Bill Pugliano

Dow Inc. (NYSE:DOW) has been one of the worst performing components of the DJIA, down over 20% YTD, which is over 250 basis points (“bps”) worse than the broader index. Currently, it is trading just above its 52-week lows and at a forward pricing multiple of just 6.0x, which is a steep discount to both its historical average and the market at large.

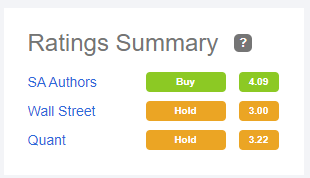

Amplifying the woes is a series of downgrades from various Wall Street analysts, including from KeyBanc, JPMorgan, and Jefferies. A poor global outlook marked with slowing growth, escalating geopolitical tensions, and currency misalignment are just a few items on the list of concerns, which are particularly pronounced in a wide-application stock such as DOW.

Seeking Alpha – Ratings Summary of DOW

The steep pullback has resulted in a prime buying opportunity for long-term investors seeking significant share price upside potential, in addition to attractive reoccurring dividend payouts. DOW’s global leadership position and massive scale position it strongly to maintain current EBITDA levels and to weather any further setbacks in the macroeconomic environment.

Company Profile

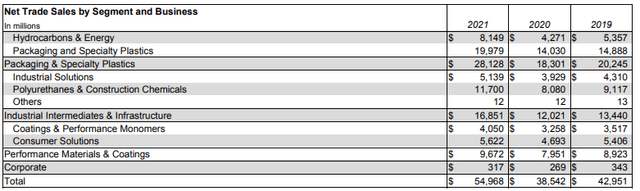

DOW is one of the top three chemical companies in the world by sales, behind Germany-based BASF and China’s Sinopec. With 2021 net sales of +$55.0B, they are the largest in North America.

Their operations are conducted worldwide through six global businesses in three primary operating segments: Packaging & Specialty Plastics; Industrial Intermediates & Infrastructure; and Performance Materials & Coatings. These segments represent approximately 50%, 30%, and 20% of total revenues, respectively.

2021 Form 10-K – 3-YR Net Sales Disaggregation

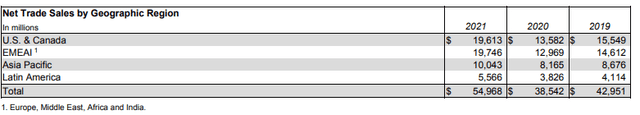

Geographically, their operations are spread evenly across the U.S. & Canada, EMEAI, and Rest of the World.

2021 Form 10-K – 3-YR Net Sales Disaggregation By Geographic Region

As one of the largest global chemical companies, they have leadership positions in a vast spectrum of commodity and specialty chemicals, including ethylene and polyethylene, to name two. Competitors include similar-sized global chemical producers, such as BASF (OTCQX:BASFY) and LyondellBasell Industries (LYB), as well as globally integrated energy companies, such as Exxon Mobil (XOM) and Shell (SHEL).

Key competitive strengths over their peers include their extensive low-cost feedstock positions around the world and their size, scale, and market reach, with world-class manufacturing sites in every geographic region. While there are many other North American producers who are within the competitive landscape, most lack the scale and brand recognition possessed by DOW.

The Fundamentals

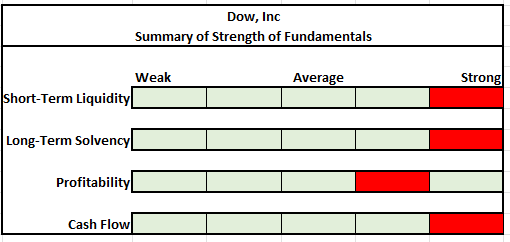

Author’s Summary Of Strength of Fundamentals

Over the past year, DOW has made material strides in strengthening their balance sheet. In 2021, they repaid over +$2.5B in debt and lowered their target leverage level to between 2.0x and 2.5x from 2.5x to 3.0x. In addition, they reduced their pension obligations to about +$3.0B and scaled back their guarantees for Sadara’s debt by +$2.5B. Overall, since their spin-off, they have reduced gross debt by more than +$6.0B. Moving forward, they are likely to continue paying down additional debt at a more moderate pace.

At present, their balance sheet includes a total cash balance of +$2.4B and available liquidity of +$12.2B. In addition, they have less than +$1.0B in debt maturities over the next five years. This represents a reduction of +$7.0B in near-term debt since their spin-off.

More impressive, their interest coverage ratio was over 12.0x. This is up drastically from the single-digit coverage levels prior to 2021. Even more, their debt composition is 100% fixed rate, thereby minimizing the risks stemming from rising interest rates.

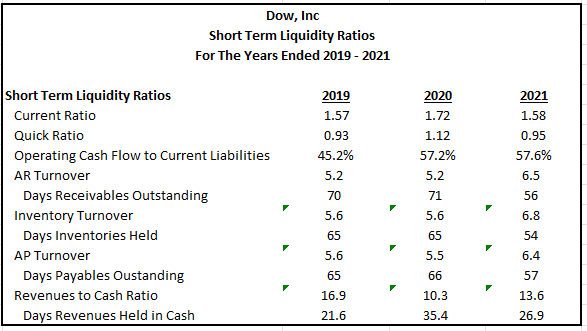

There are clearly no debt-related risks at present. And consistent with prior years, there were no indications on the current earnings report of any setbacks in their short-term operating metrics relating to liquidity.

Author’s Calculations Of Various Short-Term Liquidity Ratios

Leverage targets should remain supported by continued EBITDA strength that is being lifted by higher crude oil prices, which increases their North American feedstock advantage. While there has been a pullback in oil prices since their earnings call, they are still at elevated levels and are likely to stay higher for longer due to an uncertain supply outlook, given underinvestment in the U.S., the ongoing conflict in Europe, and the eventual need to refill the strategic petroleum reserve (“SPR”), which has been depleted as part of the Biden Administration’s emergency authorization to lower gas prices.

Total net sales were up 13% in Q2FY22, with gains in all operating segments and regions. They were also up 3% on a sequential basis, with gains in all regions except Asia Pacific, which was weighed down by the continuing pandemic-related lockdowns in China. Overall margins, however, were negatively impacted by higher raw material and energy costs. This resulted in a +$450M decline in operating EBIT from the same period last year.

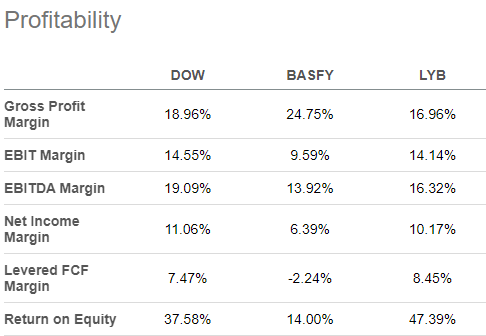

Despite the pullback in margins, DOW still compares favorably against both BASFY and LYB, with EBITDA margins that are over 270bps higher than those put out by LYB.

Seeking Alpha – Profitability Metrics Of DOW Compared To Competitors

Declining naphtha prices are likely to reduce its price differential with ethane, which would reduce DOW’s feedstock advantage in the coming periods. But this shouldn’t impede overall EBITDA from staying above +$9.0B, a key level that should support current leverage targets and cash flow priorities.

Over the last six months, DOW generated +$2.7B in free cash flow (“FCF”). And this is a continuation of strong FCF generation over the last several quarters. They are also maintaining average FCF margins in excess of 5%, while also producing a conversion rate of 56% in the first half of 2022 versus 31% last year.

The strong cash generation is enabling the payout of over +$2.0B a year in fully-covered dividends. In addition, in Q2 they initiated a new +$3.0B share repurchase program, with a target of returning 65% of operating net income to shareholders over their economic cycle. For income investors, these payments are highly attractive at current levels, yielding over 6%.

Risks To Consider

DOW is one of the most macro-related stocks due to the wide application of chemicals in daily life. As such, their current and future performance is more closely related to current business cycles than other publicly traded companies.

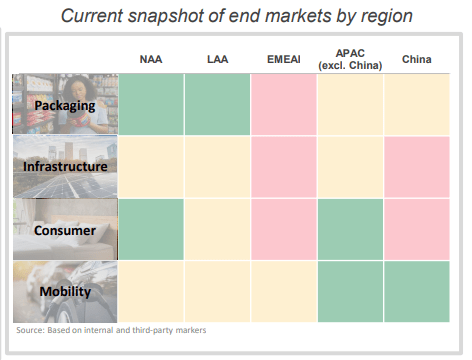

Currently, the outlook appears negative. While economic conditions in the U.S. are measurably better than in the Eurozone and China, where key indicators, such as PMI, have slipped into contractionary territory, the landscape appears to be deteriorating at an accelerating rate. Rising rates and declining sentiment are two headwinds, as is the continuing prevalence of higher input costs in the face of slowing end-market demand.

September 2022 Investor Presentation – Snapshot Of Economic Conditions By Geographic Region

In Europe, there is an increased risk of a severe disruption to gas supply, given current escalations. If gas ends up being rationed as a result, this could significantly affect DOW and other North American chemical companies.

Continuing strength in the dollar will also weigh on earnings in future periods. Already, currency effects resulted in a 3% YOY decline in net sales in the current period. And since then, the dollar has pushed even further into record territory. Looking ahead to Q3, investors should expect a sizeable sequential currency impact of at least 5% on net sales.

Though DOW has generated consistently strong FCFs, increased capital spending (“CAPEX”) on sustainability-related projects may reduce financial flexibility, especially when considering the sizeable dividend payout. Relative to depreciation and amortization, CAPEX is projected to be about 72%. This would be up from 55% in 2021. If a downturn accelerates at the same time DOW is ramping up spending, this could constrain their flexibility and jeopardize their efforts in returning cash to shareholders.

Valuation and Conclusion

DOW’s 3-YR EBITDA is more than +$9.0B, and they have nearly tripled their cumulative FCF since their spin-off. Yet, the stock trades at a forward pricing multiple of just 6.0x and is being battered by downgrades and investor flight due to rising threats to the global economy. These concerns are not unfounded, but they are overdone.

The company is a global leader with massive scale. Though their exposure to Europe is a risk, their access to comparatively low-cost North American natural gas-based feedstocks is a natural hedge. Oil prices that are likely to stay higher for longer is a further tailwind that should support overall EBITDA levels in excess of +$9.0B.

Assuming a long-run FCF growth rate of 3% and a CAPM-derived cost of equity of 11%, with stabilized revenue growth of 5%, shares would be worth approximately $80 using a benchmark yield of 4% and $65 using an even higher benchmark of 5% in a 10-YR discounted FCF model.

When considering their current price to historical multipliers of sales, cash flows, and book value, shares would also be intrinsically valued between $60-$70. All considered, a fair value of $65 would be most appropriate for DOW. This would imply upside potential of over 40% to current trading levels.

For investors seeking a true value addition to their long-term portfolios, DOW is one that is worth a core holding.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment