NiseriN

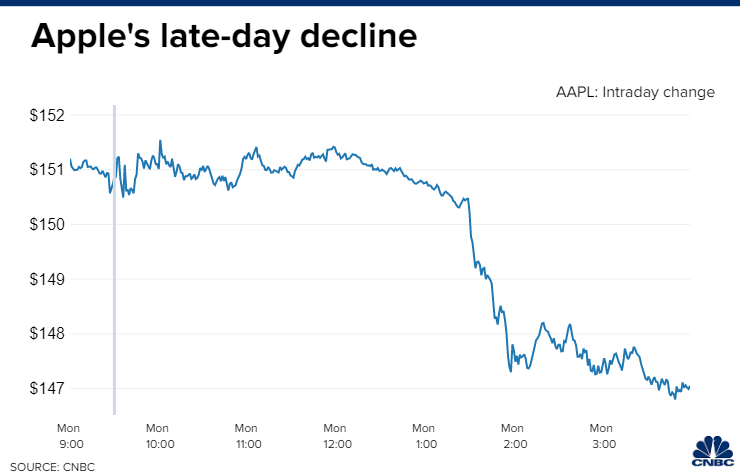

Stocks soared out of the gate at yesterday’s open, following Friday’s surge, on more impressive earnings results from the financial sector. That encouraged investors to add risk back to their portfolios, as every sector of the S&P 500 was up more than 1%. Enthusiasm waned midday when Bloomberg reported that Apple (AAPL) plans to slow its pace of hiring and spending next year in certain divisions of the company in anticipation of an economic slowdown. This is according “to people with knowledge of the matter.” That was all it took to send stocks reeling again, as investors interpret any measure of slower growth as a canary in the coal mine to recession. As you might expect, I wholeheartedly disagree.

Finviz

This was hardly an official corporate update, which we will have when Apple reports earnings on July 28. Even if it is true, it is not a plan to shed employees or cut capital spending, but slow the pace of growth in both for certain lines of business, due to uncertainty about next year. This hearsay looks more like fearmongering by short sellers who are afraid the market is on the cusp of a rebound, which was not the case for IBM (IBM) after the bell, reporting better-than-expected profits and affirming previous guidance. The CEO asserted that the company was not seeing any impact of an economic slowdown. Unlike the Apple report, this is from the horse’s mouth.

CNBC

Fears about any deterioration in the labor market are understandable, considering the warnings that Wall Street economists and strategists are raising in advance of second-quarter earnings. Nancy Lazar is a highly respected economist at Piper Sander, who I have been following since I started in the business in 1993, but I strongly disagree with her outlook for the year ahead.

According to her interview in Barron’s over the weekend, she believes a recession will start in the current quarter. Consumers’ real incomes are falling, and their net worth has declined due to the bear market in stocks and bonds. They are also spending down their savings. That means that companies will not be able to continue passing on price increases. In an effort to cut costs and protect profit margins, corporations will be forced to start laying off workers, which explains the market’s sensitivity to rumors from the likes of Apple. She expects the labor market to deteriorate rapidly, resulting in an unemployment rate of 5%. She also does not see a recovery from the recession expected to start now until the second half of next year.

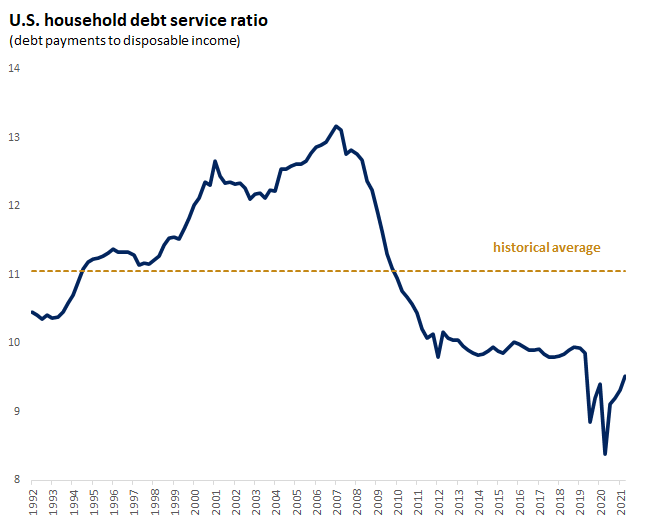

I understand the logic here, but it is based on a false set of assumption in my opinion. The most important being that the consumer is in a vulnerable position. That is clearly not the case based on the facts, as well as recent commentary from corporate leaders. The unemployment rate and weekly jobless claims remain near historically low levels with more than 11 million job openings. We have wage growth of better than 5%, while consumers are still sitting on more than $2 trillion in savings. Most importantly, the ratio of debt service payments to disposable income for the consumer remains near a historically low percentage. The consumer is in great shape to weather this storm of elevated prices, which is already starting to abate.

Edward Jones

Executives at the nation’s largest consumer bank seem to agree. During Bank of America’s (BAC) earning calls yesterday, CEO Brian Moynihan informed investors that “despite worries of a slowing economy…our customers’ resilience and health remains strong.” Defaults rates remain at historically low levels and the bank’s customers are “paying off their debt at a good clip.” Furthermore, the executives asserted that customers have increased spending, while also maintaining elevated deposit balances.

The consensus on Wall Street wants Main Street to brace for an economic downturn, but I think it is a very bad idea to buy into the pessimism. If the facts on the ground change, then so will my outlook.

Be the first to comment