da-kuk

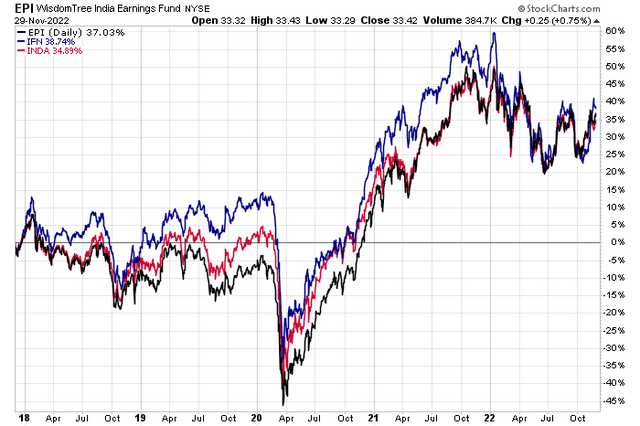

Foreign stocks are having their best month versus the S&P 500 in the last 15+ years. One niche – India equities – were up against U.S. markets, but the group features relative modest weakness against some other hot emerging markets over the last several weeks. Much attention has been on its northern neighbor, China, as that nation might let go of its strict zero-Covid and lockdown policies.

3-Month Country ETF Relative Performances: India Beats SPX

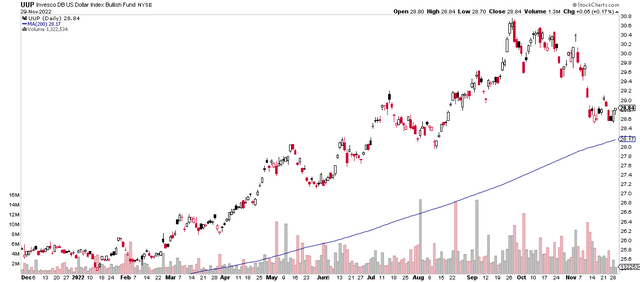

More broadly, a weaker U.S. dollar is a boon to ex-U.S. shares, particularly emerging markets. All global investors should keep their eyes on how the greenback performs in the coming months as a telltale sign of how international stocks do against the S&P 500. For now, the dollar is above its rising 200-day moving average, which is bullish, but the index is sharply under its high from more than two months ago.

U.S. Dollar: Off The Highs, Above 200dma

Jumping back into the India market, the India Fund (NYSE:IFN) aims for long-term capital appreciation, which it seeks to achieve by investing primarily in the equity securities of Indian companies, according to the India Fund ABRDN.

IFN has a high 1.35% annual expense ratio, which is a major concern for me. With just $510 million in total assets under management and under 90,000 of shares traded on average over the past 90 days, the size, liquidity, and tradability of IFN are questionable. Right now, IFN trades at a 5.84% discount to its per share net asset value. While that is enticing, the gap can always grow – a risk for its holders.

What makes IFN different from other more well-known India funds is that it is a closed-end fund and features a massive 10.5% market distribution rate. The fund recently declared an exceptionally big $1.61 dividend. Still, over the past five years, total returns among the various India equity products are comparable. For that reason, I lead toward simply owning the largest and most liquid India ETFs, which also might have less of a tax impact.

IFN Versus Other India ETFs: Similar Performances

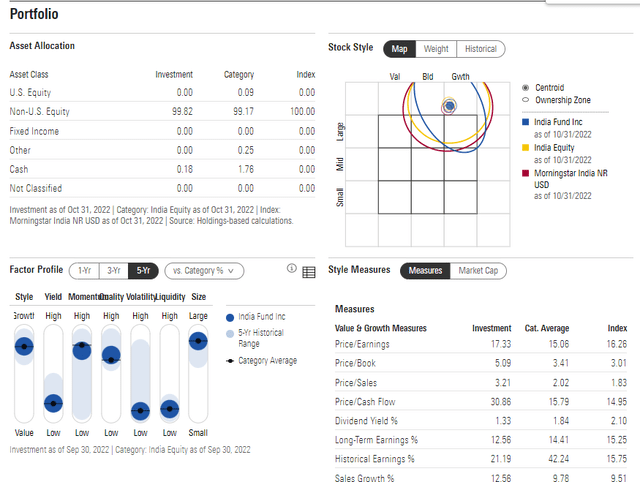

According to Morningstar, IFN is a large-cap growth ETF, arguably even a mega-cap CEF. It features high momentum and quality along with low volatility and liquidity when assessing the factor profile. With an estimated price-to-earnings ratio north of 17, it is not a cheap group of stocks, but its earnings growth rate is solid in the double digits.

IFN: Factor Profile & Portfolio Statistics

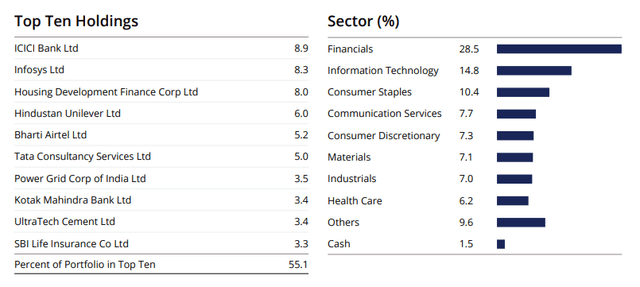

IFN is 28% in Financials and 15% in Information Technology. That gives it a bit of a barbell value and growth exposure. Health Care and Discretionary are relative underweights compared to the S&P 500. With just 40 total positions, the top 10 holdings represent a high 55% of the CEF.

IFN: Top Holdings & Sector Weights

The Technical Take

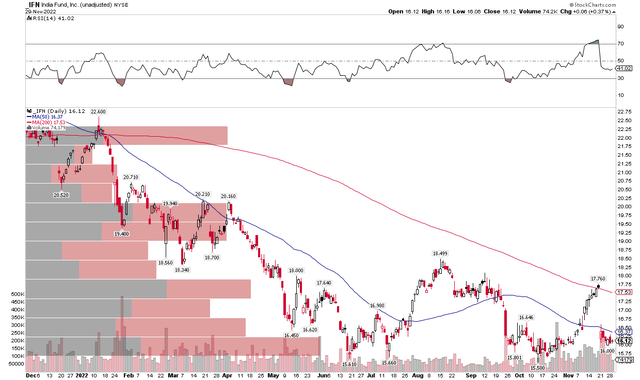

The price chart (not including dividends) is bearish, with shares trading under IFN’s falling 200-day moving average. If we include dividends, the latest price is simply back to its August and September highs, but that’s better than how broad emerging market ETFs have performed. Overall, though, the trend is down and IFN is simply keeping pace with other India funds. I see resistance near $18.50 while $15.50 is support. With such a high yield, however, I would place less emphasis on the price-only chart.

IFN: Trending Lower, But Investors Are Paid Along The Way

The Bottom Line

I prefer owning lower-cost India ETFs over IFN. Its high annual expenses and concentration are concerns, and recent years show performance is simply comparable to other popular India equity products.

Be the first to comment