Ryan Herron/E+ via Getty Images

Published on the Value Lab 13/7/22

Los Angeles benefits from several structural elements such as bureaucratic creep and network affects that supports the current lattice that defines their economy, and therefore also their real estate markets. Douglas Emmett (NYSE:DEI) strikes us as an appropriate investment for the current market environment, especially with REITs offering good risk-reward in downturns. We think that the LA market is relatively resistant, and that the yield being in line with other REITs does not reflect that. While there are some minor risks, DEI looks to be an interesting prospect in the current environment.

Structural Benefits

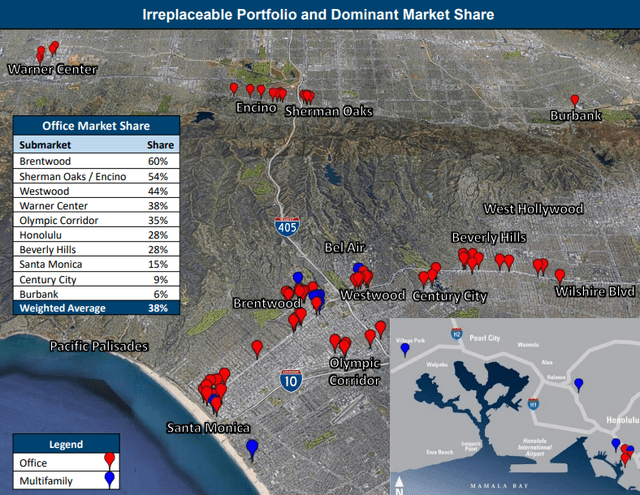

The DEI portfolio is focused almost entirely on LA, with the rest being located in Hawaii. These two markets are among the most expensive in the US and among the most expensive real estate markets in the world. The rent split between them is 90:10, and is focused on office property in LA but also multi-family properties, with all of the Hawaii properties being multifamily. Honolulu is going to be supported by a revival of tourism as the world gets tired of COVID-19, but LA has more durable structural factors that support its market.

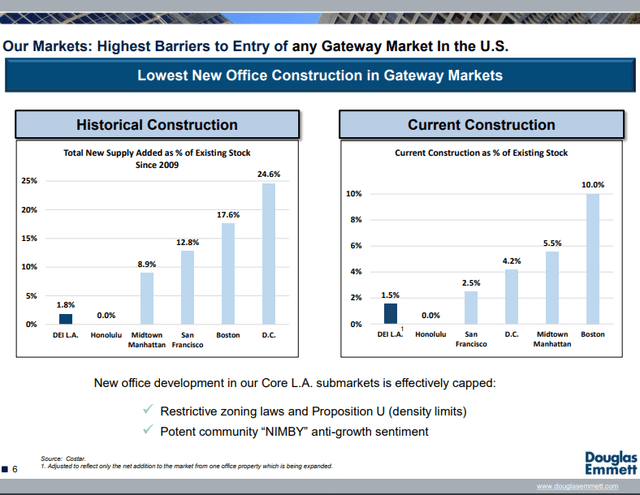

- Housing Shortage and Bureaucratic Creep – One of the most secular forces supporting LA rents is the fact that it is almost impossible to develop property there, and the nation’s housing shortage is substantially explained by LA alone, with a quarter of Californian housing deficits explained by LA. The homelessness crisis is enough of a data-point to understand the extent of the shortage, and the fact that homelessness has been an issue for LA making headlines already since the beginning of the decade, you can understand that not much has been done. There is an eternal conflict between stakeholders in every zoning approval, and betting on continued structural shortage as a result of barriers to development is as secular as betting on incompetence and bureaucratic creep. With demographic effects now also kicking in on the demand side with latent millennial family formation and other factors, as well as relatively limited state emigration that should recover with national immigration in a post-COVID era.

- Network Effects – LA’s big industries all rely very heavily on the returns to clustering. Tech development benefits from clustering, which is why China has attempted to replicate it, due to its dependence on networking to build enterprises and monetise ideas. The entertainment industry naturally also depends on network effects. This will never change, and preferential attachment just means that the clusters grow disproportionately quickly relative to smaller clusters, or at the very least are resistant to competitive decline due to higher switching costs. These industries are huge and rocket LA to the third largest in city GDP on global ranking after Tokyo and New York.

Structural Barriers (Investor Presentation DEI)

- Traffic – Another one of LA’s unsolvable problems which limits competition from other sub-markets. While Joshua Tree and other places are going from hipster to very expensive, they constitute rather different markets geographically, with the more concentrated markets operating rather independently from each other. Therefore, there are going to be limited cannibalisation effects on the split DEI portfolio.

Multi-family properties are going to be less exposed to some of the flavour-of-the-day risks like work-from-home. While WFH is a worry for some markets, LA is not going to be as exposed because in part of the traffic element. Most WFH arrangements are hybrid now and insurance as well as tax bureaucracy makes it difficult to locate yourself fully in another market or state to benefit from substantially lower prices. In the end, there is economy in being located in the city, which is also where most people want to be anyway purely from a lifestyle perspective, so that danger is limited on the multi-family portfolio.

On the office portfolio such things are a greater concern because effective on-premises headcounts will fall. Nonetheless, office real estate has not yet taken a hit, and with companies pushing for office returns, the risks are quite limited. However, if those return to office pushes fail, and lease agreements expire for rollover, companies may except the realities of their workforce’s demands and make some major changes to adapt. So this is not a totally irrelevant risk.

From an asset class perspective, REITs are solid performers both in the downcycle of a recession as well as in the market rebound, which positions DEI favourably.

Conclusions

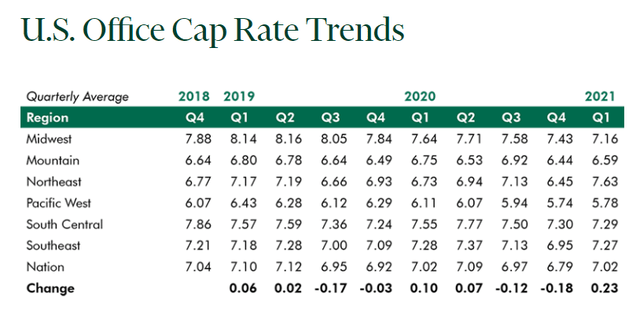

The yield is at 5%, and working off cap rates in US markets, this actually puts them 10% below the average in the Pacific West.

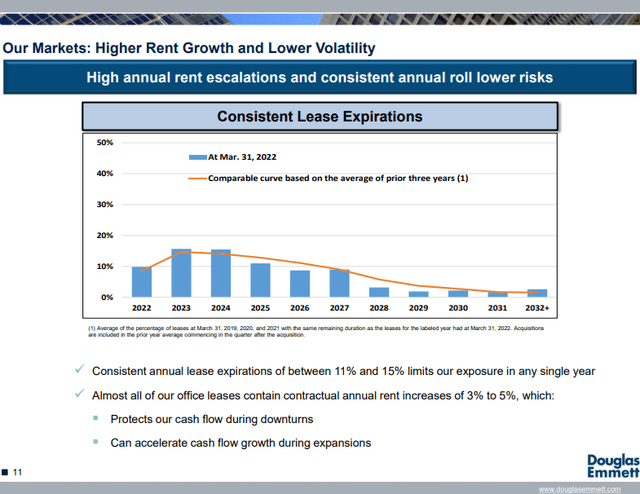

We think their exposures deserve that premium, and maybe at least that premium, so from a valuation perspective DEI is fair to good. Moreover, the cap rates provided are for direct real estate holdings, and therefore don’t value the lessened headache of holding a REIT instead. While there are some WFH risks, they seem quite limited given market direction, and we don’t care about macroeconomic risks too much even though it technically effects portfolio asset values. We are interested in yield to get a head-start on returns where capital appreciation is likely to languish, and that should be stable given the nature of lease agreements especially with offices. The lease expiration curve looks rather safe.

Lease Expiries (Investor Presentation)

Structural elements are durable and support markets, and while we’ll refrain from taking a position ourselves since we still have better ideas than this, we think for US investors and retirees the concept could be interesting. Overall, a buy.

Be the first to comment