RiverNorthPhotography

Levi Strauss (NYSE:LEVI) has delivered impressive results in the last quarter, but the company is still a somewhat risky investment. At first glance, the business seems undervalued, with a target price of about $20, which suggests a potential upside of about 33%. Although the numbers may indicate considerable upside potential, this may not be the case in the current market environment.

The revenue estimates for the rest of the year and the start of 2023 suggest negative growth as consumers fear high inflation and cut their spending. Earnings per share are also expected to take a significant hit, with Q4 EPS anticipated to be down 26.9%. If Levi suffers multiple compression, I believe the stock could go down to as low as $13.50 or lower, trading at a forward P/E ratio of 9.

Latest financial results

The revenue in the third quarter of fiscal 2022 was up 1% from about $1.5 billion in 2021 to $1.52 billion in Q3 of 2022. Even if this may seem like negligible growth, sales were 7% higher in constant currency. The business also had between $30 and $40 million of missed sales due to supply chain disruptions, primarily in the U.S, which could have added up another 2% to 3% of growth.

On the other side, earnings per share came at $0.40, beating market expectations by $0.03, but the results are down by 8% compared to last year.

The challenging operational environment and currency headwinds had an impact on the business. Gross margin came lower to 56.9% compared to 57.6% last year. The same happened to the operating margin, which also fell by 240 basis points to 12.4% and 200 basis points on a constant currency basis.

The stock market did not like the news as the shares opened the day at $16 and closed at $14.8 a share or 7.5% lower on the same day.

The CEO of the company Chip Bergh has mentioned that despite the macroeconomic backdrop remaining unpredictable in the near term, the company has a robust and well-diversified business model which is well-positioned to deliver on the long-term objectives.

I believe this to be true, but I still see a lot of factors that could hurt the share price even further in the next six months to a year, of which investors should be aware.

LEVI is in trouble

There are two reasons why I believe the company is not worth investing in. So, let’s start with the most obvious one.

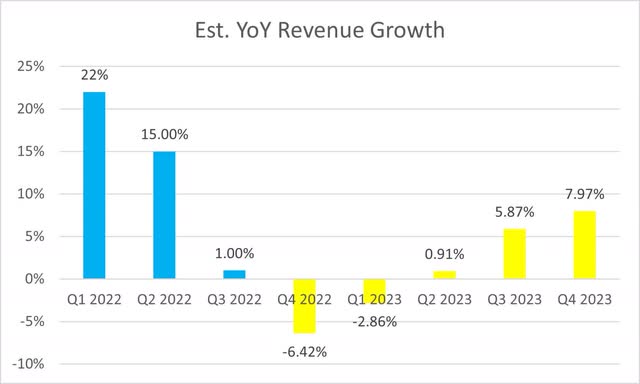

Despite its impressive revenue growth of 22% and 15% during Q1 and Q2, Levi’s is slowing down. The current macroeconomic slowdown has already impacted the business, and the third quarter results are proof of that. The company posted revenue growth of just 1% in the current quarter, and with the unpredictable business environment, management felt it necessary to revise their business guidelines.

Levi’s corrected its revenue guidance downwards from previous revenue growth expectations of between 11% and 13% down to 6.7% and 7%. Given the strong growth at the start of the year, this could only mean that Q4 will see negative growth. The latest estimates among analysts suggest a negative 6.42% revenue growth for Q4 of 2022 and a negative Q1 of the next fiscal year.

LEVI’s revenue growth estimates (Seeking Alpha)

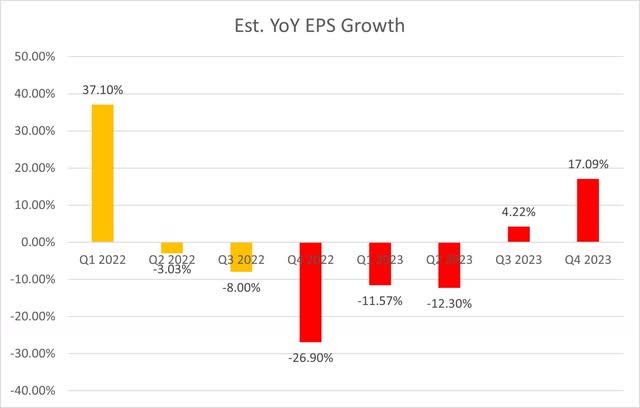

The management has also revised their net earnings projections, which have fallen from between $1.50 and $1.56 per share to between $1.44 and $1.49.

Earnings per share are estimated to take a hit in the short term, with analysts calculating earnings per share going down by 26.9% year on year in Q4 of 2022. As seen from the chart below, earnings per share of Levi are estimated to remain negative until Q2 of 2023 compared to the current fiscal year, pressured by the challenging macroeconomic environment.

Estimate YoY EPS Growth of LEVI (Seeking Alpha)

These two factors combined, negative revenue and EPS growth, could result in multiple compression taking the stock price even lower.

The Conference Board Consumer Confidence Index is the second factor that could suggest trouble. The index dropped to 102.5 from 107.8 in October, retreating after it had advanced in August and September. This suggests that the economic growth slowed in Q4. Furthermore, higher borrowing costs risk slowing purchasing of expensive products like houses, vehicles, and appliances as the Federal Reserve hikes interest rates to fight inflation.

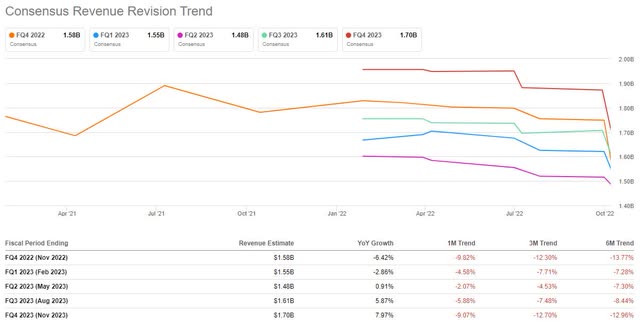

The negative sentiment towards the business can also be seen in the revisions analysts have done to Levi’s revenue earnings per share outlook. It makes me think that it is only a matter of time before we see a steady decline in the stock price.

Levi Consensus Revenue Revision (Seeking Alpha)

Valuation

Levi Strauss currently trades at $15.18 a share. At first glance, the company seems undervalued, with a target price of about $20, which suggests a potential upside of about 33%. Furthermore, during 2019 and 2021, the firm traded at a P/E ratio of 17 and 21, respectively, compared to today’s projected forward P/E ratio of just 10.4. Admittedly, the numbers may suggest a considerable upside potential, however I believe this may not be the case in the current market environment.

Consumers plan to cut spending to cope with the rising costs of living and eating out, and fashion is among the two main categories. Such a slowdown could harm the stock and the P/E ratio multiple, taking it to a P/E ratio in the high single digits.

If we look at companies such as Nike (NKE) and Ralph Lauren (RL). They also trade a significant discount on their target prices as well as with significantly lower P/E ratios than their historical average.

Furthermore, the same goes for the retail space, which has seen even more pain. Luxury retailers such as Nordstrom (JWN), Dillard’s (DDS) or Macy’s (M), which generally trade at a P/E ratio of anywhere between 11 and 15, are trading at anywhere between 5 and 9 forward P/E ratios. These companies face the same challenging environment and are struggling to surpass the financial results from last year.

With projected earnings per share of about $1.50 and a multiple in the high single digits, this suggests a price of $13.50 per share or downside risk of approximately 11%

Conclusion

I believe the apparel stocks will likely fall further to multiples similar to the department stores as both industries face similar challenges. As the Fed attempts to slow down inflation, damaging the economy is inevitable. In my opinion, it will take at least a couple of years until consumer spending and confidence return and make a stock such as LEVI a good investment.

Be the first to comment