Vasilii Binzari/iStock via Getty Images

DocuSign (NASDAQ:DOCU) has seen its growth vanish after pandemic gains – and its stock price followed suit in unforgiving fashion. The stock has fallen so low that it is trading below pre-pandemic levels. Investors seem to be ignoring the positives at play: strong free cash flow, net cash balance sheet, and secular growth story. While DOCU will need to work through execution issues, it remains undeniable that e-signatures are the future. DOCU is priced cheaply at just 5x sales – I reiterate my buy rating.

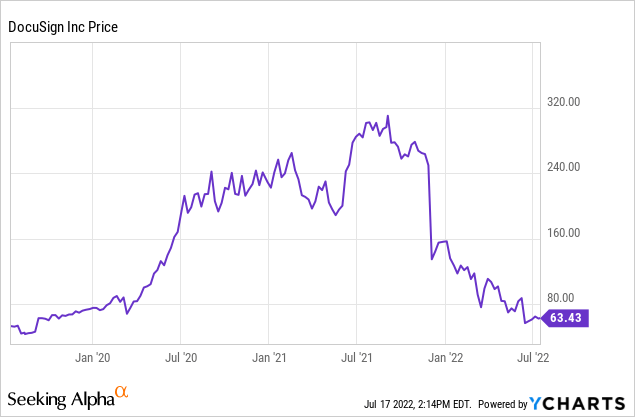

DOCU Stock Price

DOCU peaked around $314 per share in late 2021, but has since fallen an astounding 80%.

I last covered DOCU in April, where I rated the stock a buy on account of the low valuation. The stock has since slid another 25%, in large part due to shockingly poor results on the growth front.

DocuSign Stock Key Metrics

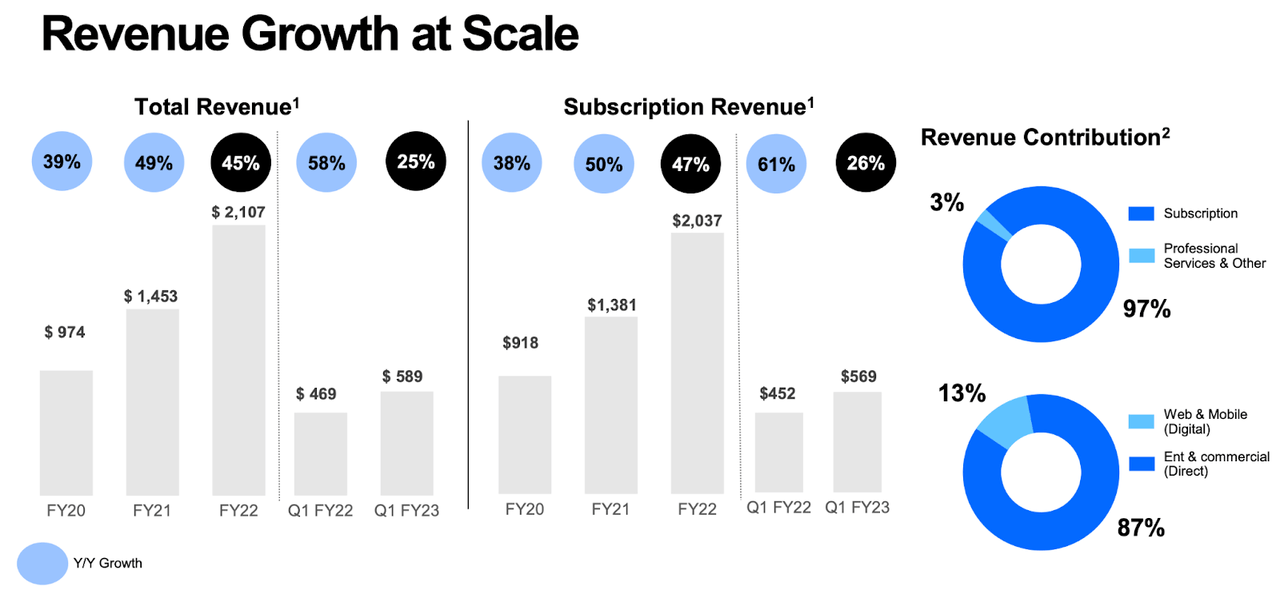

In the latest quarter, DOCU showed solid 25% growth. I will discuss the issues with the report later, but for now I will state that its current financial results remain solid.

Q1 FY23 Presentation

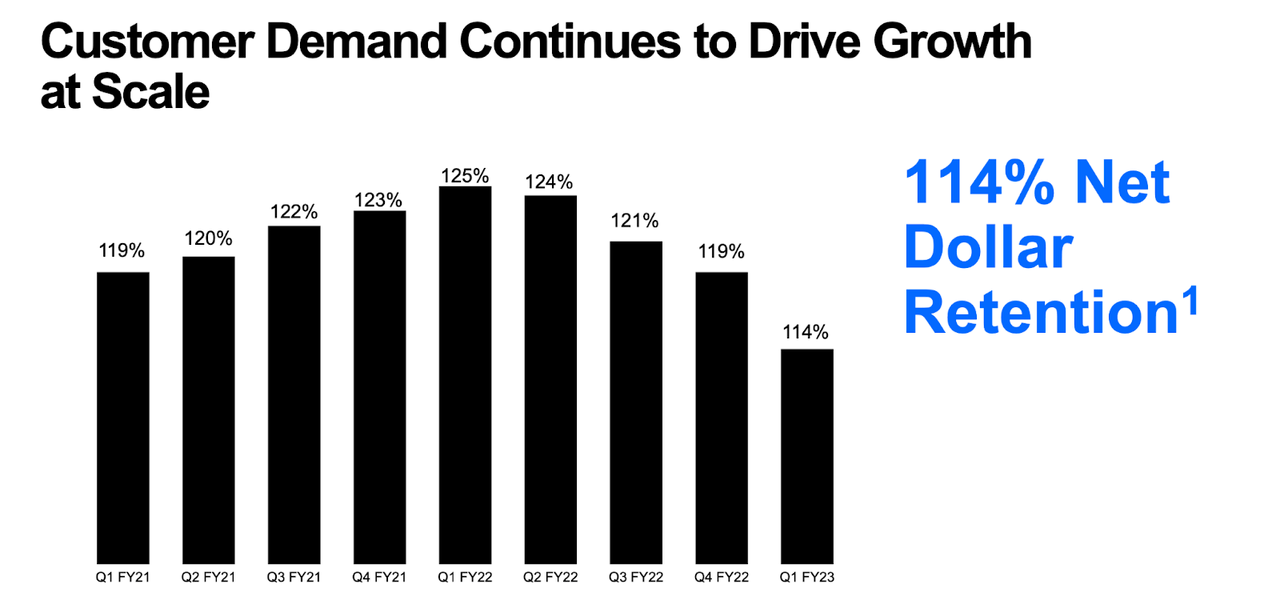

DOCU saw net dollar retention decline to 114%, which is still quite respectable.

Q1 FY23 Presentation

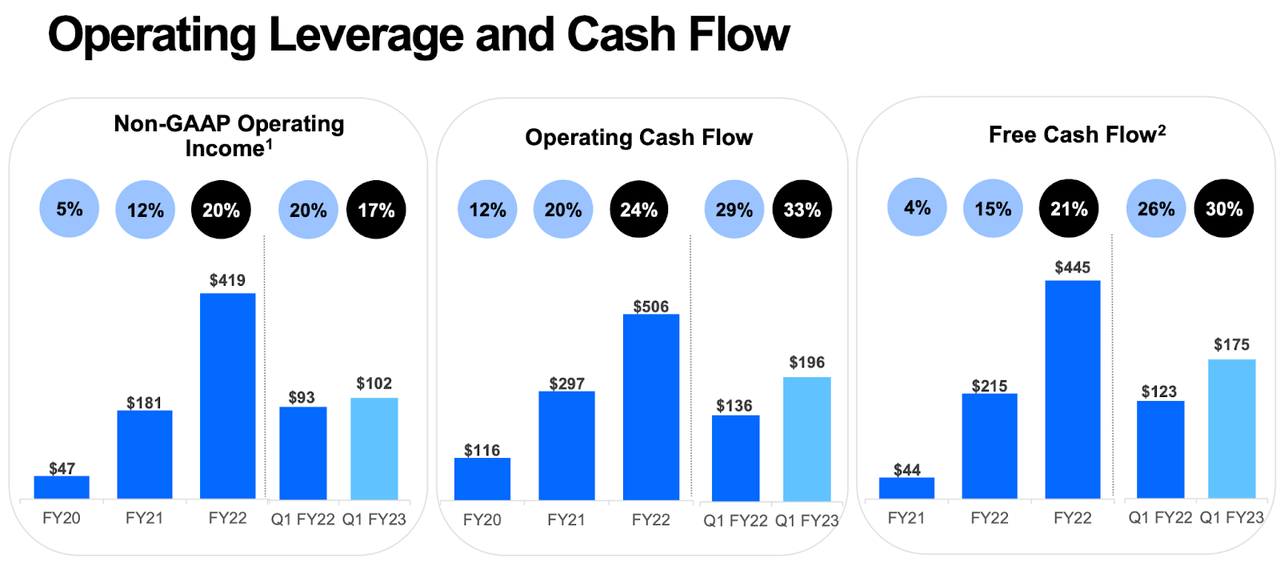

Perhaps the most significant draw to the story remains its solid margins. The company generated 17% non-GAAP operating margins and free cash flow margins were even higher due to pre-paid subscription revenues.

Q1 FY23 Presentation

The company ended the quarter with $247 million in net cash. Looking forward, DOCU guided for 18% revenue full-year revenue growth. That already represents a sizable deceleration from the 45% growth seen last year. But the real issue was that of billings, which is expected to grow by only 8% year over year to $2.541 billion.

On the conference call, analysts asked management regarding the billings outlook and the implications on future growth (it is implying around 7% to 8% revenue growth next year).

Management’s response was not too confident:

Yes. So, I mean we’re not guiding to next year at this point. I mean, as Dan said, we have new leaders in place. We’re ramping the go-to-market. We are guiding for this year to what we’re seeing, Pat. And so I think it wouldn’t be prudent for us to go beyond this year.

We’re very encouraged by the steps we’ve taken. We’re very focused on what’s in our control, whether that’s the innovation, the go-to-market pieces we’ve talked about, bringing on new team members, kind of, prioritizing the investments, those are the things we’re focused on along with, and importantly, making customers successful on the platform so that they can continue to grow and expand with us, right?

And so those are the things we’re really focused on. And we’ll have more to say as we move through the back half of the year, but we’re certainly facing headwinds across a few of those different dimensions.

Yes. I wouldn’t say that’s the mechanics. I mean, we’re — every day or every quarter, we’re looking to make the right investments to grow the top line across the go-to-market. And so our guide is reflected on what we’re seeing in the business. And as I said, as we move through the back half of the year, we’re currently anticipating some headwinds relative to what we saw 90 days ago, as we’ve looked at how the markets have developed and the go-to-market changes that we’re making are going to take a little bit longer to actually see in the financial results.

At this point, DOCU is seeing real fundamental weakness, though one must wonder if the 80% slide in the stock price has already priced in the poor outlook.

Is DOCU Stock A Buy, Sell, or Hold?

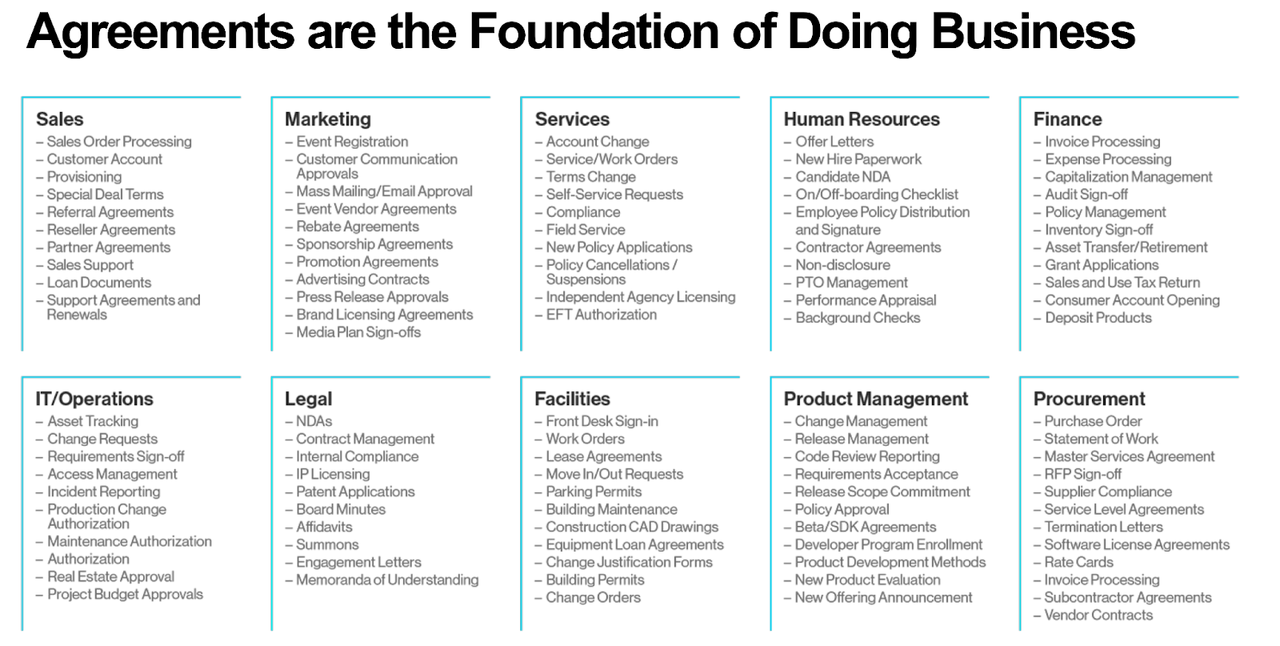

Over the long term, I find it reasonable to expect growth to return, as the e-signature market spans across wide-ranging industries and business use cases.

Q1 FY23 Presentation

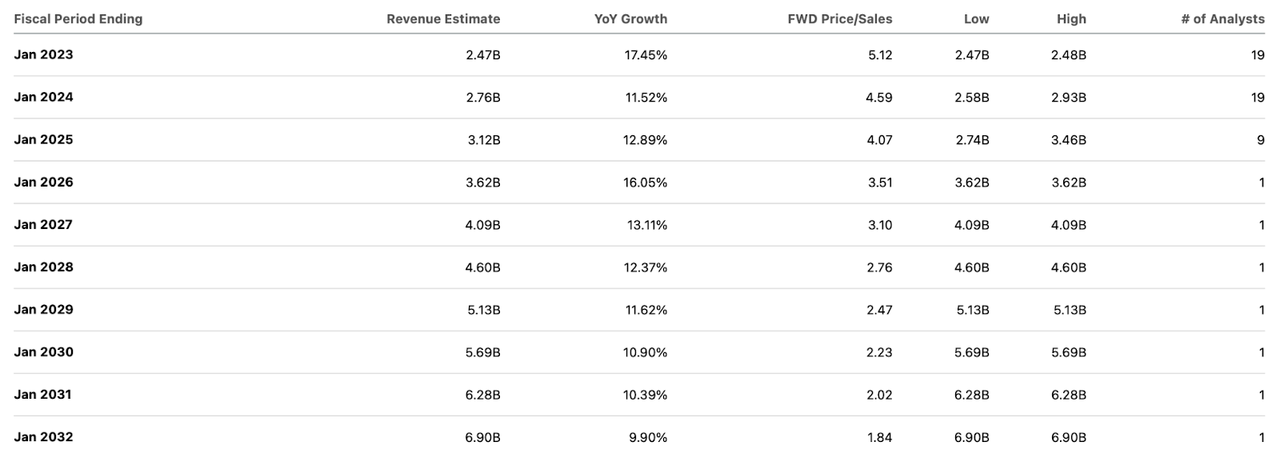

This may help explain why consensus estimates call for double-digit growth to persist over the next decade.

Seeking Alpha

DOCU’s business model inherently lends itself to operating leverage due to the fact that its customers are all sharing the same piece of software. I could see DOCU sustaining at least 30% net margins over the long term. Assuming a 12% long term growth rate and 1.5x price to earnings growth ratio (‘PEG ratio’), DOCU might trade at 5.4x sales by 2025, representing a stock price of $96 per share or 13% compounded returns over the next 3.5 years. I note that my new projected valuation is much lower than my previous model for 9x sales, as I previously expected DOCU to sustain 20% growth over the long term. DOCU may be able to generate more upside if it can fix its execution issues and return to higher growth rates.

The main risk here is if growth does not return and is instead due to competition. I could see the argument that smaller businesses would be willing to save money on alternative solutions, even if it came with less comprehensive offerings. DOCU might need to reduce prices, which would affect both its growth outlook and its profit margins. Further, in light of the lower growth rates, DOCU is not trading as cheap as other beaten-down names in the tech sector. That may mean that the stock has more room to fall, which would be a logical result to place the stock more in-line with peers on a growth-adjusted basis. To quantify that, I could see the stock falling as much as 50%, but I note that this has more to do with the attractive prices of peers. While I do rate DOCU a buy, I note that better opportunities can be found elsewhere in the tech sector.

Be the first to comment