AndreyPopov

Introduction

The booming oil and gas prices have been terrible for consumers but elsewhere, those fortunate to own direct exposure have seen their pockets lined very well, such as Dorchester Minerals (NASDAQ:DMLP) who offers a very high distribution yield of 14.14%, if continued at their most recent quarterly rate. When assessing yields of this magnitude, normally the problem stems from the risks posed by excessive leverage but in this situation, oddly their one problem is actually not enough leverage, especially given the way they pursue necessary acquisitions.

Executive Summary & Ratings

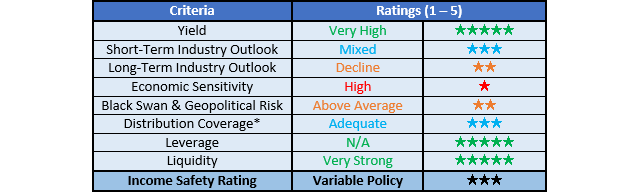

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

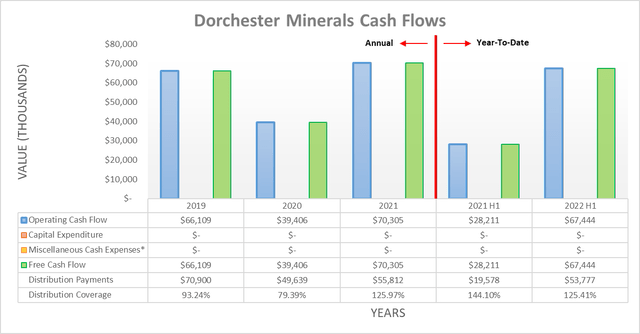

Since their entire partnership centers around oil and gas mineral rights, it was no surprise to see their cash flow performance scale up and down with oil and gas prices. Thanks to the booming operating conditions during the first half of 2022, it lifted their operating cash flow to $67.4m and thus almost matched their full-year result of $70.3m during 2021, despite being merely half the length of time.

Similar to other mineral rights partnerships, they do not incur any capital expenditure and thus as a result, the entirety of their operating cash flow is translated into free cash flow and passed along to their unitholders via variable distributions. Notwithstanding the occasional lag between free cash flow and timing of the attributable distribution payments if oil and gas prices change rapidly quarter-to-quarter, as observed during 2020 and the first half of 2022. Even though this appears to create a very desirable backdrop for income investors, given the inherent and unavoidable depletion of their assets through production, it is still necessary to acquire new mineral rights to offset production, if not preferably, grow larger across time and thus create value for their unitholders.

Interestingly, unlike virtually every other partnership, even those holding mineral rights, they do not fund their routine acquisitions via cash but rather by issuing common equity and thus as a result, their outstanding unit count climbed from 34,679,774 at the start of 2021 to reach 37,554,774 following the second quarter of 2022. There is no sign of this changing with their latest acquisition as recently as last month seeing another 816,719 common units issued, thereby boosting their outstanding unit count another 2.17% higher. Even though this may not sound significant, there are still nevertheless important consequences of this strategy, as subsequently discussed.

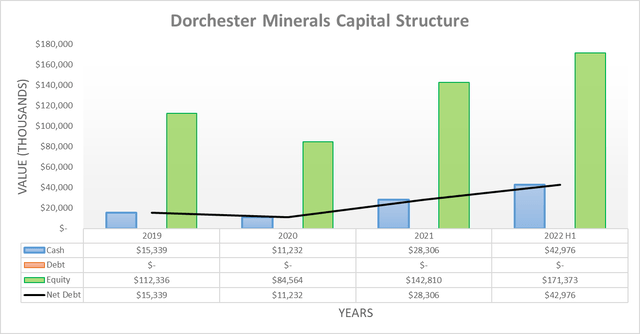

When reviewing their capital structure, it becomes apparent they never carry any debt, as alluded to earlier given their preference for funding new mineral rights acquisitions by issuing common equity instead of debt. Meanwhile, they have also refrained from issuing any hybrid securities, such as preferred units and so forth, thereby leaving them entirely capitalized via common equity, which is quite rare, especially for a partnership structure. Due to their lack of debt, they have zero leverage and thus obviously making it not only pointless but also impossible to assess.

Whilst the lack of debt may sound positive, the story does not stop here because there are other far more important implications to consider, which in my view, degrade the appeal of their units. Even though less debt equals less risks, the benefit obviously diminishes the lower it goes because put simply, making an investment safer that is already safe does not help investors and thus it does not create any meaningful value for unitholders.

If anything, their sole use of issuing common equity is actually likely doing more harm than good, in my view. It should be remembered that common equity is the most expensive source of capital and whilst yes, it does not force mandatory interest payments like debt, nothing is free in this world. In effect, its cost is their distribution yield, which averaged circa 10% during the last four years or phrased another way, it could be said their distribution yield is essentially an interest rate, given the income-focused nature of their partnership.

It should be remembered that value is not created for unitholders by growing their partnership bigger in absolute terms but rather, growing larger on a per-unit basis by undertaking investments in excess of their cost of capital. To create value for their unitholders without the use of debt, the new assets have to produce a return sufficient to not only fund a very high circa 10% distribution yield on the accompanying new common units but also leave cash in excess to grow distributions on a per unit basis. This same principle applies to the use of debt, although since debt carries a relatively lower expense, likely around the mid-single digit level, it leaves more excess cash to grow their distributions on a per unit basis, thereby creating value for unitholders versus merely growing their partnership bigger. To make matters worse, some of their acquisitions are obviously to offset the depletion of existing assets and thus not every unit issued to fund an acquisition even leads to growth in absolute terms.

In my view, they could safely afford to carry at least $100m of net debt, thereby giving a net debt-to-operating cash flow of only 1.43 if utilizing their far lower operating cash flow during 2021, which is a conservative assumption. Given their cash balance of $43m, this would see upwards of $150m of debt issued to acquire assets, which could make a very large difference given their existing portfolio of oil and gas properties cost $453.8m before accumulated depletion, as per their latest balance sheet.

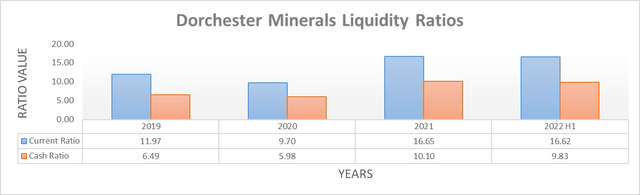

Following their lack of debt, it was only natural to expect solid liquidity, although the extent was still surprising. Since they carry almost no liabilities of any nature, it sees a current ratio of 16.62 and a cash ratio of 9.83, which are seldom ever seen elsewhere and in fact, after publishing over 500 of these analyses across the last few years, I do not recall ever seeing results of this magnitude. Whilst the lack of debt is not ideal for creating unitholder value, at least it facilitates very strong liquidity but this alone does not resolve this issue.

Conclusion

Nothing is free in this world and to this point, whilst issuing common equity to fund acquisitions removes financial risks, it also carries the greatest cost that makes it far more difficult to create value for unitholders. I would not wish to see them overleveraged, although I nevertheless feel their sole use of issuing common equity unnecessarily hinders creating value for their unitholders and thus I believe that only a hold rating is appropriate, despite their very high double-digit distribution yield.

Notes: Unless specified otherwise, all figures in this article were taken from Dorchester Minerals’ SEC filings, all calculated figures were performed by the author.

Be the first to comment