Gerald Corsi

Investment Thesis

As of the time of writing, DocuSign, Inc (NASDAQ:DOCU) is worth $12.68B in market capitalization, a massive plunge from its previous all-time highs of $60.41B since September 2021. Seeing how the stock has been on a continuous plunge and slide in the past three quarters, it is not far-fetched to assume that the company has more to fall, potentially to below $6B by the end of the year.

At that time, DOCU would be proverbially ripe for the picking, given the moderation in its historically rich valuations and its massive existing consumer base. Considering its existing partnership with Microsoft (MSFT) and the deep integration with the latter’s products, it is highly plausible that the company may be acquired by the tech giant eventually. With $12.4B of cash and equivalents on MSFT’s balance sheet and an annual generation of $63.6B in Free Cash Flows (FCF) in FY2021, DOCU may be an easy all-cash takeover target, similar to the previous Activision deal.

However, since the take-over theory is speculative at best, we recommend most, if not all, DOCU investors to sell their holdings first. The wait for any eventual takeover during this economic climate will be a disastrous endeavor, given the potential 50% loss in the holding’s value by then. If any, speculative investors may add some exposure again much later at new lows, given the bearish market condition, rising inflation, and potential recession putting more pressure on DOCU’s stock performance in the interim.

DOCU’s Performance May Have Peaked Due To The Pandemic

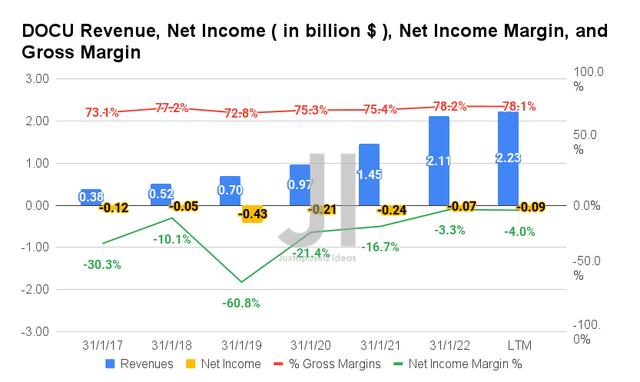

Over the past five years, DOCU has grown its revenues at an impressive CAGR of 40.90%. By the LTM, the company reported revenues of $2.23B and gross margins of 78.1%, representing an increase of 53.7% and 2.7 percentage points from FY2021 levels, respectively. In addition, DOCU reported improved net income losses at the LTM, at net incomes of -$0.09B and net income margins of -4%, indicating an improvement of 62.5% and 12.7 percentage points from FY2021 levels, respectively.

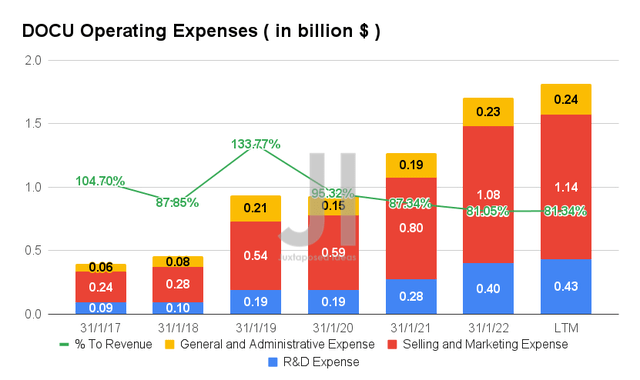

Nonetheless, it is also clear that DOCU has not achieved net income profitability, given its elevated operating expenses thus far. By the LTM, the company reported $1.81B of operating costs, constituting 81.34% of its growing revenues then. Still massive in our opinion, since the company will not be reducing any of its workforce as with many Tech Giants, despite the slowing revenue growth.

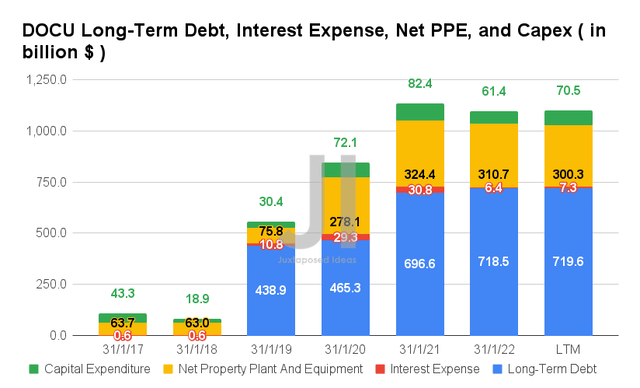

Therefore, it made sense that DOCU took on more financial obligations, given its lack of net income profitability. By the LTM, the company reported long-term debts of $719.6M, representing a notable increase of 63.9% since its IPO in 2018. Given that $690M will be due by January 2024, we speculatively expect further share dilution of up to 10.9M outstanding shares if converted based on recent stock prices. Otherwise, 1.64M shares based on the original agreement and share price of $262.65 then. Nonetheless, we applaud the management’s capable capital deployment, given that it minimizes DOCU’s exposure to any interest servicing with 0% rates for its latest capital raise. We shall see in 2024.

In the meantime, DOCU also grew its net PPE assets to $300.3M and capital expenditure to $70.5M, further contributing to its elevated costs – thereby slowing the improvement in its net income and Free Cash Flow profitability.

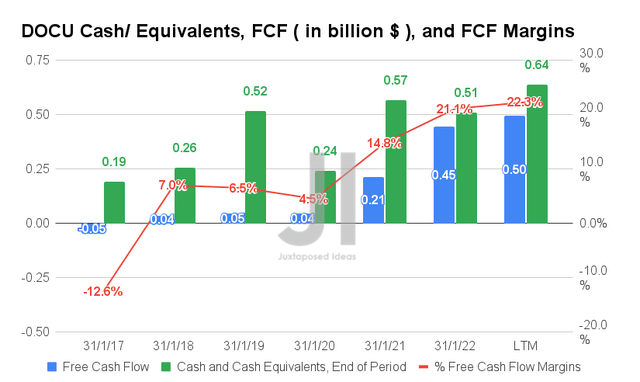

S&P Capital IQ

Nonetheless, one bright point is that DOCU has been reporting positive Free Cash Flow (FCF) generation thus far, with $0.5B of FCF and 22.3% of FCF margins in the LTM. It represents massive improvements of 1250% and 17.8 percentage points from FY2020, respectively. Thereby, boosting its cash and equivalents on its balance sheet to $0.64B at the LTM.

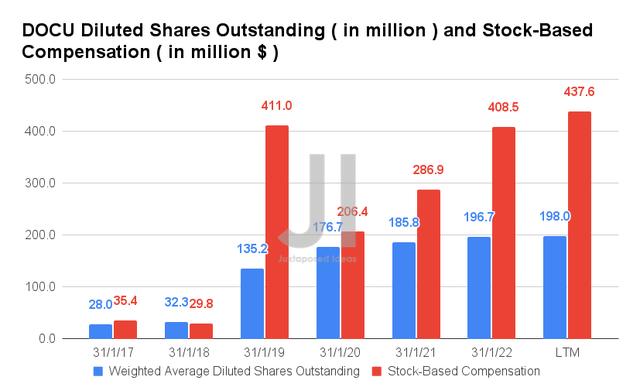

Nonetheless, given its lack of net income profitability and lower FCF generation, it is evident that DOCU has been relying on continuous Stock-Based Compensation (SBC) since its IPO. By the LTM, the company reported $437.6M of SBC expenses, representing an increase of 52.5% from FY2021 levels. Nonetheless, we also note that DOCU’s diluted shares outstanding have been relatively stable thus far, potentially attributed to its previous share-buyback programs with another $200M approved in March 2022.

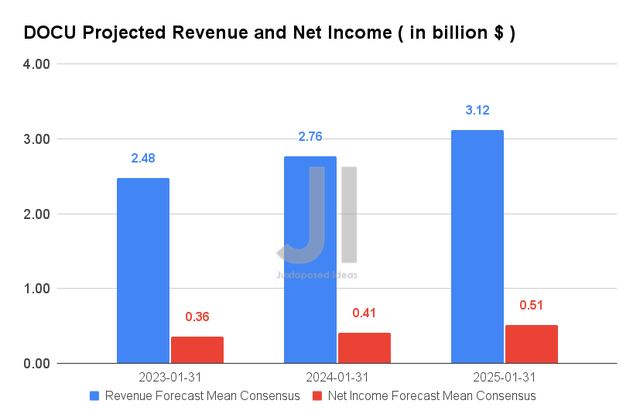

Over the next three years, DOCU is expected to record revenue growth at a CAGR of 14.11% while also finally reporting net income profitability from FY2023 onwards. Its net income margin is also expected to improve from 14.5% in FY2023 to 16.3% in FY2025. For FY2022, consensus estimates the company to report revenues of $2.48B and net incomes of $0.36B, representing impressive YoY growth of 18% and 83.7%, respectively.

However, given that the full-year billings are downgraded to $2.52B from the previous consensus estimates of up to $2.73B, it is evident that DOCU’s growth will normalize post-reopening cadence. The phenomenon is to be expected, given the hyper-growth during the COVID-19 pandemic. Nonetheless, the rising inflation and potential recession also triggered a continuous correction to its overly rich valuations, thereby explaining the plunge in its stock price thus far, given that DOCU has also yet to report net income profitability.

So, Is DOCU Stock A Buy, Sell, or Hold?

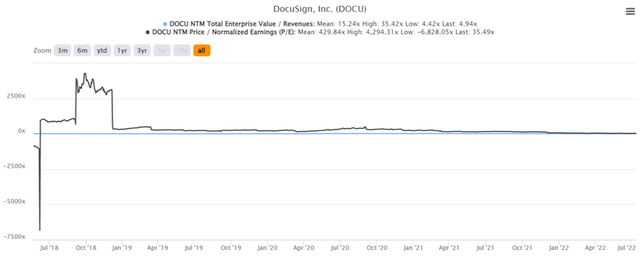

DOCU 5Y EV/Revenue and P/E Valuations

DOCU is currently trading at an EV/NTM Revenue of 4.94x and NTM P/E of 35.49x, lower than its 5Y mean of 15.24x and 429.84x, respectively. The stock is also trading at $63.43, down 79.8% from its 52 weeks high of $314.76, nearing its 52 weeks low of $55.86. Given its bubble stock status then, it is apparent that DOCU had been massively corrected in the past three quarters.

DOCU 5Y Stock Price

Therefore, despite the attractive buy rating from consensus estimates with a price target of $76.90, we are not convinced of DOCU’s 21.24% upside. We expect continued temporary headwinds to its stock performance as more retail and corporate consumers tighten their spending moving forward as well.

In addition, the lack of economic moat makes the company open to intense competition from many legacy companies, such as Microsoft, from cannibalizing the product in the far future, despite its existing partnership now. In fact, EchoSign, the original cloud-based e-signature service launched in 2006, was acquired by Adobe in 2011 to be rebranded as Adobe Acrobat Sign, which has had moderate success in the market thus far. Nonetheless, for the bulls, you may choose to hold on for the rough ride ahead, assuming a potential takeover in the far future.

Therefore, we rate DOCU stock as a Sell. Preserve your capital for now.

Be the first to comment