JHVEPhoto

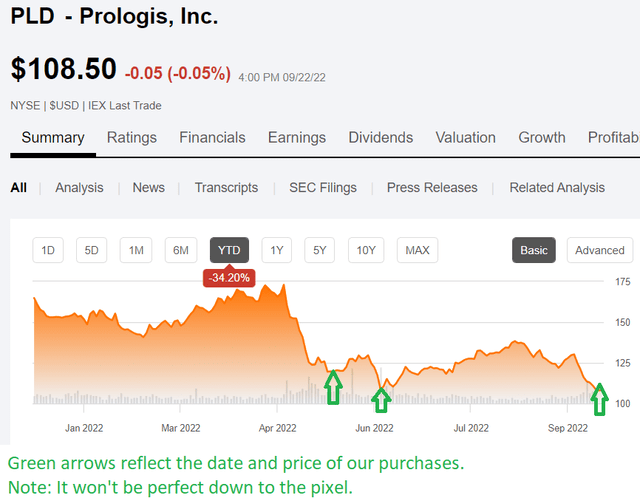

Prologis (NYSE:PLD) is becoming one of our larger positions. We bought shares 3 times over the last several months. Those purchases have all been between $108 and $119, so we’re only down a little bit. PLD has plunged year-to-date, but the fundamentals are still improving. The decline is driven by a general “risk off” sentiment as investors face the pending (or present) recession. The decline and the recession are both driven by monetary policy as the Federal Reserve pushes rates higher.

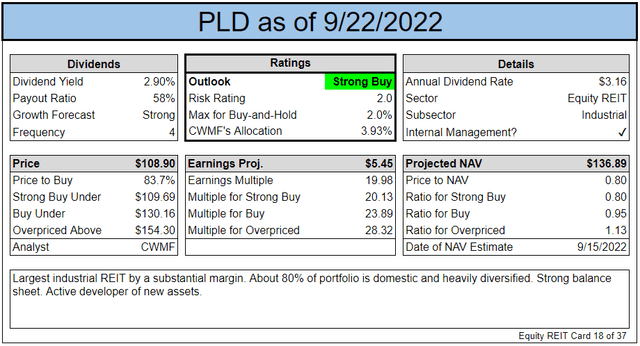

That doesn’t have a dramatic impact on the fundamentals of the REIT. Investors in PLD are not focused on the dividend yield they get today. They are focused on the dramatic growth in cash flows that is on the horizon. Look at these fundamentals and see if you agree with me: Prologis is a strong buy.

Cash Flow Growth

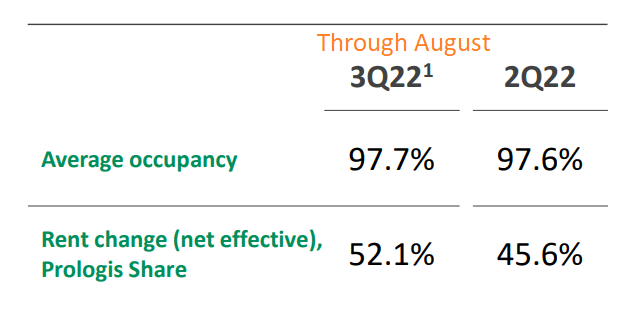

AFFO per share (the REIT metric for cash flow) is primarily driven by growth in same store NOI (Net Operating Income). PLD projects that simply renewing all existing leases to market rates would drive NOI higher by 56%:

Leases are typically in the 5-to-7-year range for industrial real estate. Due to the combination of embedded rent bumps and the big spreads on new leases, PLD is looking to average high single-digit growth in same store NOI for several years. That’s without any growth in market rates.

If market rates continue to increase (which is exactly what they are doing), the leasing spreads increase even further.

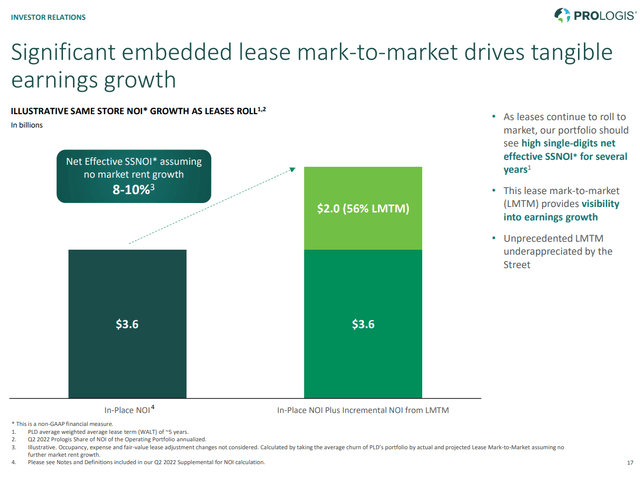

To put this in perspective, PLD’s rent change on renewals and new leases has been excellent:

Net effective rents up 45.6%. Cash rents up 27.5%. These spreads are trending higher, not lower.

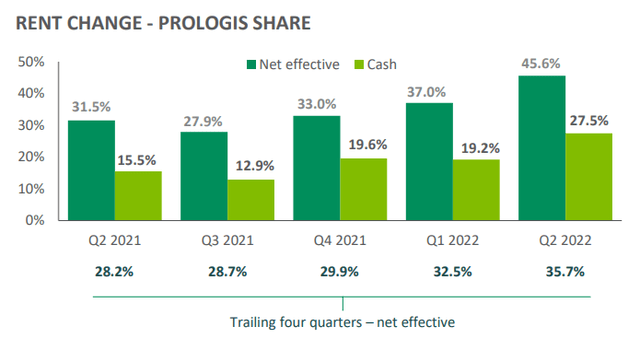

Think Q3 2022 is going to break the trend? Think again. PLD told analysts what to expect based off results through August 2022:

PLD

So instead of shrinking, leasing spreads are improving as market rents for industrial real estate climb even faster than before. As the stock market plunged, market rent or industrial real estate only went higher.

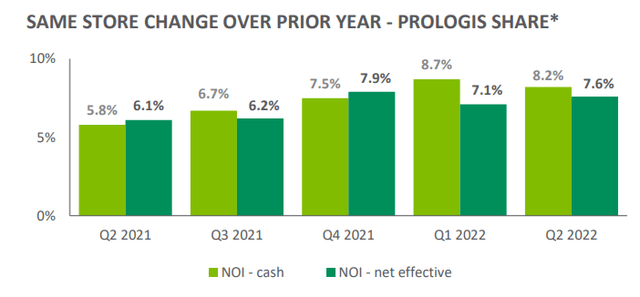

PLD says these higher spreads would drive high single-digit growth rates in same store NOI. The evidence supports that assessment:

As PLD posted excellent leasing spreads, they’ve been delivering monstrous growth in same property NOI.

Limited Supply

Industrial real estate supply isn’t growing quickly.

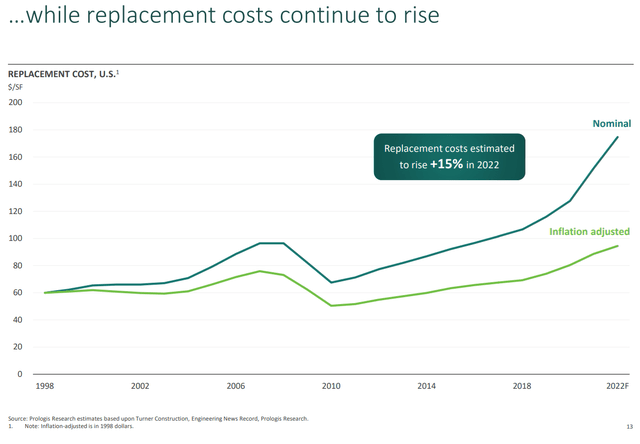

Replacement costs for industrial real estate continue to move higher:

With those costs going up, supply will almost certainly remain constrained.

Tenants could choose to not renew the lease. That would let the tenant reduce expenses. However, they won’t be able to ship product to their customers unless they find another property. That’s not easy to do when the biggest landlords, like PLD, have occupancy above 97.5%.

The tenant can renew at higher rates, or the tenant can close. Those are their options. If they close, a new tenant pays the higher rent.

How can tenants afford it? Industrial real estate is actually quite cheap as a percentage of the total cost of goods sold. Even if industrial rents continue to rise, it doesn’t represent a large enough cost to be the deciding factor for most tenants.

Strong Investment

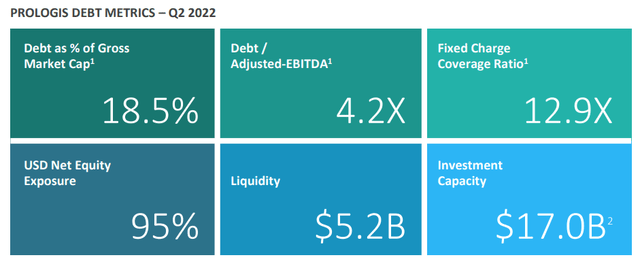

We don’t like equity REITs with high leverage. Those are the equity REITs that go bust during a downturn. PLD does not have high leverage.

That is excellent. Some investors might think debt-to-adjusted-EBITDA of 4.2x is only a bit better than a typical REIT. However, that would ignore that PLD’s EBITDA comes from properties that trade at dramatically lower cap rates.

Let me put this in perspective. If you own crappy malls with debt-to-EBITDA at 4.2x, you might have negative equity. Those properties trade at very high cap rates because they are junk. The NOI plunges rapidly and drives EBITDA lower. They are the exact opposite of PLD.

Because PLD’s properties are in demand with huge leasing spreads and quickly increasing market rents, the properties trade at low cap rates and generate very strong growth.

PLD currently trades below the net value of their assets, though that isn’t always the case. So, when debt is only 18.5% of their gross market cap, debt relative to the fair market value of assets is a bit lower.

If you owned around $120 billion of assets (at fair market value, not at historical depreciated cost as reported under GAAP) and had less than $21 billion of debt, would you consider that leverage high or low? I’d say that is pretty low.

AFFO Growth Rates

Based on same store NOI growing in the high single-digit range, investors should be looking for average AFFO growth rates in the double-digit range over the next several years. Because PLD has some industrial development projects involved in reporting their “AFFO”, the growth rate year-over-year can get messy. That makes it particularly important to focus in on average growth rates.

Dividend Growth Rates

Dividend growth over long periods should follow AFFO growth rates. PLD offers a yield of 2.9%. That’s lower than Treasury rates, but that’s also a pointless comparison. The appeal is that PLD should be able to easily reach a high-single digit growth and with a high probability for a double-digit average growth rate. Sound like a huge increase?

For 2022 the dividend was hiked 25.6%. In 2022, the quarterly dividend of $.79 is nearly double the 2015 quarterly dividend rate of $.40.

Plunging Price

PLD is plunging year-to-date with a 34% decrease. Over the last few weeks, they’ve been plunging again as shares fell abruptly from $130 on 9/12/2022 to only $108.50 today. That’s only 10 days (including weekends).

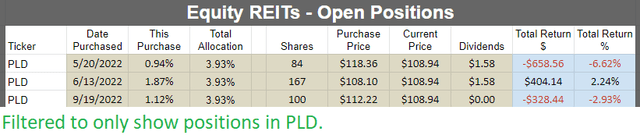

Our strategy of waiting for the plunge worked out quite well. We refused to pay the higher prices, but once shares went under $120, we started buying.

Conclusion

Prologis is a great deal around $110 per share. This isn’t about the dividend rate today. This is about generating dramatic growth over the next decade as rents increase rapidly driving same store NOI and AFFO per share higher.

Even if industrial rents stopped climbing, which has not happened, the industrial REITs would still expect dramatic growth in rents as existing leases expire. Occupancy is not a challenge. PLD is the largest industrial REIT and occupancy is above 97.5%. Demand for industrial real estate remains extremely strong and replacing existing assets is becoming even more expensive.

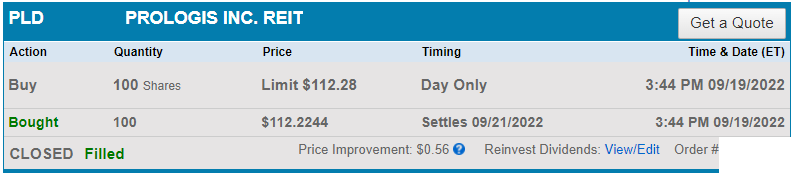

This is a structural disconnect between supply and demand that has driven rental rates dramatically higher and should continue to drive rates higher for many years. I’m taking advantage of the drop in market prices to build the industrial REIT portion of my portfolio. Our purchases are shown below:

Because we actually buy shares, rather than just “buying” them into a spreadsheet, we post the trade confirmations also:

Schwab

We view PLD as a strong buy:

Clear enough? Someone always misses the rating. Between putting it in bold and having it highlighted in green in the image, it shouldn’t be too hard to find.

Other picks? Sure. We’re also bullish on Rexford (REXR) and Terreno Realty (TRNO). Like PLD, TRNO and REXR are reporting massive leasing spreads and have exceptional balance sheets. Like PLD, TRNO and REXR should report massive growth in AFFO per share driving dividends per share higher.

TRNO and REXR trade at higher multiples, but I expect their AFFO per share growth to be even stronger.

We are also long TRNO and REXR.

Ratings: Bullish on PLD, TRNO, REXR

Be the first to comment