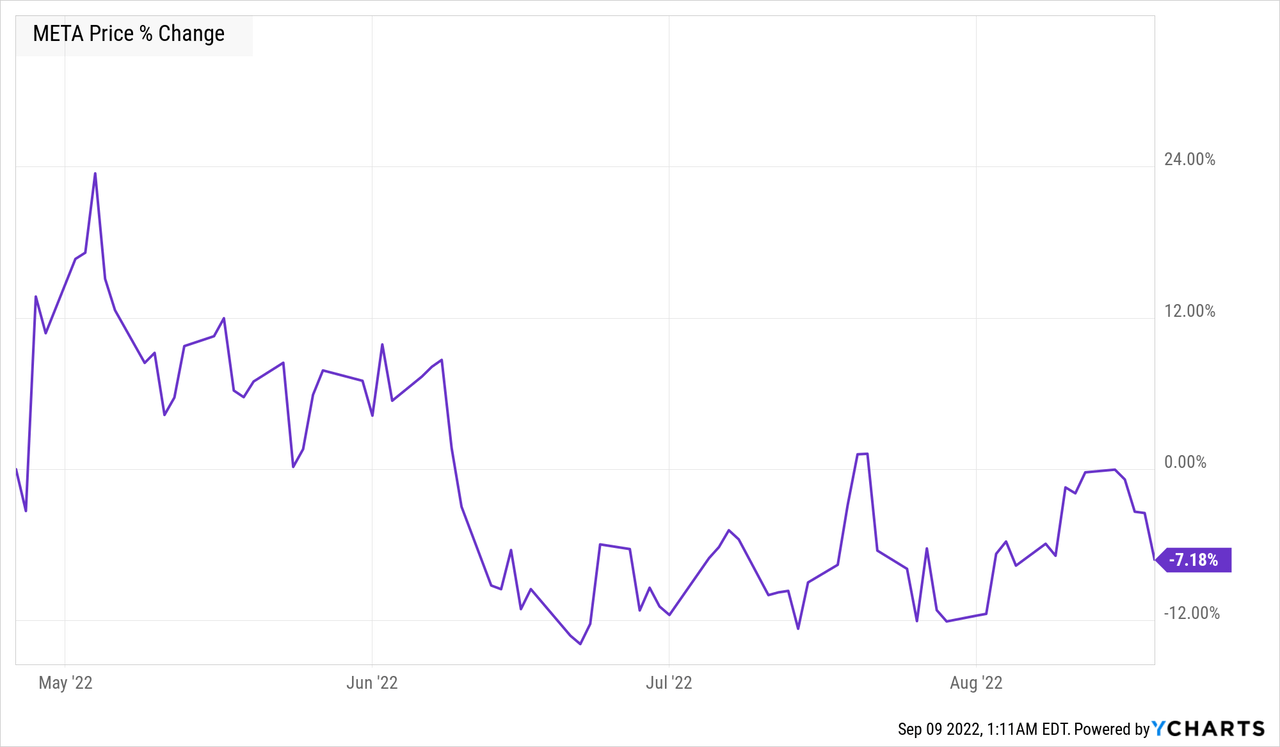

In April, we shared in the members’ area of Cash Builders Opportunities a put idea on META (then FB), when the stock was trading at around $181. This August 19, 2022 $130 put expired safely out of the money last month, allowing us to pocket the entire premium yield of $4.95 (or $495 per contract), equating to an annualized premium yield of 12.2% on cash.

It is instructive to note that META closed at $167.96 on the expiry date of the option. In other words, the stock was down by -7.4% since we wrote the put (or a loss of -23.6% annualized), yet our put option trade gained +3.8% (+12.2% annualized) in cash returns. In fact, META could have dropped to as low as $130 (the strike price) by expiry date, some -28% below its share price of $181 when the put option was established, and we’d still gain the entirety of the option premium with a double-digit annualized return on cash.

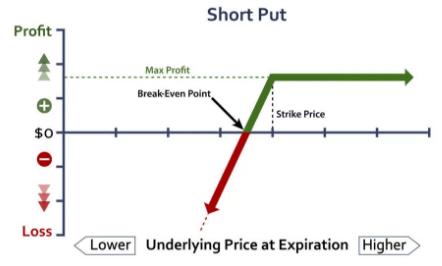

This illustrates a very powerful advantage of option writing. Even if you get the direction of the move wrong, you can still make significant profit as long as the strike price of the option is not hit by the date of expiry due to option time decay, as shown in the option expiry payoff diagram for a short put option below.

Digital Blogger

Put option trade

With META still trading close to its year-to-date lows, the time is still ripe to reload on short META puts.

I chose the $120 put expiring December 16th, 2022, for this put idea. $120 is around –25% lower than the current share price of $162.50, and is also significantly lower than the March 2020 low of $146. In fact, the last time that META traded below $120 was in the early days of January 2017, when META’s revenues and earnings were a fraction of where they are now. META would be very cheap at $120, and it would be a price that I would be happy to go long the stock at. At $120, the forward 2022 and 2023 P/E ratios would be 12.2 and 9.63, respectively.

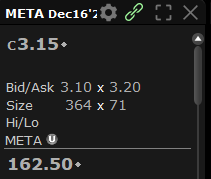

As of writing (September 8, 2022), the $120 put expiring December 16, 2022 can be sold for $3.20, corresponding to an annualized yield of this put option is 9.93% on a cash-secured basis.

Interactive Brokers

More conservative investors may favor the bull put spread. By simultaneously selling the $120 put for $3.20 and buying the $110 put for $1.95, the net credit is reduced to $1.25 whilst the maximum loss is decreased to $8.75. Moreover, the annualized return rises to 47% if your broker reduces the cash requirement of the spread to the difference in contract values.

The trade will lose money if META declines below the breakeven point of $116.80 by December 16, 2022, which is calculated as the strike price minus the option income received. Hence, investors should be comfortable being assigned META stock at a cost basis of $116.80 (-28% discount to the current share price) as the worst-case scenario.

Summary

In summary, this cash-secured put idea provides either 9.93% annualized yield on cash or the opportunity to buy META stock at $116.80 by December 16, 2022.

Be the first to comment